Has the bitcoin worth lastly damaged away from its four-year cycle sample, or is that this bull market already getting into exhaustion? By learning historic development charges, liquidity information, and macroeconomic correlations, we are able to higher perceive whether or not the present cycle has really diverged, and what which means for buyers within the months forward.

Bitcoin Worth Cycle Period

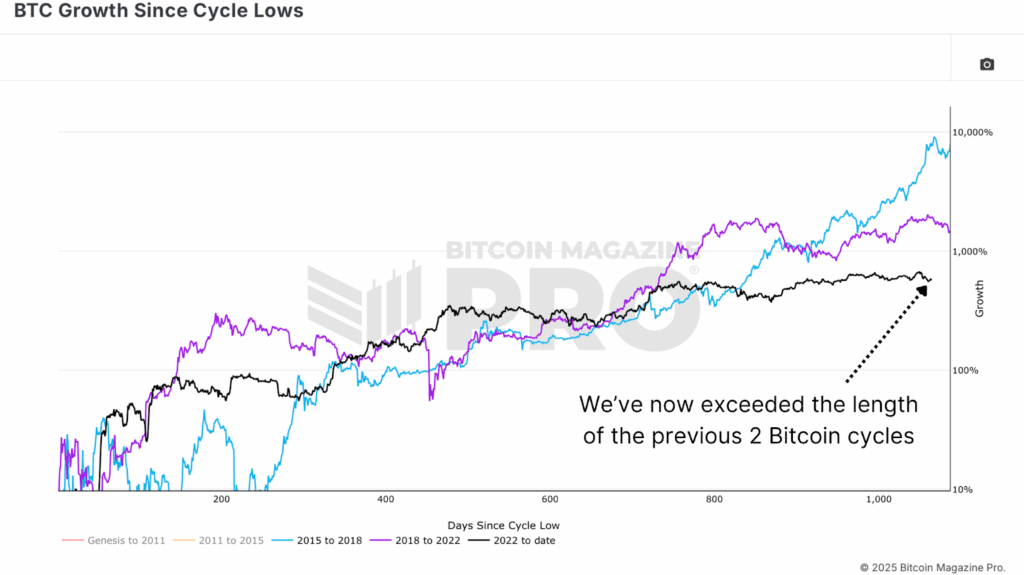

Analyzing BTC Progress Since Cycle Lows, we are able to see that Bitcoin has now formally surpassed the elapsed time from cycle low to cycle excessive seen in earlier bull markets. The 2018–2022 cycle peaked 1,059 days after its prior bear market low, and the present cycle has now moved past that period. If we common the elapsed time throughout the final two full market cycles, Bitcoin has already exceeded the historic imply and is on the verge of surpassing even the 2017 cycle size within the coming days.

Diminishing Influence on Bitcoin Worth

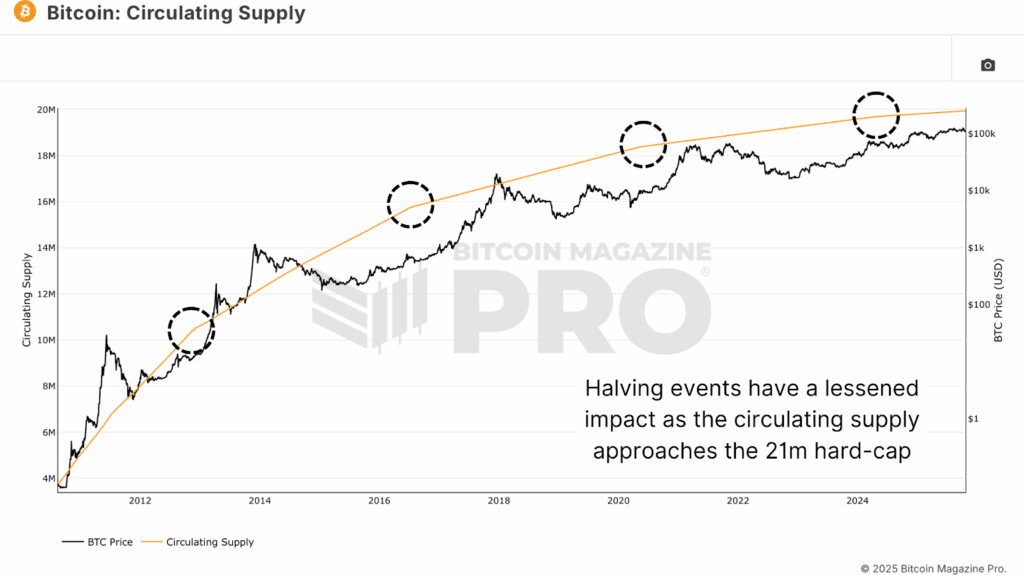

Traditionally, Bitcoin’s four-year cycle was rooted in its halving occasions, the place the block reward, and thus the inflation fee, was lower in half. Every halving triggered a pointy provide shock, driving main bull markets. Nonetheless, this cycle has behaved in a different way. Following the newest halving, Bitcoin skilled 5 months of sideways consolidation slightly than the explosive post-halving rallies seen beforehand. Whereas worth has since made notable positive factors, momentum has been weaker, main many to ask whether or not the halving has misplaced its affect.

