The Nationwide Audit Workplace issued a report yesterday on efforts being made by the Division of Work and Pensions (DWP) to deal with profit fraud, and the speed of errors being made in funds of what I name social safety.

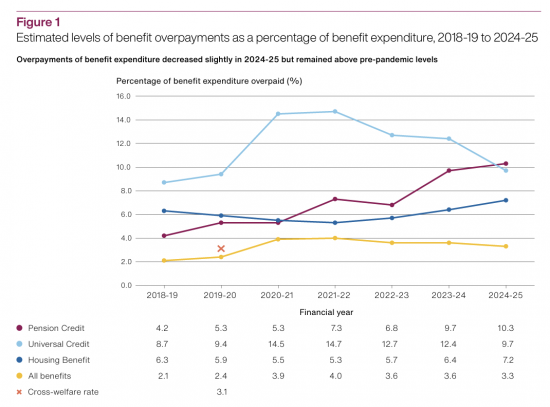

The DWP estimates that it overpaid 3.3% of profit expenditure in 2024-25 as proven in Determine 1, under. This equated to £9.5 billion of the £292.2 billion that it spent on advantages. Fraud accounted for an estimated £6.5 billion; claimant error, £1.9 billion; and official error, £1.0 billion.

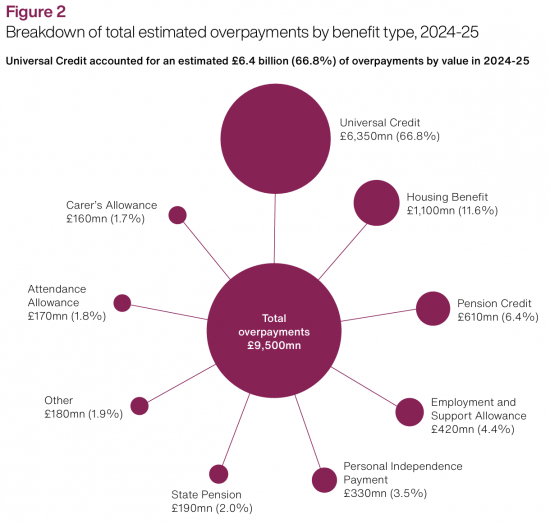

The unpaid determine is damaged down as follows:

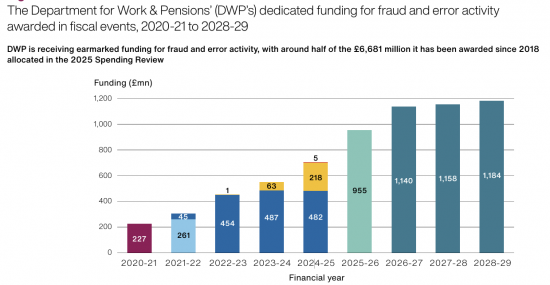

The DWP has, in response to the Nationwide Audit Workplace, been supplied with appreciable monetary assist to deal with this problem:

£6.7 billion has been supplied since 2018, with little general obvious affect. The estimated worth saved by the Division for Work & Pensions (DWP) via counter-fraud actions from April 2022 to March 2025 was £4.5 billion. The speed of return on sums expended is marginal.

What can also be very obvious is that the report is partial. It doesn’t present the unpaid advantages to which individuals had been entitled every year, that are not often the topic of political scrutiny however that are, in fact, a sign of a collection of coverage failures. These are estimated at £19 billion a yr, double the quantity misplaced. Think about the benefit to society if all such sums had been paid.

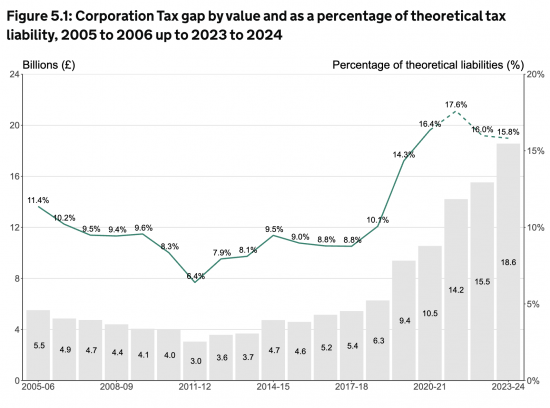

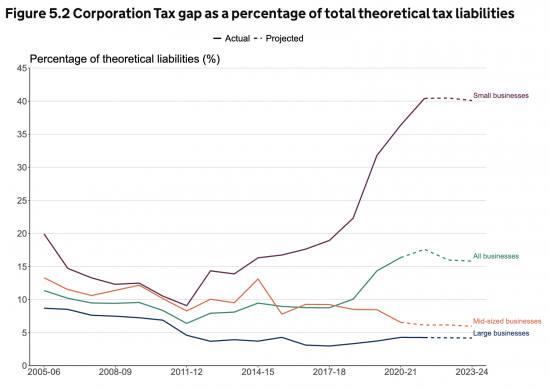

And now let me contextualise this. HM Income & Customs has estimated that the unpaid company tax within the UK quantities to fifteen.8% of all liabilities owing:

With regards to small corporations, the speed is round 40%:

The fee exceeds £18 billion a yr. And what’s being finished about it? Virtually nothing, regardless that placing essential legal guidelines in place to deal with this by requiring banks to offer knowledge to HMRC to establish corporations not paying after which eradicating restricted legal responsibility from the individuals managing the abuse could be straightforward.

So what’s the conclusion? It’s that we nonetheless have an obsession with attacking profit cheats and people who merely make harmless errors, who’ve little general affect on the economic system, and do not give a rattling about the truth that perhaps 40% of small companies are working illegally within the UK. That is what political hypocrisy, backed by class prejudice, now seems like in fashionable Britain, and the result’s horrible decision-making that harms the economic system and the well-being of huge numbers of people who find themselves deep in want and who’re all the time topic to suspicion when that’s inappropriate.

Taking additional motion

If you wish to write a letter to your MP on the problems raised on this weblog submit, there’s a ChatGPT immediate to help you in doing so, with full directions, right here.

One phrase of warning, although: please guarantee you’ve got the proper MP. ChatGPT can get it unsuitable.

Feedback

When commenting, please be aware of this weblog’s remark coverage, which is on the market right here. Contravening this coverage will lead to feedback being deleted earlier than or after preliminary publication on the editor’s sole discretion and with out clarification being required or supplied.

Thanks for studying this submit.

You possibly can share this submit on social media of your alternative by clicking these icons:

There are hyperlinks to this weblog’s glossary within the above submit that designate technical phrases utilized in it. Comply with them for extra explanations.

You possibly can subscribe to this weblog’s day by day e-mail right here.

And if you need to assist this weblog you’ll be able to, right here: