KEY

TAKEAWAYS

- Commodities and USD rotating deep contained in the lagging quadrant, indicating weak relative energy

- Bitcoin is in a robust relative uptrend vs all different asset lessons, however going by a corrective part

- Shares are the clear winner on this asset allocation battle

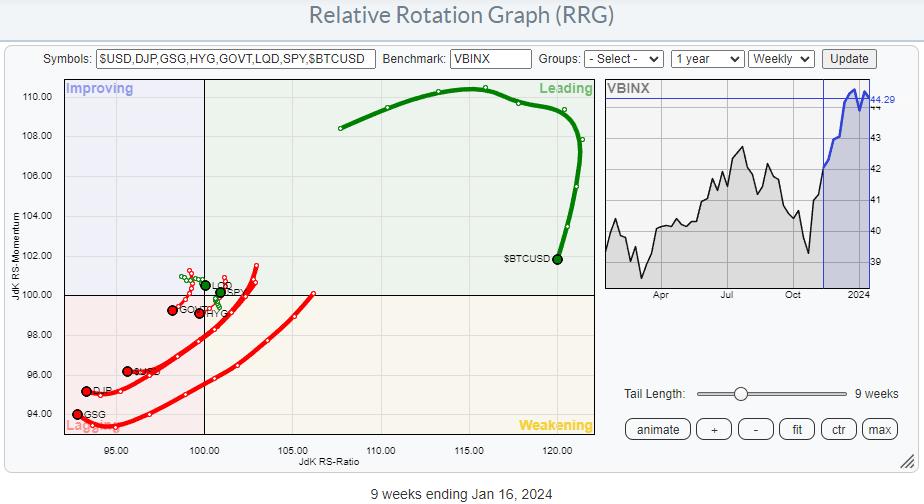

The RRG above reveals the rotation of assorted asset lessons, utilizing VBINX (Vanguard Balanced Index Fund) because the benchmark. The lengthy purple tails pushing deep into the lagging quadrant are for Commodities (DJP&GSG) and $USD, whereas the lengthy Inexperienced tail deep contained in the main quadrant and shifting decrease is for BTC.

The primary takeaways from this RRG are:

- BTC is in a really robust relative uptrend vs. all different asset lessons, however is presently going by a setback, doubtlessly providing a “buy-the-BIT-dip” situation within the subsequent few weeks.

- The lengthy purple tails deep contained in the lagging quadrant are for Commodities (DJP&GSG) and $USD. These asset lessons are in a robust relative downtrend. The slight pickup in relative momentum (JdK RS-Momentum) just isn’t significant sufficient (but) to warrant any motion.

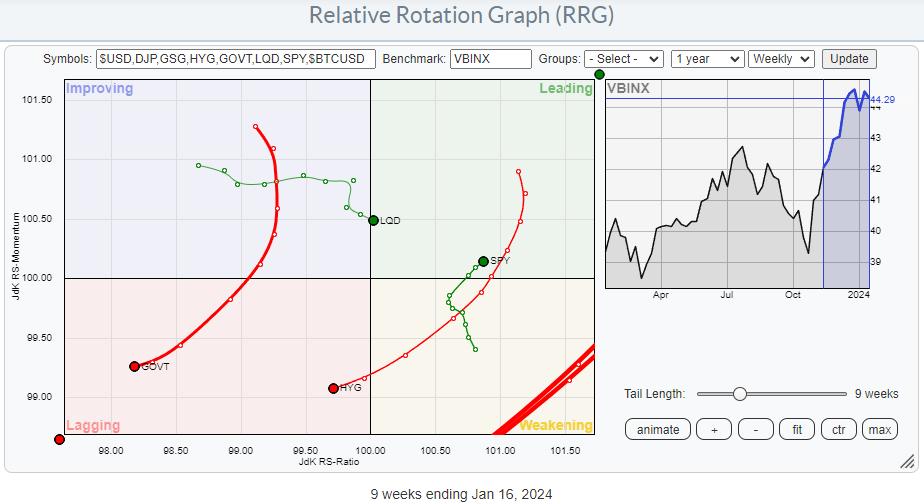

Zooming in on the middle of the RRG highlights the rotations for shares and fixed-income asset lessons. It reveals a robust rotation for shares, and it has been doing that for weeks already.

