XRP pulls again from intraday highs amid heavier buying and selling exercise, holding above key help ranges whereas lagging broader crypto benchmarks.

Information Background

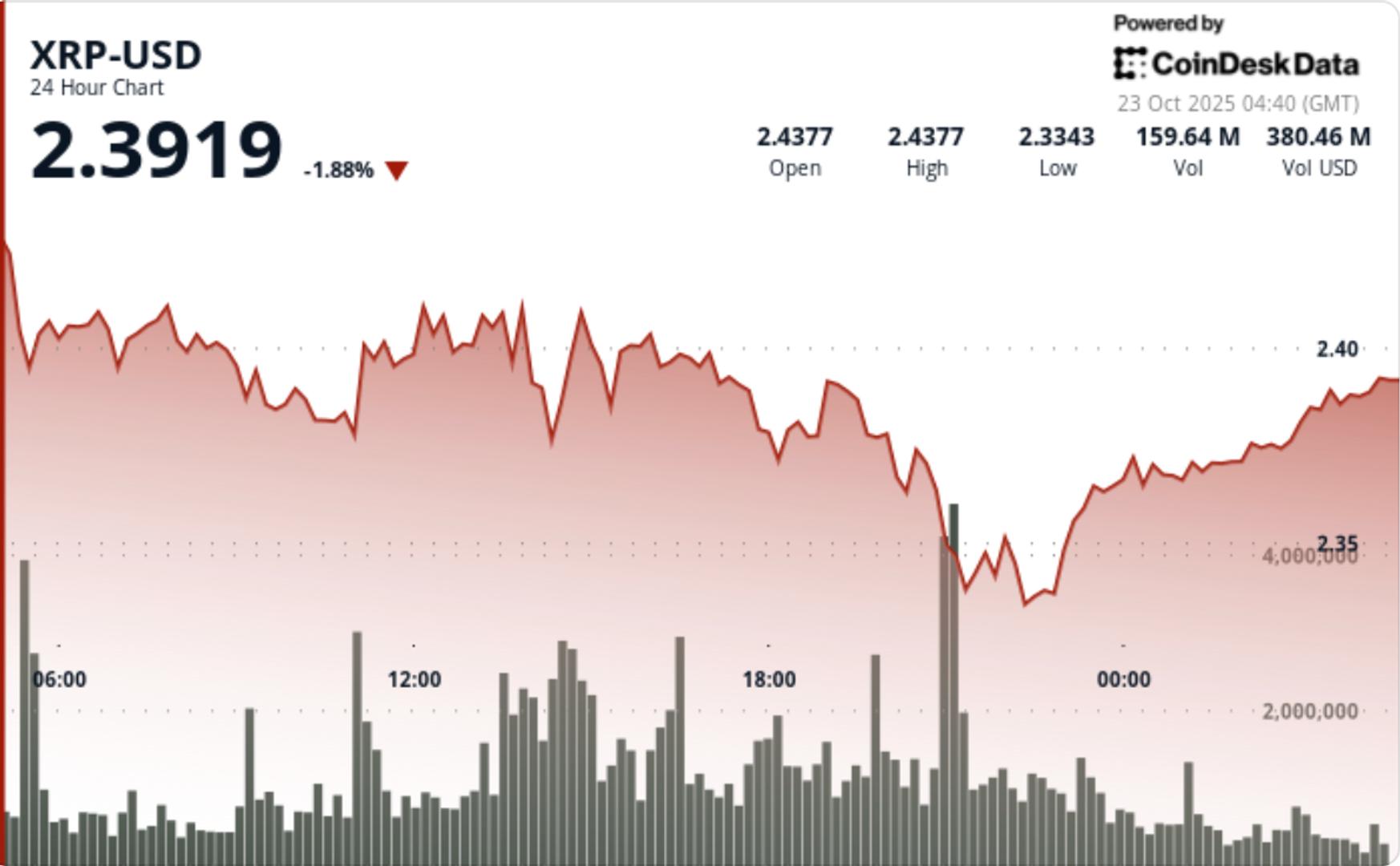

- XRP slipped 1.17% to $2.39 throughout Tuesday’s session, underperforming the CD5 index by 1.47 proportion factors as sellers regained short-term management.

- The transfer got here regardless of a 5.77% improve in buying and selling exercise above weekly averages, signaling tactical repositioning fairly than outright liquidation.

Value motion stayed contained throughout the $2.33–$2.44 hall, sustaining technical integrity whilst market flows shifted. - Merchants described the transfer as “order e book churn” — heavy rotation inside an outlined vary — with establishments recalibrating forward of potential catalysts.

Value Motion Abstract

- XRP declined from $2.44 to $2.39 by way of Tuesday’s session, carving a descending channel that outlined a 4.2% volatility vary.

- The steepest decline occurred round 21:00, when quantity surged to 111.3 million — 83% above the 24-hour common — as bears drove worth by way of $2.36 help to a session low of $2.33.

- Consumers reemerged across the psychological $2.33 stage, triggering a modest rebound to $2.39 on lighter quantity. Resistance firmed close to $2.41, with repeated rejections shaping a lower-high construction into the shut.

- The contained restoration suggests positioning fairly than directional conviction, with market makers managing stock amid low conviction flows.

Technical Evaluation

- XRP’s construction stays range-bound with a descending channel forming between $2.44 resistance and $2.33 help.

- The token’s incapability to interrupt above $2.41 displays short-term exhaustion, although persistent protection of $2.33 indicators sturdy bid depth.

- Momentum indicators hover close to impartial ranges, and quantity stays elevated sufficient to maintain curiosity however beneath breakout thresholds. Hourly information present XRP stabilizing above $2.38 midrange help whereas sustaining a narrowing volatility band — a typical pre-break compression setup.

What Merchants Are Watching

- Merchants are targeted on whether or not quantity reacceleration confirms continuation strain or precedes a imply reversion push above $2.41.

- A every day shut above that resistance may set off momentum extension towards $2.47–$2.50, whereas a sustained break beneath $2.33 dangers a return to the $2.28 zone.

- Institutional desks are additionally watching macro correlations — notably gold’s reversal decrease and bitcoin’s regular bid — to gauge rotation dynamics throughout danger property as volatility compresses.