XBRL errors can considerably impression the accuracy and reliability of your group’s monetary experiences. Guaranteeing that these errors are minimized and averted is essential for sustaining the integrity of economic knowledge and for compliance with regulatory necessities.

The SEC is paying shut consideration to the standard of your organization’s XBRL tagging, making it essential to keep away from frequent errors. In accordance with a research carried out by XBRL US, many frequent (and preventable) XBRL errors are nonetheless submitted every year, come submitting time. On this article, we are going to discover the 4 commonest XBRL errors, examples of every, and the way to keep away from/forestall them sooner or later.

Key Takeaways:

- XBRL (eXtensible Enterprise Reporting Language) errors come from mis-tagged, poorly formatted, or incorrectly offered monetary knowledge.

- These points can intervene with monetary reporting and interpretation, end in SEC scrutiny, and cut back stakeholder belief in your disclosures.

- The commonest sorts of XBRL errors embody Invalid Member-Axis Combos, Destructive Worth Errors, Required Worth Not Reported, and Date Errors.

- Crucial methods to stop and mitigate XBRL errors embody coaching your employees on XBRL requirements, taxonomy modifications, and many others., reviewing current taxonomies, collaborating throughout groups, and utilizing validation instruments.

- Certent Disclosure Administration offers validation instruments and different methods to automate XBRL tagging, centralize assessment and collaboration, and concurrently guarantee accuracy, compliance, and effectivity.

What Are XBRL Errors?

XBRL errors are brought on by inaccuracies or points within the tagging, formatting, or knowledge presentation inside an XBRL (eXtensible Enterprise Reporting Language) report. These errors may result from components like incorrect taxonomy picks, misaligned knowledge tags, or syntax errors throughout the report. These simply neglected errors can result in important misinterpretations of economic knowledge, probably inflicting compliance points, hampering strategic decision-making, and lowering the transparency of economic reporting. Figuring out and correcting these errors is crucial to make sure that monetary data is precisely communicated to stakeholders and regulators.

XBRL Tagging Challenges

Though massively useful (accuracy, transparency, comparability, and many others.), XBRL tagging presents a number of important challenges as a result of its complexity. The method calls for a excessive degree of precision, with even small errors in tagging creating important points in your monetary reporting. Moreover, the dynamic nature of economic knowledge and frequent updates to XBRL taxonomies make it troublesome for organizations to maintain their tagging constant and updated (particularly for groups that carry out this course of manually). Some main challenges of XBRL tagging that may produce errors embody:

- Taxonomy Choice: One of many main challenges is deciding on the right taxonomy components from an enormous array of obtainable tags. With so many choices, it’s straightforward to inadvertently select a tag that’s shut, however not solely correct — which regularly results in potential misrepresentation of information.

- Consistency Throughout Stories: Guaranteeing consistency in tagging throughout totally different experiences is one other core problem, particularly if you make updates to taxonomies. These modifications can complicate the tagging course of and improve the probability of consistency-based errors.

- Useful resource-Intensive Validation: Organizations want detailed validation processes to catch syntax errors and incorrect tag combos, which provides one other layer of issue. This may be resource-intensive, making it difficult for organizations to take care of each accuracy and effectivity of their XBRL reporting.

Overcoming these challenges requires a deep understanding of XBRL requirements, steady coaching, and the implementation of trendy disclosure administration instruments (like Certent Disclosure Administration) that may automate and streamline facets of XBRL tagging and validation.

Abstract: Most Widespread XBRL Errors

Under, we’re going to enter technical element about every of those errors, however let’s begin with a high-level overview first:

| Error | Clarification & The right way to Forestall |

| Invalid Member-Axis Combos | Tags the place a dimension axis is paired with a member that doesn’t logically belong. Use validation instruments early within the course of to catch invalid combos. |

| Destructive Worth Errors | Values tagged as destructive when they need to be constructive (or vice-versa) in keeping with the definition of the idea. Be sure that your crew understands one-way and two-way components and when an indication reversal is required. |

| Required Worth Not Reported | Required idea lacking from the occasion doc. Keep a guidelines of required components that should all the time be current and confirm this close to the top of the tagging course of. |

| Date Errors | Truth tagged with a date exterior the permissible interval for the idea. Map every idea to the suitable context kind and make sure the dates replicate the reporting interval finish or the suitable date outlined within the taxonomy. |

XBRL Error #1: Invalid Member-Axis Combos

Accounting for over one-third of errors recognized by XBRL US, the invalid axis member mixture is well the commonest XBRL error. This can be a qualitative error that happens when a member and axis are used collectively in a approach that doesn’t make “monetary sense.” With the variety of axes and members within the US GAAP Taxonomy, there are nearly limitless prospects for incorrect combos.

