Key Findings

- Alcohol is likely one of the most extremely taxed merchandise within the United States. The federal authorities takes a categorical strategy to alcohol taxation (e.g., taxing primarily based on classification reminiscent of beer, wine, or spirits), to which states add their very own taxes for merchandise in every class.

- Alcohol manufacturing has been some of the revolutionary areas within the U.S. economic system. New merchandise have additional blurred present categorical traces. The altering product panorama suggests the necessity for a change in taxA tax is a compulsory cost or cost collected by native, state, and nationwide governments from people or companies to cowl the prices of normal authorities companies, items, and actions.

coverage. - At present, alcohol taxes are non-neutral. Per ounce of alcohol, spirits are taxed at greater than thrice the speed of wine and double that of beer.

- Inefficiencies within the federal alcohol tax system are exacerbated by insurance policies such because the rum cover-over, rum manufacturing subsidies, wine manufacturing subsidies, and spirit tax rebalancing (Part 5010).

- An alcohol by quantity (ABV) tax may change the prevailing alcohol tax system. An ABV tax would make alcohol taxes less complicated, extra clear, and considerably extra impartial than the present system.

- If a full revamp of the alcohol tax is infeasible, policymakers ought to add a number of new tax classes to modernize the present categorical system.

Introduction

There’s nothing fairly like the sensation of settling down together with your favourite alcoholic beverage. Whether or not it’s the heat of a fantastic whiskey, the effervescence of a well-chilled beer, or the crispness of a glass of wine, having fun with these libations has lengthy been intertwined with social, cultural, and private experiences. However earlier than any client can get pleasure from their drinks, alcoholic beverage retailers, wholesalers, and producers should navigate a fancy net of rules and taxes.

Alcohol is likely one of the most extremely taxed merchandise in the USA. The U.S. takes a categorical strategy to alcohol taxation, whereby alcohol merchandise are labeled into classes (the biggest being beer, wine, and spirits) and taxed accordingly. Every state provides its personal tax for merchandise in every class.

When categorical taxes had been initially applied, clear delineations separated the classes. Beer, wine, and spirits had been very completely different merchandise, every having a considerably completely different alcohol content material. Even at the moment, most beers have an alcohol content material of round 5 %, wines have 10-16 % alcohol content material, and spirits are likely to have round 40 % alcohol by quantity. With differing alcohol contents and corresponding dangers for alcohol abuse and exterior harms, greater tax charges on clearly delineated classes of merchandise could be a sensible strategy. Nevertheless, a categorical system doesn’t work as nicely in a quickly altering product setting.

Just lately, alcohol manufacturing has emerged as some of the revolutionary areas within the U.S. economic system. Producers have developed a myriad of latest merchandise to additional enrich a well-established trade. Whereas market individuals have been fast to adapt to altering market circumstances, the historic categorical tax coverage has struggled to maintain tempo with market improvements.

Newer merchandise like exhausting seltzers and ready-to-drink cocktails straddle categorical traces and end in non-neutral and sometimes counterintuitive tax coverage. Regardless of the latest everlasting adoption of the Craft Beverage Modernization Act (CBMA) in late 2020, extra alternatives exist to enhance the tax panorama for one of many nation’s oldest merchandise.

The altering product panorama suggests the necessity for a change in tax coverage. Governments grappling with fiscal duties and public well being issues, and corporations battling for market share, have turned alcohol taxation right into a contentious subject. This paper delves into the intricate panorama of alcohol taxes, summarizing the present alcohol tax panorama and highlighting improvements which have blurred the explicit tax traces. We then discover a framework for the continued modernization of alcohol taxation. This framework offers choices for broad standards to simplify, and create extra certainty in, the alcohol tax system.

The Alcohol Tax Panorama

The financial justifications for particular taxes utilized to alcohol are primarily based on lowering exterior harms created by consuming alcohol. Excise taxes improve market costs and reduce (authorized) consumption, thus lowering the exterior harms that accompany alcohol consumption, reminiscent of drunk driving, intoxicated violence, and property injury. Alcohol taxes additionally generate income, which can be utilized to assist mitigate the harms of alcohol consumption by funding anti-addiction packages, enforcement of and incentives for sober driving, and education schemes.

Alcohol taxes are one of many nation’s oldest taxes. The federal authorities levied its first whiskey tax in 1791, 10 months earlier than ratifying the Invoice of Rights. From its preliminary imposition, and the Whiskey Insurrection that adopted, alcohol taxes have been contentious.

