Ethena Labs has revealed its newest strategic transfer: the inclusion of Bitcoin (BTC) as collateral for its artificial dollar-pegged product, USDe. This choice, geared toward considerably scaling the product’s provide from its present $2 billion, capitalizes on the burgeoning BTC spinoff markets for enhanced scalability and liquidity in delta hedging practices.

Ethena Labs’ formidable objective is to leverage the appreciable progress of BTC open curiosity, which has seen a considerable rise from $10 billion to $25 billion in only one yr, far outpacing Ethereum’s (ETH) progress charges. Ethena’s assertion highlighted the strategic advantages of integrating BTC, emphasizing the superior liquidity and period profile of Bitcoin in comparison with liquid staking tokens and the potential for USDe to realize higher scalability in consequence

“With $25bn of BTC open curiosity available for Ethena to delta hedge, the capability for USDe to scale has elevated >2.5x,” the announcement famous, illustrating the sturdy backing that BTC gives.

Excited to announce that Ethena has onboarded BTC as a backing asset to USDe

This can be a essential unlock which can allow USDe to scale considerably from the present $2bn provide pic.twitter.com/FOZRWBrVZV

— Ethena Labs (@ethena_labs) April 4, 2024

CryptoQuant CEO Points Bitcoin Crash Warning

This transfer has not been met with out skepticism. Ki Younger Ju, CEO of the analytics agency CryptoQuant, took to X to voice his issues, drawing parallels to the notorious LUNA collapse and questioning the danger administration methods employed by Ethena Labs.

“This isn’t excellent news for Bitcoin holders—it feels like a possible contagion danger, like LUNA. How do they keep a delta-neutral technique for BTC in bear markets?” Ju queried, implying that the success of such methods is basically contingent on market situations that favor bull runs.

He additional elaborated on the complexities of shorting BTC in bear markets, suggesting that the market dimension for such operations might be smaller than the whole worth locked (TVL), probably resulting in important market disruptions. The CryptoQuant CEO acknowledged:

How do they keep a delta-neutral technique for BTC in bear markets? In bull markets, they maintain spot BTC and brief BTC. If there’s a technique to brief BTC by holding some DeFi-wrapped BTC, the market dimension could be smaller than its TVL. This can be a CeFi stablecoin run by a hedge fund, efficient solely in bull markets. Right me if I’m flawed.

Ju added that he’S involved a couple of repeat of a LUNA-like doom situation: “promoting BTC to stabilize USDe’s peg if their algorithm fails throughout bear markets.”

Including to the discourse, OMAKASE, a former advisor for Sushiswap, referenced historic challenges confronted by delta-neutral methods, highlighting their propensity to show illiquid and the problem in unwinding such positions with out inflicting market slippage.

“Delta impartial methods are often by no means delta impartial. Submit dot-com growth in Singapore, it took years for banks to unwind delta impartial books that had abruptly turned illiquid. Measurement begets slippage,” OMAKASE remarked, underscoring the inherent dangers of such monetary maneuvers.

The trade’s response to Ethena Labs’ announcement has been blended, with some lauding the potential for elevated scalability and others cautioning in opposition to the dangers of replicating previous monetary crises. Just a few days in the past, Fantom founder Andre Cronje additionally questioned the steadiness of USDe.

Amidst these issues, Ethena Labs stands by its choice, pointing to the advantageous market situations and the rising BTC spinoff markets as key elements supporting their technique. “Whereas BTC doesn’t possess a local staking yield like staked ETH, staking yields of 3-4% are much less important in a bull market when funding charges are >30%,” the corporate acknowledged, indicating a strategic optimization for the present market setting. This transfer, in accordance with Ethena, is not only about scaling but additionally about providing a safer and extra sturdy product to its customers.

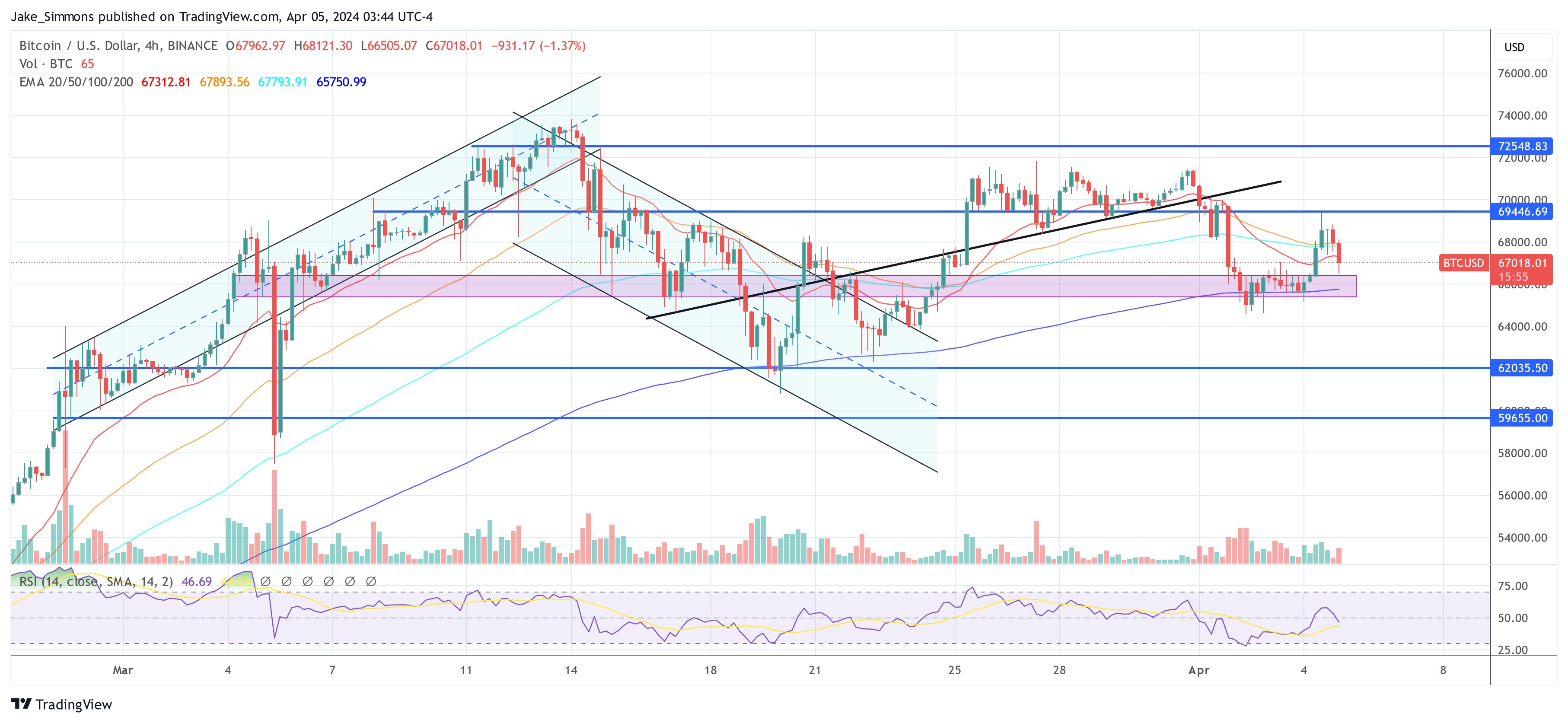

At press time, BTC traded at $67,018.

Featured picture created with DALL·E, chart from TradingView.com

Disclaimer: The article is supplied for instructional functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your personal analysis earlier than making any funding selections. Use info supplied on this web site completely at your personal danger.