Invalid Member Axis Combos Instance 1:

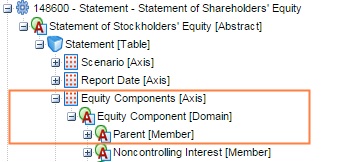

The offense that happens most continuously is the wrong use of ParentMember below LegalEntityAxis. The intention of ParentMember and its dwelling axis, EquityComponentsMember, is to establish the portion of fairness that’s attributable to the mother or father (in different phrases, excluding non-controlling pursuits). When filers place ParentMember below LegalEntityAxis, they mix fairness reporting and authorized entity ideas, which doesn’t make sense in monetary phrases.

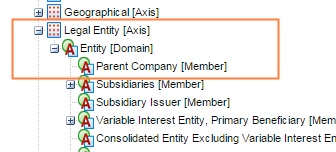

LegalEntityAxis ought to solely be used with its supposed member, ParentCompanyMember, which, by definition, is meant for the authorized entity appearing as a mother or father of an organization in a mother or father/subsidiary relationship.

Some errors could also be apparent when reviewing an organization taxonomy, corresponding to an asset kind member housed below a legal responsibility kind axis. Nonetheless, others could require a extra detailed evaluation (as seen within the following instance).

Invalid Member Axis Combos Instance 2:

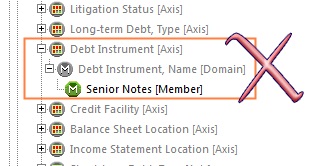

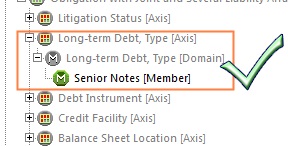

You might be reviewing your taxonomy and see SeniorNotesMember (a regular US-GAAP component) below DebtInstrumentAxis and assume that that is an applicable mixture. Nonetheless, XBRL US disagrees.

They advise towards utilizing any non-extended member together with DebtInstrumentAxis. The reason being that this particular axis is meant for the identify of company-specific debt devices (as indicated by the related area DebtInstrumentNameDomain). On this state of affairs, the suitable motion can be to research the tag to find out whether or not a alternative is required for the member (which might be an extension) or the axis (which might be a extra applicable axis of both LongTermDebtTypeAxis or ShortTermDebtTypeAxis).

As we noticed within the first instance, invalid combos gained’t essentially be apparent to the typical consumer. It is very important rigorously contemplate the member axis combos by asking your self the next questions (preserving in thoughts the general aim of creating monetary sense out of the information):

- Is the member applicable for the idea being tagged?

- Is the axis applicable for the idea being tagged?

- Are the axis and member applicable for one another?

- Is there a extra correct member/axis out there within the taxonomy?

Submitting with this kind of error leaves inaccurate and probably deceptive knowledge for public consumption and might be simply prevented. Contemplate incorporating a few of the following preventative and corrective steps into your course of.

- Coaching: In case your inner reporting employees is chargeable for component choice, make sure that they’re correctly educated to research member axis combos for appropriateness.

- Assessment New Taxonomy Objects: Implement a assessment course of for brand spanking new member/axis/component choice. With the huge array of members and axes which are out there within the taxonomy, two heads actually are higher than one at figuring out these easy-to-miss member-axis mixture errors.

- Assessment Current Firm Taxonomy: When you’ve gotten some downtime between filings (which trendy instruments ought to allow), take a while to assessment your current taxonomy construction for its appropriateness. When you wait till crunch time in your submitting schedule, it’s extra prone to get pushed apart for subsequent quarter.