The catastrophe of Prohibition offers clear proof of how mistaken alcohol coverage can go. The 18th Modification to the Structure, ratified in 1919, prohibited the sale of most alcohol, and the Volstead Act (1919) supplied for its enforcement. Prohibition was repealed with the 21st Modification to the Structure in December 1933.

Starting in 1934, the federal authorities moved to a legalize-and-tax strategy to alcohol. Over the higher a part of the subsequent century, federal tax charges steadily ratcheted greater and better.

The Craft Beverage Modernization Act (CBMA) of 2020 supplied some tax aid to vintners, distillers, and brewers. CBMA made everlasting a number of tax cuts that had been applied within the 2017 Tax Cuts and Jobs Act, together with diminished charges on beer and distilled spirits, guaranteeing tax credit for wine everlasting, and completely fixing meads and low-alcohol wines in a decrease tax class.

Present Alcohol Tax Charges

Alcohol is taxed by the federal authorities, state governments, and a few municipalities. Alcohol taxes differ by class, primarily based on elements and the way it’s produced.

The federal authorities applies a distinct tax fee to merchandise in every class.[1] Beer taxes vary from $0.11 to $0.581 per gallon primarily based on manufacturing, location, and amount. Most wines are taxed at $1.07 per gallon. Spirits merchandise have tax benefits for the preliminary gallons distilled, however spirits taxes improve shortly, with massive producers paying $13.50 per proof gallon.[2]

Spirits are taxed extra closely, even between merchandise containing the identical alcohol content material. Take into account three “normal drinks,”[3] every containing 0.6 ounces of alcohol: a 12-ounce beer containing 5 % alcohol, a cocktail made with 1.5 ounces of 40-proof spirits, and a 5-ounce glass of wine with 12 % alcohol content material. Despite the fact that the alcohol content material of every beverage is identical, the federal taxes utilized to the cocktail are greater than thrice the speed utilized to the wine and greater than double the speed utilized to beer.

States additionally apply differential tax charges by alcohol product class.

Beer

All 50 states and the District of Columbia gather their very own excise taxes on fermented malt drinks. Along with excise taxes particularly levied on beer, normal gross sales taxes from state, and typically municipal governments, are tacked on after the costs of products are subtotaled.

