Within the ever-changing panorama of the tax business, embracing automation has turn into important for tax corporations in search of to raise their consumer providers.

Bounce to:

By leveraging expertise, tax corporations can streamline their processes, improve accuracy, and supply shoppers with a extra personalised and environment friendly expertise.

On this weblog, we’ll discover how synthetic intelligence and automation, when thoughtfully applied, cannot solely revolutionize however redefine your consumer service technique. This transformative strategy can reshape and elevate your observe to fulfill the evolving wants of each your agency and shoppers.

Optimize your technique with consumer service automation

In in the present day’s aggressive tax business, corporations that fail to leverage expertise threat falling behind. By embracing cloud-based options, incorporating automation instruments, and using AI-powered software program, tax corporations can optimize their consumer service and acquire a aggressive edge.

Cloud-based options allow seamless information entry and collaboration, permitting tax professionals to work effectively from wherever, at any time. This flexibility enhances responsiveness to consumer wants and facilitates real-time collaboration amongst workforce members, guaranteeing that shoppers obtain immediate and correct service.

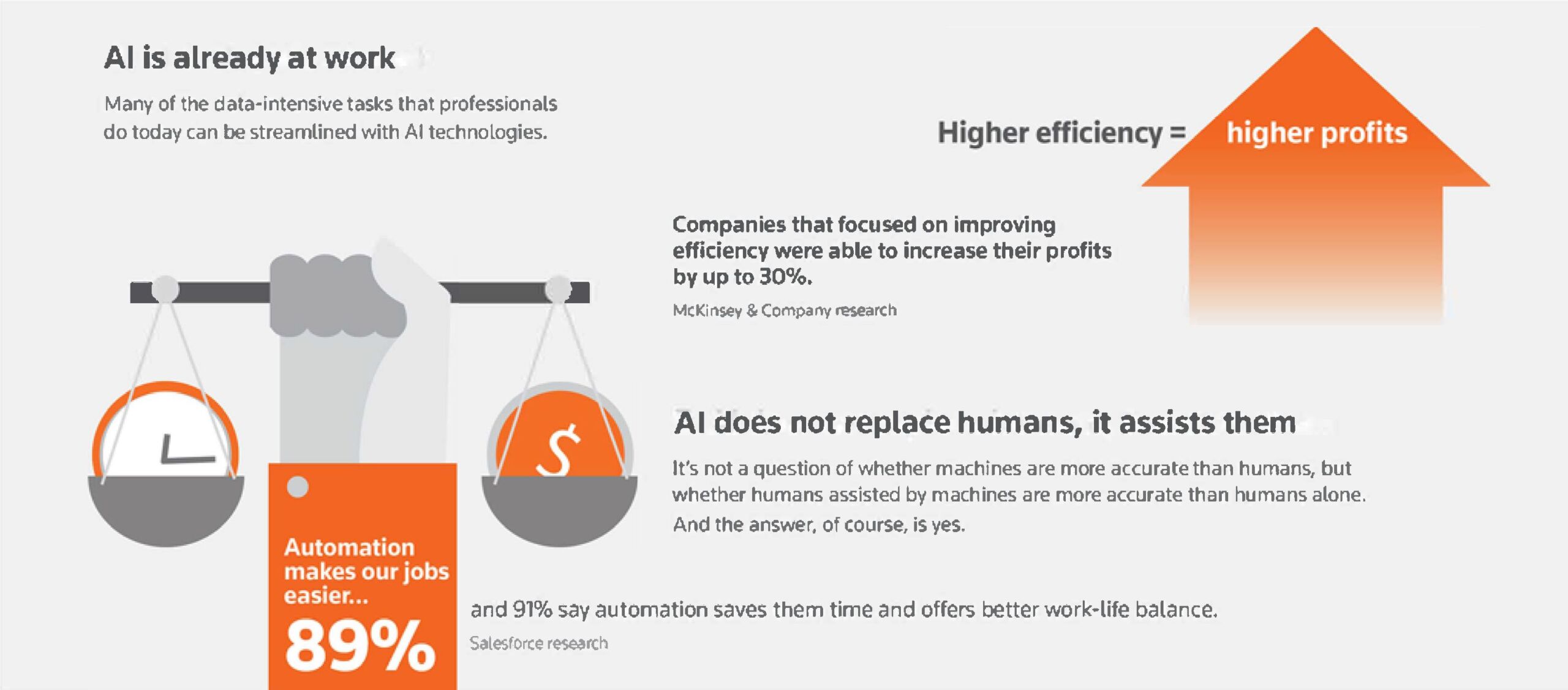

Incorporating automation instruments streamlines routine duties, releasing up beneficial time for tax professionals to concentrate on higher-value actions.

By automating repetitive processes similar to information entry, doc administration, and appointment scheduling, tax corporations can improve effectivity and scale back the danger of human error.