With the present Circulating Provide already exceeding 95% of the 21 million final complete provide of Bitcoin, the marginal provide discount might not be as vital. At this time, miners distribute roughly 450 newly created BTC per day, an quantity simply absorbed by a handful of institutional consumers or ETFs. Meaning the halving alone might not be the dominant driver of Bitcoin’s market cycles.

World Liquidity Cycles Driving the Bitcoin Worth

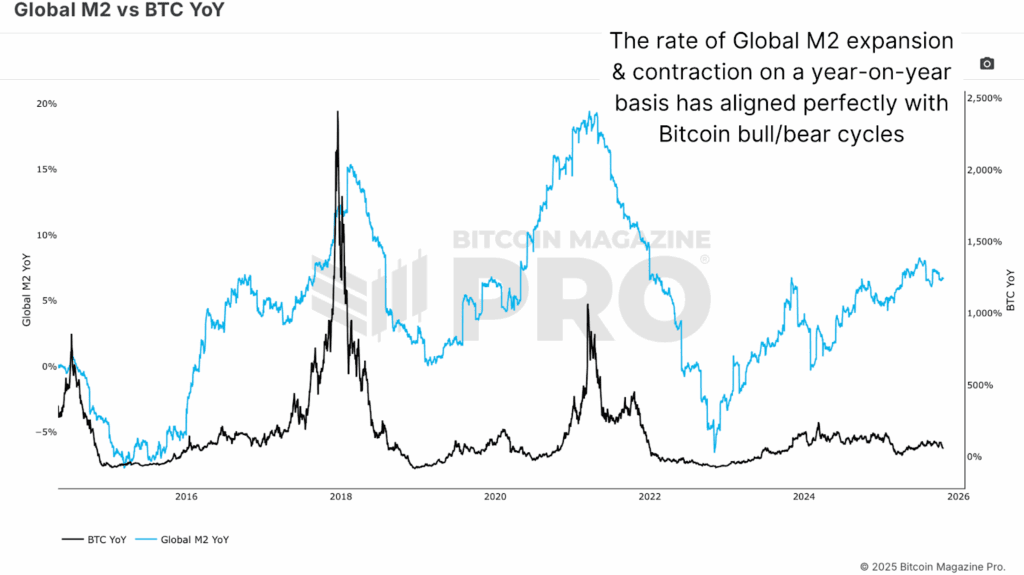

After we view World M2 Cash Provide versus BTC on a year-on-year foundation, a transparent sample emerges. Every main Bitcoin backside has aligned nearly completely with the trough of World M2 liquidity development.

If we map the Bitcoin halvings and the M2 troughs aspect by aspect, we see that halvings sometimes lag the liquidity cycle, suggesting that liquidity growth, not halving occasions, could be the true catalyst for Bitcoin’s rallies. This isn’t distinctive to Bitcoin. Gold has proven the identical habits for many years, with its worth efficiency intently mirroring the speed of World M2 growth or contraction.

