Key Takeaways

- XRP is displaying combined momentum within the cryptocurrency market at this time, with the anticipated worth at this time hovering round $2.50–$2.65.

- XRP, the fourth-largest crypto by market cap, is 3% down at this time and is buying and selling at $2.42.

- Technical indicators present a bearish short-term pattern, whereas longer-term weekly developments are bullish.

- XRP is predicted to take care of this short-term bearish pattern at this time and is unlikely to hit $3 as properly.

- Canary Capital XRP ETF is ready to launch on November 13, 2025, that means a major XRP enhance could be anticipated in mid-November.

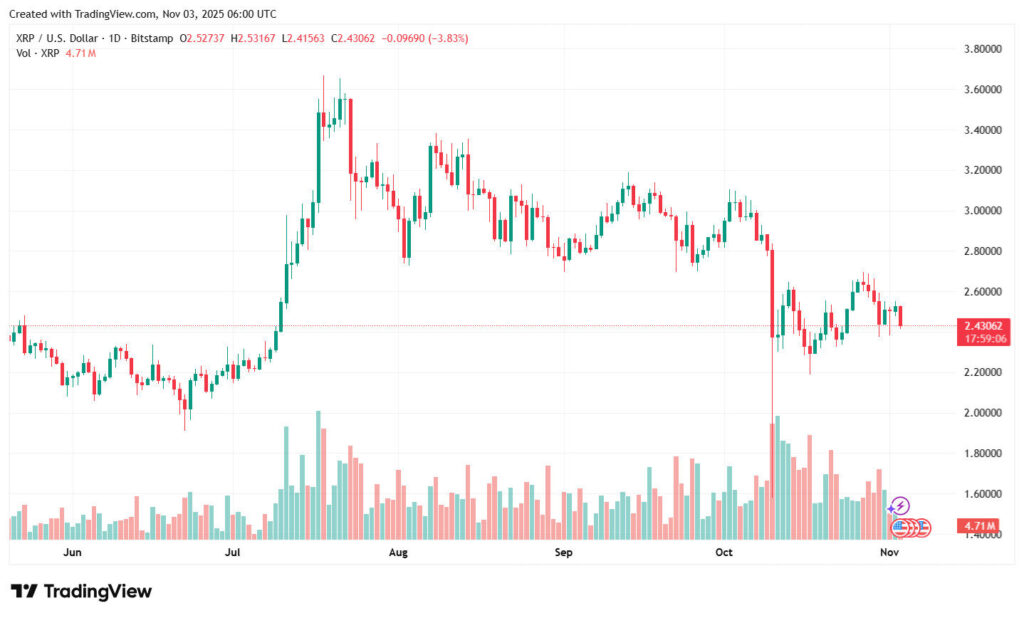

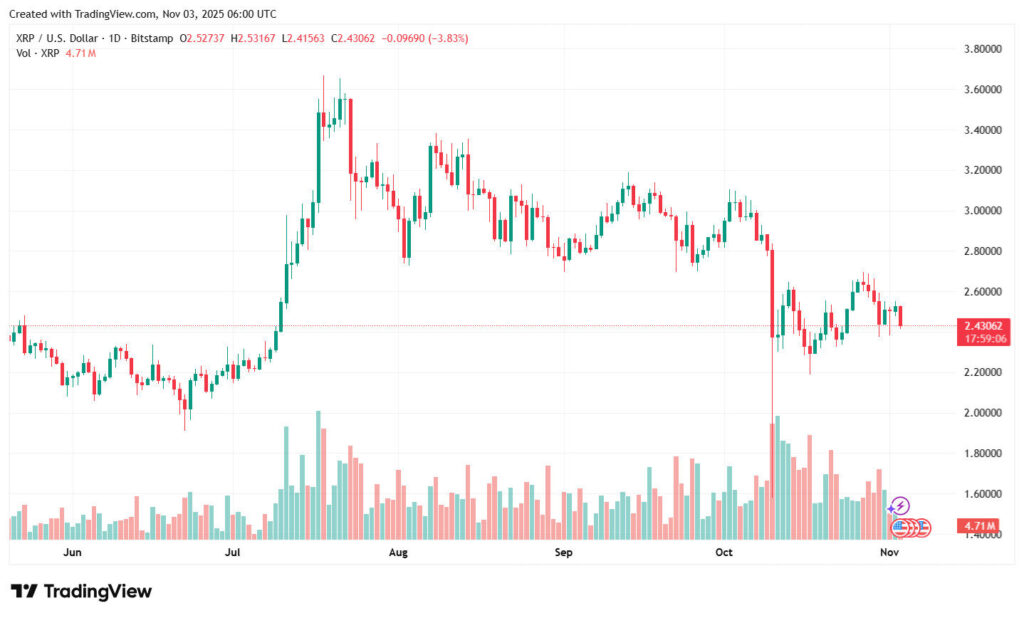

Buckle up, XRP followers, after years of ready, XRP Spot ETFs are lastly making their debut in November. Canary Capital’s Spot ETF is all set to go reside on November 13, and Bitwise Spot ETF shall be launched shortly after. XRP would possibly skyrocket as soon as these two spot ETFs are launched, however in the mean time, the fourth-largest crypto by market cap is 3% down at this time and is buying and selling at $2.42. XRP couldn’t capitalize on the Canary Capital’s ETF launch information and carry out properly out there, however XRP’s longer-term weekly developments are bullish. On the weekly timeframe, XRP’s 50-day and 200-day transferring averages are sloping upwards, signaling an upward pattern.

XRP Present Market State of affairs

XRP is at present valued at round $2.42, and Ripple’s native cryptocurrency has been displaying a virtually 3% dip in comparison with the final 24 hours. Regardless of the short-term bearish momentum, a major progress in XRP’s 24-hour every day buying and selling quantity is a constructive. XRP’s every day buying and selling quantity has seen a major 65.13% enhance within the earlier 24 hours and reached $3.15 on the time of writing. XRP Ledger’s cryptocurrency has traded 16/30 days in inexperienced, and its concern and greed index reveals 37, which is concern out there. XRP’s 50-Day Easy Shifting Common and 200-Day SMA are $ 2.74 and $ 2.64, respectively.

- Market dominance: 4.00%

- Provide inflation: 6.26% (Excessive)

- Volatility: 7.76% (Excessive)

- Circulating Provide: 59.98 billion

