Contemplating going again to highschool? The search for increased schooling generally is a worthwhile however pricey pursuit. On high of tuition and charges, hidden prices and provides add monetary and emotional challenges to the various lower-income college students who have already got debt burdens.

With so many battling monetary stress these days, value might be the principle holdup for somebody looking for increased schooling. Fortunately, there are alternatives. Try some generally ignored credit and deductions and study extra concerning the American Alternative Tax Credit score.

Discover out when you could also be one of many college students who’s eligible for an schooling tax credit score in your faculty bills.

What’s the American Alternative Tax Credit score?

The American Alternative Tax Credit score (AOTC) is a tax credit score to assist pay for certified schooling bills for the primary 4 years of schooling accomplished after highschool. You will get a most annual credit score of $2,500 per eligible scholar, and 40% or $1,000 might be refunded with no tax owed.

The AOTC helps offset the price of post-secondary schooling for college students or their dad and mom if the scholar remains to be claimed as a dependent.

Sounds nice, proper? It’s, but it surely’s essential to notice that this credit score is topic to revenue limitations, together with that your modified adjusted gross revenue (AGI) should be beneath the edge. We’ll cowl extra about {qualifications} beneath.

Who qualifies for the American Alternative Tax Credit score?

These are the final tips for who qualifies for the AOTC:

- The scholar should be you, your partner, or a dependent that you just listed in your tax return.

- The scholar should be pursuing a level or different acknowledged academic credential.

- The scholar should be enrolled at the very least half time, for at the very least one educational interval, akin to semesters, trimesters, quarters, or another interval of examine starting within the tax 12 months.

- The scholar hasn’t accomplished the primary 4 years of upper schooling at the start of the tax 12 months.

- The scholar hasn’t claimed the AOTC (or the previous Hope credit score) for greater than 4 tax years.

One different factor to notice is that when you’ve ever been a state or federal legal due to a felony drug conviction, you possible aren’t eligible.

Which schooling bills are eligible?

The AOTC relies on certified academic bills that should be paid for by you or on behalf of your self, a toddler, or a partner.

The next academic bills could also be eligible:

- Paying tuition and charges to an eligible academic institute (academic institutes may be extra than simply schools or universities and may embrace any post-secondary faculty that satisfies the participation necessities within the U.S. Division of Schooling monetary help program)

- Particular bills and scholar exercise charges which might be required for enrollment or attendance at an eligible academic institute

- Purchases and bills for books, provides, and tools deemed vital for this system of examine

The credit score doesn’t cowl prices related to:

- Room and board

- Medical bills

- Scholar charges (until required for situation of enrollment or attendance)

- Transportation

- Private, dwelling, or household bills

It’s essential to additionally word that you just can not use the identical bills paid with tax-free schooling help. Furthermore, the eligible bills can not have been used to say another tax deduction, credit score, or schooling profit.

The IRS doesn’t require you to scale back certified bills by any quantity you pay with borrowed funds, akin to bank cards or scholar loans. Nevertheless, you can’t embrace any quantity you obtain from:

- Tax-free scholarships or fellowships

- Federal Pell grants

- Tuition grants from an employer

- Refunds from the college

- Different non-taxable help acquired, apart from inheritances and items

How do I calculate my credit score quantity?

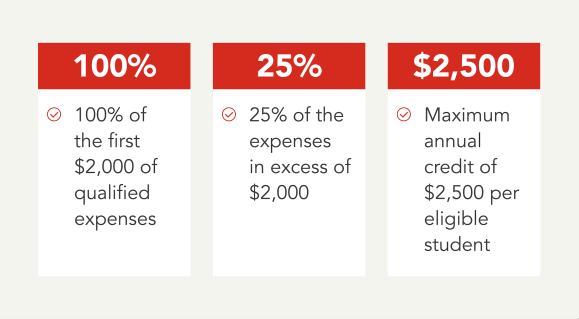

The AOTC quantity is the same as 100% of the primary $2,000 of certified bills plus 25% of the bills in extra of $2,000 for a most credit score of as much as $2,500.

Just one AOTC is obtainable per eligible scholar every tax 12 months. When you have two dependents who’re eligible college students, you’ll be able to declare a special academic tax profit for one scholar when you declare the AOTC for the opposite scholar. You’ll be able to, however don’t have to say the identical tax credit score for each dependents. And you may’t declare multiple tax profit per 12 months for every scholar.

What’s the most quantity for the credit score?

The utmost AOTC credit score may be price as much as $2,500 yearly per scholar for the primary $4,000 you spend on certified academic bills on behalf of your self, your dependents, or your partner for the primary 4 years of schooling accomplished after highschool.

The credit score interprets to $2,000 of the primary certified schooling bills paid and 25 % of the subsequent $2,000.

There are some circumstances the place utilizing the credit score will convey the quantity of tax you owe to zero. If this occurs, you’ll be able to have a portion of the remaining quantity of the credit score refunded to you, with the potential refund restricted to $1,000.

