Should you obtained a bonus you’re seemingly inquisitive about taxes. You could be asking, “how taxes are withheld out of your bonuses once you obtain them?”

Receiving a vacation bonus is thrilling, however it may be complicated to calculate your bonus tax. Studying how your bonus is taxed can assist you establish how a lot cash you’ll obtain after taxes.The IRS views any bonus you obtain as wages. Because of this virtually all bonuses are taxed. On this information, we’ll talk about suggestions for receiving bonuses and clarify how you should use our bonus tax calculator to find out how a lot taxes will likely be withheld once you obtain it.

Are taxes withheld once you obtain a bonus?

On the time of receipt of your bonus, federal taxes are sometimes withheld by your employer that may be at ahigher tax charge than your precise tax charge used once you file your taxes.

However don’t fear, since your precise tax charge based mostly in your whole taxable revenue for the yr could possibly be decrease, chances are you’ll get again a few of what was withheld out of your bonus as a part of your federal tax refund.

How are bonus taxes calculated?

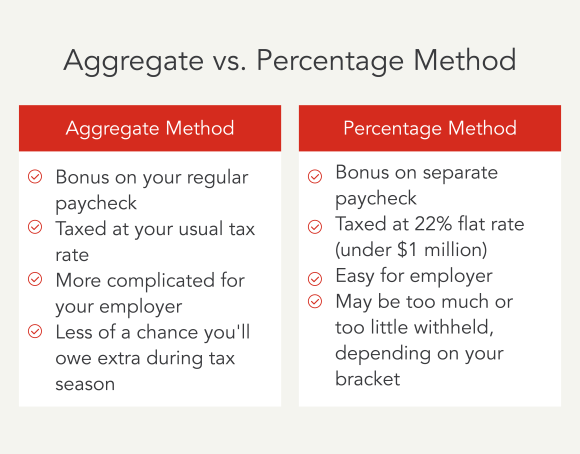

Employers sometimes use both of two strategies for calculating federal tax withholding in your bonus:

- The combination methodology

- The proportion methodology

Combination methodology

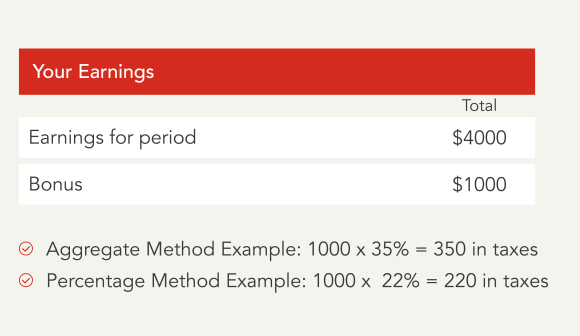

Should you obtain your bonus alongside along with your paycheck your employer will use the mixture methodology to calculate your withholding.

With the mixture methodology, your employer or payroll supplier will withhold federal taxes on the identical share that’s usually withheld out of your paycheck.

If 35% is withheld when you’re paid, then your employer will withhold 35% out of your bonus when you’re paid your bonus.

Proportion methodology

When your employer points your bonus separate out of your paycheck your employer or payroll supplier will withhold taxes utilizing the share methodology.

The proportion methodology is the only strategy to withhold bonus taxes since your employer or payroll supplier will withhold federal taxes at a flat 22% charge and never at your regular tax charge when you’re paid.

Typically, most employers and payroll suppliers select to make use of the share methodology. Underneath tax reform, the federal tax charge for withholding on a bonus was lowered to 22%, down from the federal revenue tax charge of 25%.

Try our up to date bonus calculator. This instrument solutions certainly one of our most steadily requested questions. You’ll get an estimate of how a lot federal taxes you possibly can count on to be withheld out of your bonuses once you obtain them.

What are the professionals of every bonus tax methodology?

The professionals of every methodology depend upon what your common tax charge is. If you’re in a decrease tax bracket with a decrease tax charge, then being taxed at your common decrease tax charge within the combination methodology versus the share methodology at 22% might be extra helpful to you. If you’re in a better revenue bracket and your tax charge is over 22% then having taxes withheld utilizing the share methodology gives you extra of your bonus. One factor to recollect, at tax time chances are you’ll get a few of what was withheld out of your bonus again once you file your taxes.

What are the cons of every bonus tax methodology?

There are downsides to each the mixture and share strategies.

The combination methodology can add pointless confusion to your bonus taxes as a result of your revenue tax charge comes into play, which entails your W-4 type. In some circumstances it could possibly result in paying a bigger share of your bonus in taxes which additionally means you’ve got entry to a smaller portion of your bonus.

In case your common tax charge is increased than the flat 22% charge used within the share methodology, then the share methodology offers you with extra of your bonus than the mixture methodology. Nonetheless, this might lead to a smaller tax refund or attainable taxes owed.

On the finish of the day, the strategy utilized by your employer or payroll supplier will depend on when you obtain your bonus collectively along with your paycheck or individually. For a contractor bonus, taxes are usually not withheld since you might be thought of self-employed so it’s greatest to make use of tax saving suggestions for contractors included right here.

Are there any bonuses which may not be taxable?

Bonuses you obtain out of your employer are thought of supplemental revenue. This implies they’re taxable by the IRS. Nonetheless, sure fringe advantages will not be thought of taxable bonuses. This consists of advantages like occasion tickets and reward baskets.

Different presents obtained as awards may additionally be exempt from taxes in some circumstances. This would possibly embrace:

- Money

- Money equivalents

- Holidays

Are bonuses taxed federally and by the state?

Bonuses are at all times federally taxed, and a few states could have extra taxes for bonuses. Bonus tax charges fluctuate from state to state, so you possibly can verify your state tax rules to find out your tax charge.

Are there methods to attenuate bonus taxes?

There are a number of methods you possibly can decrease the quantity of bonus taxes you owe, however it’s vital to abide by federal and state tax legal guidelines. Listed below are some suggestions for minimizing bonus taxes:

- Ask your employer to defer your bonus till subsequent yr

What occurs if too many taxes are withheld out of your bonus?

If an excessive amount of taxes are withheld out of your bonus, chances are you’ll get a few of what was withheld again within the type of a tax refund when you file your taxes.

Decrease the bonus taxes you owe and maximize your refund

Tax season can result in new tax implcations, particularly when you lately obtained your first bonus. Our bonus-tax calculator makes it straightforward to estimate how a lot taxes will likely be withheld out of your bonus once you obtain it. That means, you may get an estimation of how a lot of your bonus you’ll maintain and work out what strikes you can also make to assist your finance and tax end result.

Strive our bonus calculator for an estimate of your bonus tax withholding. It doesn’t matter what strikes you made final yr, TurboTax will make them depend in your taxes. Whether or not you need to do your taxes your self or have a TurboTax knowledgeable file for you, we’ll be sure you get each greenback you deserve and your greatest attainable refund – assured.