Observe: The next is the testimony of Daniel Bunn, President & CEO of TaxA tax is a compulsory fee or cost collected by native, state, and nationwide governments from people or companies to cowl the prices of normal authorities providers, items, and actions.

Basis, earlier than the U.S. Senate Committee on Funds listening to on April 10, 2024, titled, “Sunny Locations for Shady Individuals: Offshore Tax Evasion by the Rich and Firms”

Chairman Whitehouse, Rating Member Grassley, and distinguished members of the Senate Funds Committee, thanks for the chance to testify on offshore tax evasion.

On the outset, I wish to distinguish between the idea of tax evasion, which is prohibited and needs to be prosecuted, and tax avoidance, which is the utilization of authorized strategies to restrict publicity to tax legal responsibility. Too typically these ideas are conflated, and lawmakers and coverage specialists needs to be cautious to determine the distinction.

My view on evasion is easy: the Inner Income Service (IRS) ought to implement present tax guidelines in order that prison evaders of tax legal responsibility are dropped at justice.

Avoidance is extra sophisticated than evasion as a result of it implies that the foundations, as designed, enable companies or people to legally scale back their tax burdens. This makes defining tax avoidance very tough. Is it tax avoidance to make the most of all obtainable credit and deductions to reach at one’s authorized tax legal responsibility? Does tax avoidance change into extra salient if authorized cross-border preparations are being utilized by companies or people?

Simply as there are utterly respectable causes for taxpayers to make the most of credit and deductions, there are numerous respectable causes for people and companies to earn revenue overseas.

In both case, policymakers could also be involved concerning the underlying tax guidelines. Some members of this committee might discover it fascinating to have a low tax burden on company or particular person revenue, however the guidelines for such a system ought to transparently ship that end result. As a substitute, we regularly have guidelines that enable people or firms to realize low tax burdens by way of sophisticated and fewer clear maneuvers.

Different members of this committee might discover it fascinating to have a excessive tax burden on company or particular person revenue. Nonetheless, the next tax burden additionally requires extra substantial enforcement. For my part, the enforcement mechanisms aimed toward offshore revenue should not too completely different from capital controls. Even with these enforcement mechanisms, the savviest firms and people should still be capable to discover gaps within the system leading to the next tax burden on these with much less assets to discover and exploit enforcement gaps.

Policymakers ought to intention to align U.S. tax guidelines to help development and funding whereas elevating income with guidelines which are enforceable with low burdens for administration and compliance. Our present tax system doesn’t measure as much as these aims. Particularly, worldwide taxation of particular person revenue makes the U.S. a big worldwide outlier, and the worldwide Company Alternate Minimal Tax adopted in 2022 frustrates taxpayers and lacks closing steerage from the IRS.

My testimony will cowl official estimates of the tax holeThe tax hole is the distinction between taxes legally owed and taxes collected. The gross tax hole within the U.S. accounts for at the least 1 billion in misplaced income every year, in line with the newest estimate by the IRS (2011 to 2013), suggesting a voluntary taxpayer compliance fee of 83.6 %. The web tax hole is calculated by subtracting late tax collections from the gross tax hole: from 2011 to 2013, the typical web hole was round 1 billion.

, the coverage context for offshore revenue, and associated points for policymakers to think about with three key takeaways:

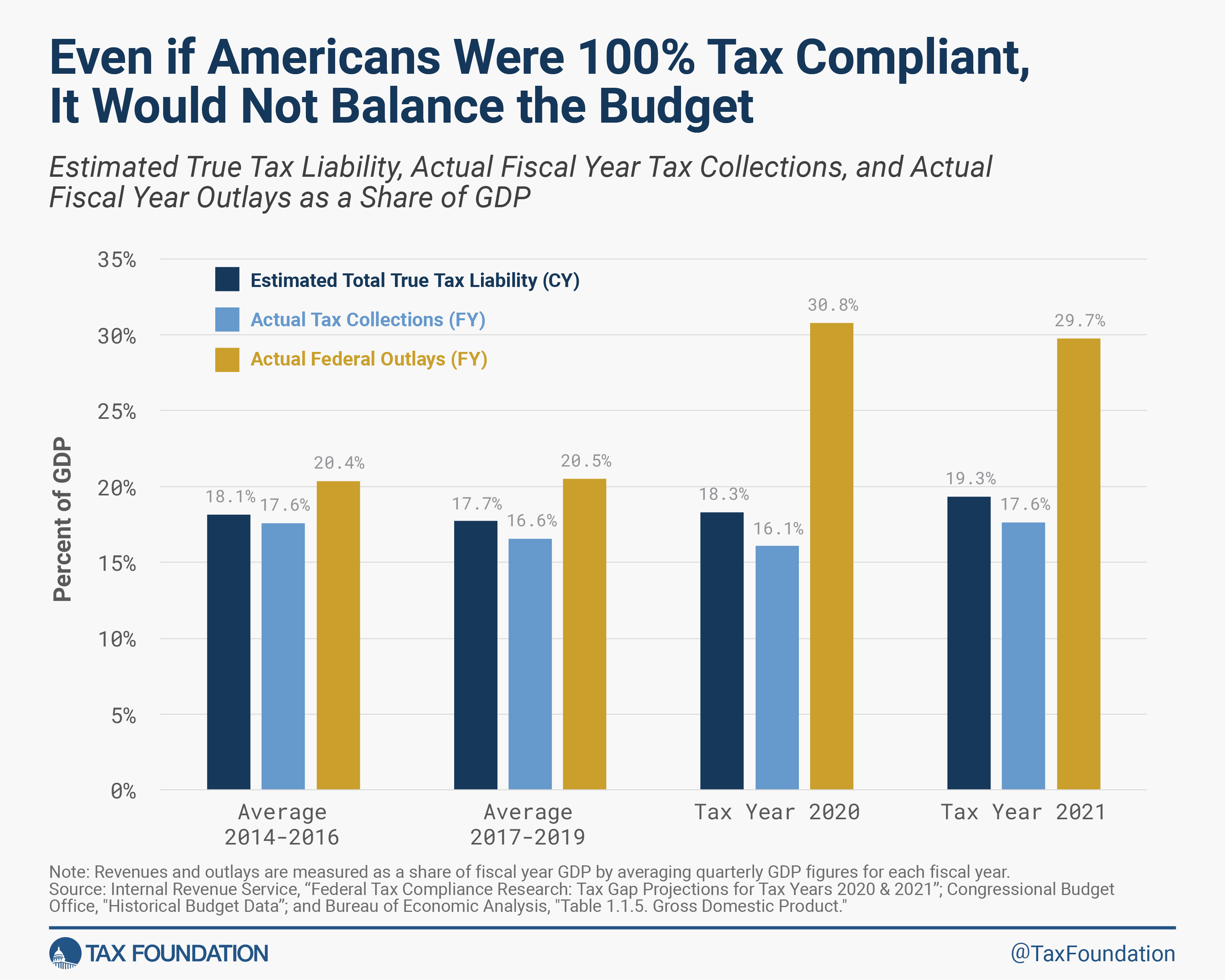

- The tax hole has remained roughly fixed as a share of GDP and even full compliance wouldn’t shut the deficit.

- Our citizenship-based revenue tax code creates complications for taxpayers for not a lot income.

- The Tax Cuts and Jobs Act (TCJA) improved our worldwide tax code by halting inversions and bringing again some worthwhile belongings from offshore places.

The Tax Hole

The newest IRS report on the tax hole measured a projected tax hole of $688 billion for fiscal 12 months 2021. On web, after accounting for enforced and late funds, the IRS projected a tax hole of $625 billion.[1]

This estimate doesn’t point out that $625 billion went unlawfully unpaid in 2021. The IRS as a substitute makes use of estimates from prior evaluation of tax compliance to estimate what’s left unpaid.

The tax hole is impacted by taxpayer noncompliance, tax enforcement, and tax coverage itself. Because of this policymakers ought to consider the tax hole when it comes to what may be executed by way of coverage to handle the general concern.

The dimensions of the estimated tax hole has hovered round 2.5 % of gross home product (GDP) in estimates the IRS has revealed over the past decade.[2]

The dimensions of the tax hole is usually pointed to as a technique to clear up the United States’ fiscal challenges. As my colleague, Scott Hodge, has written in his overview of the IRS tax hole estimates, “…even excellent tax compliance—an not possible purpose—would fall in need of eliminating the deficit.”