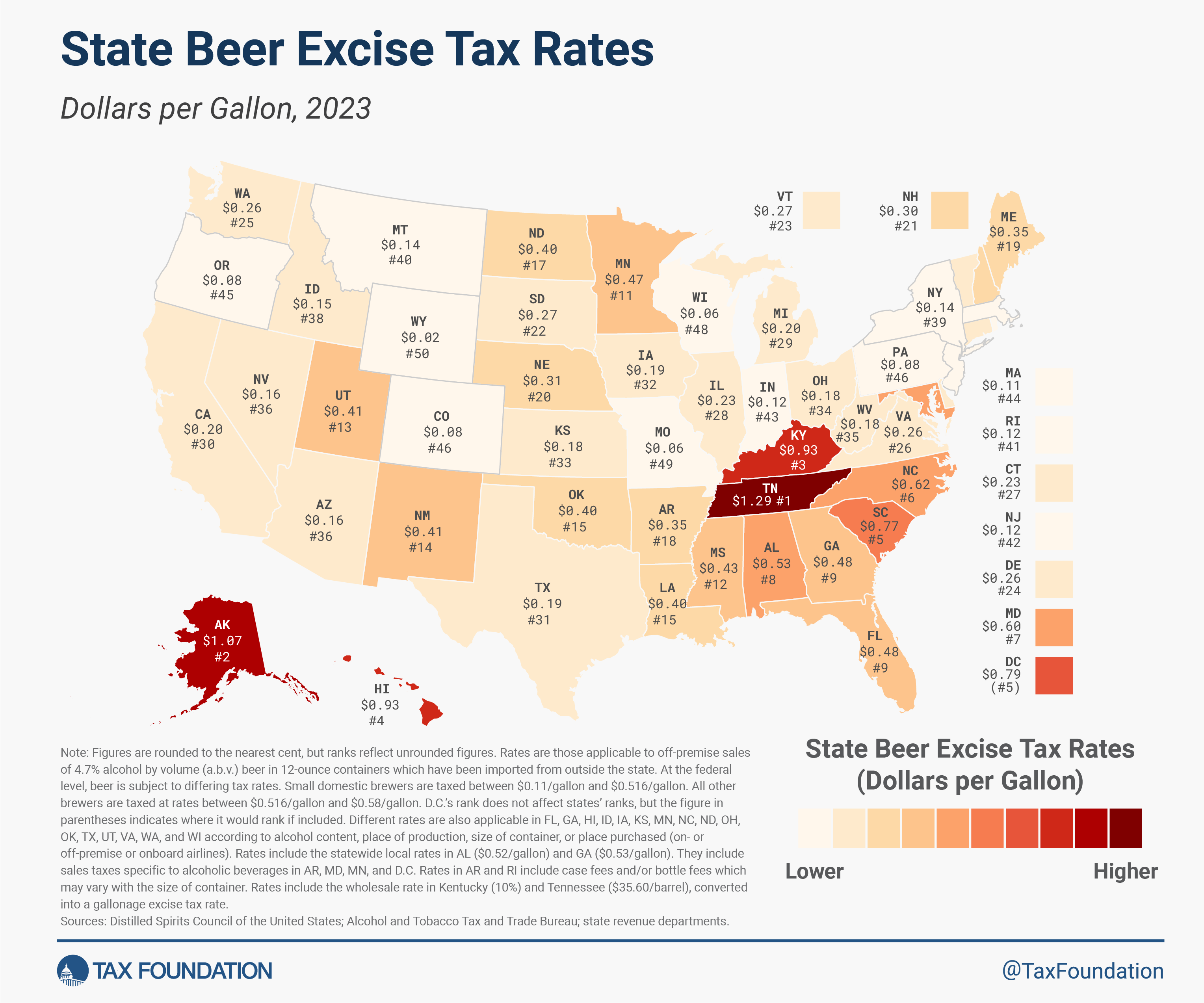

The next map reveals state beer excise taxAn excise tax is a tax imposed on a selected good or exercise. Excise taxes are generally levied on cigarettes, alcoholic drinks, soda, gasoline, insurance coverage premiums, amusement actions, and betting, and sometimes make up a comparatively small and risky portion of state and native and, to a lesser extent, federal tax collections.

charges, which differ broadly. Wyoming levies the bottom tax fee on beer at $0.02 per gallon, adopted by Missouri and Wisconsin at $0.06 per gallon.[4] Tennessee expenses the very best beer tax at $1.29 per gallon, adopted by Alaska at $1.07 per gallon.

