Word: This publish is a part of a collection on Portugal’s taxA tax is a compulsory cost or cost collected by native, state, and nationwide governments from people or companies to cowl the prices of common authorities companies, items, and actions.

coverage, analyzing the way it compares internationally, offering a deeper evaluation of present coverage, and discussing pathways towards reform.

Portugal’s value-added tax (VAT) coverage is a treasure trove of tax oddities. For instance, starting in January 2024, restaurant house owners might want to suppose twice about providing wine or smooth drinks on their menus, as doing so will hike the VAT price utilized to all their meals to the complete price. Following final 12 months’s non permanent VAT exemption for a fairly arbitrary listing of meals gadgets, that is the newest in a collection of coverage selections which have made Portugal’s VAT system extra complicated to adjust to, distorted consumption behaviour, and contributed to vital base erosion.

Portugal’s tax system faces necessary challenges, rating 34th out of 38 OECD international locations within the Worldwide Tax Competitiveness Index. Reform that prioritizes simplification and base growth would make Portugal’s VAT a really perfect instrument to effectively increase income at a time when different elements of its tax system, akin to the company tax, hamper the nation’s worldwide competitiveness and sluggish its financial progress. This makes it important to grasp the problems that plague the Portuguese VAT system in the present day.

Typically, the VAT permits the federal government to lift income extra effectively than private or company revenue taxes. For the reason that VAT is a tax on last consumption, employees’ tax legal responsibility will increase with the revenue they spend on consumption items, including to the tax burden on labor. Nevertheless, in distinction to taxes on private and company revenue, it does not tax financial savings greater than speedy consumption, making it a comparatively environment friendly option to increase income.

Portugal levies its VAT at an ordinary price of 23 %, barely above the European Union’s common normal price of 21.6 % (making it one among six Member States to use the next price). Portugal additionally applies two lowered charges of 13 and 6 % to pick out services and products, with the bottom price largely reserved for meals gadgets. Within the Worldwide Tax Competitiveness Index, its VAT system ranks solely 26th out of 38 OECD international locations, as its above-average normal price applies to a slim base that covers solely round half of ultimate consumption.

In 2021, Portugal’s VAT collected solely 51 % of notional excellent income (i.e., the income that will outcome from taxing all last consumption at the usual VAT price), under the EU common of 58 %. This hole between precise and excellent VAT revenues may be damaged down into two parts: the compliance hole and the coverage hole. The compliance hole outcomes from non-compliance with VAT regulation by way of evasion, bankruptcies, insolvencies, or administrative errors. In distinction, the coverage hole is the results of identifiable coverage decisions that erode the tax baseThe tax base is the whole quantity of revenue, property, belongings, consumption, transactions, or different financial exercise topic to taxation by a tax authority. A slim tax base is non-neutral and inefficient. A broad tax base reduces tax administration prices and permits extra income to be raised at decrease charges.

, akin to VAT registration thresholds, lowered charges, and exemptions. There are some companies—specifically, imputed rents, the supply of public items, and monetary companies—which are VAT-exempt as a result of they’re typically thought of too troublesome to levy a VAT on. Subtracting the quantity of misplaced VAT income brought on by these companies from the coverage hole leaves us with the actionable coverage hole.

