New Inside Income Service (IRS) knowledge on particular person earnings taxes for taxA tax is a compulsory cost or cost collected by native, state, and nationwide governments from people or companies to cowl the prices of basic authorities companies, items, and actions.

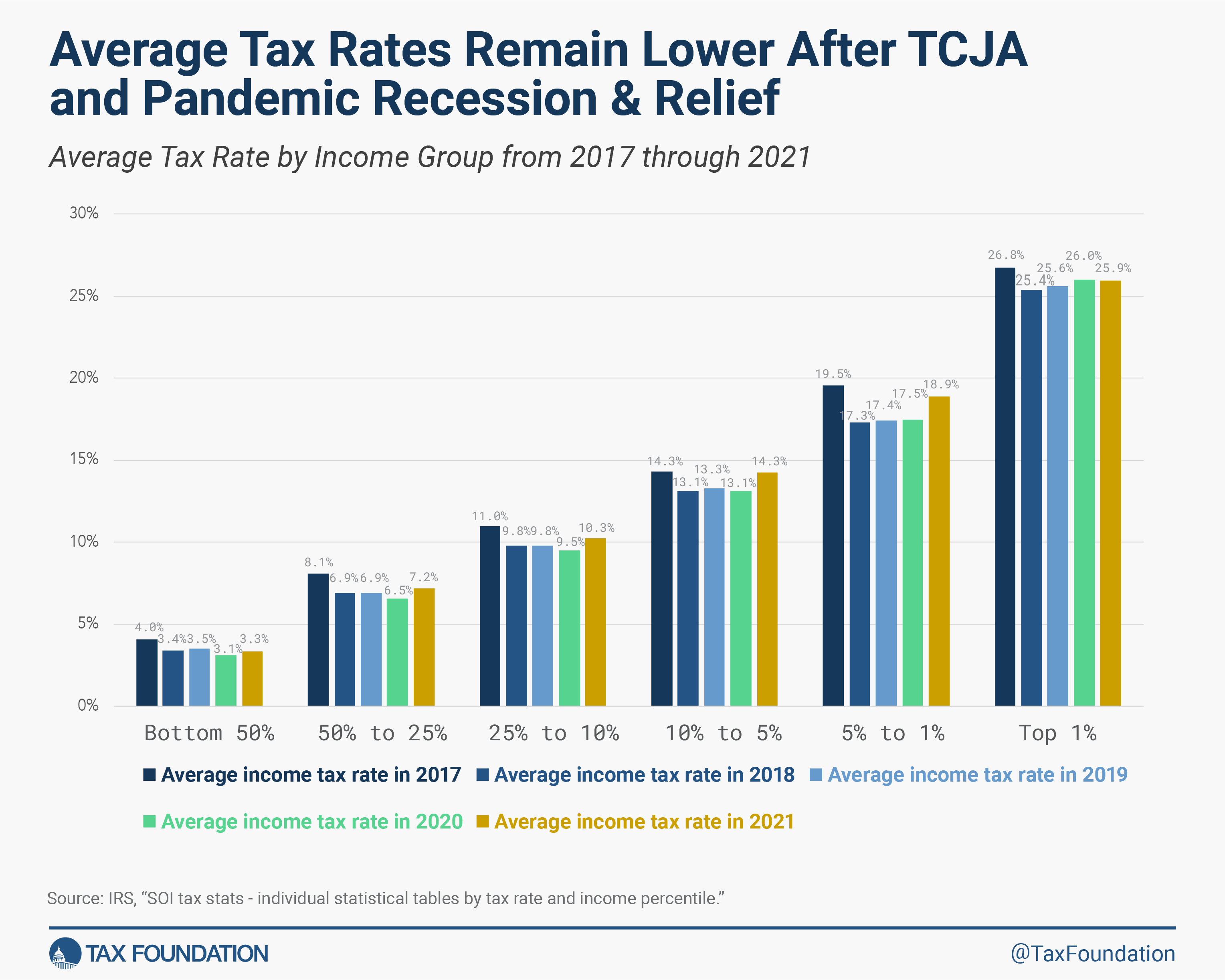

yr 2021 reveals the federal earnings tax system continues to be progressive as high-income taxpayers pay the very best common earnings tax charges. Common tax charges for all earnings teams remained decrease in 2021, 4 years after the Tax Cuts and Jobs Act (TCJA), than they had been in 2017 previous to the reform. The 2021 knowledge additionally displays adjustments in folks’s incomes and in authorities coverage throughout the coronavirus pandemic.

