Aster (ASTER) has seen heightened volatility in latest classes as broader market promoting stress weighs on altcoins and investor sentiment stays fragile. But within the midst of this downturn, the token drew sudden consideration when Changpeng Zhao (CZ) — Binance’s former CEO — posted on X that he personally purchased ASTER utilizing his personal funds instantly on Binance. The remark instantly sparked debate throughout the crypto neighborhood, with some viewing it as a confidence sign and others treating it with warning given present market situations.

Associated Studying

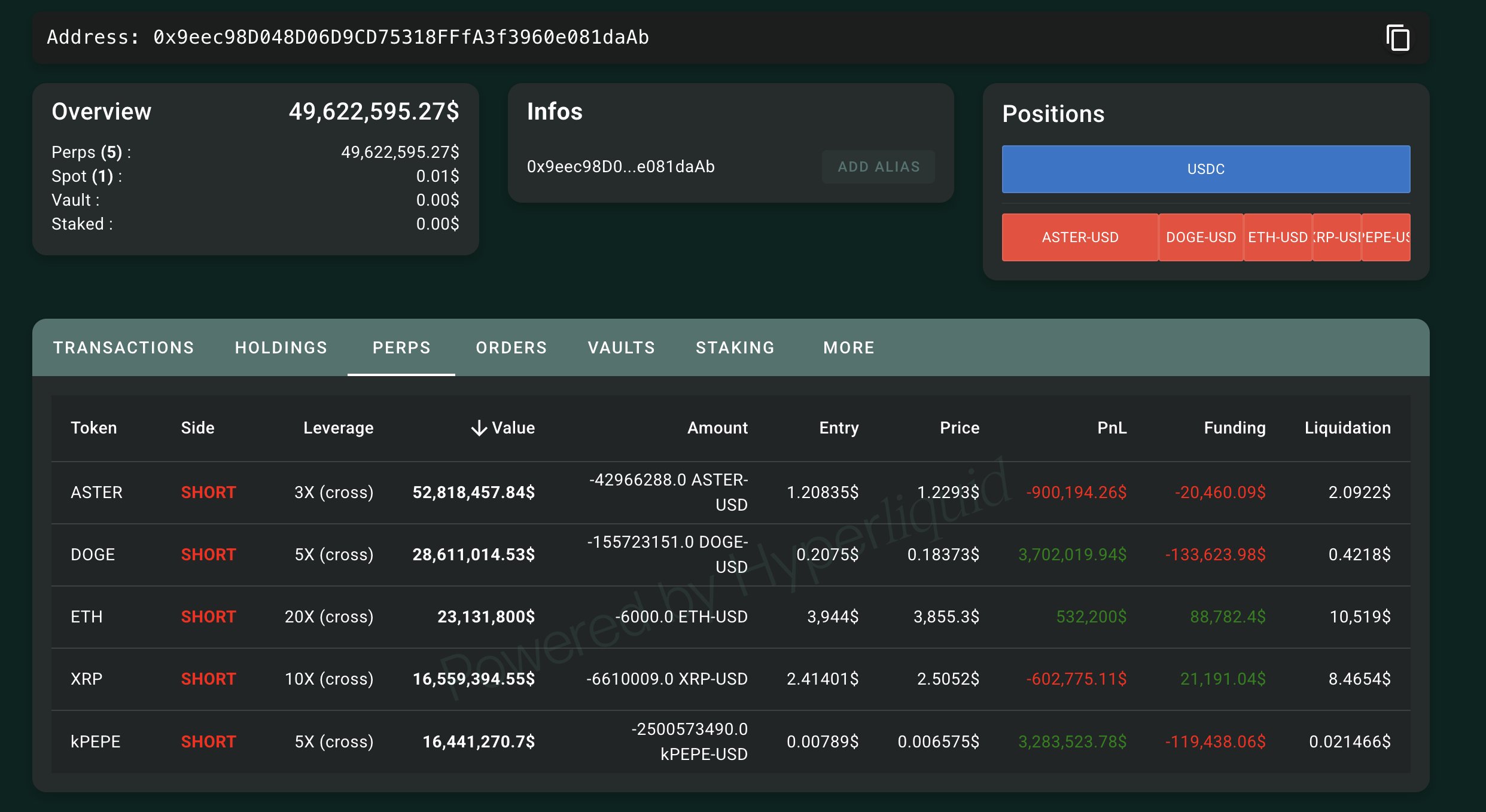

Nonetheless, not all main merchants share the bullish view. Shortly after CZ’s submit, notable on-chain whale 0x9eec elevated a bearish positioning, including considerably to an already giant ASTER quick place. This divergence between a high-profile purchaser and a whale doubling down on shorts has injected additional uncertainty into the market narrative surrounding ASTER.

Value motion stays uneven as merchants weigh institutional conduct, neighborhood affect, and market construction. With sentiment cut up and volatility rising, ASTER finds itself on the middle of a tug-of-war between speculative confidence and defensive positioning — a dynamic that might outline its near-term trajectory.

Whale Bets Towards Aster Regardless of CZ’s Public Help

Aster finds itself on the middle of an uncommon market disconnect, the place public sentiment and whale exercise are pulling in reverse instructions. In keeping with Lookonchain information, shortly after CZ publicly acknowledged that he purchased ASTER together with his personal funds, an influential on-chain dealer took the alternative stance. Pockets 0x9eec, a whale recognized for big directional performs, has been aggressively growing his ASTER quick publicity, signaling skepticism concerning the token’s near-term efficiency.

The tackle now holds 42.97 million ASTER in shorts, at present valued at roughly $52.8 million, with a liquidation worth set at $2.091. It is a important place that clearly displays conviction — and raises questions throughout the market. Whereas CZ’s remark boosted visibility and briefly stirred bullish chatter, this whale’s response seems to embody skilled skepticism, positioning for draw back reasonably than momentum continuation.