This not solely improves the general consumer expertise but additionally permits tax professionals to offer extra personalised and tailor-made providers. Moreover, using AI-powered software program empowers tax corporations with superior information evaluation capabilities. By leveraging AI, tax professionals can acquire deeper insights into consumer information, establish tendencies, and make knowledgeable selections. This allows them to offer proactive and strategic recommendation, serving to shoppers optimize their tax positions and obtain their monetary objectives.

By embracing expertise, tax corporations can automate their consumer service, streamline operations, and acquire a aggressive benefit within the ever-evolving tax panorama.

Leveraging AI for predictive analytics

Synthetic intelligence is quickly reworking the tax business, and corporations that embrace AI-powered options are poised to realize a major aggressive benefit. By leveraging AI for predictive analytics, tax corporations can anticipate consumer wants and preferences, improve decision-making processes, establish potential dangers and alternatives, streamline tax preparation and submitting, and guarantee accuracy and compliance.

One of many key advantages of AI in tax automation is its means to investigate huge quantities of information and establish patterns and insights that might be troublesome or unimaginable for people to detect. This allows tax corporations to make extra knowledgeable selections, optimize their processes, and supply tailor-made providers to their shoppers.

For instance, AI can be utilized to investigate historic consumer information to establish tendencies and patterns of their tax liabilities, serving to corporations to higher anticipate their shoppers’ wants and supply proactive recommendation.

AI will also be used to develop predictive fashions that may assist tax corporations establish potential dangers and alternatives. For instance, AI can be utilized to investigate monetary information to establish shoppers who’re vulnerable to tax audits or who could also be eligible for sure tax credit or deductions. This data can then be used to develop focused methods to mitigate dangers and maximize alternatives.

Along with its use in predictive analytics, AI will also be used to automate varied tax-related duties, similar to information entry, doc preparation, and tax calculations. This may liberate tax professionals to concentrate on higher-value actions, similar to offering strategic recommendation to shoppers.

General, AI has the potential to revolutionize the tax business and supply important advantages to tax corporations and their shoppers. By embracing AI-powered options, tax corporations can enhance their effectivity, accuracy, and compliance, and supply a extra personalised and beneficial service to their shoppers.

Efficient consumer communication

Consumer communication is important for offering a optimistic consumer expertise and constructing long-term relationships. Up to now, tax corporations have relied on conventional strategies of communication, similar to telephone calls and emails, which could be time-consuming and inefficient.

Nonetheless, with the appearance of automation, tax corporations can now streamline communication channels, implement real-time messaging platforms, and make the most of cellular apps to permit for quicker and extra environment friendly communication with shoppers.

By leveraging automation instruments, tax corporations can present shoppers with a extra personalised and environment friendly expertise. For instance, automation can be utilized to ship personalised emails or textual content messages to shoppers with updates on their tax returns or to remind them of upcoming deadlines. Moreover, automation can be utilized to create self-service portals the place shoppers can entry their tax paperwork and data at any time. This not solely saves tax corporations time and assets but additionally supplies shoppers with higher comfort and management over their tax issues.

Automation gives quite a few advantages for tax corporations, together with improved consumer service, communication, and compliance. By embracing cloud-based options, incorporating automation instruments, and using AI-powered software program, tax corporations can streamline processes, scale back errors, and supply shoppers with a extra personalised and environment friendly expertise.

Enhancing information accuracy and compliance for shoppers

Tax automation gives important potential for enhancing information accuracy and compliance inside tax corporations. By automating information entry processes, corporations can reduce guide errors and make sure the integrity of their information. Automation instruments may also implement strong information validation mechanisms to make sure that information is correct, full, and constant earlier than it’s processed or saved.

Moreover, embracing cloud-based options permits for centralized information storage and real-time information updates, guaranteeing that everybody inside the agency has entry to probably the most up-to-date and correct data. Automation may also facilitate the era of real-time reviews and analytics, enabling corporations to establish and deal with compliance points promptly.

Navigating the way forward for tax automation

As you navigate the evolving panorama of tax automation, the adoption of expertise represents not only a strategic transfer however a basic shift that may redefine your agency’s trajectory. Incorporating automation, cloud-based options, and synthetic intelligence (AI) goes past mere course of streamlining; it positions your observe on the forefront of business progress.

Venturing into the realm of automation requires greater than embracing new instruments—it’s about implementing a sensible strategy centered on effectivity, accuracy, and consumer satisfaction. The way forward for tax automation isn’t solely about streamlined operations; it possesses the potential to boost your observe, offering a consumer expertise that aligns seamlessly with the calls for of the trendy period.

To be taught extra about consumer service automation, watch our on-demand webcast beneath:

On-Demand WebcastThe Way forward for Tax Automation: The right way to Elevate Your Agency’s Consumer Service

|

Product Web page

|

|