- In 2021, taxpayers filed 153.6 million tax returns, reported incomes greater than $14.7 trillion in adjusted gross earnings (AGI), and paid almost $2.2 trillion in particular person earnings taxes.

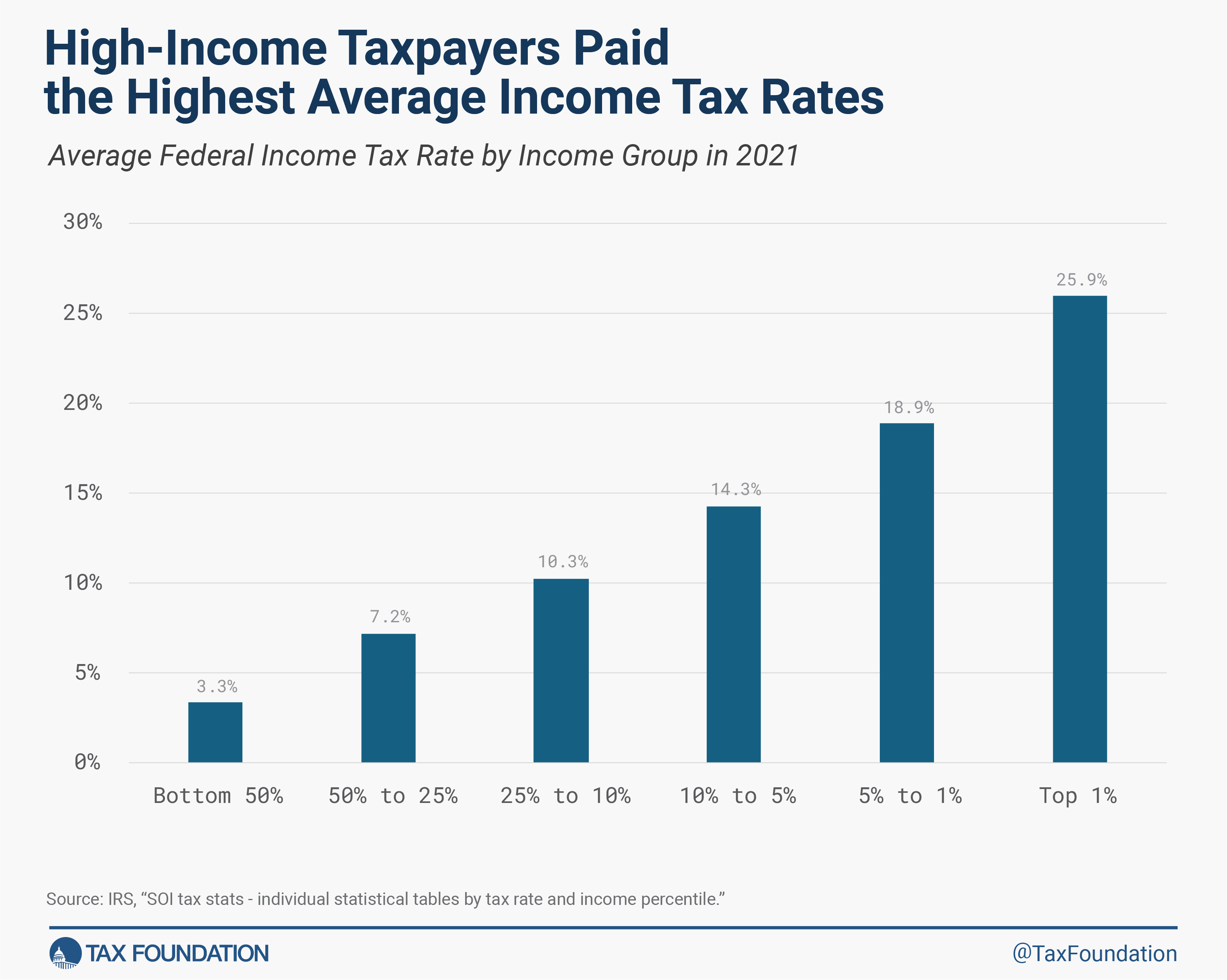

- The common earnings tax price in 2021 was 14.9 %. The highest 1 % of taxpayers paid a 25.9 % common price, almost eight occasions increased than the three.3 % common price paid by the underside half of taxpayers.