This divergence between symbolic insider confidence and quant-driven bearish positioning highlights a broader dynamic within the present market. Retail contributors typically react shortly to influencer commentary, whereas giant merchants lean on order stream, funding dynamics, and liquidity construction. With Aster buying and selling in a unstable surroundings and crypto markets below macro stress, whales seem extra targeted on danger administration and worth construction than narrative.

The truth that such a big quick exists, and continues to develop, means that refined gamers anticipate both additional correction or a liquidity occasion earlier than a sustainable upside transfer. For merchants, the important thing shall be watching whether or not ASTER approaches the whale’s liquidation zone — a stage that might create violent short-covering if reclaimed — or whether or not the market continues to comply with the whale’s thesis and slides decrease.

Associated Studying

ASTER Downtrend Intact Beneath Key Transferring Averages

Aster’s worth motion on the 4-hour chart exhibits continued weak spot regardless of a quick volatility spike triggered by CZ’s announcement. The token stays in a transparent downtrend, persistently buying and selling under the 50-day and 200-day shifting averages, signaling that bearish momentum nonetheless dominates. The sharp bounce towards $1.25 shortly light, with sellers stepping in nearly instantly and pushing the value again towards the $1.00 zone. This response means that the rally was pushed extra by short-term sentiment following CZ’s point out than by sustained demand.

The failed breakout try additionally highlights how fragile confidence is within the present market surroundings. The shifting averages are sloping downward, reinforcing a bearish construction, and worth has but to reclaim key resistance ranges round $1.20–$1.30, which might be required to sign any significant development reversal. Quantity spiked throughout the latest transfer, indicating aggressive positioning — possible tied to quick buildup from whales, as seen in on-chain information.

Associated Studying

Proper now, the $0.95–$1.00 vary seems to be appearing as rapid assist, but when promoting persists, a deeper retracement towards prior liquidity zones can’t be dominated out. For bulls to regain management, Aster should reclaim the 50-day MA and maintain above it with sustained quantity. Till then, warning stays warranted, as worth construction favors sellers and broader market sentiment stays fragile.

Featured picture from ChatGPT, chart from TradingView.com