- Validation: There are a number of validation instruments on the market that may establish this kind of error (amongst different points) and summarize them in a report, which might then be addressed utilizing the correct reporting narrative. By means of insightsoftware’s partnership with XBRL US, this validation might be simply accomplished in our Certent Disclosure Administration platform.

The standard of your XBRL tagging speaks volumes about your organization’s monetary disclosures. A disclosure administration platform like Certent may help you keep away from these errors with a sequence of validation warnings (plus automating a wide range of different processes).

XBRL Error #2: Destructive Worth Errors

The destructive worth error is the second commonest error dedicated by filers and accounts for over 12% of all XBRL errors. Primarily, this error happens when an idea reported as a destructive worth is anticipated to have a constructive worth. In accordance with XBRL US, sure ideas ought to solely have destructive values in distinctive circumstances. Fortunately, a validation device is a good way to test for this kind of error. Nonetheless, with over 15,000 components within the taxonomy and quite a few distinctive firm disclosures, you will need to assessment your destructive values internally as an extra line of protection.

So as to carry out a destructive worth test, you’ll need to filter by occasion doc values. In Certent’s Disclosure Administration platform, you possibly can rapidly pull up all destructive occasion doc values and navigate on to their location within the doc with a click on of your mouse. When you’ve recognized the destructive values in your doc, it’s essential to know why it was reported as destructive so you may make any applicable corrections to the underlying logic.

Destructive Worth Errors Instance 1: Reverse Signal and/or Negate Label

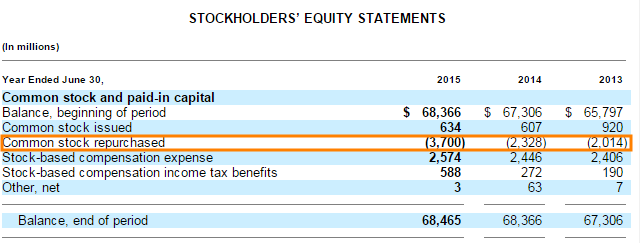

There are particular conditions through which a change will all the time have a destructive impact. For instance, the repurchase of frequent inventory will all the time cut back shareholders’ fairness. Due to this, the component TreasuryStockValueAcquiredCostMethod (which might usually be utilized to this idea/line merchandise) has a steadiness kind of debit within the US GAAP taxonomy. When this component is utilized with out being negated, a destructive worth error is created. One other instance of an idea that’s prone to destructive worth errors is treasury inventory. Inventory repurchases have a destructive impact on shareholders’ fairness and are offered within the fairness assertion in parentheses (as proven within the picture under).

Picture Caption: Microsoft Company 2015 10-Ok

If TreasuryStockValueAcquiredCostMethod is utilized to this line with a regular label function, the steadiness kind of the component (debit) mixed with the destructive presentation provides us a destructive debit (i.e. a credit score), which is wrong for an idea that reduces fairness. Subsequently, this explicit component ought to have a reverse signal and a negated label utilized. Reversing the signal modifications a price to the alternative signal within the occasion doc (i.e. destructive to a constructive or constructive to a destructive). As soon as the occasion doc worth is constructive, it’ll additionally present as constructive within the XBRL rendering. This must be corrected by altering the popular label function within the firm taxonomy to NegatedLabel, which can trigger the values tagged with the negated label to be offered as the alternative signal.

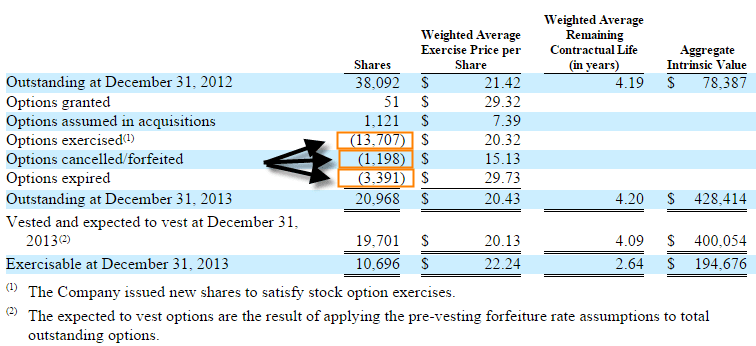

One other instance of a typical space that requires a reversed signal and a negated label is a regular inventory possibility exercise roll-forward desk. On this commonplace disclosure, exercised, cancelled, and expired shares are usually offered as destructive values as a result of they cut back the variety of choices out there for grant. Nonetheless, it isn’t attainable for a destructive variety of shares to be exercised, cancelled, or expired. Because of this, these ideas additionally require reversed indicators and negated label roles. SEC XBRL Employees Observations establish further examples of ideas that ought to solely have constructive values.

