Key Takeaways

- The market stays secure and sideways.

- The overbought situation may set off a small bullish run.

- Buying and selling quantity has risen to over 25% from the final week

- A inexperienced flag for the ETF onboarding may usher in a bull run.

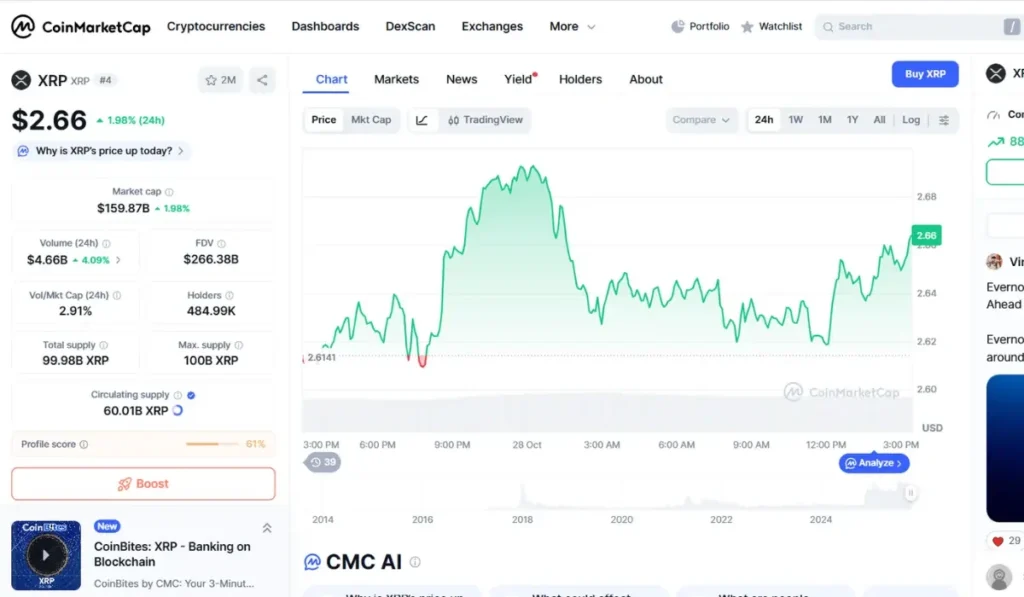

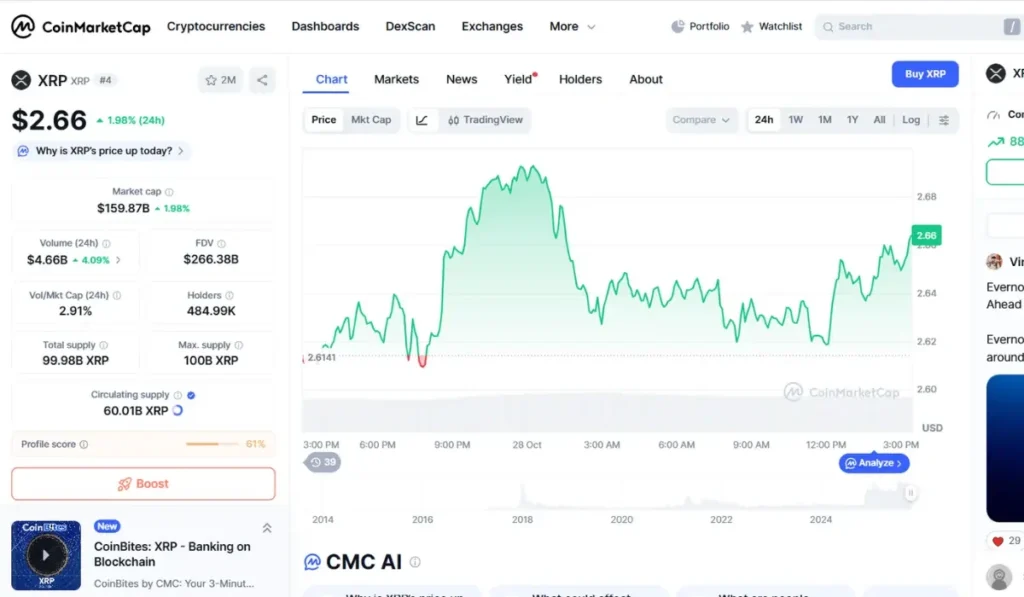

XRP is buying and selling round $2.66. This value signifies sure key information as it’s above each Transferring averages 20 and 200, whereas it’s beneath the MA-50($2.766). This suggests that XRP value is affected by medium-term resistance; nevertheless, the excellent news is that it has a possible for making a bull run because it has a long-term assist indicated by MA 20 and 200.

Picture Supply: CoinMarketCap

XRP Quick-Time period Value Prediction

| Month | Minimal | Common | Most |

|---|---|---|---|

| October | $2.00 | $2.35 | $2.60 |

| November | $2.1 | $2.55 | $2.85 |

| December | $2.40 | $2.80 | $3.20 |

Evaluation of Buying and selling Quantity

When trying on the weekly averages of XRP, we see a 26% rise in buying and selling quantity. That is an indicator of accelerating dealer curiosity and institutional involvement within the XRP market.

The change reserves, that are the belongings saved throughout the change orderbooks, are displaying a lower. That is an indicator that merchants are holding XRP with them in anticipation of a value hike. All of that is with none main institutional information or developments.

Indicator Evaluation Reveals Doable Overbought Market

The information that may be collected from momentum indicators stays combined as of now. Whereas ADX on a one-day chart is indicating the continuation of the pattern, MACD is indicating in any other case. This MACD indication of a bearish momentum needs to be met with warning.

Coming to the Relative Energy Index and CCI indicators, the costs are likely to lie in a impartial to bullish territory. With overbought alerts being flashed by the Stochastic RSI, a possible warning for a short-term bearish run is on the horizon. Nevertheless, neither patrons nor sellers dominate the market; nevertheless, with a reasonable market volatility, the intraday technique is indicative of succumbing to the promoting strain.

Sideways Market For Coming Days

