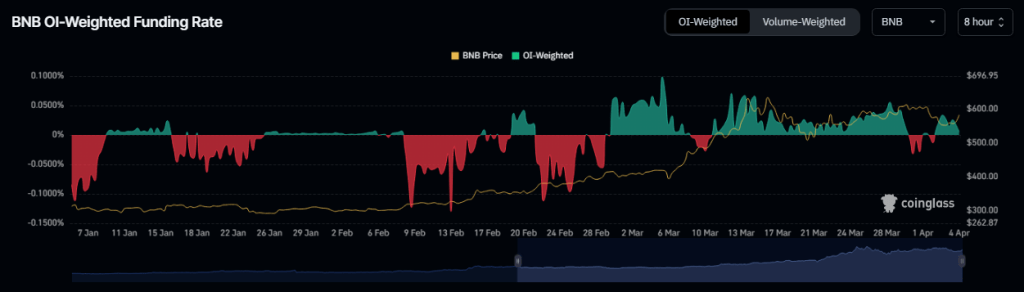

The outlook for Binance Coin (BNB) has turned cloudy, with each futures market information and technical indicators flashing bearish alerts. Based mostly on our evaluation of Coinglass information, unfavorable funding charges and declining open curiosity in BNB futures contracts paint an image of rising pessimism amongst merchants.

A unfavorable funding fee means that extra merchants are holding quick positions, anticipating a decline within the worth of the asset. This sentiment was confirmed on April 1st, when BNB’s funding fee dipped into unfavorable territory at -0.012%.

Binance Coin Funding Price And Open Curiosity Down

Additional fueling the bearish narrative, BNB’s futures open curiosity has additionally witnessed a slight decline of 0.15%. Open curiosity displays the full quantity of excellent futures contracts that haven’t been settled but.

A lower in open curiosity suggests merchants are exiting their positions with out opening new ones, doubtlessly signaling waning confidence available in the market.

Supply: Coinglass

Funding charges are a vital mechanism in perpetual futures contracts that maintain the contract worth aligned with the spot worth. When the contract worth trades larger than the spot worth, lengthy place holders pay a charge to shorts, leading to constructive funding charges.

Conversely, unfavorable funding charges materialize when the contract worth dips beneath the spot worth, indicating that quick sellers are at present paying charges to longs.

Supply: Coinglass

Extra Merchants Shut Their Positions

As unfavorable sentiments mount, this open curiosity is predicted to plummet additional. This is able to suggest that extra merchants are closing their positions and never opening new ones, suggesting a possible worth drop for BNB.

The bearish sentiment isn’t confined to the futures market. The Shifting Common Convergence Divergence (MACD), one other technical indicator, is suggesting a potential resurgence in promoting stress.

There’s a sign that the MACD line may cross beneath the sign line, usually interpreted as a bearish signal signaling the return of sellers to the market. It’s noteworthy that since March 18th, the MACD strains for BNB have been positioned for a downtrend.

BNB market cap at present at $87.9 billion. Chart: TradingView.com

BNB Worth Retreat In The Offing?

Contemplating each the futures market and technical evaluation, there’s a possible for a short-term decline in BNB’s worth. Nevertheless, it’s essential to acknowledge that market sentiment can shift quickly, and technical indicators aren’t infallible predictors of future worth actions.

On the time of writing, BNB was buying and selling at $587, up 6% within the final 24 hours, information from CoinMarketCap reveals.

In the meantime, a more in-depth take a look at BNB’s technical indicators on the 24-hour chart reveals one other pattern.

The Directional Motion Index (DMI), used to gauge pattern energy, displayed a bearish crossover the place the unfavorable directional index sits above the constructive directional index. This positioning means that bearish momentum is at present dominating the market.

Analysts generally interpret this specific crossover as an crucial sign prompting merchants to think about exiting lengthy positions and initiating quick positions.

This strategic transfer aligns with the prevailing pattern indicated by the DMI, reinforcing the notion of a prevailing bearish sentiment throughout the market ecosystem.

Featured picture from Pexels, chart from TradingView

Disclaimer: The article is offered for academic functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your individual analysis earlier than making any funding selections. Use info offered on this web site completely at your individual threat.