Picture Caption: Yahoo! Inc. 2013 Kind 10-Ok

Destructive Worth Errors Instance 2: Incorrect Aspect Use

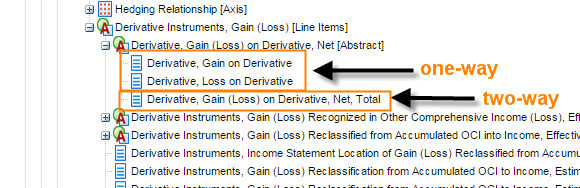

There are two sorts of components within the taxonomy when destructive worth errors are being mentioned:

- One-way components are supposed to seize a one-way change in an idea (e.g. a spinoff acquire).

- Two-way components seize each will increase and reduces (e.g. features and losses on derivatives).

It’s necessary to make the correct component choice on your firm’s particular person state of affairs. If an idea in your doc will nearly all the time have the identical steadiness kind (and due to this fact nearly all the time be offered as both constructive or destructive, however not each), it’s higher to decide on the component with the narrower definition. Nonetheless, if the steadiness kind of the idea fluctuates between debit and credit score, it will be extra applicable to make use of a two-way component. When you come throughout a destructive worth related to a one-way component in your assessment, chances are you’ll wish to contemplate changing it with a component that’s extra particular to the idea being disclosed.

Destructive Worth Errors Instance 3: Dimensional Qualification (Members)

The subsequent kind of destructive worth error is said to lacking dimensional tags or members. Generally there are legit causes to have a destructive worth for an idea that’s anticipated to be constructive, corresponding to accounting changes and inter-company eliminations. The construction of the taxonomy of all these disclosures usually offers for the usage of members corresponding to RestatementAdjustmentMember and ConsolidationEliminationsMember. A lot of these members permit ideas that usually must be constructive to be destructive, with out inflicting errors. Another members that may point out reductions in in any other case constructive values could embody textual content corresponding to “reconciliation,” “netting,” and “adjustment.”

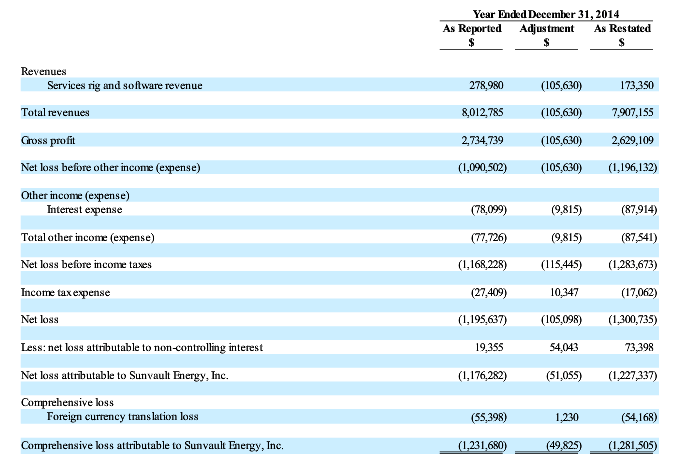

XBRL Error #3: Required Worth Not Reported

Because the third commonest XBRL error, required worth not reported accounts for almost 10% of XBRL errors. This happens when a required worth or a mix of values just isn’t reported as a reality(s) within the occasion doc. The lacking required components that trigger this kind of error encompass frequent ideas which are both explicitly outlined within the US GAAP taxonomy, Accounting Requirements Codification (corresponding to earnings per share), or components within the US-GAAP taxonomy which are outlined generically (corresponding to Belongings). It may be troublesome to establish lacking ideas within the sea of values that make up monetary statements, so this error is finest prevented by utilizing a validation device like Certent Disclosure Administration.

