Tax professionals are anticipating 1040 preparation turning into extra advanced subsequent yr. This is how one can keep prepared.

Highlights:

|

The One Huge Lovely Invoice Act (OBBBA) is poised to complicate this upcoming tax season. It comprises a number of modifications and consolidations of present tax provisions, creates new reporting necessities, and alters sure eligibility thresholds. Evidently, these sweeping adjustments have main implications for tax professionals and their shoppers in 2026.

Right here’s why a 10-15% improve in 1040 return complexity is projected for subsequent yr together with recommendation on how your agency can put together for it.

Soar to ↓

What are the most important tax adjustments underneath OBBBA?

Listed below are the parts of OBBBA that almost all immediately affect tax professionals and their shoppers.

Everlasting extension of TCJA provisions

- Normal deduction: The elevated customary deduction launched by the Tax Cuts and Jobs Act (TCJA) is now everlasting.

- Lowered tax charges: Particular person earnings tax fee reductions from the TCJA at the moment are solidified.

SALT cap changes

- Raised cap: The state and native tax (SALT) deduction cap will increase from $10,000 to $40,000 beginning in 2025.

- Expiration: The cap will revert to $10,000 in 2030.

- Annual development: The cap will obtain an annual 1% increase by means of 2029.

- Phaseouts: Begins phasing out for people with modified adjusted gross earnings (MAGI) over $500,000.

New particular person tax breaks

- Tip earnings deduction: As much as $25,000 in tip earnings is now deductible.

- Senior deduction: People 65 and older can deduct an extra $6,000, topic to phase-out.

- Time beyond regulation deduction: People can deduct as much as $12,500 ($25,000 for joint filers) of certified time beyond regulation compensation, topic to phase-out.

- Auto loan interest deduction: Taxpayers can deduct as much as $10,000 yearly in curiosity on new personal-use automobile loans (2025–2028), topic to income-based phaseouts

Compliance and complexity

As is clear on this abstract, tax professionals may have their work minimize out for them subsequent yr. Purchasers are prone to have a number of questions on new reporting necessities and will even miss particulars with out skilled steering. For instance, service and hospitality companies should begin monitoring and reporting ideas and time beyond regulation earnings. Such a change might require upgraded payroll techniques and coaching for workers.

Professionals may even have their very own wrinkles to type out, decoding the nuances of this new laws and making an attempt to decide the tax implications. Making certain that shoppers stay compliant and capable of reap new advantages would require further analysis, which in fact requires time.

General, these adjustments are anticipated to create a rise within the complexity of Kind 1040 filings. The added burden stems from the necessity to report new kinds of earnings and apply up to date eligibility standards. Consequently, tax preparation will demand extra time, precision, and help from professionals and their software program suppliers.

How automation simplifies 1040 engagements

The forecasted surge in 1040 complexity will come as grim information to many tax professionals. Busy season already pushes loads of practices to the brink of exhaustion. For them, this might imply further effort and time that nicely exceeds their capability. That’s why implementing professional-grade automation for this upcoming busy season is extra necessary than ever.

Right here’s a take a look at how our 1040 options streamline tax preparation so customers have extra bandwidth to navigate the surprising:

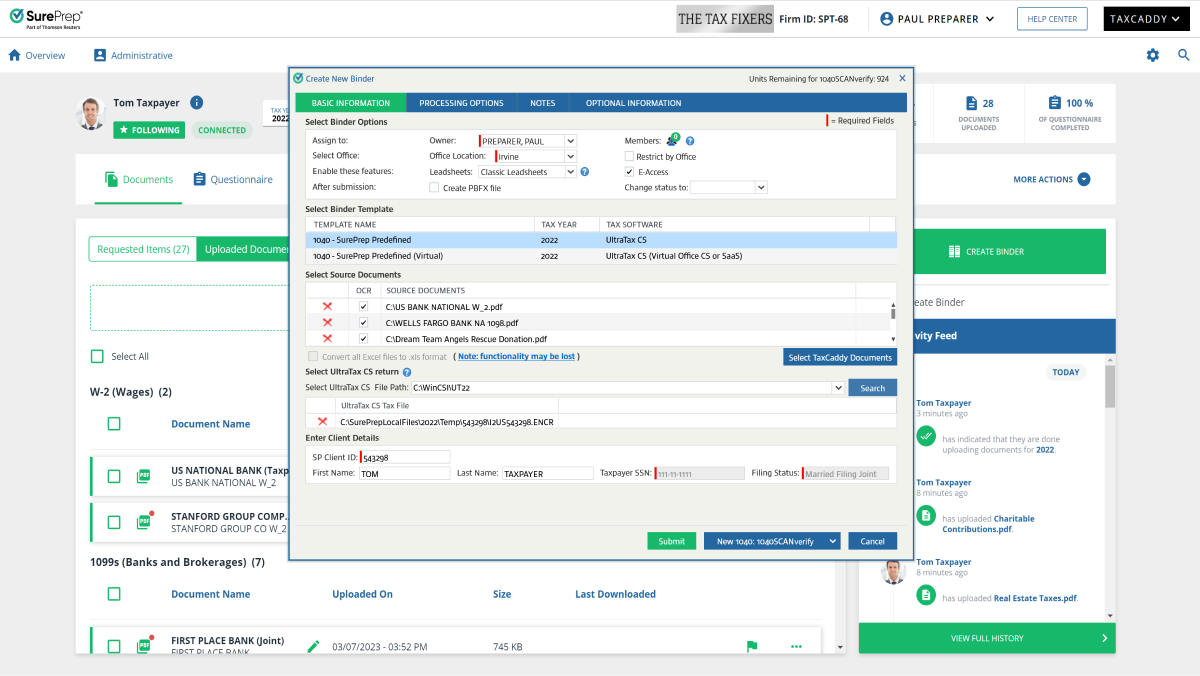

1040SCAN

What it does:

Scans OCR information and exports it to your tax software program, drastically lowering information entry necessities

What units it aside:

- Acknowledges 4–7x as many tax paperwork as various options

- Auto-verifies OCR information on 65% of ordinary paperwork

- Customers reported a 39% discount in preparation time in a 2021 research

SPbinder

What it does:

Organizes workpapers right into a standardized index tree that follows the circulation of the tax return

What units it aside:

- Equips preparers with tick marks, annotations, notes, and hyper-linked cross-references that work on all supported file varieties

- Reviewers can observe workpaper progress with change monitoring and as much as 4 sign-off ranges

- Customers reported a 29% discount in evaluation time in a 2021 research

SafeSend

What it does:

Gives a safe platform for communication and collaboration throughout doc gathering and tax return supply

What units it aside:

- Customers can trade e-signatures, customized questionnaires, tax paperwork, and invoices multi function place

- Sends automated reminders so workers don’t should chase down shoppers for paperwork and funds

Smarter analysis for a extra sophisticated panorama

Having the proper options in place can considerably scale back time spent on 1040 tax prep, however what’s your agency’s plan for navigating OBBBA subsequent tax season? With sure interpretations of the brand new laws nonetheless up within the air, professionals want easy steering they will belief.

CoCounsel Tax makes use of next-level agentic AI to supply easy solutions to advanced tax questions. In comparison with consumer-grade AI instruments that use a mix of dependable and unreliable sources throughout the online, CoCounsel Tax is skilled on Checkpoint content material verified by subject material consultants. The tip end result: Quicker, extra correct analysis that helps tax professionals navigate this still-evolving compliance panorama with confidence.

Why This autumn is one of the best time to organize

It’s not too late to equip your agency for the OBBBA subsequent tax season. Right here’s why This autumn may be an efficient window to implement new expertise:

Strategic timing benefits: This autumn offers the essential “calm earlier than the storm” — sufficient time for thorough testing, workers coaching, and workflow integration earlier than tax season stress begins.

Price range alignment: Tax practices historically plan their budgets for the upcoming yr throughout This autumn. Aligning your tech spend with annual finances cycles makes it simpler to display ROI metrics and justify the expenditures.

Stronger help: This autumn implementation provides corporations a adequate window to plan and troubleshoot whereas workloads are nonetheless comparatively mild. Distributors are additionally extra prone to have sufficient help availability in comparison with Q1.

Navigating OBBBA subsequent tax season

Whereas the OBBBA brings unprecedented complexity to the 2026 tax season, corporations geared up with professional-grade automation and AI-powered analysis instruments will navigate these adjustments with confidence. The appropriate expertise investments immediately rework potential chaos into aggressive benefit, guaranteeing your follow not solely survives however thrives throughout this important transition interval.

Try our OBBBA useful resource hub for insights, FAQs and a full govt abstract on the brand new laws.