David Lawant, Head of Analysis at FalconX, a digital belongings prime brokerage with buying and selling, financing, and custody for main monetary establishments, just lately provided an evaluation on X (previously Twitter) concerning the evolving position of Bitcoin halvings in market dynamics. This evaluation challenges the standard view that halvings instantly and considerably have an effect on Bitcoin’s value, as a substitute highlighting a broader financial and strategic context that is perhaps influencing investor perceptions and market habits extra profoundly.

The Miner’s Diminishing Affect On Bitcoin Value

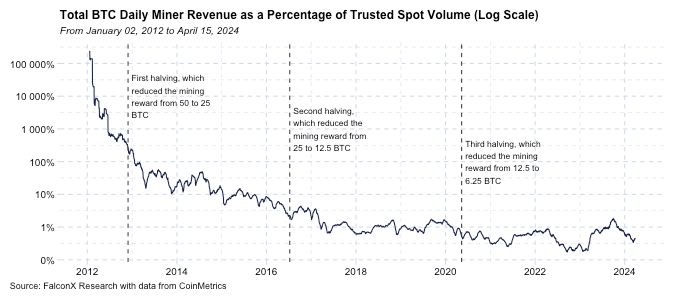

Lawant begins by addressing the altering influence of Bitcoin miners on market costs. He presents an in depth chart evaluating the overall mining income to the Bitcoin spot traded quantity from 2012 onwards, clearly marking the dates of the three earlier halvings. This information reveals a major shift: “Probably the most essential chart for comprehending halving dynamics is the one under, not the value chart. It illustrates the proportion of complete mining income in comparison with BTC spot traded quantity since 2012, with the three halving dates marked.”

In 2012, complete mining income was multiples of the day by day traded quantity, highlighting a time when miners’ selections to promote might have important impacts in the marketplace. By 2016, this determine was nonetheless a notable double-digit proportion of day by day quantity however has since declined. Lawant emphasizes, “Whereas miners stay integral to the Bitcoin ecosystem, their affect on value formation has notably waned.”

He elaborates that this discount is partly because of the rising diversification of Bitcoin holders and the rising sophistication of economic devices throughout the cryptocurrency market. Moreover, not all mining income is instantly impacted by halving occasions—miners might select to carry onto their rewards moderately than promote, affecting the direct influence of decreased block rewards on provide.

Lawant connects the timing of halvings to broader financial cycles, proposing that halvings don’t happen in isolation however alongside important financial coverage shifts. This juxtaposition will increase the narrative influence of halvings, as they underscore Bitcoin’s attributes of shortage and decentralization in periods when conventional financial programs are underneath stress.

“Bitcoin halving occasions are inclined to happen throughout important financial coverage turning factors, so the narrative match is simply too excellent to imagine they can not affect costs,” Lawant observes. This assertion suggests a psychological and strategic dimension the place the perceived worth of Bitcoin’s shortage turns into extra pronounced.

The evaluation then shifts in the direction of the macroeconomic setting influencing Bitcoin’s enchantment. Lawant references the 2020 dialogue by investor Paul Tudor Jones who labeled the financial local weather as “The Nice Financial Inflation,” a interval marked by aggressive financial growth by central banks. Lawant argues, “I’d argue that this was a extra essential issue within the 2020-2021 bull run than the direct move influence from the halving,” stating that macroeconomic components might have had a extra substantial affect on Bitcoin’s value than the halving itself.

Future Prospects: Macroeconomics Over Mechanics

Trying in the direction of the long run, Lawant speculates that because the world enters a brand new part of financial uncertainty and potential financial reform, macroeconomic components will more and more dictate Bitcoin’s value actions moderately than the mechanical features of halvings.

“Now in 2024, the considerations middle across the aftermath of the fiscal/financial insurance policies which were in place for many years however are getting turbocharged in a world that could be very totally different from 4 years in the past. […] We’re doubtlessly getting into a brand new leg of this macroeconomic cycle, and macro is turning into a extra important think about BTC value motion,” he concludes.

This attitude means that whereas the direct value influence of Bitcoin halvings might diminish, the broader financial context will possible spotlight Bitcoin’s basic properties—immutability and a hard and fast provide cap—as essential anchors for its worth proposition in a quickly evolving financial panorama.

At press time, BTC traded at $62,873.

Featured picture created with DALL·E, chart from TradingView.com

Disclaimer: The article is offered for academic functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding selections. Use data offered on this web site solely at your personal threat.