Rising applied sciences are important for wealth administration corporations as economies confronted a dampened funding setting in 2023, with disappointing fairness returns and sky-high rates of interest. Because of this, wealth preservation grew to become essentially the most essential objective for high-net-worth particular person (HNWI) traders final yr. So, how will this form the wealth administration developments in Asia in 2024

Count on a renewed deal with rising applied sciences, secure returns, and newer buyer segments for wealth administration corporations.

Wanting again at 2023

Final yr, Capgemini’s Wealth Administration High Tendencies 2023 anticipated that wealth administration corporations would increase their digital capabilities and choices to incorporate digital belongings; this development performed out as corporations pursued speedy digital enlargement.

The report additionally highlighted corporations increasing asset lessons, with forays into ESG-focused belongings, as bettering ESG metrics grew to become a key precedence.

The report additionally foretold the rising significance of an increasing buyer base for wealth administration corporations, with the prosperous wealth band turning into a key focus in 2023.

It additionally anticipated the necessity for enhanced digital device adoption for wealth advisors, and Capgemini’s World Wealth Report 2023 confirmed 55 % of HNWIs reported that their expertise in digital channels is a important issue for choosing a wealth administration agency.

The rise of the prosperous section

In 2023, the prosperous wealth section, comprising people with investable belongings between US$250,000 and US$1 million, emerged as a important focus space for wealth administration corporations.

Capgemini’s World Wealth Report 2023 highlighted the section’s substantial market dimension, controlling practically US$27 trillion in wealth. Nonetheless, profitability and repair providing challenges have restricted the section’s potential development.

In the meantime, within the Asia Pacific area, the wealth administration sector is experiencing a unprecedented growth. Property beneath administration are on monitor to balloon from US$18.50 trillion in 2023 to US$33 trillion by 2028.

This development trajectory interprets to a strong compound annual development price (CAGR) of 12.27 % all through the forecast interval, as detailed in a latest analysis report.

In Southeast Asia, corporations like Apex Non-public Wealth Administration and Fargo Wealth Administration in Singapore are evolving to satisfy altering calls for. Apex gives a variety of monetary companies, from retirement and funding planning to insurance coverage, addressing its shoppers’ diversified wants.

Fargo, a digital-first multi-family workplace, delivers in depth wealth administration options, together with asset allocation, danger administration, and wealth planning, with a specific deal with China and the Asia-Pacific. These modifications signify a broader trade transfer in the direction of digitalisation and bespoke companies in wealth administration.

In 2024, wealth administration corporations are anticipated to leverage personalisation methods to draw prosperous traders and increase their consumer base.

The prosperous section’s demand for digital-only, cost-effective companies is prompting corporations like UBS and Merrill Wealth Administration to introduce modern platforms and companies catering to this demographic.

Because the prosperous inhabitants and investable earnings develop, competitors amongst banks, wealth administration corporations, and WealthTechs will intensify, specializing in consumer relevance and lifecycle stage-specific gives.

The return of fixed-income investing

Within the wake of rising rates of interest and unsure fairness returns, fixed-income investing is making a comeback as a secure and worthwhile automobile for wealth development and stability.

The bond markets skilled a major rebound in 2023, and wealth managers are more and more specializing in fixed-income devices to hedge dangers and develop their shoppers’ wealth.

The development in the direction of fixed-income investing is pushed by evolving buyer calls for for wealth preservation and lower-risk funding avenues. Companies like Schwab Asset Administration and BlackRock have launched new fixed-income merchandise, acknowledging the rising curiosity on this asset class.

Within the context of Southeast Asia, Syfe, a digital wealth supervisor based mostly in Singapore, has partnered with Pimco, a longtime funding administration agency, to introduce two fixed-income merchandise.

These merchandise, a part of the Syfe Earnings+ collection, are designed to cater to traders’ preferences for secure and probably worthwhile funding avenues, that includes actively managed funds from Pimco’s portfolio.

In 2024, fixed-income markets are anticipated to be enticing additions to funding portfolios, offering a buffer towards volatility and producing reliable returns.

Generative AI enhancing consumer engagement.

Generative AI is revolutionising consumer engagement in wealth administration by producing insightful, personalised content material. This expertise allows wealth managers to know consumer wants higher, optimise funding methods, and ship greater worth.

The marketplace for generative AI in wealth administration is poised for important enlargement, with a projected worth of roughly US$ 2.5 trillion by 2032.

Main wealth administration corporations embrace generative AI to enhance companies, with corporations like Vanguard, JP Morgan Chase, and Morgan Stanley launching AI-driven platforms and bots.

As an illustration, HSBC International Non-public Banking shoppers in Asia are offered with an funding alternative within the type of a structured product that’s tied to the financial institution’s AiGO8 index (Synthetic Intelligence Powered International Alternatives), a multi-asset index pushed by AI.

This explicit providing is a product of a collaborative effort with EquBot, a San Francisco-based funding advisory agency.

Generative AI holds immense potential for wealth managers to revolutionise advisory companies, providing environment friendly and personalised options that optimise workflows, save time, improve effectivity, and minimize prices.

Capitalising on intergenerational wealth switch

The wealth administration trade prepares for a major demographic shift as an ageing high-net-worth inhabitants transfers wealth to the following era.

Companies have to deal with early engagement with shoppers’ heirs, tailoring companies to satisfy the distinctive wants of youthful generations.