A required worth not reported error signifies that sure ideas or different essential components (e.g. earnings per share) aren’t reported within the occasion doc. Except you’re a private firm that isn’t required to report earnings per share, a lacking earnings per share reality signifies incorrect XBRL reporting. Normally, earnings per share knowledge is lacking as a result of the idea was tagged with a customized component extension. Nonetheless, for the reason that Accounting Requirements Codification explicitly defines this idea, the corporate’s disclosure of earnings per share will nearly all the time be in step with the component supplied within the US GAAP taxonomy. One other instance of an inappropriate customized component extension can be the extension of an property component. The US GAAP taxonomy defines this component generically to keep away from pointless extensions.

Along with pointless extensions, the required worth not reported error is brought on by inappropriate US GAAP component choice. Probably the most frequent error associated to lacking required data happens on the Money Circulate Assertion, which we’ll focus on subsequent.

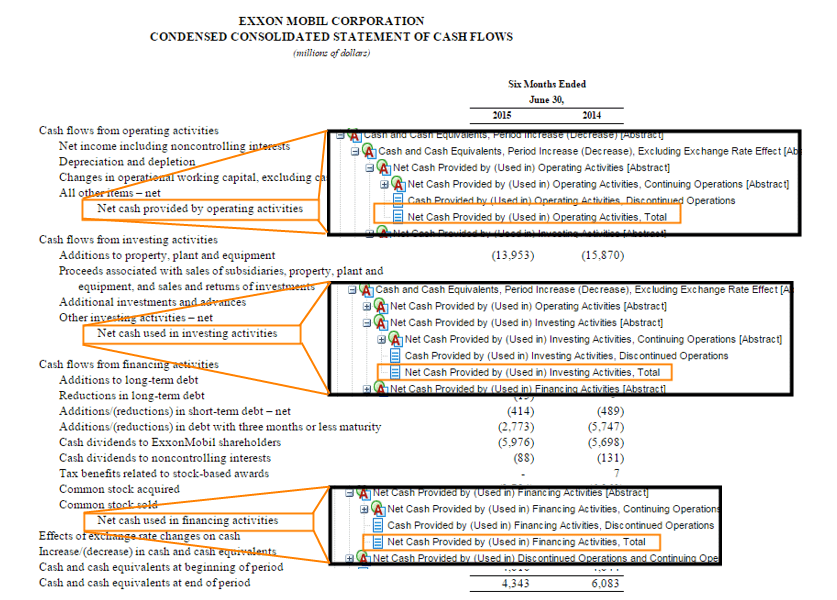

Required Worth Not Reported Instance 1: Money Circulate Assertion

Within the Money Circulate Assertion of Exxon Mobil Company under (which doesn’t signify their precise component choice), it might seem that the weather chosen for the whole of the working, investing, and financing actions sections are right. In spite of everything, the chosen components seem like the given complete components. However, a better take a look at the construction of the taxonomy is required.

Picture Caption: Exxon Mobil Company 2015 10-Q

The definition of all three chosen components signifies that discontinued operations are included within the calculation. Nonetheless, since no discontinued operations exist on this assertion, the chosen components are inappropriate. The precise error that outcomes from this incorrect component choice is the lacking Persevering with Operations and Discontinued Operations components which are anticipated to be included with a component that’s outlined as the whole of each. XBRL US offers finest observe steering, which incorporates further data and proposals on this money move assertion subject.

This error doesn’t simply happen throughout a taxonomy construct — it additionally happens when circumstances change, however the related components don’t. For instance, Accounting Requirements Replace quantity 2014-08, issued in April 2014, modified the standards for reporting discontinued operations. This modification precipitated a variety of filers to reclassify disposals from discontinued operations to persevering with operations. If all discontinued operations had been utterly reclassified and the working, investing, and financing actions complete components weren’t up to date, then the result’s incorrectly reported ideas and a required worth not reported error.

Streamline Your Monetary 12 months-Finish Shut Course of

XBRL Error #4: Date Errors

In accordance with XBRL US, date errors are the fourth commonest XBRL error dedicated by filers and account for nearly 10% of all errors. These are precipitated when ideas in an XBRL doc are tagged with incorrect dates in relation to the top date of the reporting interval. The date error may also pop up when an idea is tagged with the suitable calendar, however has not been correctly dimensionalized. With correct coaching and a radical assessment course of, this error might be simply averted.