With all of the potential assumptions that may be made utilizing the obtainable technical indicators, it seems that XRP costs are going to fluctuate. The higher degree of $2.7472 stays secure, however the decrease degree of $2.7373 may very well be damaged due to what the symptoms have identified – an overbought situation.

Nevertheless, if the decrease degree can act as a assist degree, the market might stay sideways oscillating between the mentioned ranges for considerably of few days(roughly 5). The whale influx, courtesy of the upcoming institutional integration, may imply that the costs are shifting sideways due to the decrease volatility the market is presently experiencing on account of bigger holdings in expectation of the XRP ETF onboarding and the resultant bull run.

ETF Onboarding Has an Influence

With the US authorities shutdown being lifted, hopes for the method of onboarding XRP ETFs appear to be on observe once more. This may very well be a significant cause why there’s an overbought situation out there.

If so, costs are going to stay secure for probably the most half, however with a bearish tendency looming across the market. Market updates are key throughout this time, as a single information can change the way in which the market operates.

If regulators wave the inexperienced flag for XRP ETF, it can add yet one more layer of certainty to the asset, boosting its curiosity out there. This might set off a widespread bull run courtesy of huge inflows from varied sources. In the intervening time, nevertheless, the market appears to be at its saturated level in anticipation of this occasion.

This considerably impacts the intraday potentialities of XRP because the market both stabilizes on the present value or goes down barely because of the current bearish momentum.

Conclusion – XRP Value Prediction

For the present day’s market, XRP costs might stay largely secure with some minor dip potential because of the market’s overbought situation. As information concerning the institutional onboarding will get clearer, there’s a probability for extra investor influx, and costs may rise as soon as once more.

However for right now, the market might stay secure and sideways.

| Disclaimer: These crypto value forecasts are based mostly on predictive modeling and shouldn’t be thought of monetary recommendation. |