Offering digital advisory companies with a human contact, understanding their values and preferences, and shifting funding methods to incorporate ESG investments and different belongings is important to retaining and rising this section.

Embedding social fairness and inclusion

Wealth administration corporations are more and more specializing in creating, measuring, and speaking influence to satisfy the wants of socially aware shoppers.

Impression investing exceeded US$1.1 trillion in belongings in 2022, and corporations try in the direction of a extra numerous workforce and adjust to regulatory necessities.

Companies like Constancy Investments, Wells Fargo, and Morgan Stanley are driving social influence via initiatives concentrating on minority and underserved teams.

In Singapore, the Impression Funding Change (IIX) has emerged as a major entity in sustainability and influence investing since its inception in 2009. IIX’s operations are geared in the direction of directing catalytic capital into underserved communities, providing a variety of funding avenues, together with ventures, bonds, and funds.

The demand for impactful investments is substantial, and corporations that efficiently leverage information and talk their funding influence will likely be positioned for achievement.

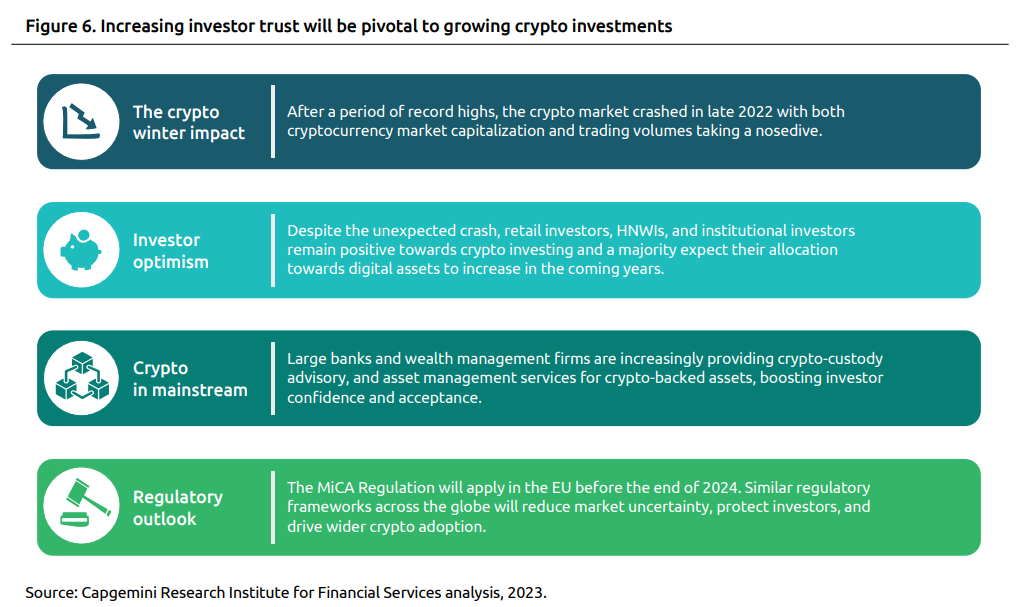

Rebuilding belief in digital belongings

The cryptocurrency market is at a crossroads following high-profile collapses and a chronic bear market.

Nonetheless, investor curiosity persists, and with laws taking form worldwide, extra widespread adoption is predicted. Establishing belief is pivotal for increasing publicity to cryptocurrencies.

Establishments like Constancy Investments and Julius Baer are enhancing investor belief by integrating crypto buying and selling and reporting into their platforms and providing recommendation and custodial companies on digital belongings.

The long run development of digital belongings and crypto hinges on regulatory readability and choices from trusted, established establishments.

Asset tokenisation driving effectivity.

Asset tokenisation revolutionises the worldwide asset market by offering unprecedented monetary and financial alternatives.

Tokenisation transfers possession rights of tangible or intangible belongings into tokens based mostly on blockchain expertise, providing liquidity, transparency, and accessibility to international traders.

Establishments like J.P. Morgan and KKR actively take part within the asset tokenisation ecosystem, strengthening its legitimacy and acceptance.

Asset tokenisation can remodel monetary companies by opening investments to a bigger international pool and rising liquidity. Monetary establishments can put together for this development by figuring out the required infrastructure to assist tokenisation and integrating it with legacy programs.

A latest report signifies that roughly 86 % of asset managers in Asia are getting ready to incorporate tokenised funds of their product choices over the following three years.

SC Ventures, the innovation and fintech funding unit of Commonplace Chartered, has launched a tokenisation platform named Libeara. This platform has facilitated FundBridge Capital, a fund supervisor, in establishing the inaugural tokenised fund based mostly on Singapore greenback authorities bonds, tailor-made explicitly for accredited traders.

Synthesising wealth administration developments in 2024

As we glance in the direction of 2024, wealth administration corporations discover themselves at an important juncture, steering via a sea of rising developments, every heralding its personal set of challenges and prospects.

The wealth administration trade in 2024 is about to be formed by these seven key developments, every driving innovation, effectivity, and development in distinctive methods.

The trade’s trajectory is being formed by a mix of technological developments, demographic shifts, and evolving market dynamics.

To thrive on this evolving panorama, corporations should embrace adaptability, harness innovation, and keep a steadfast deal with client-centric methods. The synthesis of those developments presents a multifaceted roadmap, guiding corporations towards sustained development and resilience in a quickly altering monetary ecosystem.