We had an replace from the Federal Reserve on FedNow this week. There are actually 400 banks taking part within the prompt funds community as both a sender or receiver.

They launched final July with 35 establishments and have been rising steadily since then. The final public assertion that I’ve heard was when FedNow chief, Mark Gould, spoke on the American Fintech Council’s Coverage Summit in November once they had 200 banks on the platform.

A number of the nation’s largest banks reminiscent of Financial institution of America, Citi, Capital One and PNC have nonetheless not joined. However these banks have indicated that they’ll finally be a part of.

Most giant banks are members of The Clearing Home’s RTP community so can course of real-time funds through that community. Then, after all, there are additionally real-time cost choices from the cardboard networks, Visa Direct and Mastercard Ship, which have nearly common protection and work internationally as properly.

FedNow is run by the federal authorities so it may well afford a gradual rollout. The Fed is enjoying the lengthy sport and it’s inevitable that the majority funds will transfer to real-time finally.

When that occurs FedNow will possible be an enormous participant in funds.

Featured

FedNow attracts some banks, as others lag

By Lynne Marek

The crypto change is in search of the dismissal of a lawsuit on the middle of the company’s oversight technique.

From Fintech Nexus

> In 2024, Lenders Want a Higher Delinquency Technique

By Rochelle Gorey

Lenders’ delinquency technique have to be rooted in an “empathy-first” mannequin to help prospects in experiencing hardship. Clients in misery want help and assets, not disgrace.

> Liveness detection is cat and mouse

By Tony Zerucha

The significance of liveness detection was one constructive growth arising from the COVID-19 pandemic. It’s a necessary function of a biometric-based safety technique, iProov chief product and innovation officer Joe Palmer stated.

The tokenized funds market witnessed its issuance on public blockchains develop from $100 million to over $800 million in 2023.

Podcast

Andrew B. Morris, Chief Content material Officer and Curt Persaud, Co-Founder & CTO of Fintech Islands on Caribbean fintech

Fintech Islands is the largest fintech occasion within the Caribbean, it’s going down on January 24-26 in Barbados.

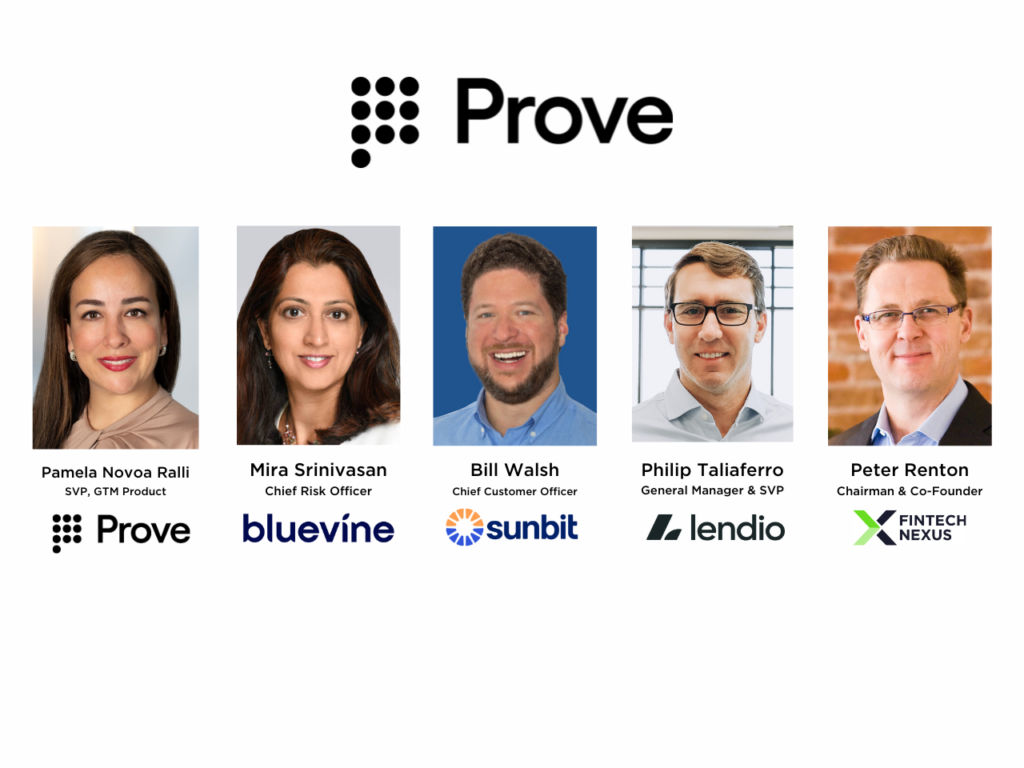

Webinar

Constructing Belief: Scalable Methods for Client and Enterprise Onboarding

Jan 23, 2pm EST

Identification verification is a key a part of monetary establishments’ and banks’ buyer journeys. Nevertheless, with ongoing compliance…

Additionally Making Information

- USA: LoanDepot outage drags into second week after ransomware assault

LoanDepot prospects say they’ve been unable to make mortgage funds or entry their on-line accounts following a suspected ransomware assault on the corporate final week. The mortgage and mortgage large stated on January 8 that it was working to “restore regular enterprise operations as shortly as potential” following a safety incident.

To sponsor our newsletters and attain 220,000 fintech fanatics along with your message, contact us right here.