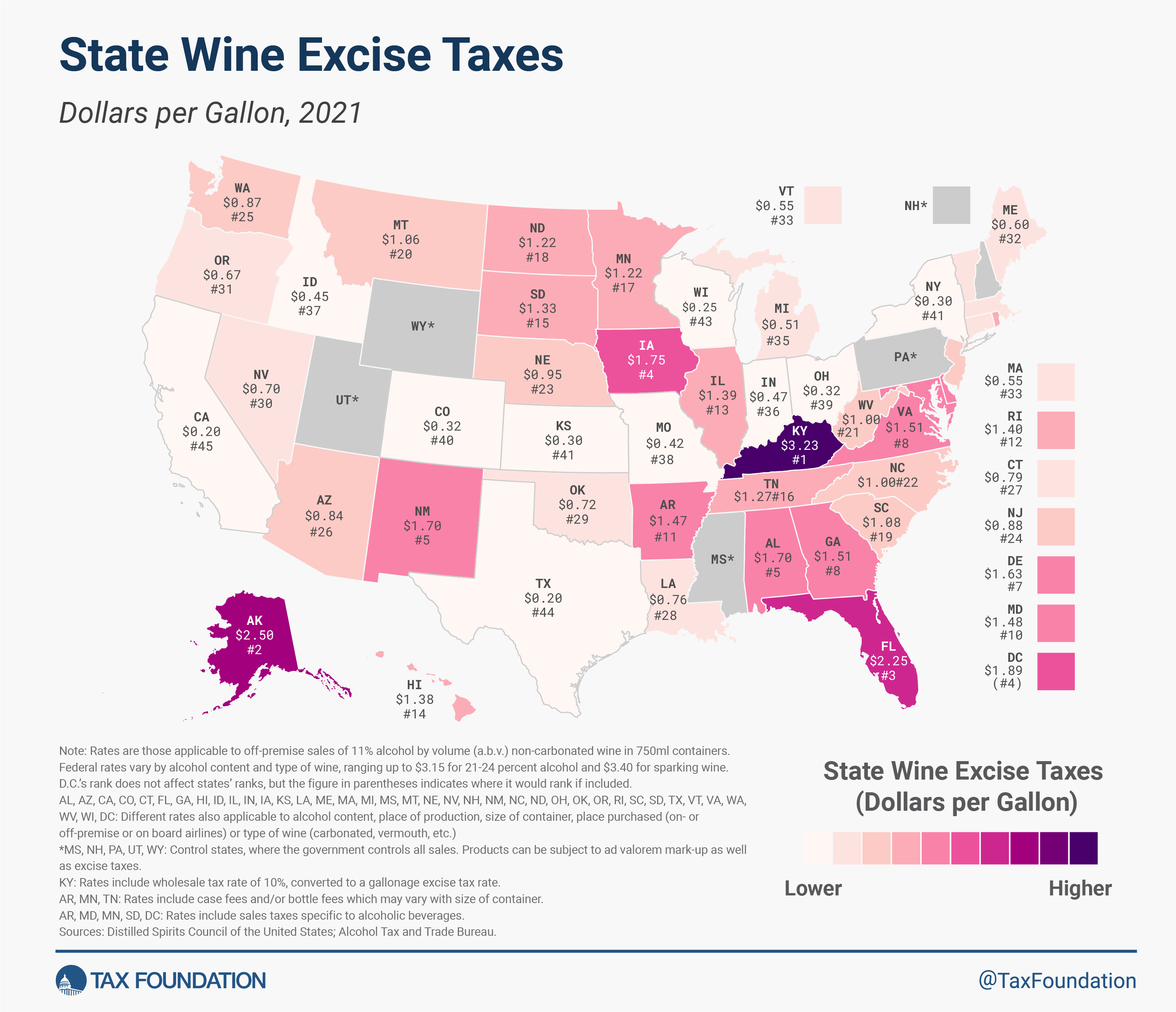

Wine

States are likely to tax wine at the next fee than beer however at a decrease fee than distilled spirits. Kentucky levies the very best state wine tax at $3.23 per gallon, nicely above Alaska’s second-place $2.50 per gallon.[5] The bottom excise taxes might be present in California and Texas, which each levy a tax of $0.20 per gallon.