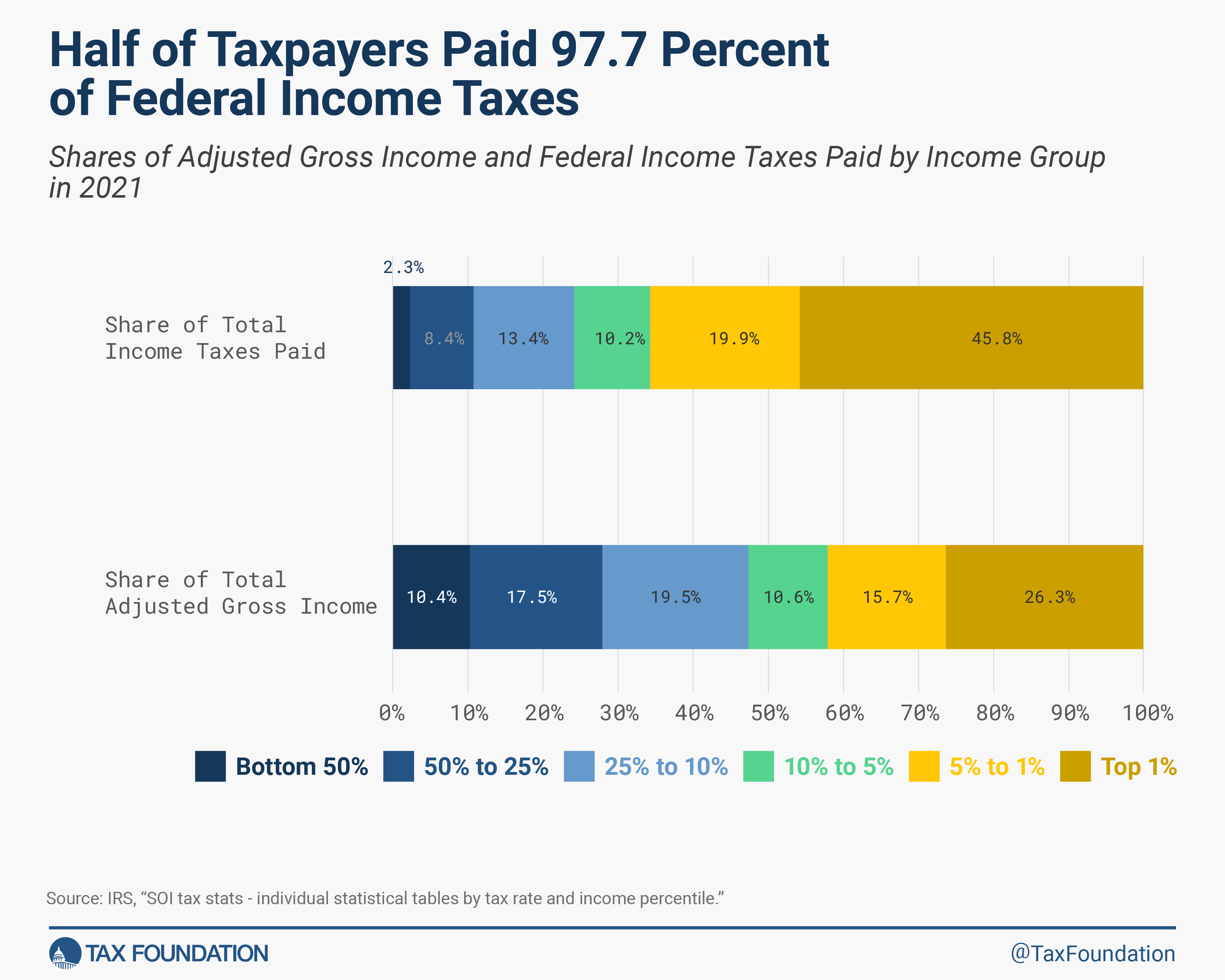

- The highest 1 %’s earnings share rose from 22.2 % in 2020 to 26.3 % in 2021 and its share of federal earnings taxes paid rose from 42.3 % to 45.8 %.

