The advantages of staying distant in a post-pandemic world.

Leap to:

As a tax skilled, you possibly can in all probability consider a number of ways in which digitization has made your job simpler. However have you ever thought of how your agency’s expertise helps distant shopper collaboration?

What are the advantages of distant 1040 shopper collaboration?

Remote 1040 shopper collaboration promotes flexibility, enhances effectivity, and will increase shopper satisfaction. However probably the most profitable tax workflows usually rely upon the extent of shopper engagement all through the 1040 course of.

Engaged taxpayers are important to a well-managed busy season. Their attentiveness dictates how quickly you obtain signed engagement letters, tax paperwork, and bill funds. In case your distant 1040 shopper collaboration course of doesn’t align together with your shoppers’ expertise habits, you’re much less prone to obtain responses inside a well timed window.

Assist your taxpayers show you how to. Present them with cloud-based, remote-friendly instruments that resemble their on a regular basis digital functions. This could result in:

- Sooner responses

- Faster turnaround instances

- Fewer tax season delays.

Actual-time communication by way of digital platforms additionally fosters a extra accessible, customized shopper expertise. You might even cut back or remove telephone calls and in-person conferences.

Keep in mind, realizing your shoppers is vital. Their expertise habits and preferences are paramount for driving engagement. What do they need? How are you going to enhance their expertise? There are a number of components to think about when bringing your 1040 shopper collaboration course of into the trendy age.

How cellular apps meet shopper expectations

A Chase survey discovered that 87% of respondents use their cellular banking app at the least as soon as monthly—with 90% preferring to handle all their funds in a single place. The rising reputation of centralized cellular banking means that shoppers desire a related expertise with their taxes.

Consider all of the duties that your taxpayers will deal with in the course of the shopper collaboration course of:

- Sending supply paperwork

- Filling out their questionnaire

- Offering signatures

- Reviewing the finished return

- Paying their bill

- Speaking together with your agency

Managing these duties throughout a number of functions or by way of cluttered inboxes will increase the chance of confusion and procrastination. With an all-in-one cellular app along with a web site, shoppers can simply maintain observe of things and shortly deal with them—from anyplace.

Streamlining your 1040 supply doc assortment

Has this ever occurred to your agency? Slightly than sending tax paperwork by way of correct channels, your shopper emails you a batch of poorly cropped, blurry picture recordsdata. Cellular photo-scanning has been a normal follow in on-line banking for years. Now those self same client habits are trickling into the tax area, however some corporations don’t have the right instruments to satisfy them.

At the moment, flexibility is important if you would like correct, promptly delivered documentation. Give your shoppers the sources to ship tax data in no matter manner is most handy for them. This might embrace:

- Cellular photo-scanning. This characteristic provides taxpayers the power to take pictures of paper paperwork and ship them as cropped, standardized PDFs.

- Browse and add. For taxpayers with regionally saved recordsdata, shopper collaboration apps usually embrace browse and add performance or a drag-and-drop characteristic.

- Dropbox/Google Drive. Some shoppers could maintain tax paperwork on a cloud storage service like Dropbox or Google Drive. Integrating with these platforms saves shoppers from manually downloading and importing recordsdata.

- Reply with the quantity. Typically shoppers have tax data to report with out an accompanying doc. For these cases, shoppers ought to have an choice to submit particular quantities.

Guaranteeing your distant 1040 shopper collaboration course of is safe

Based on a research commissioned by Apple, information breaches reached an all-time excessive in 2023. And Accounting At the moment reported that 85% of accounting professionals have been, or know somebody who has been, a sufferer of fraud. Along with effectivity and comfort, information safety needs to be a high precedence in your distant 1040 shopper collaboration.

Whereas e-mail is a helpful platform for basic communication, it isn’t really useful for exchanges of delicate shopper data. Doing so will increase the danger of knowledge leaks, phishing scams, and malware assaults.

As an alternative, contemplate transferring all communication and doc exchanges to a safe shopper collaboration platform. Be sure you search for SOC (system and group management) certification, multi-factor authentication, and encryption particulars when selecting an utility.

handle shopper resistance to new tech

One of many essential causes corporations hesitate to alter their 1040 shopper collaboration course of is worry of pushback. Unsuccessful adoption may end up in wasted licensing prices, upset shoppers, and extra complications in your agency.

Nevertheless, as taxpayers change into extra reliant on cellular and cloud applied sciences with every passing yr, these considerations change into much less warranted. In November 2023, cellular visitors comprised 58.9% of the U.S. market share in comparison with simply 38.9% for desktop visitors, in line with Similarweb. And Pew Analysis discovered that 83% of People aged 50-64 owned a smartphone in 2021.