XRP Market Overview: Technical Evaluation, Institutional Updates, and Macroeconomic Components

As of November 3, 2025, XRP is in a neutral-to-bearish consolidation part regardless of the ETF launches. In keeping with the most recent technical evaluation, XRP reveals resistance close to $2.55. November shall be essential for XRP as Canary Capital’s and Bitwise’s spot ETFs await their launch. Macroeconomic components like anticipated Fed fee cuts and evolving U.S. crypto laws will present an excellent market atmosphere for XRP within the upcoming months.

Technical Evaluation Overview

XRP is at present buying and selling close to $2.49–$2.55, recording a repeated resistance at $2.55 and retaining important help round $2.49. XRP’s buying and selling quantity has spiked 85% throughout this downtrend. The surge in quantity is displaying robust institutional exercise, together with promoting or potential reaccumulation close to help. momentum indicators, together with RSI and MACD, are displaying impartial signaling, a consolidation as an alternative of a powerful instant breakout. In keeping with our consultants, a decisive breakout above $2.73 at this time might set off a worth rally in the direction of $3.00; as of now, it’s unlikely.

XRP Institutional Updates

November is essential for XRP’s institutional adoption as a result of Canary Capital and Bitwise are set to launch spot XRP ETFs between November 13 and 20. The most recent data means that at the least seven issuers are making ready XRP ETF merchandise, indicating enhanced demand and a momentum shift in the direction of belongings held to ETF shares. Ripple continues to increase its On-Demand Liquidity (ODL) community and partnerships, which is excellent for XRP’s institutional actions and worth motion.

Macroeconomic Components

The potential rate of interest cuts and constructive CPI information from the Federal Reserve could make an affect on belongings like XRP. The current U.S authorities shutdown saga has created issues for all cryptocurrencies, together with XRP. The delayed ETF amendments decelerated XRP’s worth, and the ultimate regulatory processings for XRP Spot ETFs are accomplished and set to be launched in mid-November. These components are succesful sufficient to drive XRP ahead and making a key distinction.