- The highest 50 % of all taxpayers paid 97.7 % of all federal particular person earnings taxes, whereas the underside 50 % paid the remaining 2.3 %.

- The 2021 figures embrace pandemic-related tax objects from the American Rescue Plan Act (ARPA), such because the non-refundable a part of the third spherical of Restoration Rebates and the expanded little one tax credit scoreA tax credit score is a provision that reduces a taxpayer’s closing tax invoice, dollar-for-dollar. A tax credit score differs from deductions and exemptions, which cut back taxable earnings, moderately than the taxpayer’s tax invoice immediately.

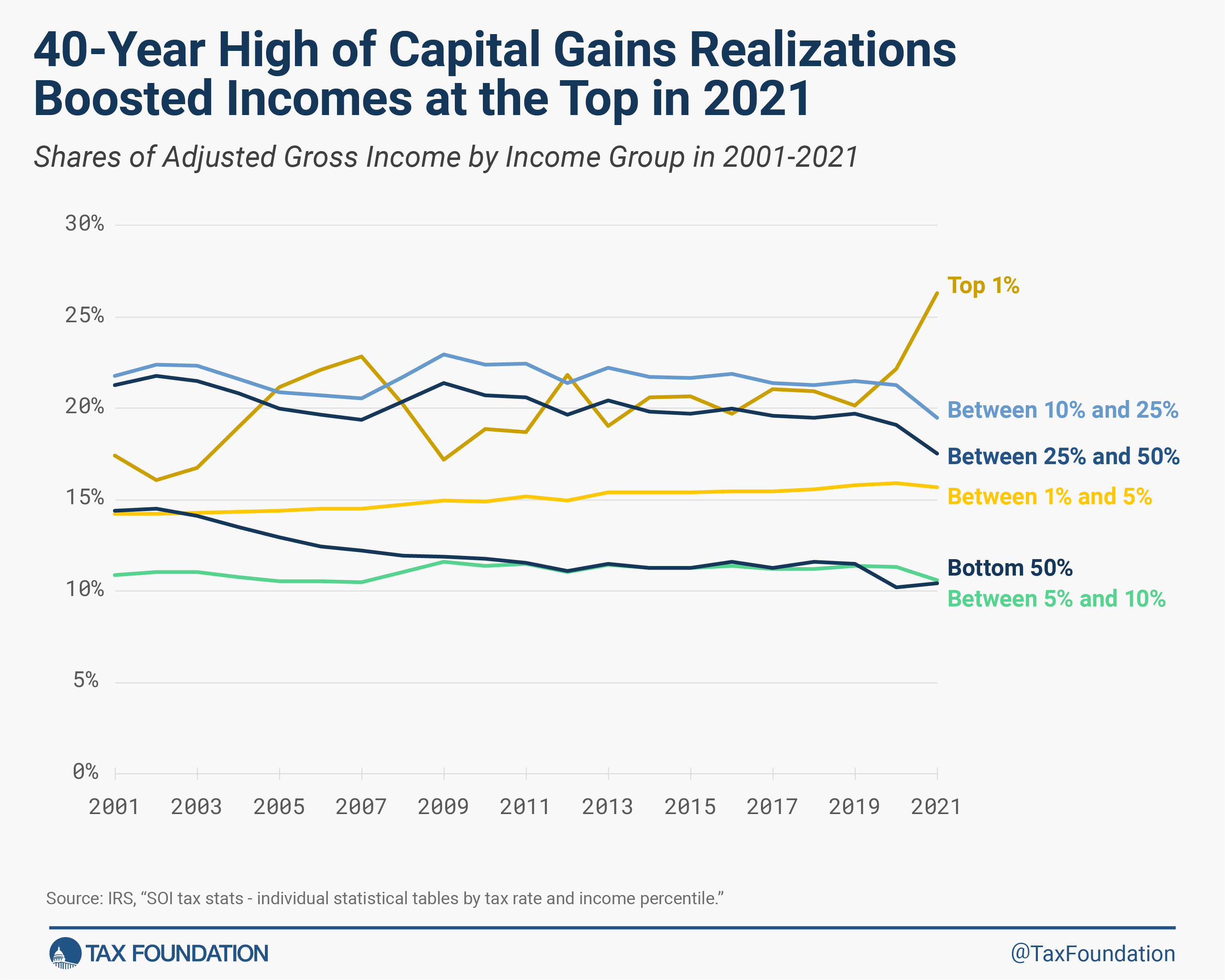

(CTC) and earned earnings tax credit score (EITC). - Capital beneficial properties realizations exceeded $2 trillion to succeed in a 40-year excessive, driving earnings development and taxes paid for high-income teams.

