Citi is a TPG promoting associate.

The Citi® / AAdvantage® Platinum Choose® World Elite Mastercard® is a stable possibility for American Airways vacationers on the lookout for their first checked bag free on home flights.

You possibly can spend towards Million Miler standing and construct up your AAdvantage mileage steadiness to your subsequent journey. Should you’re contemplating making use of for the Citi / AAdvantage Platinum Choose, it’s possible you’ll be unsure whether or not you have got a excessive sufficient credit score rating to be accredited. Here is what it’s best to know.

The knowledge for the Citi / AAdvantage Platinum Choose World Elite Mastercard has been collected independently by The Factors Man. The cardboard particulars on this web page haven’t been reviewed or supplied by the cardboard issuer.

What credit score rating qualifies for approval?

Citi does not publish particular credit score scores wanted to be accepted for its playing cards. In spite of everything, your credit score rating is only one of many issues issuers consider when deciding whether or not to approve a shopper for a card.

However you will usually want a good credit score rating of at the least 670 or larger to be accredited for a rewards bank card just like the Citi / AAdvantage Platinum Choose Mastercard. That stated, it is potential to get denied in case your rating is excessive, even when different features of your credit score portfolio could also be interesting to the issuer.

Associated studying: Why good credit score is essential to constructing your level wealth

What’s the Citi / AAdvantage Platinum Choose?

The Citi AAdvantage Platinum Choose is a cobranded American Airways bank card issued by Citi. This bank card can simply be well worth the $99 annual charge (waived for the primary yr) even when you solely fly American Airways domestically a couple of instances per yr.

It is because by merely having this card you and as much as 4 companions touring with you on the identical reservation get your first checked bag free on home American Airways itineraries.

Every day Publication

Reward your inbox with the TPG Every day publication

Be part of over 700,000 readers for breaking information, in-depth guides and unique offers from TPG’s consultants

You will additionally earn 2 miles per greenback spent at fuel stations, eating places and on eligible American Airways purchases.

Associated studying: Citi / AAdvantage Platinum Choose card assessment

What number of card accounts can I’ve open?

Citi seemingly does not restrict the general variety of bank cards you may have open. Nonetheless, Citi does appear to have a most credit score line that it’s prepared to increase throughout all your Citi playing cards.

So, you probably have at the least one different Citi bank card and aren’t accredited for a brand new card, it’s possible you’ll need to name Citi’s reconsideration line to see if shifting some credit score from one in every of your present playing cards will help you open the brand new card.

Associated studying: What number of bank cards do you have got?

Who’s eligible for a sign-up bonus?

You will not be eligible to earn a sign-up bonus on the Citi / AAdvantage Platinum Choose Mastercard when you’ve acquired a sign-up bonus for the cardboard inside the final 48 months. Particularly, the pricing and knowledge part on the appliance web page for this card notes:

American Airways AAdvantage® bonus miles should not obtainable you probably have acquired a brand new account bonus for a Citi® / AAdvantage® Platinum Choose® account up to now 48 months.

Associated studying: Incomes one other AAdvantage card sign-up bonus: What you should know

Tips on how to verify your credit score rating

There are various methods to verify your credit score rating without cost. For instance, many bank cards allow you to verify your FICO rating for gratis to you. It is a good suggestion to trace the development of your rating over time, particularly when you’re working to enhance your credit score rating.

But it surely’s necessary to comprehend that you do not have only one credit score rating. As an alternative, there are completely different calculation strategies, akin to FICO Rating and VantageScore, and completely different credit score reporting companies, akin to TransUnion and Experian.

Your credit score rating will range primarily based on the calculation methodology and credit score reporting company that’s used.

Associated studying: 6 issues to do to enhance your credit score

Components that have an effect on your credit score rating

As soon as you understand your credit score rating vary, it’s possible you’ll surprise what elements have an effect on your credit score rating. There are a couple of formulation for calculating your credit score rating, however not one of the precise calculations are public.

