Bitcoin enters the ultimate day of the quarter in a decent coil of technicals and macro catalysts, with merchants fixated on a handful of ranges that may possible set the tone for October. Ostium Analysis’s week-ahead outlook frames the setup as a fading “window of weak point” into a possible This autumn tailwind, however provided that the market navigates an event-heavy calendar with out dropping essential helps. As creator Nik Patel places it, “weekly momentum continues to be supportive of upper costs and I consider we are actually rising from the window of weak point I had marked out from Friday twentieth Sept.”

Key Bitcoin Ranges Sign Explosive October

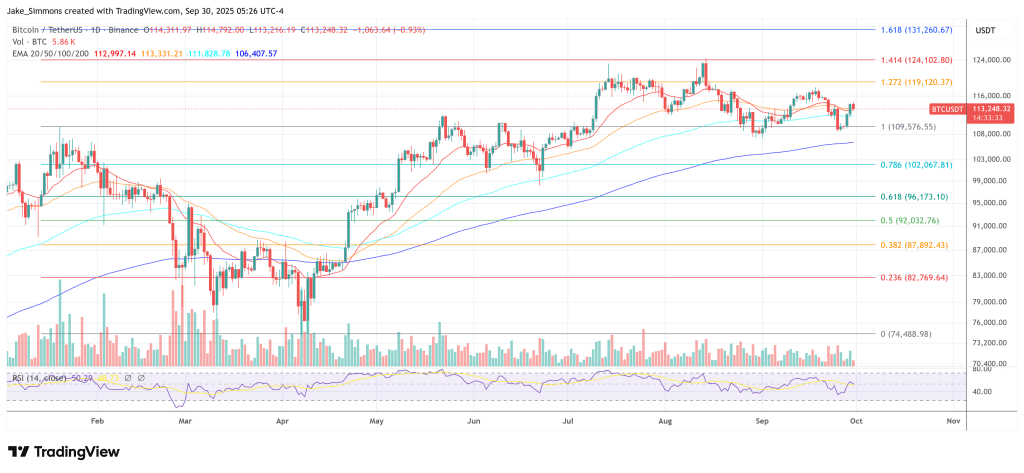

Spot value motion stays outlined by final week’s rejection on the August open close to $112,000 and a swift slide into the low-$108,000s earlier than a rebound into Sunday’s shut. On the weekly timeframe, momentum nonetheless tilts larger, however Patel warns that quarter-end, the October flip, and a dense run of information can stretch volatility.

His base case is unambiguous: “I believe any dip you get this week is one you need to take a look at as a possibility for longs for the rest of This autumn,” he writes, including that considerations a few cycle high in October are misplaced given “tailwinds into mid-Dec.” The mid-cycle danger marker sits round $99,000, with a longer-term invalidation tied to the 360-day transferring common close to $97,900. “Except we lose $99k on a weekly shut, nothing right here seems to be mid-term bearish to me,” Patel states.

Associated Studying

On the every day chart, the market carved the next low above roughly $107,000 after the $112,000 rejection, holding the short-term construction constructive. Patel’s upside set off is exact: “If we do now push larger off this low by means of the remainder of this week to shut again above the August open and trendline resistance up close to $115.7k, I believe it is vitally unlikely you see $107k–$108k retested in October.” Conversely, he stresses the draw back waypoint in a volatility burst: “I believe the bottom we see this week is the 200dMA at $104.6k on a serious flush of the lows.”

The tactical map he sketches provides bulls and bears one thing to do, generally inside the similar session. On the lengthy facet, he favors fading a stop-hunt beneath final week’s low or into the September open, “with invalidation on an in depth beneath the 360-day transferring common, at the moment at $97.9k, beneath which we’ve got not closed since March 2023.”

If the market squeezes first, he outlines a switch-hitter method: a sharper rally into the quarterly shut that “takes out the $114k excessive into Oct 1st,” adopted by a fade on bearish divergence aiming “for a minimum of $110k, if not $108.5k into the weekend,” the place he’s ready to flip lengthy once more.

Associated Studying

Macro complicates an in any other case orderly technical image. Patel expects the greenback to overextend earlier than rolling over, a sequence that will assist danger later in This autumn: final week’s post-FOMC greenback bid is “short-lived,” with DXY “99 as the very best I’m anticipating,” and a bigger transfer towards 93 in This autumn if momentum breaks down beneath the September open. On equities, he anticipates “somewhat choppier” October than crypto however nonetheless frames dips as alternatives into year-end.

Positioning and derivatives context backstop the directional view. Patel highlights snapshots throughout Velo and CoinGlass, three-month annualized foundation, and Bitcoin versus altcoin open curiosity, then overlays anticipated one-week and one-month liquidation clusters as an instance the place pressured move might speed up both path. The through-line stays that this week’s volatility is probably going the prelude, not the postscript, to This autumn. “The chance for these lows to be cleaned up must be over the subsequent 5–7 days,” he notes. “If we run final week’s low after which reclaim on the decrease timeframes, that might be the October low forming early.”

In sum, Bitcoin’s near-term riddle is much less about development decay than the choreography of a shakeout. Above ~$112,000, patrons can press shortly towards the ~$115,700 pivot; past that, the all-time-highs narrative returns to heart stage. Sweep the lows first and maintain the $104,600–$107,000 shelf, and the market could also be laying its October flooring. Solely a weekly shut beneath $99,000 would meaningfully dent the This autumn bull case Patel maps out for readers this week. “You shouldn’t get bear-holed,” he writes. “As such, any dip between now and the weekend is the place I’m anticipating the formation of an October low.

At press time, BTC traded at $113,248.

Featured picture created with DALL.E, chart from TradingView.com