Insurance policies Impacting Offshore Revenue

The IRS notes within the tax hole report that their projections are restricted and should not totally account for international revenue. Even with out an official estimate of the tax hole for international revenue, it’s value reviewing the standing of U.S. insurance policies and their approaches to taxing international revenue.

The USA has traditionally been an outlier in its strategy to taxing international revenue of U.S. residents and U.S.-headquartered firms. The U.S. and Eritrea are the one two nations on this planet that tax their citizen’s revenue irrespective of the place they reside. And till 2017, the U.S. was amongst solely a handful of nations that didn’t present a deduction or exemption for international enterprise revenue. Alongside that change in 2017, the U.S. continues to tax the worldwide earnings of U.S. firms utilizing a number of completely different guidelines.

Insurance policies Concerning International Particular person Revenue

The challenges of imposing citizenship-based taxation of particular person revenue led lawmakers to undertake the International Account Tax Compliance Act (FATCA) in 2010. This regulation imposes a heavy compliance burden for banks around the globe and U.S. residents with earnings and financial savings overseas.

When the regulation was adopted, the Joint Committee on Taxation estimated that FATCA would elevate $8.7 billion.[3] A 2022 report by the Treasury Inspector Common for Tax Administration recognized $574 million in prices of the primary ten years of FATCA implementation.[4]

A 2019 report from the Authorities Accountability Workplace identifies different prices and challenges to FATCA.[5] Annual renunciations of U.S. citizenship rose from 1,601 to 4,449 from 2011 by way of 2016. The report notes that this improve of practically 178 % is “attributable partially to the [FATCA] difficulties.”

Many U.S. expatriates discover themselves caught by the FATCA guidelines and overlapping compliance burdens. So-called unintended Individuals, who might not even have been conscious they had been technically U.S. residents previous to a FATCA compliance discover, have little recourse apart from to formally surrender their citizenship.

Citizenship-based taxation is poor tax coverage. And the FATCA, as an enforcement instrument of that regime, has revealed the perverse incentives of imposing such a coverage.

Insurance policies Concerning International Enterprise Revenue

Equally, for enterprise revenue, the coverage panorama reveals the complexity that may come up within the context of a hybrid territorial tax systemA territorial tax system for companies, versus a worldwide tax system, excludes income multinational firms earn in international nations from their home tax base. As a part of the 2017 Tax Cuts and Jobs Act (TCJA), the United States shifted from worldwide taxation in direction of territorial taxation.

. In 2017, the U.S. adopted a deduction for international dividends as a transition away from a totally worldwide tax systemA worldwide tax system for companies, versus a territorial tax system, consists of foreign-earned revenue within the home tax base. As a part of the 2017 Tax Cuts and Jobs Act (TCJA), america shifted from worldwide taxation in direction of territorial taxation.

with deferral.

Previous to the TCJA, the U.S. operated a worldwide tax system with the choice to defer taxes on international revenue till the earnings had been repatriated, an strategy most developed nations had deserted in favor of a territorial tax system that largely exempts international earnings from home tax. To make issues worse, when U.S. firms introduced earnings again, they confronted a federal tax fee of 35 %, which was the very best company tax fee within the Organisation for Co-operation and Improvement (OECD).

