Internet wealth taxes are recurrent taxes on a person’s wealth, internet of debt. The idea of a internet wealth taxA wealth tax is imposed on a person’s internet wealth, or the market worth of their whole owned property minus liabilities. A wealth tax could be narrowly or broadly outlined, and relying on the definition of wealth, the base for a wealth tax can differ.

is just like an actual property taxA property tax is primarily levied on immovable property like land and buildings, in addition to on tangible private property that’s movable, like autos and tools. Property taxes are the one largest supply of state and native income within the U.S. and assist fund faculties, roads, police, and different companies.

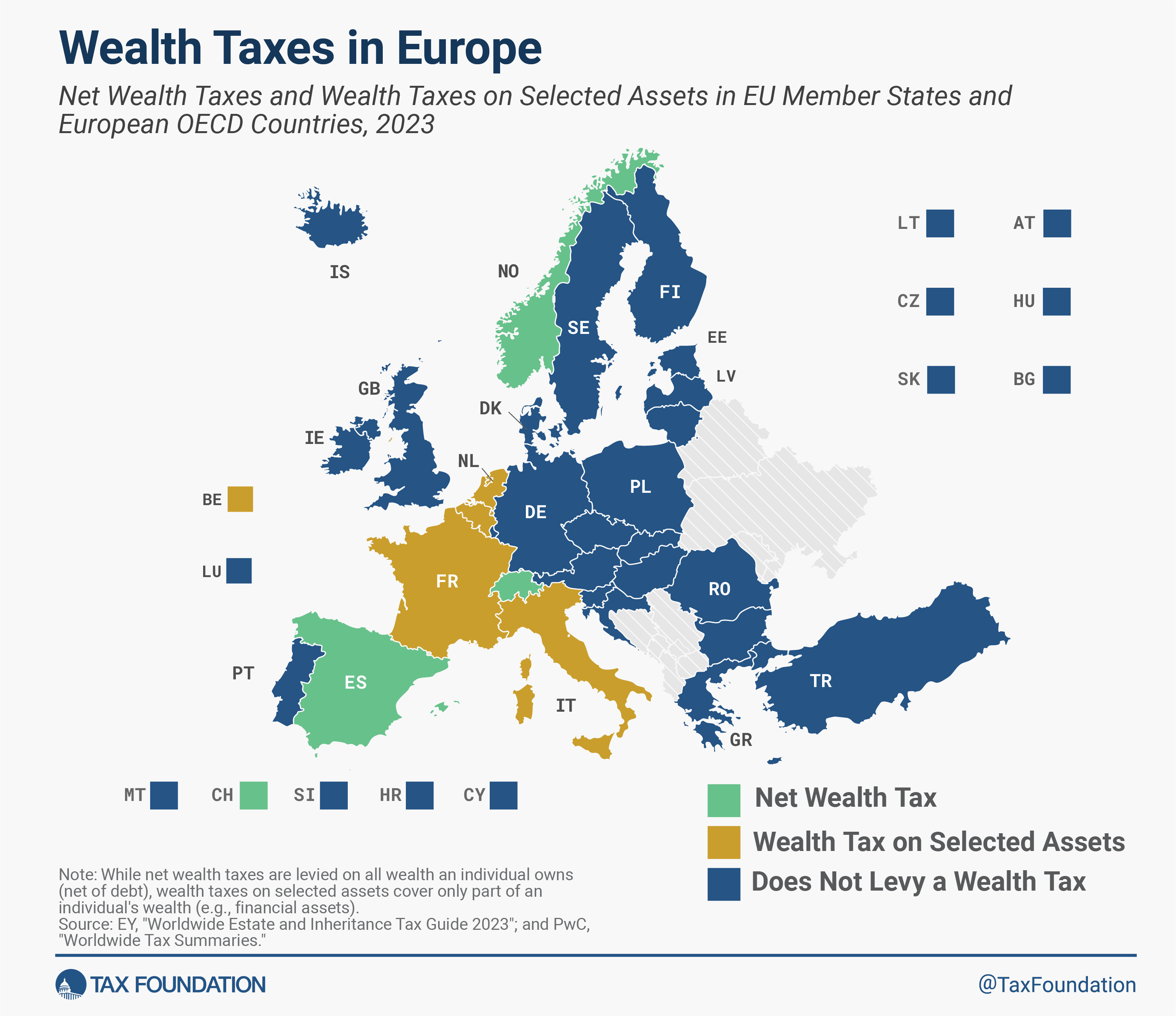

. However as a substitute of solely taxing actual property, it covers all wealth a person owns. As right now’s map exhibits, solely three international locations levy internet wealth taxes in Europe—Norway, Spain, and Switzerland. France and Italy levy wealth taxes on chosen property however not on a person’s internet wealth per se.