XRP Value Prediction In the present day: Why Is XRP Down In the present day?

XRP Ledger’s native crypto is 3% down at this time, and the present XRP downtrend is because of the mixture of broader market reactions, aggressive profit-taking by holders, and technical exhaustion. The most recent market information means that the Merchants and holders have been promoting the digital belongings, together with XRP, after the Fed’s 0.25% fee minimize and the top of quantitative tightening. This promoting strain has created a destructive pattern and led to XRP’s downtrend. XRP’s technical chart patterns present bearish indicators, like a descending triangle sample. In keeping with our prediction consultants, over the subsequent 5 days, XRP would attain the very best worth of $2.50 the next day, which might characterize a 1.45% progress in comparison with the present worth. They famous that this adopted a -6.96% worth change during the last 7 days.

| Date | Min Value | Avg Value | Max Value |

|---|---|---|---|

| Nov 3, 2025 | $2.48 | $2.80 | $2.83 |

| Nov 4, 2025 | $2.52 | $2.83 | $2.85 |

| Nov 5, 2025 | $2.50 | $2.79 | $2.82 |

| Nov 6, 2025 | $2.48 | $2.80 | $2.85 |

| Nov 7, 2025 | $2.46 | $2.75 | $2.80 |

| Nov 8, 2025 | $2.45 | $2.70 | $2.79 |

| Nov 9, 2025 | $2.43 | $2.68 | $2.75 |

Disclaimer: XRP worth prediction information within the above desk is speculative and derived from present market efficiency. So the value is topic to alter based on various market momentum.

Our consultants claimed that the XRP worth was anticipated to commerce between a minimal of round $2.43 and a most close to $2.85 within the following week. In keeping with our XRP prediction, the fourth-largest crypto by market cap is predicted to commerce at a mean worth of $2.76 this week.

Medium-Time period Value Prediction: XRP Value Predictions 2025

Right here is the XRP’s medium-term worth prediction evaluation that shall be useful for short-term buyers.

| Month | Min. Value | Avg. Value | Max. Value | Change |

|---|---|---|---|---|

| Nov 2025 | $ 2.43 | $ 2.57 | $ 2.81 | 14.55% |

| Dec 2025 | $ 2.45 | $ 2.56 | $ 2.76 | 12.49% |

Our consultants predicted that in 2025, XRP could be anticipated to alter fingers in a buying and selling channel between $2.43 and $2.81, resulting in a mean yearly worth of $2.57. They famous that this might lead to a possible return on funding of 14.60% in comparison with the present charges.

Lengthy-Time period Value Prediction: XRP Value Prediction 2025-2030

Right here is the long-term worth prediction evaluation of XRP. Lengthy-term buyers and merchants could make knowledgeable choices utilizing the next desk.

| Yr | Minimal Value (USD) | Common Value (USD) | Most Value (USD) |

|---|---|---|---|

| 2025 | $2.19 | $2.44 | $2.68 |

| 2026 | $3.90 | $4.54 | $5.10 |

| 2027 | $6.04 | $6.23 | $7.74 |

| 2028 | $8.48 | $8.79 | $10.50 |

| 2029 | $12.79 | $13.14 | $14.94 |

| 2030 | $16.05 | $17.30 | $20.12 |

In keeping with our prediction, XRP will break its $3.00 psychological level in 2026, and the next XRP ETF updates are additionally pointing in that route. In the intervening time, XRP reveals a combined to bearish momentum out there, however the newest institutional updates will change the scenario and enhance the digital asset.

The Backside Line

In keeping with our prediction, XRP buyers aren’t having a good time in the mean time, however the short-term dip shall be momentary, and the value rally is predicted to skyrocket as soon as the ETFs are launched and institutional adoption surges. Our consultants claimed that long-term projections for 2029 and 2030 could be bullish, with optimistic situations predicting common costs exceeding $17 and highs reaching over $20. Cryptocurrency funding has a number of monetary dangers; in case you are investing in it, seek the advice of a monetary advisor or crypto knowledgeable beforehand.