Spirits

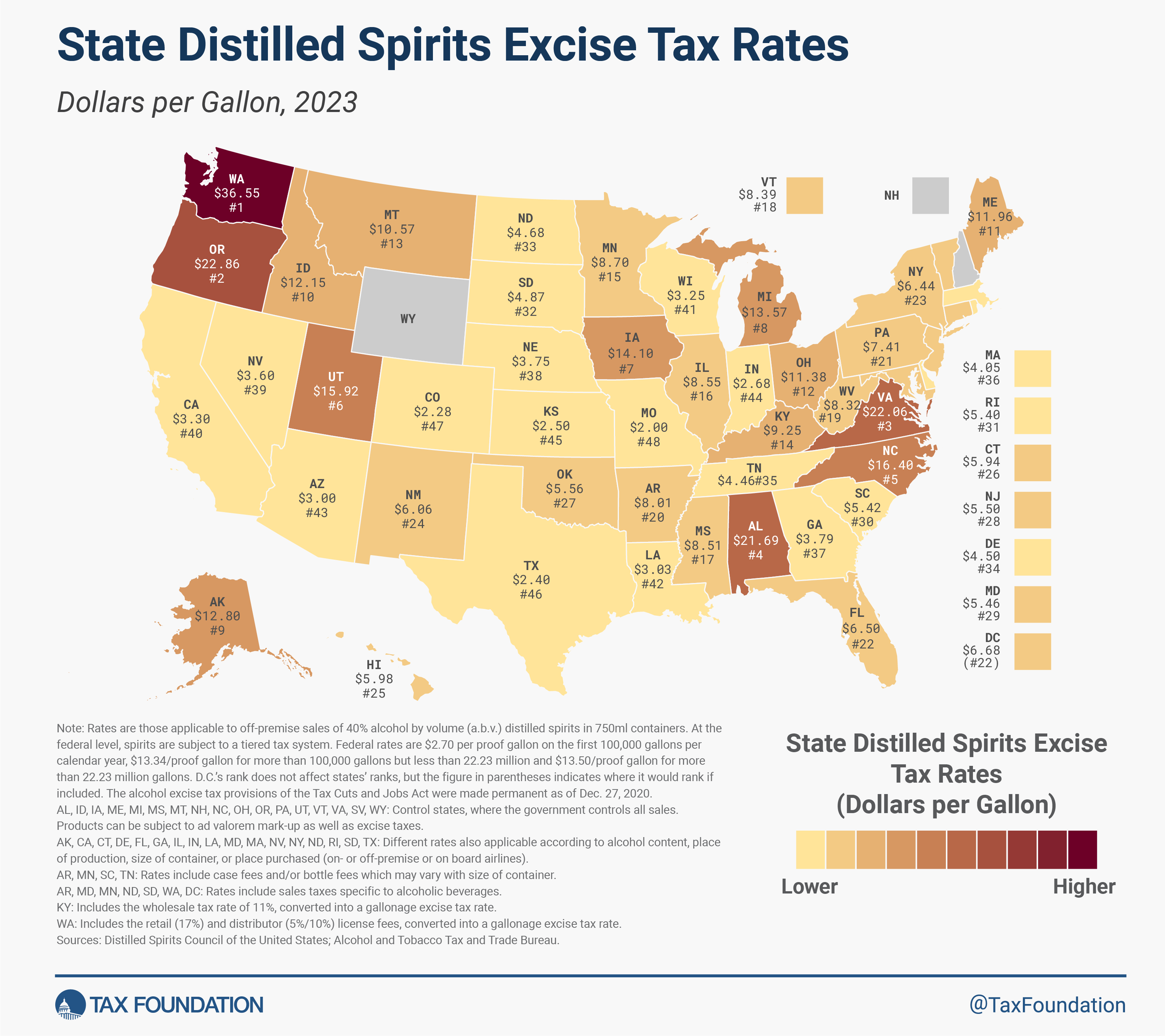

Just like the federal authorities, most states apply the stiffest tax charges, and extra restrictive rules, to distilled spirits. States additionally levy particular charges and taxes on spirits, together with case and bottle charges, particular gross sales taxes on spirits (separate from, and along with, the excise tax), wholesale taxes, and retail and distributor license charges.

In 17 states, the federal government operates a monopoly of state-controlled liquor shops. In these management states, the state can artificially inflate costs in lieu of levying a proper tax. The info in Determine 3 symbolize the implied excise tax charges in these states with authorities monopoly gross sales.[6]

Washington levies the very best excise tax fee on distilled spirits at $36.55 per gallon, adopted by neighboring Oregon at $22.86 per gallon. Distilled spirits are taxed the least in Wyoming and New Hampshire. These two management states achieve income instantly from alcohol gross sales by way of government-run shops and have set costs low sufficient that they’re comparable to purchasing spirits with out taxes.

Constructing on a Poor Basis

The present tax system has a number of flaws that usually compound to make the alcohol tax panorama way more advanced and inefficient than essential.

First, the explicit system shouldn’t be all-inclusive. Governments should explicitly outline the merchandise in a given tax class. As a result of alcohol might be produced from so many various elements and with completely different strategies, present definitions fail to delineate what merchandise match into which tax class, if any. This impact is exacerbated by latest improvements which have blurred the prevailing categorical traces.

Second, the completely different tax charges utilized to the varied classes make alcohol taxes non-neutral. Alcohols created from sure processes or uncooked elements obtain preferential tax therapy. The differential tax therapy of assorted merchandise gives a dizzying array of incentives for producers to do issues apart from spend money on creating new and higher merchandise.

Lastly, these differential tax results are compounded with the creation of manufacturing subsidies. Lots of the manufacturing subsidies search to rebalance the results created by the differential tax charges however typically find yourself rewarding solely a choose few producers.

Rum Cowl-Over and Rum Subsidies

Distilled spirits are topic to a federal excise tax within the U.S. as excessive as $13.50 per proof gallon. Of this, $10.50 per proof gallon of the federal excise tax on rum produced in Puerto Rico and the U.S. Virgin Islands (USVI) is routinely returned to the territories primarily based on their share of home manufacturing. The roughly $700 million in annual excise tax income going again to the islands is also known as the “rum cover-over.”

Starting within the early Nineties, the $10.50 per proof gallon returned to Puerto Rico and the USVI quickly elevated to $13.25. The upper fee of tax collections returned to the territories would typically be included in tax extender packages. The extra income was welcomed by the territories, however as a result of the extra income was continuously a part of a brief tax extender package deal, the income was troublesome for the territories to depend on reliably. The revenues from the rum cover-over at the moment are a battleground each between members of Congress and between beer and spirits industries.

