The query dominating crypto desks this week is whether or not the cycle is undamaged, and when the bull run will return. Two broadly adopted macro commentators sketched the identical causal chain from public-sector money administration to crypto asset beta, arguing that the present drawdown is a liquidity story first and a sentiment story second—and that its reversal hinges on the mechanics of the US Treasury Basic Account (TGA), Federal Reserve balance-sheet coverage, and the timing of Washington’s reopening.

Crypto Market Awaits US Authorities Shutdown Decision

Macro analyst @plur_daddy on X summarizes the present state bluntly: “We’re seeing the contraction in liquidity flowing by into threat markets. Naturally it first confirmed up in BTC and market internals inside equities, and now’s lastly hitting the broader indices.” He describes a textbook high quality rotation underway—speculative thematics “similar to quantum, nuclear, drones, and alt power have been getting destroyed,” whereas flows consolidate into the megacap cohort and earnings-backed momentum, notably the AI capex advanced.

The underlying plumbing, in his studying, is starved of financial institution reserves as money piles into the TGA and quantitative tightening (QT) continues to shrink the Fed’s steadiness sheet. “Financial liquidity is drawing down because the TGA has grow to be overfilled past the Treasury Dept’s $850bn cap, attributable to mechanical components round larger issuance, timing of particular funds, and the federal government shutdown. There’s a broader lack of financial institution reserves which continues to fall beneath the important thing $3trn threshold.” His conclusion is conditional however clear: these stresses “will precipitate actions to calm market plumbing however it would take time.”

Associated Studying

On the greenback and cross-asset threat, he factors to a vital degree: “The DXY has been rallying and is now approaching a key degree at 101, which might be a logical level for it to high. I proceed to consider the Trump administration needs a decrease greenback.” The trail to a crypto backside, in his cadence, is explicitly tied to coverage milestones: “The federal government reopening offers a transparent catalyst to mark the underside in liquidity situations. Then, we get QT unwinding Dec 1 after which doubtlessly extra Fed actions (similar to hints on payments repurchases) on Dec 10. The fiscal deficit will broaden considerably beginning Jan 1 because the OBBBA will absolutely kick in.”

He characterizes Bitcoin’s habits as resilient—“BTC has held in nicely regardless of large OG promoting, the aftermath of 10/10, and the components above”—and describes his personal playbook accordingly: “I presently have a large money place and plan to aggressively add equities (particularly the reminiscence commerce) and BTC as soon as the federal government reopening appears imminent.” Hours later he added, “Purchased some BTC. Seeing progress being made in direction of authorities reopening and indicators that liquidity headwinds have peaked. Danger/reward right here is powerful with sentiment bombed out.”

When The Liquidity Returns

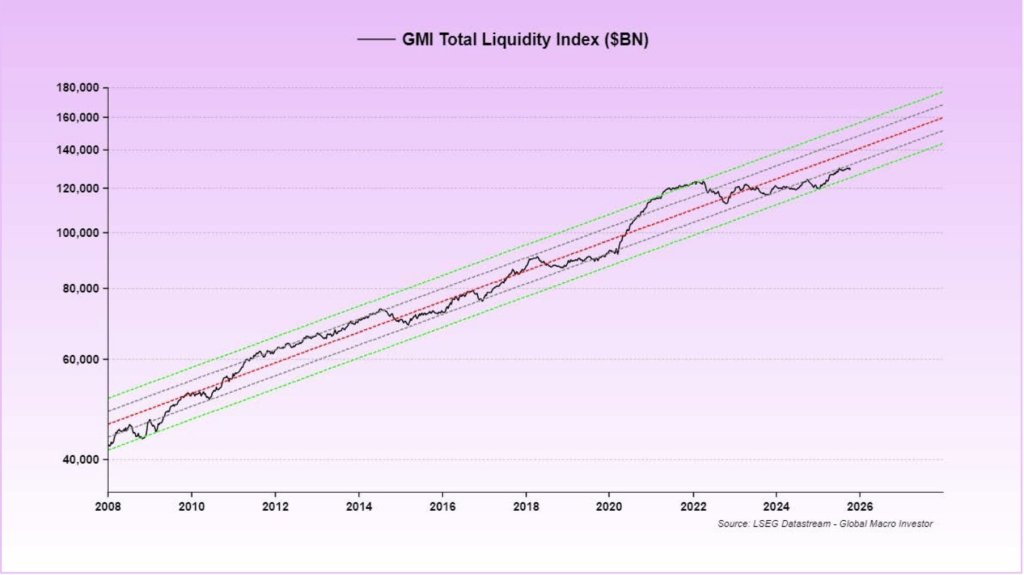

Raoul Pal, whose framework facilities virtually fully on the world liquidity cycle, pushes the identical thesis to its logical macro conclusion. “If world liquidity is the only most dominant macro issue then we MUST give attention to that,” he writes, earlier than distilling the subsequent 12 months of market construction right into a single constraint: “REMEMBER — THE ONLY GAME IN TOWN IS ROLLING $10TRN IN DEBT. EVERYTHING ELSE IS A SIDESHOW. THIS IS THE GAME OF THE NEXT 12 MONTHS.”

In Pal’s telling, the shutdown’s impact is instant and mechanical—“the gov shutdown has compelled a pointy tightening of liquidity because the TGA builds up with no the place to spend it. This isn’t offset by the power to empty the Reverse Repo (it’s drained). And QT drains it additional”—and crypto, because the highest-beta liquidity asset, takes the brunt.

The pivot, he argues, is likewise mechanical as soon as fiscal operations restart: “As quickly because the gov shutdown ends, the Treasury begins spending $250bn to $350bn in a few months. QT ends and the steadiness sheet technically expands. The Greenback will possible start to weaken once more as liquidity begins to circulation.”

Associated Studying

He layers on potential coverage and regulatory catalysts—“SLR modifications unencumber extra of the banks steadiness sheets permitting for credit score enlargement. The CLARITY Act will get handed, giving the crypto regs so desperately wanted for big scale adoption by banks, asset managers and companies total. The Massive Lovely Invoice then kicks in to goose the economic system into the midterms”—and frames the worldwide backdrop as additive, with China’s balance-sheet enlargement and Japan’s coverage combine supporting a broader threat rally.

His tactical recommendation is to simply accept bull-market volatility with out over-reacting: “All the time bear in mind the Dont Fuck This Up guidelines… and wait out the volatility. Drawdowns like this are frequent place in bull markets and their job is to check your religion. BTFD for those who can.” The punchline comes all the way down to a single indicator inside his dashboard: “td:dr — When this quantity goes up, all numbers go up.”

The through-line throughout each views is the primacy of greenback liquidity—particularly, the interplay of Treasury money balances, Fed asset purchases or run-off, and the obtainable inventory of financial institution reserves after the Reverse Repo Program has largely normalized. When the TGA rises with out offset, it capabilities as a suction pump on mixture reserves; when it falls because the Treasury spends, reserves rebuild, the marginal price of leverage eases, and high-beta belongings—crypto first—are likely to outperform.

The place does that depart the timing query implied by each purple candle on crypto Twitter? Neither supply provides a date, however each tether the subsequent leg larger to the identical sequence: a decision in Washington that flips the TGA from hoarding to spending, seen easing in reserve shortage as QT pauses or is unwound, a swerve decrease within the greenback from resistance, and renewed fiscal impulse that re-steepens the expansion impulse into 2026.

At press time, the whole crypto market cap stood at $3.38 trillion.

Featured picture created with DALL.E, chart from TradingView.com