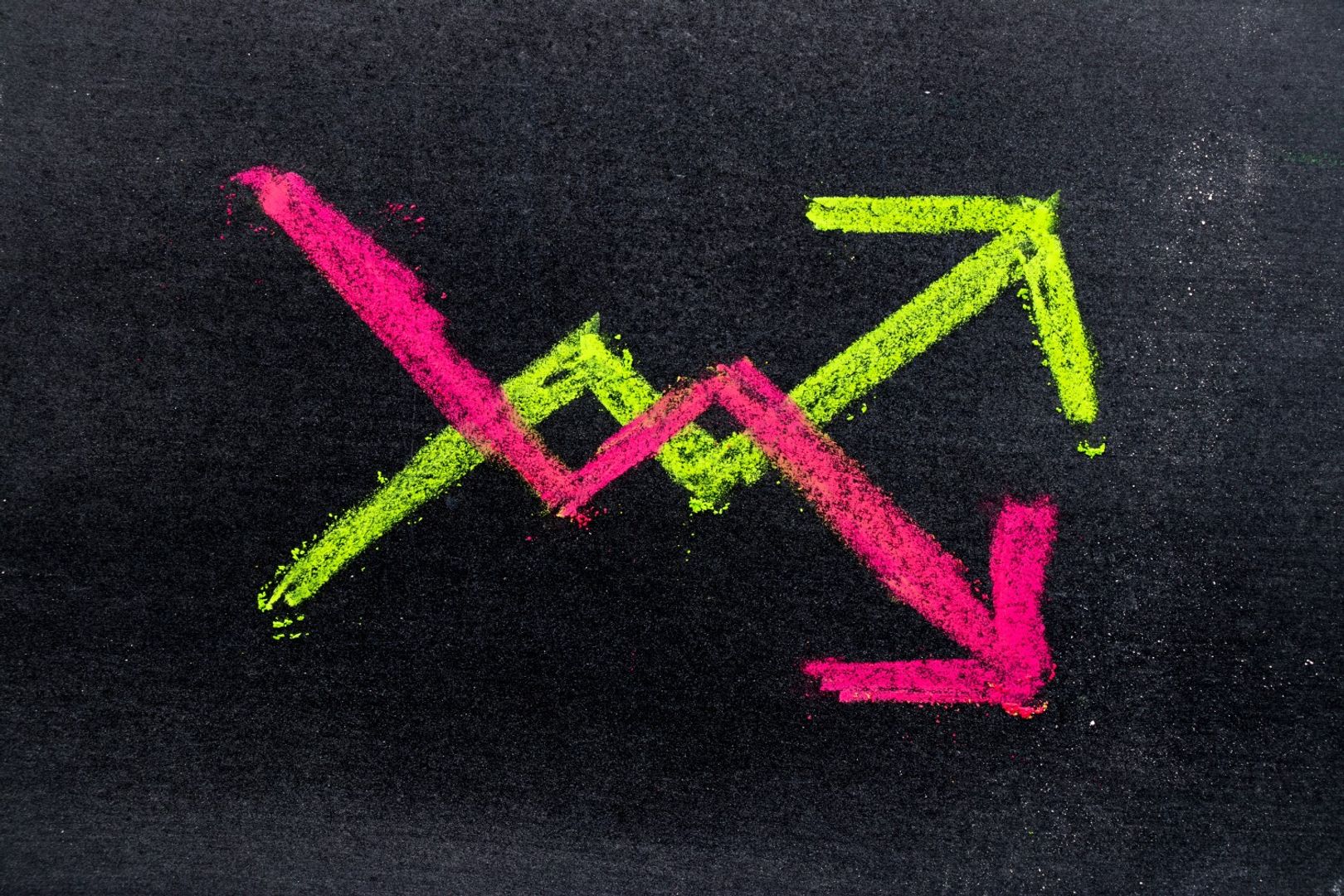

Choices information from Deribit reveals a putting divergence in sentiment for main cryptocurrencies, with bullish positioning in XRP and solana (SOL contrasting with lingering draw back fears in bitcoin (BTC) and ether (ETH).

As of the time of writing, XRP name choices or bullish bets had been pricier than places throughout all tenors, in accordance with information supply Amberdata.Notably, the December expiry calls traded at a premium of 6 volatility factors to places, indicating a bias for a year-end rally. XRP, the payments-focused cryptocurrency, is the third-largest by market worth.

SOL choices additionally exhibited bullishness, with December calls buying and selling at a premium of 10 vol factors to places.

A name choice offers the customer the correct, however not the duty, to buy the underlying asset at a predetermined worth on or earlier than a specified future date. It represents a bullish wager available on the market, whereas a put choice insures towards worth slides.

XRP’s constructive tone is probably going pushed by renewed enthusiasm round potential approval of spot exchange-traded funds (ETFs) within the U.S. No less than six to seven main issuers, together with Bitwise, 21Shares, WisdomTree, CoinShares, Canary Capital and Franklin Templeton, have energetic functions or amendments pending earlier than the U.S. Securities and Change Fee (SEC).

The SEC has delayed selections on these filings, pushing key approvals, reminiscent of WisdomTree’s XRP ETF, into late October 2025. As these filings fall inside an identical evaluate interval, the market appears to be making ready for a synchronized approval or rejection occasion that might considerably influence XRP’s worth.

The XRP neighborhood is extremely optimistic, eyeing substantial worth positive aspects by year-end if ETFs are accredited.

“The primary-month stream base case: $5B+. Unbiased market desks peg first-month spot XRP ETF inflows at $5B+ earlier than the reflexive chase. That’s a critical demand shock to a provide that’s partly escrow-locked and concentrated,” standard pseudonymous XRP holder Pimpius stated on X, mentioning $50 because the potential year-end worth for XRP. The cryptocurrency presently trades at round $2.88, in accordance with CoinDesk information.

Optimism from SOL possible stems from the rcent approval of its mum or dad blockchain Solana’s Alpenglow improve, which is prone to enhance the community pace. Bitget’s Chief Analyst Ryan Lee referred to as it “a defining second for the community’s trajectory.”

“The approval of Solana’s Alpenglow improve with greater than 98 p.c staker help marks a defining second for the community’s trajectory. Lowering transaction finality from 12.8 seconds to only 100–150 milliseconds transforms Solana into one of many quickest blockchains in operation, unlocking potentialities that stretch properly past marginal effectivity positive aspects,” Lee stated in an e mail.

Lee stated that the pace enhance will speed up Solana’s adoption in real-time buying and selling, high-frequency methods and seamless on-chain arbitrage. He defined that Alpenglow’s design matches blockchain settlement speeds with conventional monetary programs, overcoming a significant hurdle for establishments hesitant to undertake decentralized infrastructure. This alignment makes Solana a pretty and scalable blockchain choice for institutional use.

Bearish sentiment in BTC and ETH

The sentiment relating to bitcoin seems decisively bearish, as places are priced increased than requires even the March 2026 expiry commerce.

BTC’s rally has stalled above $100,000, with costs struggling to rally after Friday’s disappointing U.S. jobs report, which heightened expectations for Fed fee cuts. Analysts have blamed the slowdown in ETF inflows, profit-taking by long-term holders and whale rotation into ether for BTC’s dour worth motion.

That stated, choices tied to ether additionally confirmed a bias for places out to the December expiry. ETH has pulled again sharply to $4,300 from the file excessive of practically $5,000 reached final month.