In an excellent fiscal world, the rum cover-over could be innocuous. Just like the best way most gasoline tax revenues are earmarked for highway expenditures, returning federal excise taxes to the territories answerable for producing a lot of that income could be a easy fiscal shortcut.

The controversy surrounding the cover-over revenues is tied to an present battle over subsidies supplied to rum producers in Puerto Rico and the USVI and the disproportional tax fee charged to spirits. As mentioned above, the federal tax fee for spirits is greater than double the tax utilized to beer with the identical alcohol content material. On the similar time, rum producers in Puerto Rico and USVI have obtained substantial subsidies and tax breaks for the operations within the territories, supplied by the territories however functionally funded by the cover-over.

The result’s that spirits producers are extra closely taxed than producers of different alcohol, and sure producers are closely backed whereas different mainland rum producers obtain no such profit. On the very least, the rum cover-over program could be drastically improved with higher transparency necessities to assist make clear the precise results of this system. The subsidies and cover-over could possibly be eliminated completely within the absence of a federal tax on alcohol or in a system of equalized tax charges.

Wine Manufacturing Tax Credit and Part 5010

Wine receives each manufacturing subsidies and a good tax therapy in comparison with different varieties of alcohol. The CBMA prolonged the small home producer tax credit scoreA tax credit score is a provision that reduces a taxpayer’s ultimate tax invoice, dollar-for-dollar. A tax credit score differs from deductions and exemptions, which scale back taxable revenue, slightly than the taxpayer’s tax invoice instantly.

to all wine producers no matter measurement. The next tax credit can be found to all wine producers every calendar yr:

- $1.00 per gallon on the primary 30,000 gallons produced or imported into the USA

- $0.90 per gallon on the subsequent 100,000 gallons

- $0.535 per gallon on the subsequent 620,000 gallons

The influence of wine manufacturing tax credit is magnified when wine is produced after which added to spirits. Inner Income Code Part 5010 offers a credit score towards excise tax for wine and flavors content material in distilled spirits. The Part 5010 credit score can scale back tax owed as a result of wine and flavors are typically taxed at decrease charges than distilled spirits.

The motivation for 5010 was easy. Earlier than 1980, all elements utilized in producing a spirit (e.g., wine, flavors, and different elements) had been taxed individually earlier than being mixed right into a ultimate product. The Distilled Spirits Tax Revision Act of 1979 modified the appliance of the tax to the ultimate product, considerably rising the tax fee utilized to all elements within the manufacturing of spirits. To compensate distilled spirits producers who used lower-taxed elements within the manufacturing of their merchandise (e.g., wine and flavors), Congress amended the Inner Income Code to supply the 5010 tax credit score.

On account of Part 5010, most spirits producers use wine and flavors to considerably scale back their efficient tax fee. Desk 2 reveals a hypothetical instance of the overall price and tax burden for producing spirits with varied ranges of wine content material.

The extra wine that spirits producers add to their product, the decrease the tax. As soon as once more, the non-neutrality of the tax code concerning alcohol merchandise influences manufacturing and the sorts of merchandise accessible for consumption.

Blurred Traces of a Categorical System

Over time, producers innovate. New merchandise are developed and consumption modifications. The alcohol trade has been rife with innovation, with shoppers reaping the rewards of latest merchandise.

Craft brewing revolutionized the beer trade, exponentially rising the variety of beers accessible to American shoppers. In response to the Brewer’s Affiliation, the variety of breweries working within the U.S. elevated 26-fold previously 30 years, from 359 in 1992 to 9,709 in 2022.[7]

The rise in craft brewing not solely diversified the flavour profile of the merchandise available on the market, however the alcohol content material in these merchandise additionally typically diverged considerably from the standard 4-5 % in massive batch brews (e.g., Bud Lite, Miller Real Draft, Coors, and so on.). Craft India Pale Ales (IPAs) have a considerably greater alcohol content material than the preferred mild American lagers. Double IPAs typically have 10 % alcohol by quantity or extra, placing them nearer in alcohol content material to most wines than beers.

Different merchandise blur the traces even additional. Malt liquor, a higher-alcohol-content beer brewed with further malt, by its personal title is such a transparent class stratifier.

