Introduction

A easy information to utilizing Abiroid Vary Filtered Pattern Indicators on MT4:

https://www.mql5.com/en/market/product/149941/

This indicator helps you see traits, ranges, and breakouts.

Options

- Kalman smoothing to scale back market noise.

- Supertrend bands for development course.

- Volatility-based vary bands to identify ranging markets.

- Shade-coded dots and arrows for fast studying.

- Arrow alerts for development continuation.

- Alerts for development adjustments.

- Adjustable inputs for various kinds.

Methods to Use

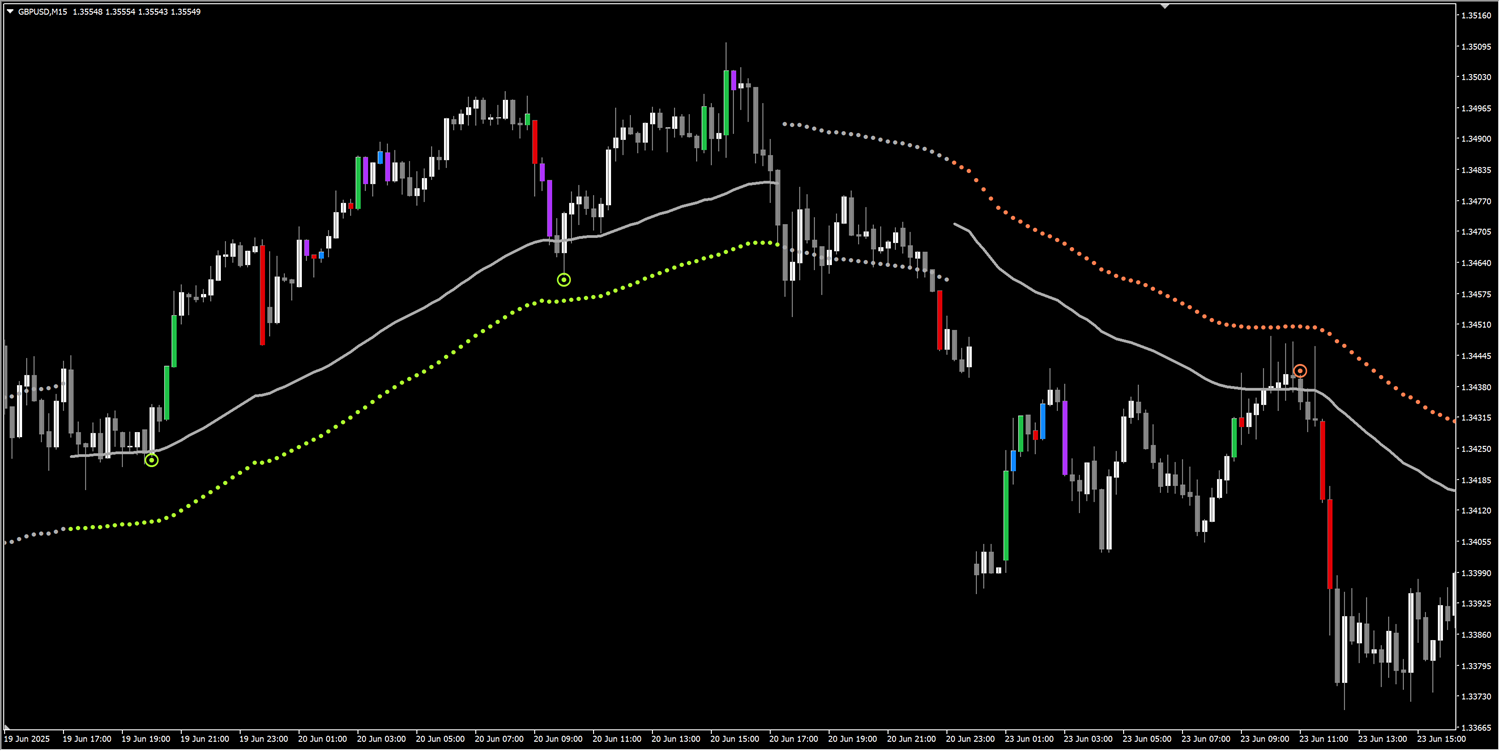

