On-chain analytics agency Santiment has revealed how Bitcoin, XRP, and different cryptocurrencies have dropped right into a “purchase zone” on a well-liked metric.

MVRV Ratio Exhibits Excessive Diploma Of Quick-Time period Ache In Bitcoin & Altcoins

In a brand new put up on X, Santiment has mentioned how the varied belongings within the cryptocurrency sector are wanting based mostly on the 30-day MVRV Ratio. The Market Worth to Realized Worth (MVRV) Ratio is an on-chain indicator that measures the ratio between the market cap and Realized Cap for a given coin.

The Realized Cap right here refers to a capitalization mannequin that calculates the asset’s whole worth by assuming the worth of every particular person token is the same as the worth at which it was final transacted on the blockchain. Briefly, what this mannequin captures is an estimation for the quantity of capital that BTC buyers as an entire have invested into the cryptocurrency. The same old market cap, then again, represents the quantity holders are carrying at present.

When the worth of the MVRV Ratio is larger than 1, it means the market cap is larger than the Realized Cap. In different phrases, the general community is in a state of revenue. However, an indicator under this threshold implies the dominance of losses amongst buyers.

Within the context of the present matter, the model of the MVRV Ratio that’s of curiosity is the 30-day one, monitoring the profit-loss stability of the merchants who bought their cash throughout the previous month.

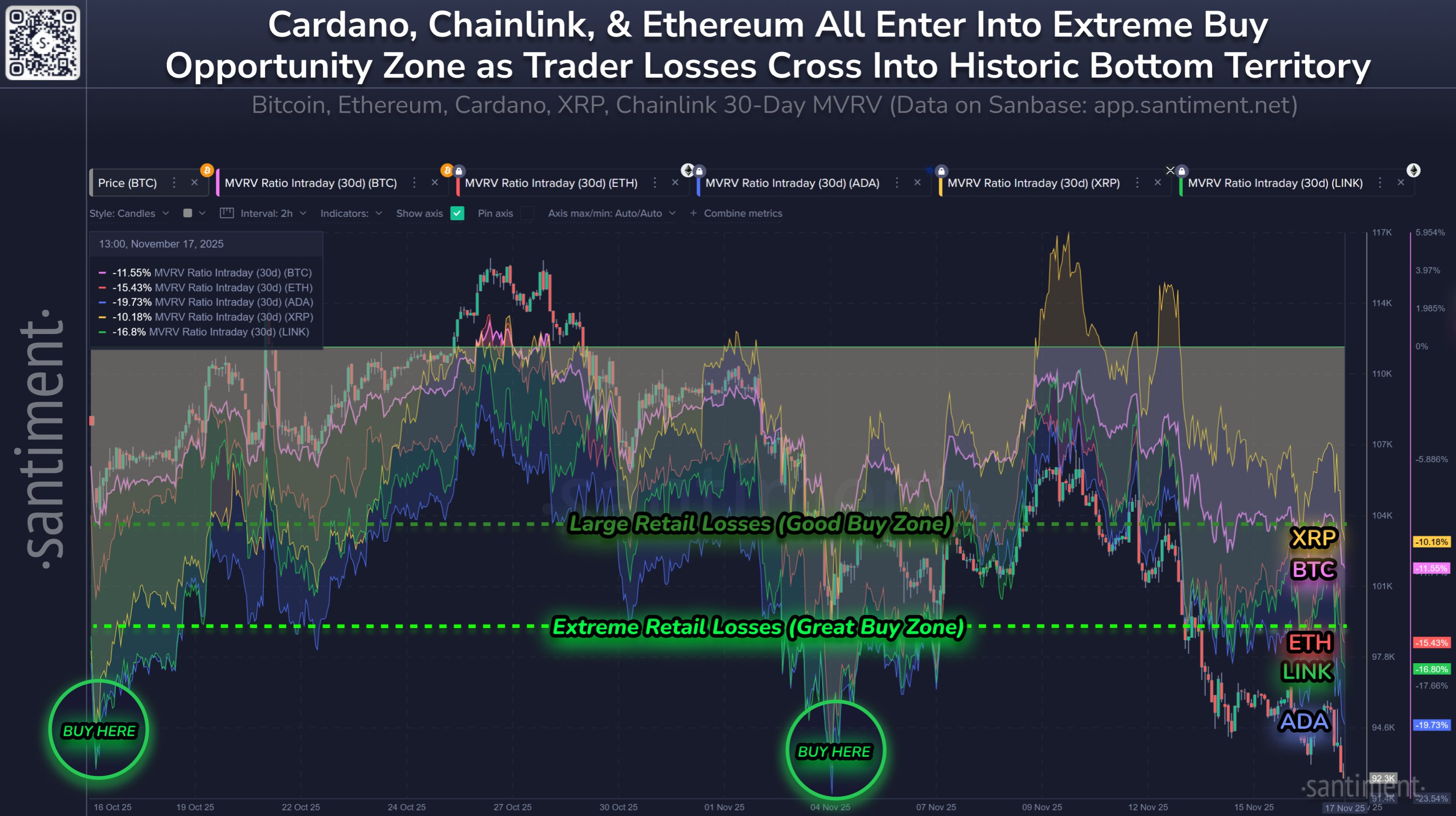

Beneath is the chart for the metric shared by Santiment that reveals the pattern in its worth for 5 main cryptocurrencies: Bitcoin, XRP, Ethereum, Chainlink, and Cardano:

As is seen within the graph, the 30-day MVRV Ratio has witnessed a plunge not too long ago because the sector has gone via a bearish shift. Current Bitcoin consumers at the moment are about 11.5% underwater, whereas XRP ones are round 10.2%. Each of those are past the edge that the analytics agency classifies because the boundary for a “good purchase zone.”

The 30-day buyers have suffered even worse losses within the case of Ethereum, Cardano, and Chainlink, being down 15.4%, 19.7%, and 16.8%, respectively. All of those fall inside Santiment’s “excessive purchase zone.”

“In a zero sum recreation, purchase belongings when common commerce returns of your friends are in excessive negatives,” famous the analytics agency. “The decrease MVRV’s go, the upper the likelihood is of a speedy restoration.”

It now stays to be seen whether or not market ache has been sufficient for XRP and others to trigger a market rebound, or if extra drawdown is coming.

XRP Value

On the time of writing, XRP is floating round $2.18, down greater than 11% over the past week.