The tail on SPY rotated by weakening, after a stint by main, and is now shifting again into the main quadrant. As you realize, this is among the strongest potential rotations, because it indicators the beginning of a brand new up-leg inside an already rising relative pattern.

The fixed-income tails are shifting in the wrong way, aside from company bonds.

- Authorities Bonds (GOVT) rotated again into the lagging quadrant from bettering and is now again at a unfavorable RRG-Heading, shifting additional into the lagging quadrant.

- Excessive-yield bonds (HYG) have simply crossed again into the lagging quadrant after a full rotation by main and weakening, beginning a brand new relative downtrend.

- Company Bonds is presently the strongest asset class within the fixed-income area, crossing into main however doing so at a unfavorable RRG-Heading.

All in all, these rotations current a really clear image in favor of shares over bonds.

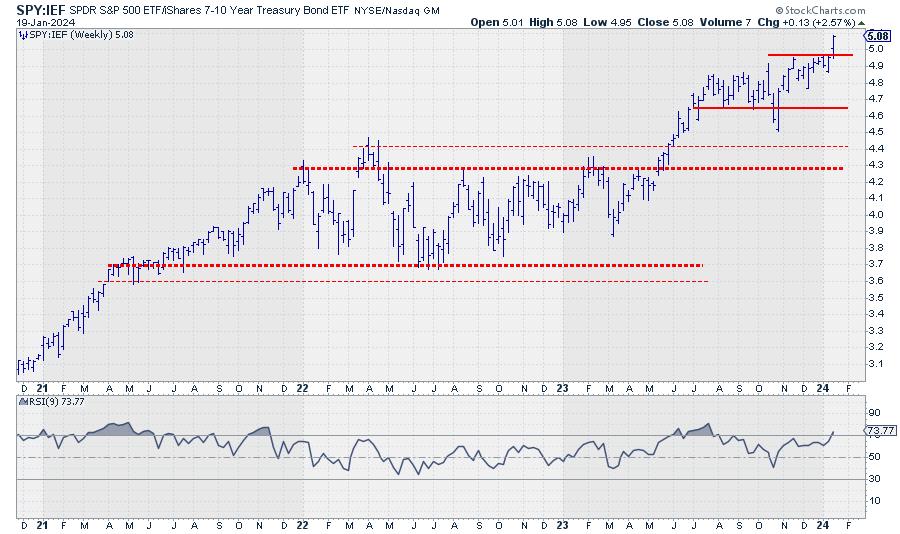

The direct comparability of SPY towards IEF underscores this energy with a stable breakaway from the consolidation interval in play since This fall-2023. The break to new highs unlocks recent upside potential for extra outperformance of shares.

#StayAlert, –Julius

Julius de Kempenaer

Senior Technical Analyst, StockCharts.com

Creator, Relative Rotation Graphs

Founder, RRG Analysis

Host of: Sector Highlight

Please discover my handles for social media channels beneath the Bio beneath.

Suggestions, feedback or questions are welcome at Juliusdk@stockcharts.com. I can not promise to answer every message, however I’ll definitely learn them and, the place moderately potential, use the suggestions and feedback or reply questions.

To debate RRG with me on S.C.A.N., tag me utilizing the deal with Julius_RRG.

RRG, Relative Rotation Graphs, JdK RS-Ratio, and JdK RS-Momentum are registered logos of RRG Analysis.

Julius de Kempenaer is the creator of Relative Rotation Graphs™. This distinctive technique to visualise relative energy inside a universe of securities was first launched on Bloomberg skilled companies terminals in January of 2011 and was launched on StockCharts.com in July of 2014.

After graduating from the Dutch Royal Navy Academy, Julius served within the Dutch Air Drive in a number of officer ranks. He retired from the navy as a captain in 1990 to enter the monetary business as a portfolio supervisor for Fairness & Legislation (now a part of AXA Funding Managers).

Be taught Extra