The April fifteenth tax deadline has come and gone. When you missed the tax deadline, don’t fear, you may nonetheless file. Listed below are 3 steps to get your taxes accomplished at present and get your refund.

File Now – Don’t wait any longer!

When you haven’t filed your taxes but, don’t panic. You’ll be able to nonetheless file at present. If you’re anticipating a tax refund, which near 80% of individuals do, you’ll not obtain a penalty for submitting late. Merely log on and use e-file with direct deposit to get your refund quick.

Don’t suppose it’s worthwhile to file? You should still wish to.

Yearly the IRS reviews over $1 billion {dollars} in unclaimed tax refunds. Even when you made underneath the IRS revenue threshold for submitting ($13,850 single, $27,700 married submitting collectively for 2023), you must nonetheless file a tax return when you had federal taxes withheld out of your paychecks or you’re eligible for tax credit just like the Earned Earnings Tax Credit score.

Use E-file with Direct Deposit

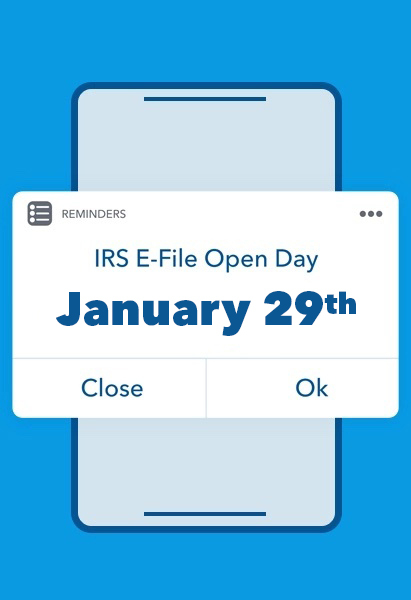

Though you missed the deadline, you may nonetheless log on and e-file your taxes conveniently with TurboTax. E-file permits your tax return to be acquired and processed by the IRS shortly and simply. Plus, additionally, you will obtain acknowledgement of receipt of your return.

When you mail in your tax return, it is going to take the IRS longer to obtain and course of your return. E-file with direct deposit is the quickest technique to get your tax refund. The IRS states they are going to concern 9 out of 10 tax refunds inside 21 days or much less from acceptance.

Pay Any Taxes Owed

When you owe cash, you’ll wish to file as quickly as you may to keep away from an even bigger failure-to-pay penalty. When you didn’t file an extension in April you’ll have a failure-to-file and a failure-to-pay penalty. Though you could have a penalty for submitting late, your penalty can be smaller than when you don’t file in any respect. Submitting as quickly as attainable will cut back what you owe in curiosity. The longer you wait to file, the larger the curiosity penalty.

Some taxpayers delay submitting as a result of they owe cash and so they don’t understand how they’re going to pay. When you delay submitting for that reason, there are steps you may take that can be higher and less expensive for you.

You need to file as quickly as attainable, pay what you may, after which request a fee plan from the IRS. The IRS has a number of choices that will help you. You’ll be able to request a brief time period fee plan, long run installment settlement, supply in compromise, or quickly delay collections in some conditions. You’ll be able to arrange a:

- Quick time period fee plan: You need to choose this plan when you pays what you owe inside 180 days.

- Long run installment agreements: This plan means that you can pay what you owe over six years.

- Installment settlement: In case your whole taxes, penalties, and curiosity is as much as $50,000, you may request an installment settlement on-line.

Don’t fear when you missed the deadline, you may nonetheless file with TurboTax. It doesn’t matter what strikes you made final yr, TurboTax will make them rely in your taxes. Whether or not you wish to do your taxes your self or have a TurboTax knowledgeable file for you, we’ll ensure you get each greenback you deserve and your greatest attainable refund – assured.

Victims of current federally declared disasters got extensions to file and pay taxes. You could find out the precise prolonged deadlines in our IRS Points Deadline Extensions For Tax Yr 2023 article.

File sooner and simpler with the free TurboTax App