What do I have to do to say the American Alternative Tax Credit score?

So as to go about claiming the AOTC, a number of necessities should be met.

Enrollment

First, you should be enrolled for at the very least one educational interval that begins within the tax 12 months. Enrollment consists of being at the very least part-time and enrolled in a post-secondary undergraduate program resulting in a level, certificates, or different acknowledged academic credential.

A college will determine what qualifies as full-time or half-time enrollment, and though the quantity may be increased or decrease, most academic institutes see 12 credit score hours in a single semester as full-time standing. The distinction is that the usual half-time workload can’t be decrease than the established Division of Schooling commonplace.

The scholar should not have accomplished the primary 4 years of post-secondary schooling as of the start of the tax 12 months. That is decided by the college.

Type 1098 T

So as to be eligible to say the AOTC, the regulation requires a taxpayer or a dependent to have acquired Type 1098-T, Tuition Assertion, from an eligible academic establishment, home or international.

College students usually obtain a Type 1098-T Tuition Assertion from their faculty by January thirty first. This Tuition Assertion helps you determine your credit score. Field 1 of the shape may have an quantity that reveals what you’ve paid for certified tuition and associated bills in the course of the 12 months.

Modified adjusted gross revenue

To say the total AOTC, your modified adjusted gross revenue (MAGI) should be $80,000 or much less as a single filer. In case you are married submitting collectively, to say the total AOTC, your MAGI should be $160,000 or much less.

A phase-out applies to the AOTC, which means that at a sure threshold, you’ll solely be eligible for a partial credit score.

For 2023, the phase-out applies if:

- You’re a single filer with an AGI between $80,000 and $90,000

- You’re a joint tax filer with an AGI between $160,000 and $180,000

In case your MAGI exceeds $90,000 as a single filer or $180,000 as a joint filer, you’re not eligible for the credit score.

4-year restrict

When you have beforehand claimed the American Alternative Tax Credit score, you’ll be able to solely declare the AOTC a complete of 4 occasions.

When you’ve ensured your bills qualify and also you meet the above necessities, Type 8863, Academic Credit (American Alternative and Lifetime Studying Credit), might be included along with your tax return to say the AOTC.

What are different schooling tax breaks to contemplate?

The federal and state governments help increased schooling bills by way of varied tax deductions, tax credit, and tax-advantaged saving plans. The packages provided might help decrease your revenue taxes and make schooling extra inexpensive with regards to tuition and charges, scholar mortgage curiosity, certified schooling bills, and enterprise deductions for work-related schooling.

Saving plans can even assist with increased schooling bills. Look into certified tuition packages (529 plans) and Coverdell Schooling Financial savings Account (ESA). These are tax-advantaged accounts that mean you can save and pay for certified schooling bills.

American Alternative Tax Credit score vs. Lifetime Studying Credit score

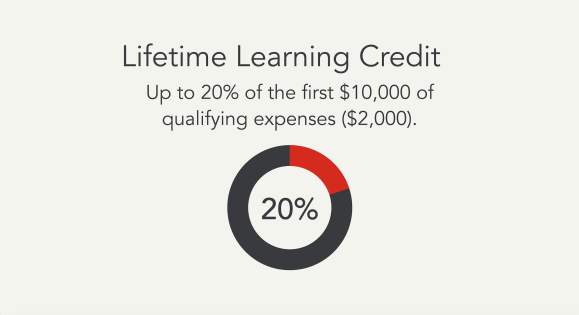

The American Alternative Tax Credit score and the Lifetime Studying Credit score (LLC) are in style schooling tax breaks that assist taxpayers with the price of increased schooling by lowering your invoice in your annual tax return.

There are a number of variations and a few similarities between the AOTC and the LLC, however with the LLC, you’ll be able to declare as much as 20% of the primary $10,000 of qualifying bills (a most credit score of as much as $2,000). The LLC additionally covers a broader group of scholars and isn’t restricted to simply these pursuing a level or learning at the very least part-time. It’s obtainable to college students part-time, full-time, undergraduate, graduate, and programs.

In contrast to the refundable AOTC, the LLC is nonrefundable, so as soon as your tax invoice hits zero, you received’t obtain a refund on any credit score stability.

Should you’re eligible, on the identical tax return, you’ll be able to declare each the AOTC and the LLC (in addition to a deduction for tuition and charges) – however not for a similar scholar or the identical certified bills. Assess your particular person state of affairs to find out what tax credit score proves to be the larger profit.

File with confidence

Make the steps to increased schooling with confidence and depart the monetary stress and burden behind. Hunt down academic tax breaks just like the AOTC which might be geared in direction of partially refundable tax credit that cowl the price of certified schooling bills of post-secondary college students.

It doesn’t matter what strikes you made final 12 months, TurboTax will make them depend in your taxes. Whether or not you need to do your taxes your self or have a TurboTax professional file for you, we’ll be sure to get each greenback you deserve and your greatest doable refund – assured.

10 responses to “The American Alternative Tax Credit score: Advantages for College students”