Crypto analyst Osemka is drawing a direct structural comparability between XRP’s present consolidation and the ultimate base gold printed earlier than its breakout to recent highs. In line with his charts, XRP/USD on the two-day timeframe is buying and selling in what he characterizes as a reaccumulation vary quite than a topping sample.

Will XRP Observe Gold’s Sample?

The construction is labeled in basic Elliott Wave A-B-C type, with the C leg ending in what he calls a “Spring.” The October 10 crash marks the Wyckoff phrases the ultimate violent liquidation wick that clears late longs and forces capitulation earlier than the following markup section.

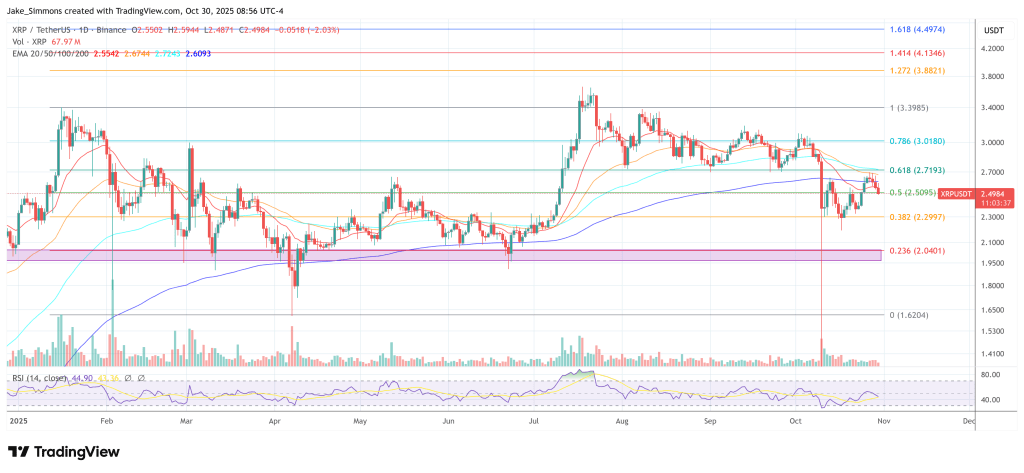

The XRP chart reveals value capped by a horizontal resistance band close to the native high marked “B,” with that B excessive sitting above $3.40 and increasing towards roughly $3.66 on the peak. After that transfer, XRP retraced right into a sideway band the place Osemka labels inside subdivisions “a,” “b,” and “c,” implying a corrective inside chop contained in the broader vary.

The decrease boundary of the vary is drawn within the $1.62 space. This decrease boundary is concurrently labeled “A” and described as the bottom of Reaccumulation, implying that patrons repeatedly defended that zone. The following rally again towards the higher boundary outlined the “B” high. What adopted was a ultimate flush into “C,” which he explicitly tags “Spring,” with the wick piercing beneath prior assist after which snapping again above $2.20–$2.30 and into the ~$2.58 area proven on the chart.

Associated Studying

The message is that the C wave was quick, deep, and terminal. He calls it “a pointy ending within the C wave,” including that that is “quite common.” In classical Elliott interpretation, an A-B-C corrective transfer that ends with an aggressive C spike usually resolves with pattern continuation within the path of the unique impulse. In his wording, the surge established the impulse, and every thing since has been digestion, not distribution. He argues that “it’s onerous to see this vary as something lower than an extended reaccumulation after November’s surge.”

Notably, Osemka locations XRP’s sample subsequent to gold’s weekly chart throughout its personal multi-quarter sideways section. Gold’s construction is annotated virtually identically: an “A” low anchored round roughly $1,680–$1,700 per ounce, a mid-range chop labeled “a / b / c,” a “B” excessive urgent into the $2,050–$2,100 ceiling, and eventually a “C” leg that undercut that very same $1,700 flooring earlier than reversing.

Associated Studying

When gold lastly pushed by means of the long-capped $2,100 space in July 2024 and broke into sustained new all-time highs close to $2,480, that break acted like a set off: safe-haven demand, Fed rate-cut expectations and central financial institution shopping for drove an virtually uninterrupted vertical section within the steel, and over the next months gold saved taking out spherical numbers — $2,500, $3,000, $4,000 and past — in the end stretching greater than 80% greater from that $2,100 breakout zone to succeed in about $4,381 per ounce on the peak.

By inserting XRP and gold aspect by aspect, utilizing the identical lettering, identical boundary logic, and the identical “Spring” terminology, Osemka is presenting XRP as sitting on the equal second gold occupied simply earlier than its parabolic run.

“This one is for the XRP neighborhood, the place I see some gurus preaching for the top of the cycle. Bros, it’s onerous to see this vary as something lower than an extended reaccumulation after November’s surge. In Elliott wave phrases: an ABC with a pointy ending within the C wave. Quite common. Final shakeout or Spring. There may be mainly no distinction to this reaccumulation instance on Gold years in the past. Thank me later,” the analyst concluded.

At press time, XRP traded at $2.49.

Featured picture created with DALL.E, chart from TradingView.com