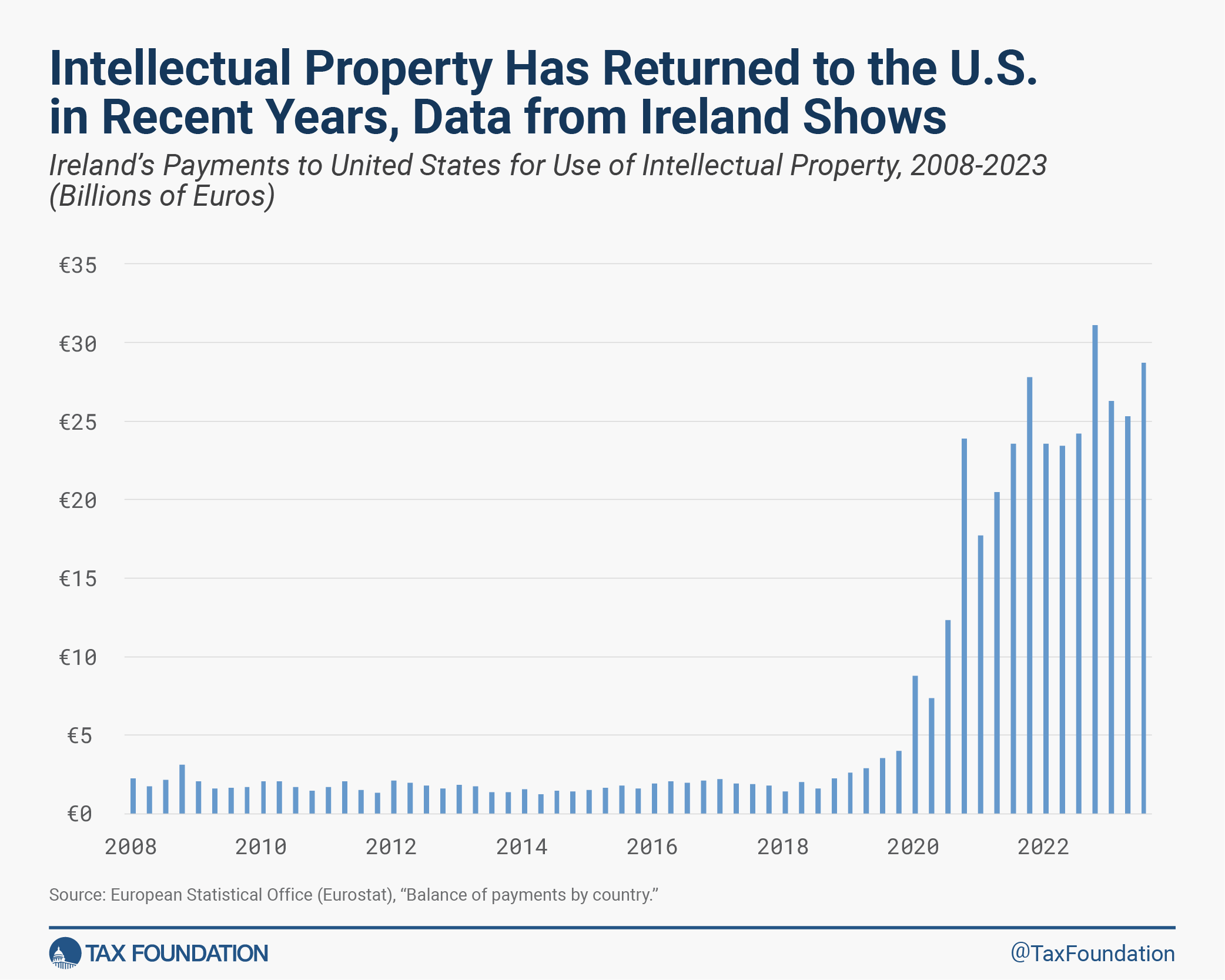

This incentivized U.S.-based enterprise to both maintain their earnings offshore or to maneuver their headquarters to a international jurisdiction. Since 2017, trillions of international earnings have been repatriated, and tax inversions have stopped.[6]

Moreover, worthwhile enterprise belongings (specifically, mental property belongings) have been returned to the U.S. from offshore places, as may be seen in current information from Irish cross-border funds. Beforehand, funds from Eire for utilizing mental property owned by U.S. firms would move to small offshore jurisdictions with no company revenue taxA company revenue tax (CIT) is levied by federal and state governments on enterprise income. Many firms should not topic to the CIT as a result of they’re taxed as pass-through companies, with revenue reportable underneath the particular person revenue tax.

. Following current coverage adjustments within the U.S. and Eire, a few of that mental property returned to america, and funds are flowing from Eire to the U.S. due to that change.