Inverse Correlations Shaping Bitcoin Worth Traits

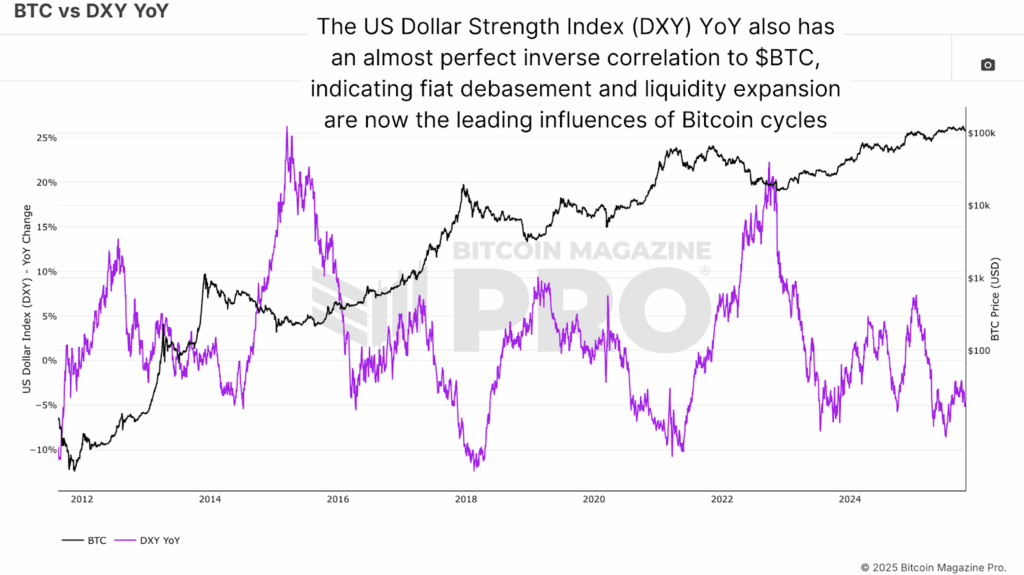

A key a part of this liquidity story lies within the U.S. Greenback Power Index (DXY). Traditionally, BTC versus DXY on a year-on-year foundation has been nearly completely inversely correlated. When the greenback strengthens year-on-year, Bitcoin tends to enter bear market circumstances. When the greenback weakens, Bitcoin begins a brand new bull market. This inverse relationship additionally holds true for Gold and fairness markets, underscoring the broader debasement cycle thesis that as fiat currencies lose buying energy, laborious belongings quickly respect.

Presently, the DXY has been in a short-term uptrend, coinciding with Bitcoin’s latest consolidation. Nonetheless, the index is now approaching a key historic resistance zone, one which has beforehand marked main turning factors and preceded extended DXY declines. If this sample holds, the subsequent main drop in greenback power may set off a renewed upcycle for Bitcoin.

Quantitative Tightening and the Bitcoin Worth

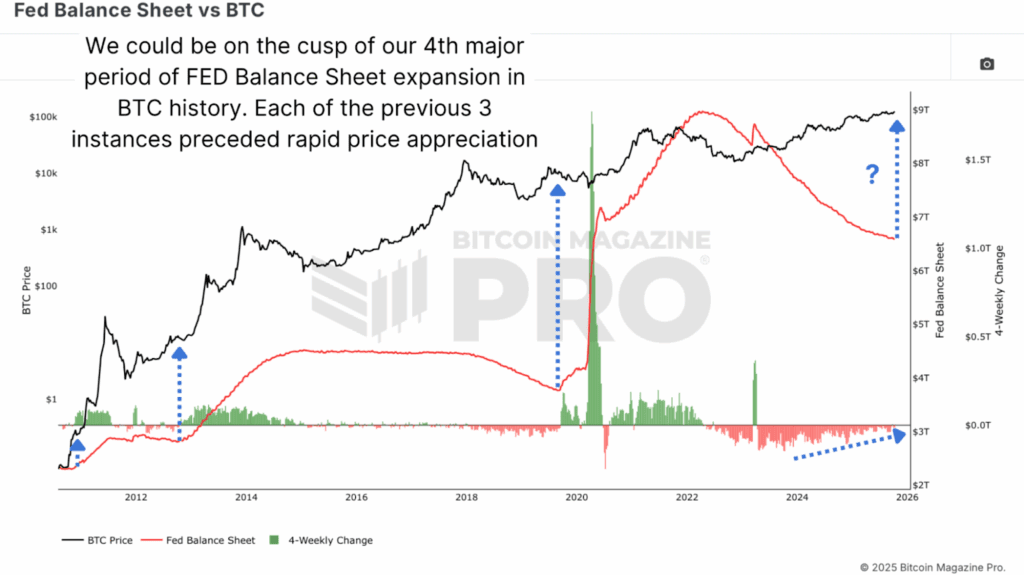

Feedback from Federal Reserve Chair Jerome Powell not too long ago hinted that the period of stability sheet contraction (quantitative tightening) could also be nearing an finish. Trying on the Fed Steadiness Sheet versus BTC, the beginning of stability sheet growth and renewed quantitative easing has traditionally coincided with main upward strikes in Bitcoin and fairness markets alike.

Throughout the two years following earlier Fed stability sheet expansions, the S&P 500 averaged a 47% return, greater than 5 occasions the common two-year efficiency throughout impartial intervals. If we’re certainly getting into a brand new easing part, it couldn’t solely delay Bitcoin’s present cycle but in addition set the stage for a liquidity-driven melt-up throughout danger belongings.

Conclusion: The Evolving Bitcoin Worth Cycle

Bitcoin has now outlasted the timeframes of its earlier two cycles, main many to query whether or not the four-year rhythm nonetheless applies. However after we step again, a distinct narrative emerges, one pushed not by programmed shortage, however by World liquidity, fiat debasement, and macro capital circulate. The “four-year cycle” might not be damaged, however it could have merely developed.

If the U.S. Greenback weakens, the Fed pauses tightening, and World M2 development accelerates, then Bitcoin possible nonetheless has room to run. For now, as at all times, the most effective method stays the identical: react, don’t predict. Keep data-driven, keep affected person, and maintain your eyes on liquidity.

For a extra in-depth look into this subject, watch our most up-to-date YouTube video right here: The place Are We In This Bitcoin Cycle

For deeper information, charts, {and professional} insights into bitcoin worth tendencies, go to BitcoinMagazinePro.com.

Subscribe to Bitcoin Journal Professional on YouTube for extra professional market insights and evaluation!

Disclaimer: This text is for informational functions solely and shouldn’t be thought of monetary recommendation. All the time do your personal analysis earlier than making any funding selections.