Reported Earnings and Taxes Paid Elevated in Tax Yr 2021

Taxpayers reported greater than $14.7 trillion in AGI on 153.5 million tax returns in 2021, a rise of almost $2.2 trillion in AGI and a lower of three.9 million in returns in comparison with 2020. Complete earnings taxes paid rose by $485 billion to almost $2.2 trillion, a 28 % enhance above 2020. The common particular person earnings taxA person earnings tax (or private earnings tax) is levied on the wages, salaries, investments, or different types of earnings a person or family earns. The U.S. imposes a progressive earnings tax the place charges enhance with earnings. The Federal Earnings Tax was established in 1913 with the ratification of the sixteenth Modification. Although barely 100 years outdated, particular person earnings taxes are the largest supply of tax income within the U.S.

price inched up from 13.6 % in 2020 to 14.9 % in 2021.

As a result of the Workplace of Administration and Finances (OMB) classifies the refundable a part of tax credit as spending, the IRS doesn’t embrace it in tax share figures. The consequence overstates the tax burden of the underside half of taxpayers.

Pandemic-Associated Downturn and Reduction Packages

The pandemic-related downturn and reduction packages each have an effect on the 2021 knowledge. After dropping by 6.6 % from 2019 to 2020, AGI reported by the underside half of taxpayers elevated by 20 % in 2021. The highest half of taxpayers noticed a 7 % enhance in AGI from 2019 to 2020 and a 17 % enhance in 2021. The American Rescue Plan Act (ARPA) supplied a 3rd spherical of restoration rebates of as much as $1,400 per eligible particular person and dependent, phasing out for single taxpayers with incomes above $75,000 and joint filers with incomes above $150,000. The ARPA additionally expanded premium tax credit, the kid tax credit score (CTC) to a most of $3,000 (with an additional $600 for youngsters beneath age 6) that was absolutely refundable and obtainable to households with out earned earnings, and the earned earnings tax credit score (EITC) for filers with out qualifying kids.

From 2020 to 2021, AGI grew throughout all earnings teams on common, however grew quicker throughout increased earnings teams. A big a part of that year-over-year earnings development was from a major enhance in capital beneficial properties realizations after a powerful yr of inventory market efficiency. Greater development at increased earnings ranges, mixed with vital expansions of tax credit for middle- and lower-income teams, resulted in a bigger share of earnings reported and taxes paid on the prime and a better common earnings tax price general..

The underside half of taxpayers, or taxpayers making beneath $46,637, confronted a median earnings tax price of three.3 %. As family earnings will increase, common earnings tax charges rise. For instance, taxpayers with AGI between the tenth and fifth percentiles ($169,800 and $252,840) paid a median earnings tax price of 14.3 %—4 occasions the speed paid by taxpayers within the backside half.

The highest 1 % of taxpayers (AGI of $682,577 and above) paid the very best common earnings tax price of 25.93 %—almost eight occasions the speed confronted by the underside half of taxpayers.

Excessive-Earnings Taxpayers Paid the Highest Common Earnings Tax Charges

In 2021, taxpayers with increased incomes paid a lot increased common earnings tax charges than taxpayers with decrease incomes.

The underside half of taxpayers, or taxpayers making beneath $46,637, confronted a median earnings tax price of three.3 %. As family earnings will increase, common earnings tax charges rise. For instance, taxpayers with AGI between the tenth and fifth percentiles ($169,800 and $252,840) paid a median earnings tax price of 14.3 %—4 occasions the speed paid by taxpayers within the backside half.

The highest 1 % of taxpayers (AGI of $682,577 and above) paid the very best common earnings tax price of 25.93 %—almost eight occasions the speed confronted by the underside half of taxpayers.