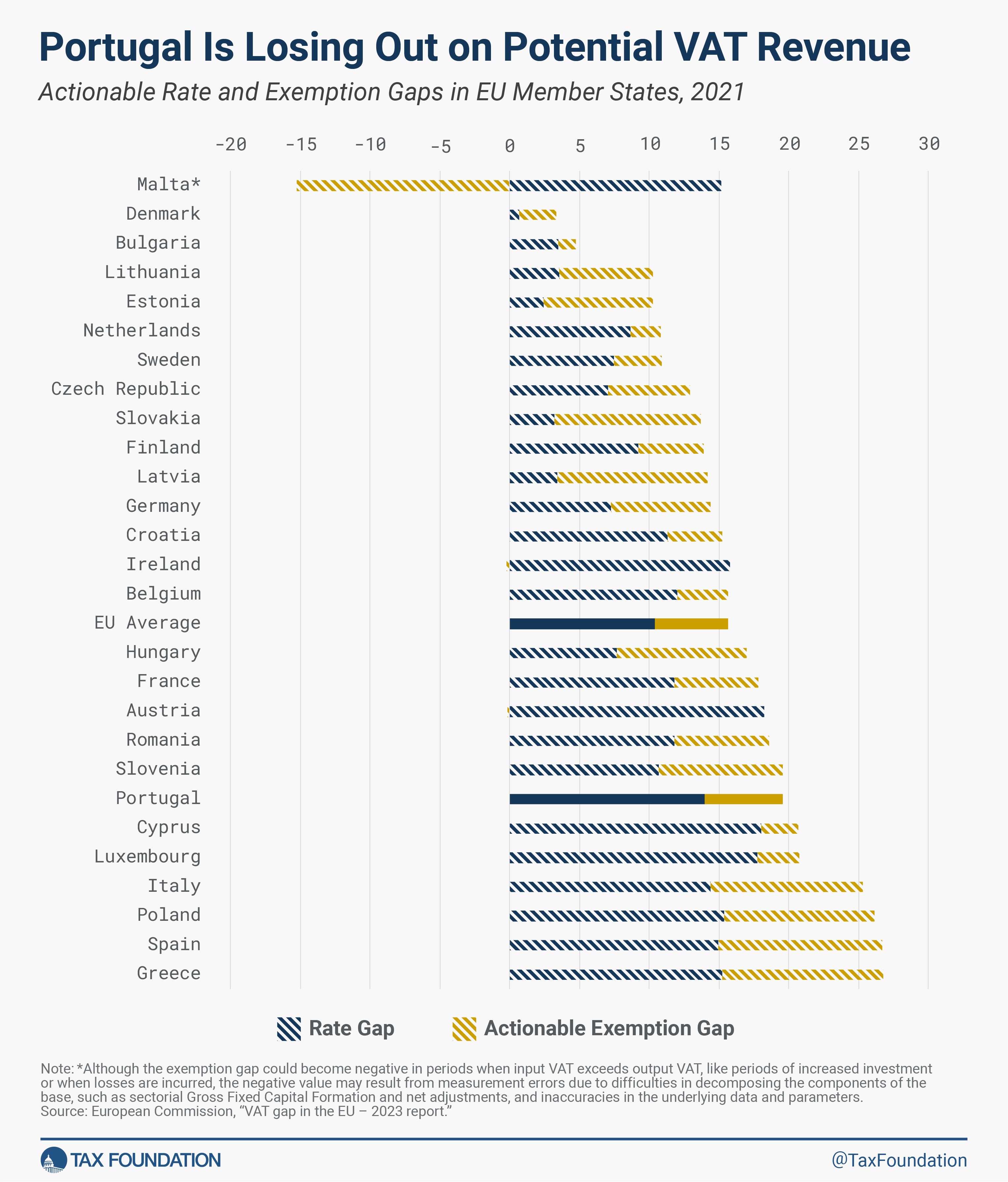

In Portugal, using lowered charges and exemptions for choose items and companies bear a lot of the blame for its massive VAT hole. In 2021, Portugal misplaced out on 19.6 % of potential income, considerably above the EU common of 15.7 %. If the nation had been to shut the actionable coverage hole in its VAT base solely, the vast majority of income, 13.9 proportion factors, would come up from lifting lowered charges as much as the usual price. A smaller portion, 5.6 proportion factors, would come from together with actionable exemptions within the VAT base.

Portugal’s VAT already accounts for 25.5 % of complete tax revenues, or EUR 20 billion, in comparison with solely EUR 5.2 billion raised by taxes on company revenue in 2021. Closing Portugal’s actionable VAT coverage hole would improve its VAT revenues by 42.5 %, elevating EUR 8.1 billion in 2021. This income would come at a low effectivity value, as abolishing lowered charges and exemptions would remove the distortions to consumption decisions and compliance prices related to making use of a number of totally different charges. This makes VAT base broadeningBase broadening is the growth of the quantity of financial exercise topic to tax, normally by eliminating exemptions, exclusions, deductions, credit, and different preferences. Slim tax bases are non-neutral, favoring one product or trade over one other, and might undermine income stability.

a really perfect instrument to provide the Portuguese authorities the fiscal room to implement pro-growth tax reforms, together with extra bold company tax reform or private revenue tax cuts. For instance, Tax Basis’s most up-to-date report on VAT growth and labour tax cuts finds that closing the actionable VAT coverage hole would supply Portugal with sufficient income to scale back the usual VAT price to 13 % or lower the primary two private revenue tax brackets to 0 % and the third from 28.5 % to five %.

The following publish on this collection will dive extra deeply into the construction of Portugal’s private revenue tax system.

Keep knowledgeable on the tax insurance policies impacting you.

Subscribe to get insights from our trusted specialists delivered straight to your inbox.

Share