General, you could be assured that almost all of your shoppers are doubtless comfy with cellular expertise. Most probably, they like it. For the few taxpayers which might be resistant to alter, see what sorts of coaching, help, and advertising and marketing supplies every shopper collaboration app gives. Some distributors embrace taxpayer-facing help of their product bundle; others make you provide help your self.

Selecting the best digital options in your 1040 course of

Client demand for cellular choices and all-in-one functions could be seen throughout the tech panorama. But most distant 1040 shopper collaboration options don’t replicate this actuality. Many on-line portals nonetheless lack cellular performance and require corporations so as to add third-party distributors like DocuSign.

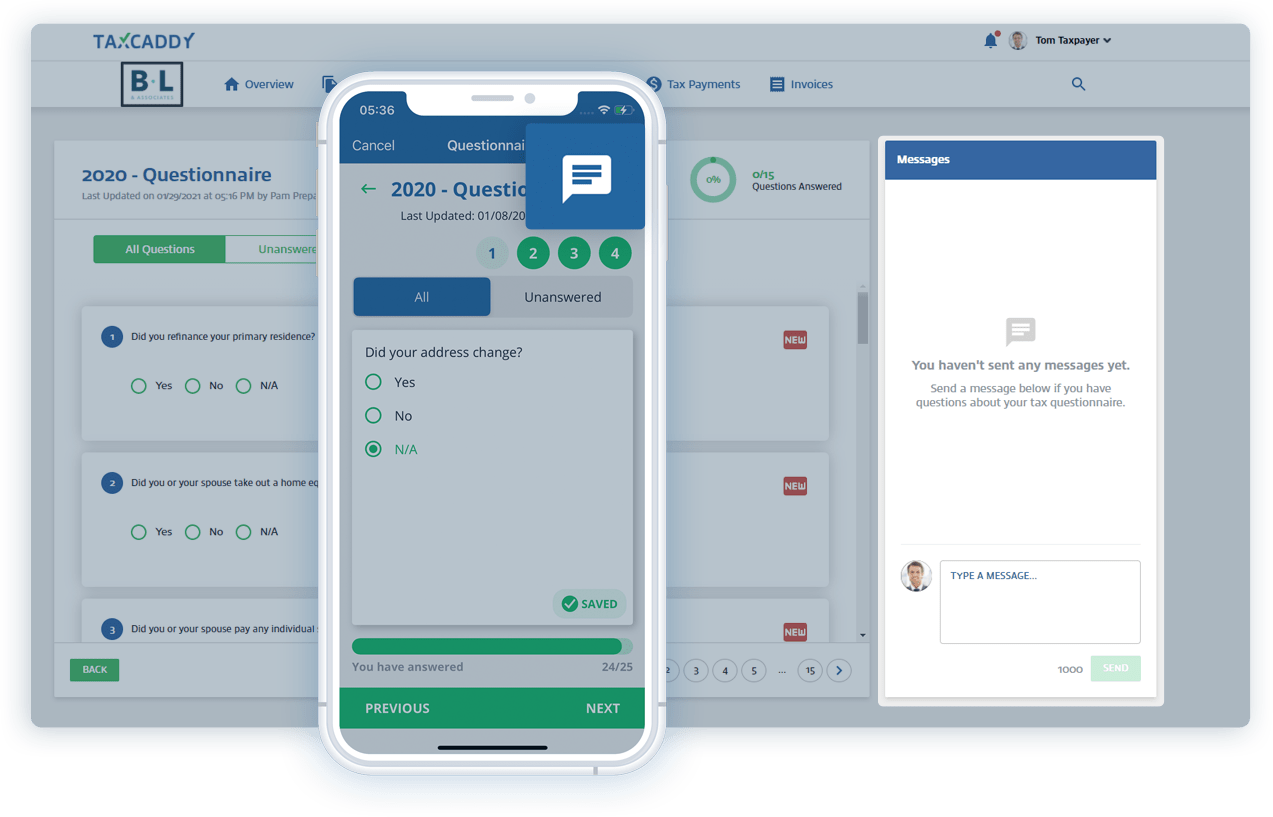

SurePrep TaxCaddy is among the few merchandise that consolidates all 1040 shopper collaboration right into a single cloud-based app. Taxpayers can add paperwork, e-sign, pay their bill, and message your agency from their smartphone, desktop, or pill. And with full UltraTax CS and GoSystem Tax RS integration, TaxCaddy robotically creates Doc Request Lists for every shopper so your employees doesn’t should.

TaxCaddy continues to be the final word 1040 shopper collaboration answer by offering probably the most taxpayer-focused shopper portal accessible. If you’re able to simplify distant collaboration for shoppers and tax professionals, contact us for extra details about TaxCaddy.

OptionsEradicate the standard organizer and improve shopper satisfaction with an easy-to-use tax shopper portal accessible by way of web site and cellular app. |