Excessive-Earnings Taxpayers Paid the Majority of Federal Earnings Taxes

In 2021, the underside half of taxpayers earned 10.4 % of whole AGI and paid 2.3 % of all federal particular person earnings taxes. The highest 1 % earned 26.3 % of whole AGI and paid 45.8 % of all federal earnings taxes.

In all, the highest 1 % of taxpayers accounted for extra earnings taxes paid than the underside 90 % mixed. The highest 1 % of taxpayers paid greater than $1 trillion in earnings taxes whereas the underside 90 % paid $531 billion.

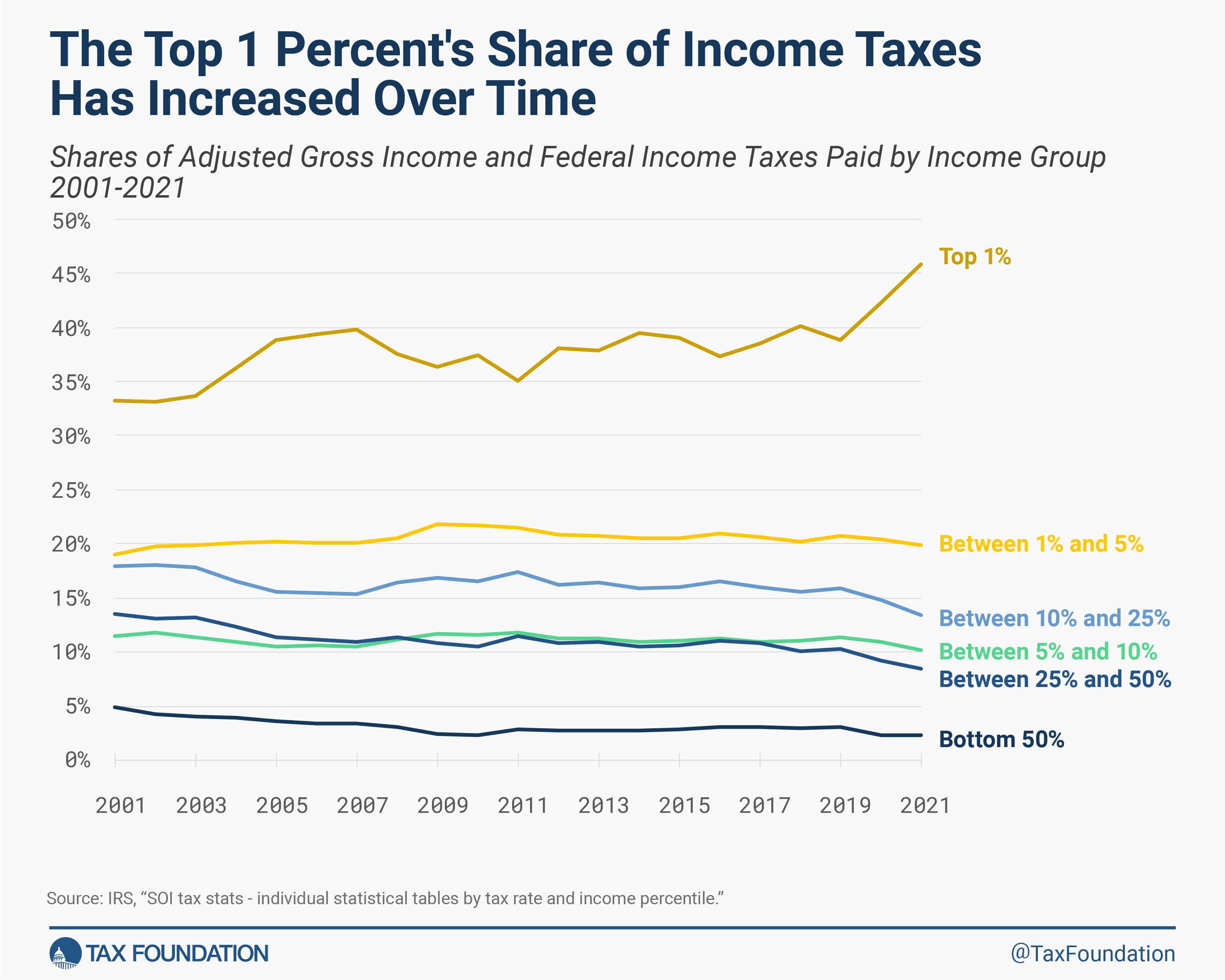

The share of earnings taxes paid by the highest 1 % elevated from 33.2 % in 2001 to 45.8 % in 2021. Whereas the share has typically been rising over the interval, 2020 and 2021 are outlier years largely due to the adjustments in earnings and in tax coverage throughout the coronavirus pandemic. Over the identical interval, the share paid by the underside 50 % of taxpayers fell from 4.9 % to only over 2.3 % in 2021.