U.S. enterprise taxpayers should navigate an internet of anti-avoidance guidelines, together with our Subpart F regime, our tax on International Intangible Low-Tax Revenue (GILTI), the Base Erosion and Anti-abuse Tax (BEAT), and the Company Various Minimal Tax (CAMT) adopted in 2022 as a part of the InflationInflation is when the final worth of products and providers will increase throughout the economic system, decreasing the buying energy of a forex and the worth of sure belongings. The identical paycheck covers much less items, providers, and payments. It’s typically known as a “hidden tax,” because it leaves taxpayers much less well-off resulting from larger prices and “bracket creep,” whereas rising the federal government’s spending energy.

Discount Act. Every of those include their very own complexities and challenges, however the CAMT stands out as taxpayers nonetheless do not need closing steerage from the IRS for complying with that coverage.

Likewise, the worldwide minimal tax will introduce a brand new stage of complexity for U.S. multinational companies, even when the U.S. doesn’t undertake these guidelines.

In the meantime, measures of income of U.S. firms in tax havens present that the general quantities of income in these jurisdictions is comparatively small. Some measures present a decline in recent times. As Adam Michel of the Cato Institute identified in a current report, since 2016, the haven revenue share of direct funding revenue has been declining.[7]

This helps the concept that the foundations adopted in 2017 improved the tax remedy of international earnings, made the U.S. a extra aggressive location for incomes income, and that lawmakers needs to be cautious to not upset this steadiness.

Conclusion

Policymakers ought to intention for insurance policies which are pro-growth, environment friendly at elevating income, and enforceable. Our present guidelines for international revenue fall brief, notably our citizenship-based taxation of particular person revenue and the Company Various Minimal Tax.

Over the past decade, there has not been a significant change to the tax hole. Policymakers ought to deal with particular guidelines they wish to change to restrict avoidance or enforcement measure they suppose will deal with evasion.

U.S. policymakers will seemingly be contemplating adjustments to guidelines for offshore revenue as a part of laws to handle the expiring Tax Cuts and Jobs Act provisions in 2025. In that context, lawmakers ought to intention for insurance policies that help funding and hiring in america and refining anti-avoidance measures to enhance administrability and decrease compliance prices.

Keep knowledgeable on the tax insurance policies impacting you.

Subscribe to get insights from our trusted specialists delivered straight to your inbox.

[1] Inner Income Service, “Federal Tax Compliance Analysis: Tax Hole Projections for Tax Years 2020 & 2021,” Oct. 2023, https://www.irs.gov/pub/irs-pdf/p5869.pdf.

[2] Tax Basis, “IRS Report Exhibits Closing the Tax Hole Would Not Shut the Deficit,” Oct. 25, 2023, https://taxfoundation.org/weblog/irs-tax-gap-report/.

[3] The Joint Committee on Taxation, “Estimated Income Results Of The Income Provisions Contained In An Modification To The Senate Modification To The Home Modification To The Senate Modification To H.R. 2847, The ‘Hiring Incentives To Restore Employment Act’ Scheduled For Consideration By The Home Of Representatives,” March 4, 2010, https://www.jct.gov/publications/2010/jcx-6-10/.

[4] Treasury Inspector Common for Tax Administration, “Further Actions Are Wanted to Deal with Non-Submitting and Non-Reporting Compliance Below the International Account Tax Compliance Act,” Apr. 7, 2022, https://www.oversight.gov/websites/default/recordsdata/oig-reports/TIGTA/202230019fr.pdf.

[5] U.S. Authorities Accountability Workplace, “International Asset Reporting: Actions Wanted to Improve Compliance Efforts, Get rid of Overlapping Necessities, and Mitigate Burdens on U.S. Individuals Overseas,” Apr. 1, 2019, https://www.gao.gov/merchandise/gao-19-180.

[6] For extra data on the 2017 rule adjustments and their impression, see Alan Cole, “The Influence of GILTI, FDII, and BEAT,” Jan. 31, 2024, https://taxfoundation.org/analysis/all/federal/impact-gilti-fdii-beat/.

[7] See Determine 4 in Adam N. Michel, “Daring Worldwide Tax Reforms to Counteract the OECD International Tax,” Feb. 13, 2024, https://www.cato.org/policy-analysis/bold-international-tax-reforms-counteract-oecd-global-tax#data-multinational-business-income-overstates-tax-haven-profits.

Share