In response to on-chain knowledge and market studies, XRP is beneath contemporary promoting strain as a result of a big share of holders at the moment are exhibiting losses.

Associated Studying

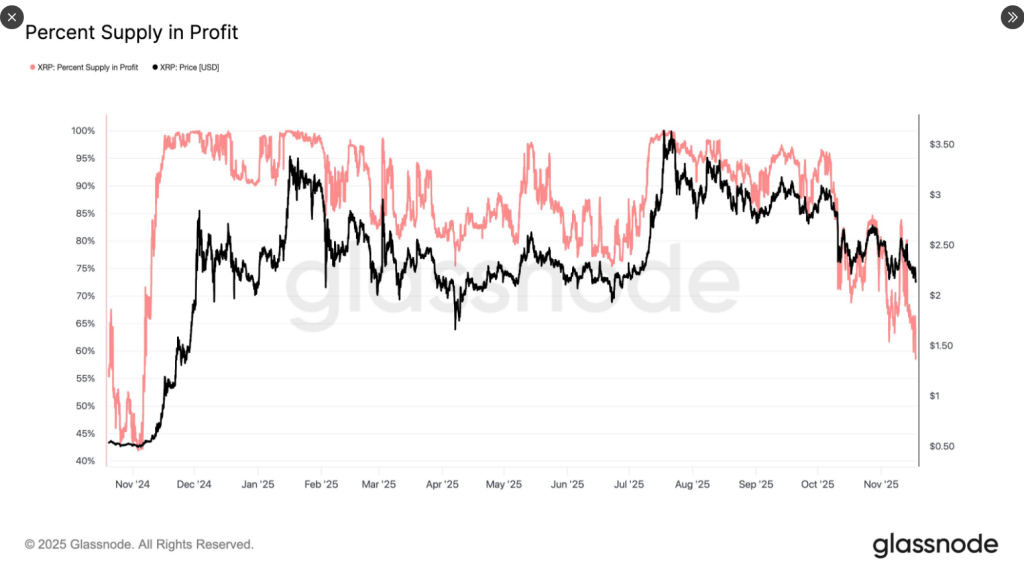

Glassnode studies that 41.5% of XRP provide — or near 27 billion tokens — sits in loss, the bottom profitability degree since November 2024 when XRP traded close to $0.53.

At at the moment’s ranges, about 4 instances increased than that November determine, a giant share of holders purchased above present costs and at the moment are uncovered.

Holder Focus Raises Promoting Threat

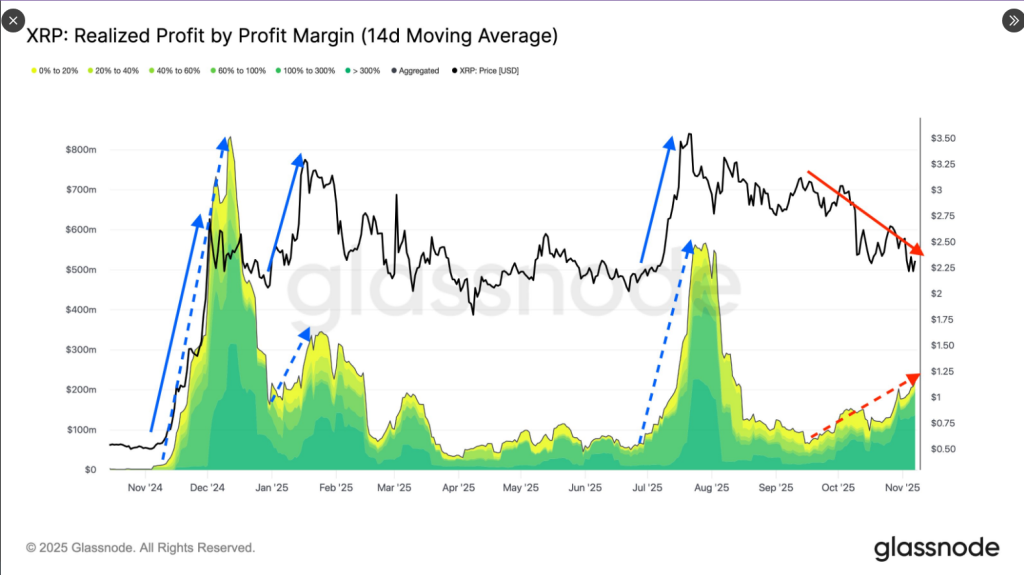

Market analysts say this positioning has modified dealer habits. Tony Sycamore, a market analyst at IG Australia, disclosed that many wallets doubtless picked up XRP when it was above $3.00 throughout months together with January, July, August, September, and early October.

Which means a large group is now holding paper losses after the 40%+ slide from the July $3.65 peak. The size of unrealized losses can encourage some buyers to exit if costs hold drifting decrease, which might add promoting strain.

The share of XRP provide in revenue has fallen to 58.5%, the bottom since Nov 2024, when worth was $0.53.

Immediately, regardless of buying and selling ~4× increased ($2.15), 41.5% of provide (~26.5B XRP) sits in loss — a transparent signal of a top-heavy and structurally fragile market dominated by late patrons.

📉… https://t.co/CBXPzDalxV pic.twitter.com/UpLNKV7LqD— glassnode (@glassnode) November 17, 2025

ETFs May Deliver Recent Demand Or Little Influence

Studies have disclosed a wave of exchange-traded funds tied to XRP that will alter flows. Canary Capital launched the primary spot-XRP ETF on November 13 and posted the strongest first-day outcome for US ETFs in 2025.

Franklin Templeton’s EZRP is scheduled to start buying and selling on November 18, with funds from Bitwise, 21Shares and CoinShares shut behind. Merchants hope these merchandise will appeal to new cash into XRP, however historical past reveals preliminary demand can range broadly and is determined by broader market liquidity and threat urge for food.

Key Foothold

On the time of reporting, XRP trades round $2.19, down greater than 10% within the final seven days. Analysts are watching the $2.16 space as a key foothold.

💥 JUST IN: FRANKLIN TEMPLETON’S SPOT $XRP ETF (EZRP) LAUNCHES TOMORROW.

BULLISH 🚀 pic.twitter.com/rmGN1rdVGI

— Amonyx (@amonbuy) November 17, 2025

If that degree is defended, a bounce towards the $2.35–$2.60 band might be attainable. If it fails, additional retracement in direction of decrease ranges is a practical final result, specifically with a big portion of holders underwater and cease orders probably clustered beneath present assist.

On-Chain Alerts Paint A High-Heavy Image

In response to knowledge from blockchain trackers, the market appears to be like “top-heavy,” which means that a lot of those that entered just lately paid excessive costs for his or her cash and are thus extra weak. That sample usually makes rallies much less secure till profit-taking strain eases or contemporary patrons step in.

Associated Studying

On the identical time, exercise on the XRP Ledger has been rising, and renewed readability round guidelines for digital belongings in some jurisdictions has helped sentiment a bit.

Within the close to time period, worth motion will doubtless correlate with ETF inflows and whether or not patrons can defend the $2.15 degree. A transparent break above $2.60 might relieve promoting strain, whereas a break beneath assist may set off additional promoting by holders attempting to restrict losses.

For now, XRP is caught in a battle between the strain of unrealized losses and new potential flows of capital from ETFs.

Featured picture from Unsplash, chart from TradingView