Many ready-to-drink cocktails are distilled spirits drinks. After combining the spirit with a mixer (e.g., a Jack and Coke), the ultimate product accessible to buy has an alcohol content material nearer to a beer than a bottle of liquor.

Laborious seltzers have been round for a couple of many years within the U.S., however their reputation exploded previously 5 years. Initially designed out of client love for vodka sodas and related carbonated alcoholic drinks, many exhausting seltzers comprise no spirits in any respect. Laborious seltzers are sometimes constructed from fermented cane sugar, although different occasions exhausting seltzers might be brewed from malted barley or made with vodka. Whereas malt-based seltzers are produced with grain, they create a ultimate product that bears little resemblance to its malt-based beer cousin. Laborious seltzers typically have an alcohol content material much like that of beer, however the best way during which the ultimate product is taxed relies on the elements used. Vodka-based seltzers are charged a stiffer tax fee than malt-based seltzers.

Lastly, different alcohol merchandise merely don’t match into any present class. Laborious cider is made primarily from apples and pears and was such an outlier that Congress handed new tax laws in December 2015 to create a brand new class and tax fee for exhausting ciders. Kombucha is a fermented tea; it’s naturally alcoholic, however the alcoholic content material might be elevated by way of strategic fermentation, leading to fashionable merchandise with alcohol by quantity much like beer. Quite a few different merchandise don’t match nicely right into a three- (or four- or five-) class tax system.

Although tax coverage can adapt to blurred categorical traces, that change is usually sluggish, requires legislative consideration, and provides substantial complexity to the tax system.

A Framework for Alcohol Taxation

Taxes utilized to alcohol ought to be easy, clear, impartial, and secure. When well-designed, alcohol taxes ought to effectively present tax income to fund packages to deal with exterior harms and anti-addiction packages related to alcohol consumption, whereas concurrently serving as a financial disincentive for overconsumption.

With a low fee and a broad base, alcohol taxes ought to encourage productive (product-improving) innovation and discourage unproductive (rent-seeking and regulatory seize) expenditures. The tax system can present a stage enjoying area for all producers and adapt to an revolutionary and altering market setting.

An Alcohol by Quantity Tax

A perfect alcohol tax designed from scratch would remove tax classes and manufacturing subsidies. Any product containing alcohol could be taxed primarily based on its alcohol content material, whatever the strategy of extracting the alcohol (e.g., distilling, mashing, or steeping) or the preliminary beginning ingredient (grapes, grain, potatoes, sugar cane, apple, pear, honey, and so on.). The alcohol by quantity (ABV) tax ensures neutrality by taxing all drinks containing the identical quantity of alcohol on the similar tax fee.

A linear tax could be the only choice. For illustrative functions, assume all “normal drinks” (Desk 1 above) containing 0.6 ounces of alcohol had been taxed at $0.04 (or $0.66 per 1.0 oz. of ethyl alcohol, which additionally equals $4.25 per proof gallon). That’s barely lower than the speed at present utilized to wine—about $1.02 per gallon of wine and $13.33 per barrel of beer.

Desk 3 beneath illustrates the hypothetical tax fee for quite a lot of merchandise. For a linear tax, the tax fee will increase proportionally for all sorts of alcohol. A beer with 10 % alcohol content material is taxed twice as a lot as a beer with 5 % alcohol content material: $0.08 and $0.04, respectively.

The harms of alcohol efficiency and consumption could improve exponentially, not linearly. Consuming 8 oz. of alcohol could be greater than twice as harmful and dangerous as consuming 4 oz. of alcohol. On this case, alcohol taxes must also improve exponentially with efficiency. A drink with 1.2 oz. of alcohol could be charged greater than twice as a lot tax as a drink with 0.6 oz. of alcohol. Such insurance policies are imperfect, as ingesting 8 oz. of alcohol has related results whether or not consumed by way of one drink or a number of drinks, however the tempo of consumption has relevance for coverage.

The desk additionally reveals an instance of an rising tax fee primarily based on alcohol efficiency. The ultimate column illustrates a tax fee during which the bottom fee ($0.066 per oz. of pure alcohol) is then mixed with a fee that’s 10 occasions the squared quantity of the bottom fee.[8]

The speed for a 3 oz. drink with a 40 % ABV or 1.2 oz. of alcohol could be $0.143, greater than twice the speed for the same drink with half the alcohol content material. The rising tax fee by alcohol content material would incentivize consumption of decrease alcohol content material drinks. A non-linear tax could be extra advanced, however could higher match exterior harms attributable to alcohol consumption.

