Earlier this week, I printed a proposed glossary entry on the true nature of our so-called nationwide debt. This gained a whole lot of reward, however there have been enhancements to make, so I’ve labored on it.

I’ve added a abstract primarily based on what was already in it.

I’ve additionally added a complete new part as a result of it was put to me that defining what the nationwide debt is is barely a part of the reply most individuals need when discussing this situation. What additionally they need to know is why these demanding that or not it’s repaid are mistaken.

The extra part reads as follows:

Repaying the nationwide debt

All of the above having been famous, various refrains are generally heard from politicians, together with:

- The nationwide debt is simply too excessive.

- Nationwide debt is squeezing out non-public funding, which is simply too low consequently.

- We’re leaving a burden of debt to our grandchildren.

- The nationwide debt is unaffordable.

- Except we get the price of the nationwide debt beneath management we can not afford public providers.

The implication of all of those is that we might all be higher off if the nationwide debt was repaid.

Not one of the claims that these politicians make are true. For instance:

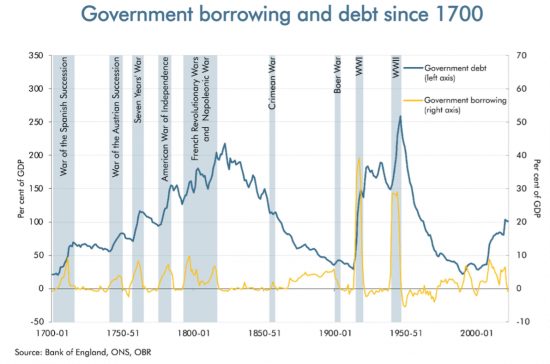

- For very lengthy intervals of time, the ratio of UK nationwide debt to Nationwide earnings was a lot larger than it’s at current and calamity didn’t observe. The truth is, NHS, a lot of our social housing, and the rebuilding after the Second World Conflict all occurred when nationwide debt was at vastly larger ranges than it’s now:

- There isn’t any proof that our nationwide debt is in any method lowering the quantity of funding in non-public enterprise. Personal enterprise will not be investing sufficient within the UK, however that’s as a result of it can not consider issues to do with funding funds even supposing they have been exceptionally low cost for greater than a decade and has nothing to do with the scale of the nationwide debt.

- The nationwide debt has by no means been repaid, as is obvious from the above chart. Our grandchildren won’t repay it, any greater than we’ve got repaid the nationwide debt created by our personal grandparents. The truth is, fortunate grandchildren will inherit a part of the nationwide debt as a result of it’s made up of personal financial savings accounts that kind part of non-public wealth. Inheriting part of your grandparent’s financial savings is what many grandchildren would possibly hope for.

- The nationwide debt is at all times inexpensive. The federal government can at all times select to make it so in a rustic just like the UK. If the rate of interest is simply too excessive at any cut-off date then that could be a measure of the truth that the Financial institution of England is setting inappropriate rates of interest, and never that the nationwide debt is simply too costly.

- There may be nothing about our nationwide debt that stops the federal government supplying providers to individuals who want them within the UK. That’s partly as a result of doing so will at all times pay for itself if there are sources accessible to produce these providers as a result of they’re then put to make use of, creating earnings, and so taxes paid on that earnings and the spending (and so additional earnings) that it then generates. That can also be as a result of there is no such thing as a recognized cap on the extent of nationwide debt that we should always restrict ourselves to. Many European nations have debt to nationwide earnings ranges significantly larger than that within the UK, and Japan has a nationwide debt to earnings stage properly over double that of the UK, and all these economies are functioning completely properly. So can we even when we improve the nationwide debt.

Maybe extra importantly, repaying the nationwide debt can be disastrous. It might imply that:

- The federal government must withdraw greater than £1.6 trillion of cash from use within the economic system, which might most probably create an unprecedented monetary disaster, ship a recession, and depart companies and households with out the essential money sources that they should make cost to one another, not least as a result of the banking cost system can be crippled with out there being a nationwide debt that delivers it with the cash that it must operate.

- Nearly all public providers would collapse as a result of their funding must be withdrawn for prolonged intervals.

- Most non-public pensions would collapse as a result of they use the financial savings amenities that the nationwide debt gives as the muse for the funds that they take advantage of pensioners.

- The federal government would lose management of rates of interest throughout the economic system.

- Due to the scarcity of kilos accessible to make funds throughout the economic system that compensation of the nationwide debt would create it’s doubtless that we must use foreign currency to commerce within the UK, creating large uncertainty for the entire economic system. This might additionally make it nearly not possible to run an efficient tax system.

- Overseas governments and firms would have nice issue holding sterling balances, and this might enormously hurt commerce in UK items and providers.

These demanding compensation of the nationwide debt actually must be very cautious about what they need for. Even partial compensation or limitations on the expansion in that debt might produce a few of the above outcomes.

The reality is that the nationwide debt is key to the success of our economic system as a result of it gives us with our nationwide cash provide, and we can not survive with out that. These suggesting we will both restrict this so-called debt, do with out it, or repay it, have to be handled with suspicion. What they suggest not solely threatens all the public sector of the UK, but additionally the financial viability of the nation as a complete. It’s for them to justify why they might want to do this.

A PDF of the brand new model of the entry is accessible right here. Feedback are nonetheless welcome.