Internet Wealth Taxes in Europe

Norway levies a internet wealth taxA tax is a compulsory fee or cost collected by native, state, and nationwide governments from people or companies to cowl the prices of common authorities companies, items, and actions.

of 1 p.c on people’ wealth shares exceeding NOK 1.7 million (EUR 150,000 or USD 160,000), with 0.7 p.c going to municipalities and 0.3 p.c to the central authorities. Norway’s internet wealth tax dates to 1892. Moreover, for internet wealth exceeding NOK 20 million (USD 1.94 million), the tax price is 1.1 p.c.

Spain’s internet wealth tax is a progressive taxA progressive tax is one the place the common tax burden will increase with revenue. Excessive-income households pay a disproportionate share of the tax burden, whereas low- and middle-income taxpayers shoulder a comparatively small tax burden.

starting from 0.16 p.c (in Navarra) to three.5 p.c on wealth shares above EUR 700,000 (USD 757,850; decrease in some areas), with charges various considerably throughout Spain’s autonomous areas (Madrid, Andalusia, Cantabria, and Extremadura provide a 100% reduction). Spanish residents are topic to the tax on a worldwide foundation whereas nonresidents pay the tax solely on property positioned in Spain.

Moreover, the Spanish central authorities launched a “solidarity wealth tax” in 2022 and 2023 (to be collected in 2023 and 2024) starting from 1.7 p.c to three.5 p.c on people with internet property exceeding EUR 3 million (USD 3.25 million). Underneath this new tax scheme, the central authorities collects any extra income from the solidarity tax as soon as the regional wealth tax assortment is deducted. Three regional governments of Madrid, Andalusia, and Galicia appealed the solidarity wealth tax to the Constitutional Court docket. When the courtroom dominated in December 2023 that the solidarity wealth tax is constitutional (regardless of what consultants argued), the Spanish central authorities prolonged the solidarity tax’s utility till the regional financing system is reformed. Consequently, Madrid, Cantabria, Extremadura, and Andalusia restored the wealth tax in order that the regional governments retain the revenues the central authorities plans to gather in 2024.

In the meantime, Portugal’s choice to lengthen its tax regime for nonresidents is well timed, since extra Spanish taxpayers are contemplating altering their tax residence.

Switzerland levies its internet wealth tax on the cantonal stage and covers worldwide property (besides actual property and everlasting institutions positioned overseas). The tax charges and allowances differ considerably throughout cantons. The Swiss internet wealth tax was first carried out in 1840.

Wealth Taxes on Chosen Property

France abolished its internet wealth tax in 2018 and changed it that 12 months with an actual property wealth tax. French tax residents whose internet worldwide actual property property are valued at or above EUR 1.3 million (USD 1.41 million) are topic to the tax, in addition to non-French tax residents whose internet actual property property positioned in France are valued at or above EUR 1.3 million. Relying on the web worth of the true property property, the tax price ranges as a lot as 1.5 p.c.

Italy taxes monetary property held overseas with out Italian intermediaries by particular person resident taxpayers at 0.2 p.c and 0.4 p.c for property held in sure international locations. As well as, actual property properties held overseas by Italian tax residents are taxed at 1.06 p.c in 2024, up from 0.76 p.c in 2023.

Since 2021, Belgium has had a solidarity tax or tax on securities accounts (TSA) of 0.15 p.c on securities accounts with a mean worth of EUR 1 million (USD 1.08 million).

Within the Netherlands, the worth of internet wealth, excluding major residence and substantial pursuits in corporations, is included within the revenue tax. However, the Dutch Supreme Court docket dominated in 2021 that this technique violates European regulation relating to property rights and non-discrimination. In 2022, a brand new short-term various system for the years 2023, 2024, and 2025 was proposed the place every asset class (e.g., financial savings, money owed, and others) would have its personal deemed return. For 2024, the weighted common yield over all classes will likely be utilized to the whole property above a private exemption of EUR 57,000 (USD 61,697) to find out the taxable profit that will likely be topic to tax at a flat price of 36 p.c. The federal government is aiming to have a brand new system based mostly on precise returns by 2026.

Wealth taxes not solely gather little income and create authorized uncertainty, however an OECD report argues that they’ll additionally disincentivize entrepreneurship, harming innovation and impacting long-term progress. As an alternative of reforming and climbing wealth taxes in Europe, international locations ought to repeal it.

Discover Wealth Taxes by Nation

Keep knowledgeable on the tax insurance policies impacting you.

Subscribe to get insights from our trusted consultants delivered straight to your inbox.

Share