No matter whether or not a flat taxAn revenue tax is known as a “flat tax” when all taxable revenue is topic to the identical tax fee, no matter revenue stage or belongings.

fee or an rising tax fee is utilized, a tax utilized to alcohol by quantity could be a well-targeted, impartial tax. If manufacturing subsidies are eliminated, this method could possibly be revenue-neutral, even with a decrease fee utilized to all classes. New merchandise may simply match into the tax system and few modifications would have to be remodeled time. Briefly, an ABV tax is well-designed.

Extra Tax Classes

If eradicating your entire alcohol tax code and beginning over is infeasible, taxing our bodies ought to contemplate a number of new tax classes to work into the present system design. Alcohol merchandise ought to be taxed relative to their exterior harms and several other new classes are wanted to embody the quickly altering panorama of alcohol merchandise.

The beer class would doubtless have to be divided into a number of classes by alcohol content material for low-, medium-, and high-gravity beers. Most European international locations apply a hybrid fee, during which tax charges are set individually for beer, wine, and spirits. Then, inside every class, taxes improve by alcohol content material.[9] Beers with greater alcohol content material are taxed extra closely.

Merchandise that match exterior of the usual beer, wine, and spirits classes would wish their very own class. Congress gave the blueprint for these new classes by establishing a class for exhausting ciders in 2015. Ciders containing as much as 8.5 % alcohol by quantity are taxed federally at a fee of $0.226 per gallon. Comparable classes could possibly be made for mead, kombucha, sake, orahovac, and different merchandise.

A brand new product class may supply a low-tax choice for brand new and revolutionary merchandise. This might assist new corporations compete for market share and provides regulators time to review the precise risks or harms of latest merchandise earlier than assigning the product to an present class or its personal new class.

Whereas an entire overhaul of the alcohol tax code could pose challenges, a realistic strategy includes introducing new tax classes inside the present framework. Recognizing the various and altering panorama of alcohol merchandise is crucial. By tailoring tax buildings to replicate the exterior harms and traits of every product, it’s doable to realize a extra nuanced and equitable system inside the constraints of the prevailing tax code.

Keep knowledgeable on the tax insurance policies impacting you.

Subscribe to get insights from our trusted consultants delivered straight to your inbox.

[1] Alcohol and Tobacco Tax and Commerce Bureau, “ACE CBMA Tax Charges Desk,” 2023, https://www.ttb.gov/photographs/pdfs/cbma/ACE_CBMA_Tax_Rates_Table.pdf.

[2] A proof gallon is one gallon of spirits that incorporates 50 % alcohol. A bottle at 80 proof (40 % alcohol) spirits, for instance, could be 0.8 proof gallons per gallon of liquid.

[3] In response to U.S. Dietary Tips for People, one normal drink or “drink equal” incorporates 0.6 ounces of ethyl alcohol. Extra info might be discovered at https://www.dietaryguidelines.gov/.

[4] Adam Hoffer, “How Excessive are Beer Taxes in Your State?,” Tax Basis, Jun. 27, 2023, https://taxfoundation.org/knowledge/all/state/state-beer-taxes-2023/.

[5] Jeremiah Nguyen and Janelle Fritts, “How Excessive are Wine Taxes in Your State?,” Tax Basis, Jun. 23, 2021, https://taxfoundation.org/knowledge/all/state/state-wine-taxes-2021/.

[6] Adam Hoffer, “How Laborious Do Distilled Spirits Taxes Chew in Your State?,” Tax Basis, Jun. 13, 2023, https://taxfoundation.org/knowledge/all/state/state-distilled-spirits-taxes-2023/.

[7] Brewer’s Affiliation, “Nationwide Beer Gross sales & Manufacturing Knowledge,” 2022, https://www.brewersassociation.org/statistics-and-data/national-beer-stats/.

[8] For a drink with .06 oz. of alcohol, (e.g. a 12-oz. beer with 5 % ABV), the bottom tax fee could be $0.04. Add to that the bottom fee squared. ($0.04)2 = 0.0016, multiplied by 10 = $0.016. $0.04 + $0.016 yields a complete fee of $0.056.

[9] Adam Hoffer, “Beer Taxes in Europe,” Tax Basis, Sep. 19, 2023, https://taxfoundation.org/knowledge/all/international/beer-taxes-in-europe-2023/.

Share