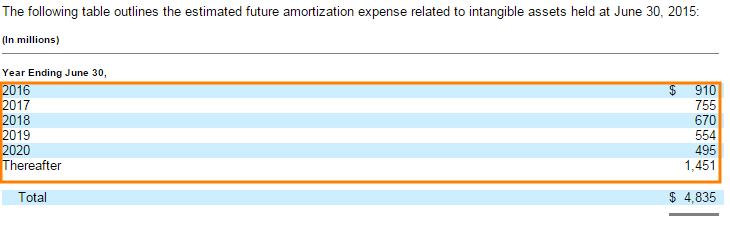

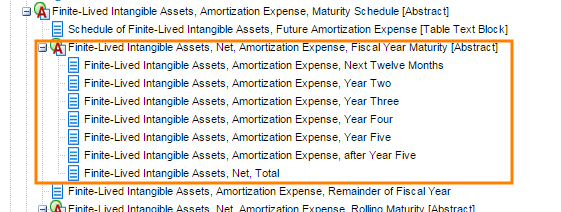

Date Error Instance 1: Future Amortization Expense

Under is an excerpt from Microsoft Company’s 2015 10-Ok “Goodwill and Different Intangible Belongings” be aware. Since future dates are said on this disclosure, one could be inclined to tag every line with the related fiscal 12 months calendar. But, that may be inappropriate as a result of this desk consists of an estimate on the reporting interval finish of future bills, not an actual quantity.

Picture Caption: Microsoft Company 2015 10-Ok

The US GAAP taxonomy incorporates “future” components that point out the related idea as an estimate of a future recognition. If this kind of component exists within the taxonomy for a selected idea, the suitable remedy is to make use of a date context of the top of the reporting interval of the doc.

Picture Caption: 2015 US GAAP Taxonomy Future Components

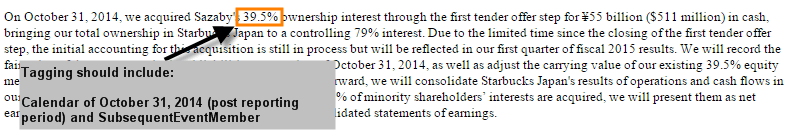

Date Error Instance 2: Subsequent Occasions

Naturally, most ideas in a 10-Q or 10-Ok shall be tagged with a calendar that’s previous to or equal to the doc’s interval finish date. It is because it’s the interval being reported, however subsequent occasions, by definition, happen after the top date of the reporting interval. Accordingly, they need to be tagged with the date on which the following occasion occurred. It’s important, nonetheless, to guarantee that the occasion can be particularly indicated as a subsequent occasion with SubsequentEventMember. Go to XBRL US for added steering on subsequent occasions.

Picture Caption: Starbucks Company 2014 10-Ok: Subsequent Occasions Be aware

Date Error Instance 3: Forecasts

Not each forecast in a monetary report may have an current future component within the US GAAP taxonomy. In some circumstances, a unique method have to be taken. Within the instance under, the 2 values in containers signify the deliberate variety of closures. As a result of nobody can present assurance of the long run, they’re forecast for the intervals indicated. On this case, it’s applicable to tag the values with the long run date indicated within the doc. Nonetheless, it’s additionally necessary to additional establish them with ScenarioForecastMember since they aren’t precise info which have occurred.

Picture Caption: Staples, Inc. 2014 10-Q for the interval ended November 1, 2014

How Certent Disclosure Administration Prevents XBRL Errors

In in the present day’s enterprise panorama, you will need to assessment your XBRL for correct use of future dates, destructive values, axis combos, and extra. Certent Disclosure Administration makes it straightforward to take corrective actions throughout all of those with its intuitive and unified interface. Incorporating checks for the commonest XBRL errors in your doc assessment course of will make sure the accuracy of your knowledge and improve the standard of your filings. Get a demo of Certent Disclosure Administration under to see the way it can enhance your XBRL tagging and reporting for 2026.