I’m now engaged on the final main part of the Taxing Wealth Report. This refers back to the administration of HMRC.

My focus was initially going to be on the dearth of funding equipped to HMRC, about which its administration will get somewhat excited as a result of they assume that proves their claims that they’ve improved the organisation’s productiveness. Nevertheless, the extra that I get into this challenge, the extra I realise that the questions that have to be requested are far more vital. Specifically, I’m very involved concerning the high quality of the information that HMRC makes accessible to allow us to appraise its efficiency and so resolve whether or not its funding is suitable.

I would talk about the issues that I’ve discovered with HMRC‘s accounts in one other put up. On this one, I wish to handle one among my long-standing bugbears, which is HMRC‘s information on the tax hole.

The tax hole is the distinction between the tax that HMRC assume needs to be collected in a tax 12 months, primarily based upon the laws then in existence, and the quantity of tax really paid in that 12 months. I’ve, for a few years, criticised HMRC information on this challenge and the methodologies that they’ve employed to estimate the tax hole, while additionally giving them due credit score for the truth that they’re the one main tax authority that does attempt to publish this info on an annual foundation.

My query at this second is simply how helpful that yearly revealed information actually is. That’s as a result of HMRC have a behavior of updating their estimates of tax gaps, repeatedly. The truth is, hardly a 12 months goes by with out HMRC revising the information that they’ve beforehand revealed on the tax hole for a selected 12 months.

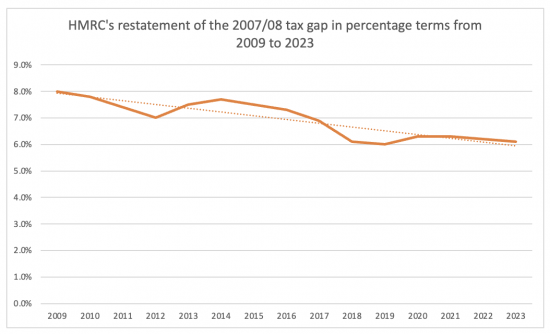

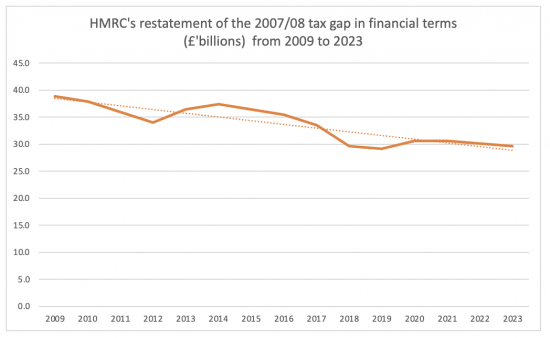

Take for instance the tax hole for the 12 months 2007/08, which is without doubt one of the earliest for which information is accessible. Info for that 12 months was first revealed within the 2009 tax hole report and was steered to be £38.8 billion. That was eight per cent of the whole tax owing for that 12 months. Since then, that estimate has been revised. That revision has not occurred a couple of times, which is probably the most that might ever actually occur with regard to business monetary accounting info earlier than critical questions concerning the underlying high quality of the accounting info of the reporting organisation arose and its auditors grew to become topic to intense scrutiny. It has, in actual fact occurred yearly since publication first place. Consequently, the proportion tax hole for the years query has been re-stated as follows:

I added a development line.

Expressed in monetary phrases, the tax hole for that 12 months has moved as follows:

The info supply is the Excel information publication that helps the 2023 tax hole from HMRC.

1.9% of the tax hole for 2007/08 has disappeared since 2009. The sum in query is £9.2 billion. That might be excellent news if I believed it was true. Truly, I believe it just because re-estimation has taken place.

Take into consideration this for a minute and replicate on how HMRC would react if a taxpayer went again to them yearly, saying that they wished to revise the estimates included of their accounts going again nicely over a decade. That could be tolerated as soon as, topic to a possible tax investigation except superb causes got. A number of restatements would, most definitely, give rise to the tax payer struggling a unprecedented diploma of scrutiny, which I believe it cheap to presume they’d not get pleasure from. Restating yearly could be totally unacceptable, however that might be notably true if, as on this case, the estimate was revised downwards from years 12 months, implying the whole total revenue annually rose in consequence, with successive tax underpayments arising in consequence. All hell would break unfastened if that had been to occur, and rightly so. So why do HMRC assume that they’ll get away with this?

My questions are easy. Firstly, why are HMC allowed to do that with out sufficiently highlighting what they’re doing on an ongoing foundation, which is to all the time (it appears) discover errors that swimsuit their administration’s agenda?

Why, secondly, are they allowed in consequence to current this headline information with out making it sufficiently clear that the comparisons that they’re make are usually not with the contemporaneous information of the durations to which they refer, however to some transferring goal that has been in existence ever since? I discover it annoying when monetary statements are restated, normally for one 12 months at more often than not, and normally for causes which are made very clear within the monetary statements, however the different factor what is going on with HMRC is that it is rather exhausting to elucidate why these successive restatements are occurring, and even have to be made. And for the document, I’ve learn the methodology notes.

If HMRC wish to present info that they need me to imagine, then I do actually assume that they need to be topic to the requirement that they impose on others, which is that we use our greatest effort to get info proper the primary time that they put together and submit it. They need to not benefit from the alternative that others do to not frequently restate it to swimsuit our personal agenda.

Is it an excessive amount of to ask that HMRC state their opinion after which follow it?