Bitcoin (BTC), the biggest cryptocurrency out there, has seen its worth hover between $42,000 and $43,000, halting its restoration from the dip beneath $38,500.

With the upcoming halving occasion scheduled for April, market consultants and crypto analysts akin to Rekt Capital are observing historic patterns that counsel an attention-grabbing worth motion situation, probably igniting one other vital worth surge for Bitcoin.

Pre-Halving Rally For Bitcoin Imminent?

Rekt Capital, identified for its experience in analyzing market developments, highlights the importance of historic patterns about earlier halving occasions. These patterns reveal a constant pattern of considerable rallies main as much as the halving, adopted by a brief interval of correction and consolidation earlier than a serious bull run and peak.

In accordance to Rekt Capital, Bitcoin ought to start its Pre-Halving Rally as early as subsequent week if historical past signifies.

This rally, pushed by traders “shopping for the hype” in anticipation of the halving, goals to capitalize on the worth surge and notice earnings by “promoting the information.” Brief-term merchants and speculators typically exploit this hype-driven rally and promote their positions.

The following promoting stress contributes to a phenomenon often called the pre-halving retrace. This retrace sometimes happens a few weeks earlier than the precise halving occasion.

In earlier halving cycles, the pre-halving retrace reached depths of -38% in 2016 and -20% in 2020. It’s value noting that this part can final for a number of weeks, introducing uncertainty amongst traders concerning whether or not the halving will act as a bullish catalyst for Bitcoin’s worth.

General, the historic patterns noticed by Rekt Capital level to the potential of a pre-halving rally within the coming weeks, adopted by a correction interval often called the pre-halving retrace.

Whereas previous efficiency isn’t any assure of future outcomes, these historic developments present priceless steerage on how the worth of Bitcoin could carry out within the coming weeks and days earlier than the halving.

Lengthy-Time period Holder Help And ETF Shopping for Strain

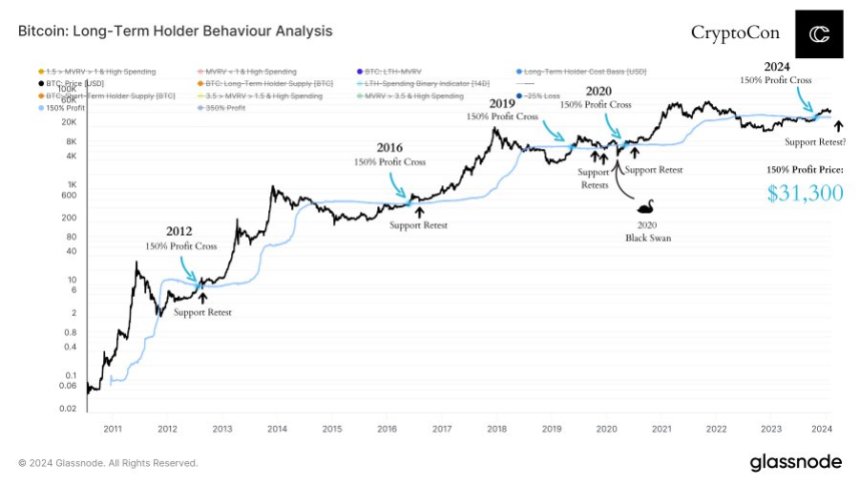

Regardless of anticipated short-term good points for BTC, Crypto Con has just lately drawn consideration to a historic pattern within the Bitcoin market. In accordance with Crypto Con, no Bitcoin cycle has ever escaped a retest of the 150% long-term holder help line.

In accordance to the analyst, this line has acted as an important stage of help throughout varied market cycles. Even through the unprecedented black swan occasion and subsequent restoration in 2020, the worth retested this line as help.

By analyzing this metric, Crypto Con means that based mostly on historic patterns, Bitcoin’s worth may have roughly $31,300 to retest the long-term holder help line.

The anticipated influence of ETF shopping for stress on Bitcoin’s worth is counterbalancing the argument for additional corrections. Introducing ETFs (Change-Traded Funds) into the cryptocurrency market is a comparatively new growth. As such, the results of ETF inflows on Bitcoin’s worth stay to be seen and are a topic of ongoing statement.

Whereas the potential retest of the long-term holder help line could create non permanent worth fluctuations, proponents of Bitcoin as an funding alternative view such a situation as a shopping for alternative.

Finally, Crypto Con believes that those that consider within the long-term prospects of Bitcoin could select to benefit from any worth dips ensuing from a retest of help.

BTC trades at $42,800, up a slight 0.4% previously 24 hours as of this writing.

Featured picture from Shutterstock, chart from TradingView.com

Disclaimer: The article is offered for academic functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your individual analysis earlier than making any funding selections. Use info offered on this web site fully at your individual danger.