I’ve mentioned for awhile that we may use some short-term promoting to unwind overbought situations and even damaging divergences in some instances. I used to be on the lookout for maybe 4-5%, however it’s actually tough to foretell the sort and depth of promoting that we’ll see when secular bull markets face a downturn. Personally, I would be shocked if this latest weak spot morphs right into a bear market. I am not saying that it is not attainable, however my key alerts counsel it’s totally, impossible.

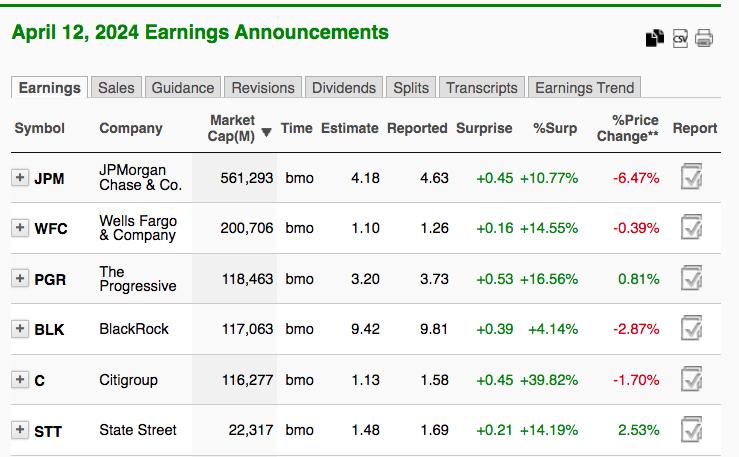

We have seen some draw back strikes up to now of simply 1-2% and others, just like the correction final summer time, that stretched to 10%. I consider earnings will probably be sturdy, however the big transfer off the October 2023 low could have in-built that constructive information. You’ve got most likely heard that outdated Wall Road adage, “purchase on rumor, promote on information”, proper? Effectively, that is precisely what we noticed Friday, with respect to the key financials that reported quarterly outcomes Friday morning. The earnings numbers regarded fairly good on Zacks:

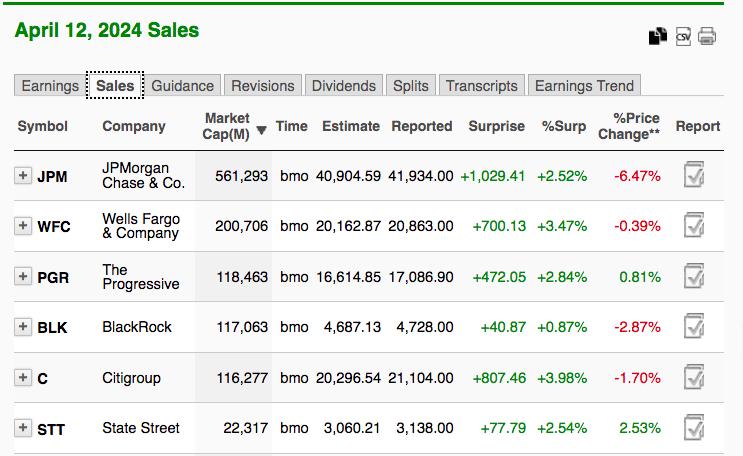

Reported EPS was considerably greater than estimates in each case. Citigroup (C), specifically, crushed estimates, blowing them away by almost 40%. There have been income beats by all 6 firms as effectively:

Once more, it was C that posted the most effective income beat – almost 4% greater than expectations. From these great numbers, it is simple to NOW see why financials had carried out so effectively.

However one factor that confuses many retail merchants is that sturdy outcomes don’t all the time translate into greater inventory costs. Take a look at the quarterly earnings worth reactions on these 6 shares:

Is this kind of market response justified after seeing these quarterly outcomes? I do not assume so, however the inventory market does not care what I believe. Market makers have a job to do – construct positions for his or her institutional shoppers at our expense. The short-term is NOT environment friendly. Costs do not do what you assume they will do. Then you definitely get confused, believing monetary shares are useless. After they drop for awhile, you panic and promote and, after market makers get all of the shares they want, financials regain their energy. That is what the inventory market does. The short-term inefficiencies put on on merchants, inflicting them to surrender, and that creates provide for market makers to construct their stock. Then rinse and repeat. Because the late nice Yogi Berra would say, “it is deja vu once more!”

I mentioned why we won’t belief this promoting in my newest EB Weekly Market Recap VIDEO, “Sizzling CPI Stokes Inflation Fears”. The secular bull market stays completely intact. Test it out and go away me a remark. Additionally, please “LIKE” the video and “SUBSCRIBE” to our YouTube channel, if you have not already. It’s going to assist us construct our YouTube neighborhood and I would definitely admire it.

On Monday, April fifteenth, I will be offering one other monetary inventory that’s poised to report glorious quarterly outcomes. This firm has been an enormous chief amongst its friends, suggesting a blowout report forward. If financials reverse their present weak spot, I might not be stunned to see a really POSITIVE market response to this firm’s report. To obtain this firm and take a look at its chart, merely CLICK HERE to subscribe to our FREE EB Digest publication. There isn’t a bank card required to affix the EB Digest, simply your title and e mail tackle!

Blissful buying and selling!

Tom

Tom Bowley is the Chief Market Strategist of EarningsBeats.com, an organization offering a analysis and academic platform for each funding professionals and particular person traders. Tom writes a complete Each day Market Report (DMR), offering steering to EB.com members on daily basis that the inventory market is open. Tom has contributed technical experience right here at StockCharts.com since 2006 and has a basic background in public accounting as effectively, mixing a singular ability set to strategy the U.S. inventory market.