Equally, the share of adjusted gross earnings reported by the highest 1 % elevated from 22.2 % in 2020 to 26.3 % in 2021. The AGI share of the highest 1 % tends to fluctuate over the enterprise cycle, rising and falling to a higher extent than earnings reported by different teams. This was significantly the case in 2021 as capital beneficial properties realizations elevated sharply to succeed in their highest degree in 40 years. The share of AGI reported by the underside 50 % of taxpayers fell from 14.4 % in 2001 to 10.4 % in 2021 (a slight uptick from its share in 2020).

The Tax Cuts and Jobs Act Diminished Common Tax PriceThe common tax price is the entire tax paid divided by taxable earnings. Whereas marginal tax charges present the quantity of tax paid on the following greenback earned, common tax charges present the general share of earnings paid in taxes.

s throughout Earnings Teams

The 2021 tax yr was the fourth because the Tax Cuts and Jobs Act (TCJA) made many vital, however non permanent, adjustments to the person earnings tax code to decrease tax charges, widen brackets, enhance the customary deductionThe usual deduction reduces a taxpayer’s taxable earnings by a set quantity decided by the federal government. It was almost doubled for all courses of filers by the 2017 Tax Cuts and Jobs Act (TCJA) as an incentive for taxpayers to not itemize deductions when submitting their federal earnings taxes.

and little one tax credit score, and extra. The adjustments lowered tax burdens, on common, for taxpayers throughout all earnings ranges. In 2021, tax reduction within the type of expanded tax credit additionally affected common tax charges of middle- and lower-income taxpayers, although the IRS doesn’t embrace the impression of the refundable portion of tax credit in its dataset. Common tax charges had been decrease in 2021 than in 2017 throughout all earnings teams.

Keep knowledgeable on the tax insurance policies impacting you.

Subscribe to get insights from our trusted specialists delivered straight to your inbox.

Appendix

For knowledge previous to 2001, all tax returns which have a optimistic AGI are included, even those who would not have a optimistic earnings tax legal responsibility. For knowledge from 2001 ahead, returns with adverse AGI are additionally included, however dependent returns are excluded. The unit of research is the tax return. Within the figures previous to 2001, some dependent returns are included. Underneath different items of research (just like the U.S. Treasury Division’s Household Financial Unit), these returns would probably be paired with dad and mom’ returns.

Earnings tax after credit (the measure of “earnings taxes paid” above) doesn’t account for the refundable portion of tax credit such because the EITC. If the refundable portion had been included, the tax share of the highest earnings teams can be increased and the typical tax price of backside earnings teams can be decrease. The refundable portion is assessed as a spending program by the Workplace of Administration and Finances (OMB) and subsequently will not be included by the IRS in these figures.

The one tax analyzed right here is the federal particular person earnings tax, which is liable for greater than 25 % of the nation’s taxes paid (in any respect ranges of presidency). Federal earnings taxes are way more progressive than federal payroll taxes, that are liable for about 20 % of all taxes paid (in any respect ranges of presidency), and are extra progressive than most state and native taxes.

AGI is a reasonably slender earnings idea and doesn’t embrace earnings objects like authorities transfers (aside from the portion of Social Safety advantages that’s taxed), the worth of employer-provided medical insurance, underreported or unreported earnings (most notably that of sole proprietors), earnings derived from municipal bond curiosity, web imputed rental earnings, and others.

These figures characterize the authorized incidence of the earnings tax. Most distributional tables (corresponding to these from the Congressional Finances Workplace (CBO), the Tax Coverage Middle, Residents for Tax Justice, the Treasury Division, and the Joint Committee on Taxation (JCT)) assume that the complete financial incidence of non-public earnings taxes falls on the earnings earner.

Share