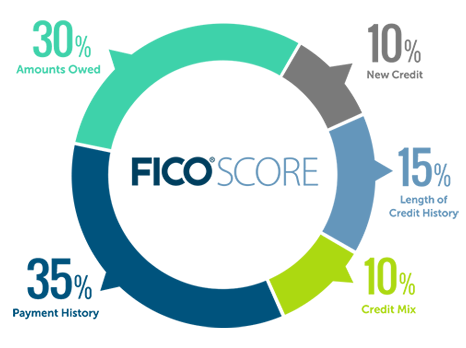

This being stated, FICO is comparatively clear concerning the various factors they assess and the way a lot weight every is given:

- Fee historical past (35%): Whether or not you have paid previous credit score accounts on time.

- Quantities owed (30%): The relative measurement of your present debt and the ratio of your present debt to your obtainable credit score.

- Size of credit score historical past (15%): How lengthy your credit score accounts have been established (together with the age of your oldest account, the age of your latest account and the common age of all of your accounts), how lengthy sure credit score accounts have been established and the way lengthy it has been because you used sure accounts.

- New credit score (10%): The variety of accounts you have opened just lately.

- Credit score combine (10%): The variety of several types of credit score accounts you have got. This contains bank cards, retail accounts, installment loans, finance firm accounts and mortgage loans.

What to do when you get rejected

In case your utility is rejected, you will get a letter within the mail that states why Citi turned down your utility. Relying on the explanations given for the rejection, it’s possible you’ll need to use this data to enhance your credit score rating earlier than making use of once more.

Or, when you imagine you may present further data that may result in approval of your utility, you may name Citi’s reconsideration line at 1-800-695-5171 and make your case.

You will need to clarify that you just just lately utilized for the Citi / AAdvantage Platinum Choose World Elite Mastercard, had been shocked to see that your utility was rejected and ask to talk to somebody about getting that call reconsidered.

As soon as the agent pulls up your utility, be ready to current a compelling argument for why Citi ought to approve your utility.

Associated studying: How unhealthy is it to get denied for a bank card?

How lengthy to attend earlier than making use of once more

It is best to keep away from making use of once more for a Citi card till you have addressed the explanations Citi gave for rejecting you. However, if you wish to apply once more or apply for a special Citi card, the consensus is you can solely apply for one Citi card (private or enterprise) each eight days and not more than two playing cards in a 65-day window.

Associated studying: The last word information to bank card utility restrictions

Do you get lounge entry?

No, you don’t get lounge entry as a cardholder of the Citi / AAdvantage Platinum Choose Mastercard.

Should you’re on the lookout for Admirals Membership entry when flying American Airways, it’s best to take into account the $595 annual charge Citi® / AAdvantage® Govt World Elite Mastercard® (see charges and costs).

This card gives full membership entry privileges to Admirals Membership lounges for the first cardholder.

Associated studying: Finest bank cards for airport lounge entry

Do you get a free checked bag?

As a cardholder of the Citi AAdvantage Platinum Choose, you and as much as 4 companions touring with you on the identical reservation will every get a primary checked bag free on home itineraries which can be marketed by American Airways and operated by American Airways or American Eagle.

To benefit from this profit, your bank card account should be open at the least seven days earlier than journey and the reservation should embody the first bank card member’s American Airways AAdvantage quantity at the least seven days earlier than journey. Obese and oversize charges nonetheless apply.

Associated studying: Tips on how to keep away from checked baggage charges on main home airways

Backside line

There is not any single finest bank card for American Airways flyers. As an alternative, the finest card for you will depend on what you are on the lookout for in a card. The Citi / AAdvantage Platinum Choose and AAdvantage Aviator Pink are each good choices for American Airways vacationers who fly with the airline steadily sufficient to get at the least $99 of worth from the cardboard’s checked bag allowance on home American Airways itineraries.

These playing cards have completely different incomes charges and advantages, so that you simply should resolve which card’s advantages you like.

*The Factors Man credit score ranges are derived from FICO® Rating 8, which is one in every of many several types of credit score scores. Should you apply for a bank card, the lender might use a special credit score rating when contemplating your utility for credit score.