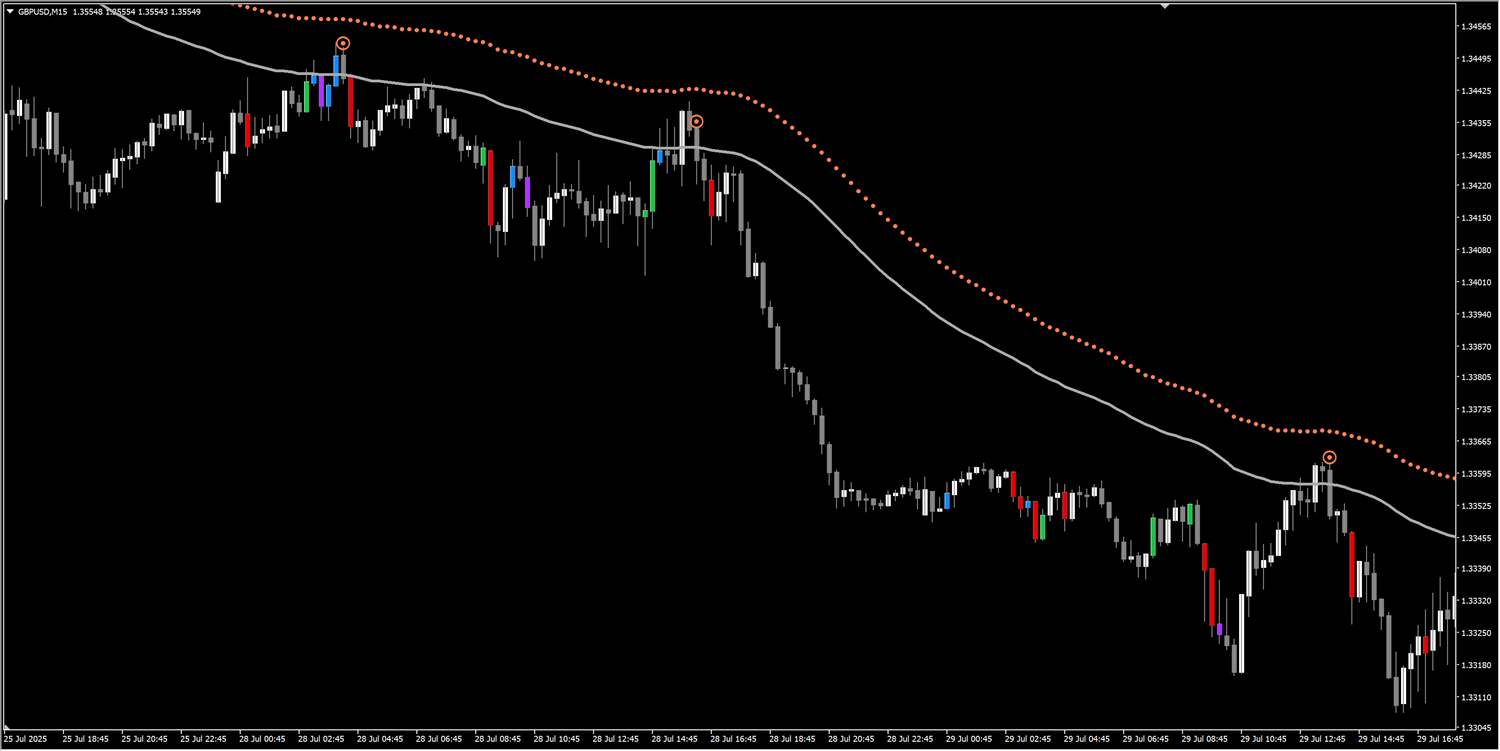

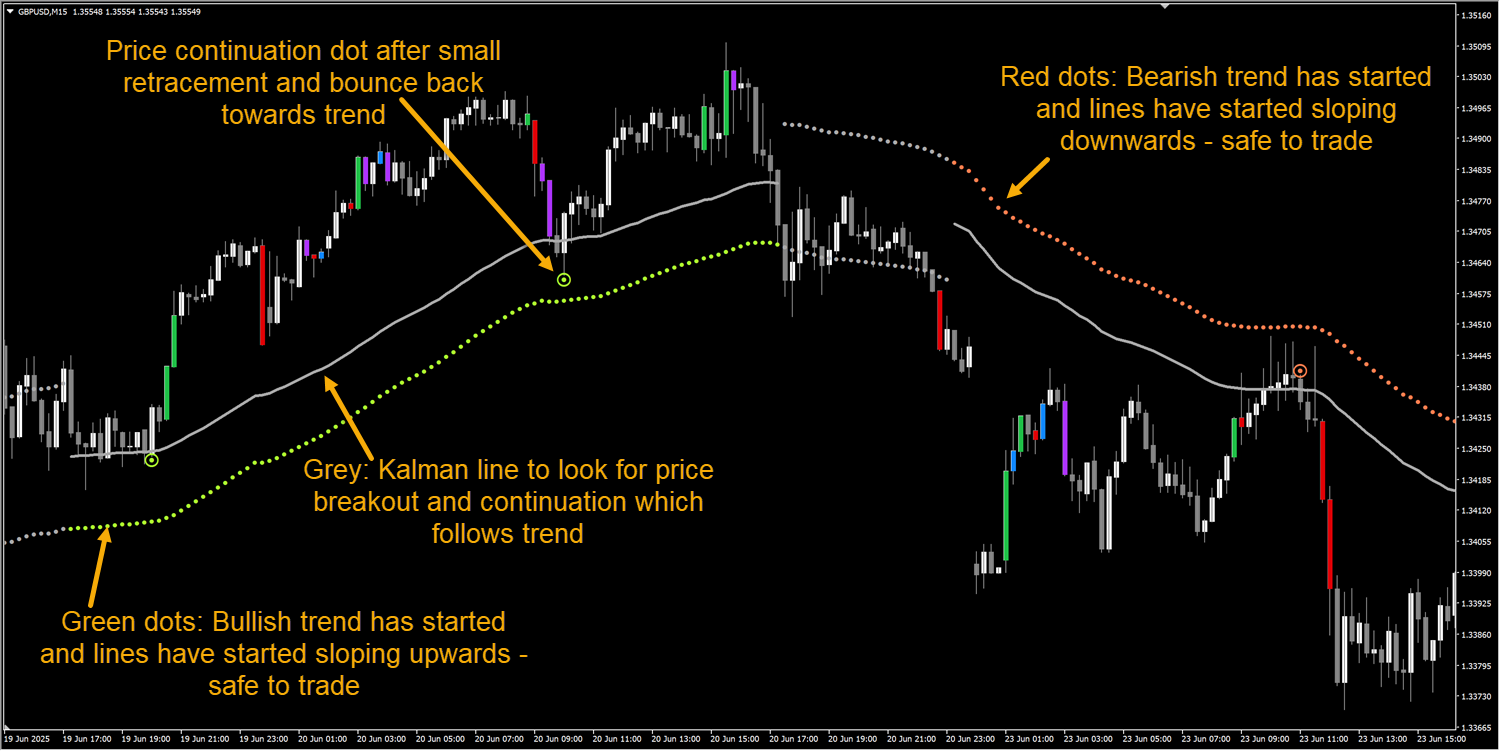

- Inexperienced dots = bullish bias. Purple dots = bearish bias. Grey dots = ranging (don’t commerce).

- For Bullish, be sure that the dots are in a slight upwards slope to substantiate up development and for Bearish dots must be barely sloping downwards

Word that after development slope has began, when a retracement occurs again to heart grey Kalman line, it is going to flatten just a little. That is anticipated. However total channel ought to have already began a slope after development change.

Don’t commerce alerts, when the strains are flat like this:

This means a ranging market. This indicator works finest throughout a trending market.

- Finest timeframes:

- Scalping: M1–M15 (quicker Kalman, shorter ATR).

- Day buying and selling: M15–H1 (default settings work effectively).

- Swing: H4–D1 (smoother Kalman – increased kalman alpha like 0.05, increased ATR issue).

- Market sort:

- Trending pairs relying on market timings: EUR/USD, GBP/USD, AUD/USD.

- Keep away from very skinny/low-liquidity pairs throughout off-hours.

- Fast tip: Test increased timeframe development first (e.g., H4) then use M15 for entries.

Stops:

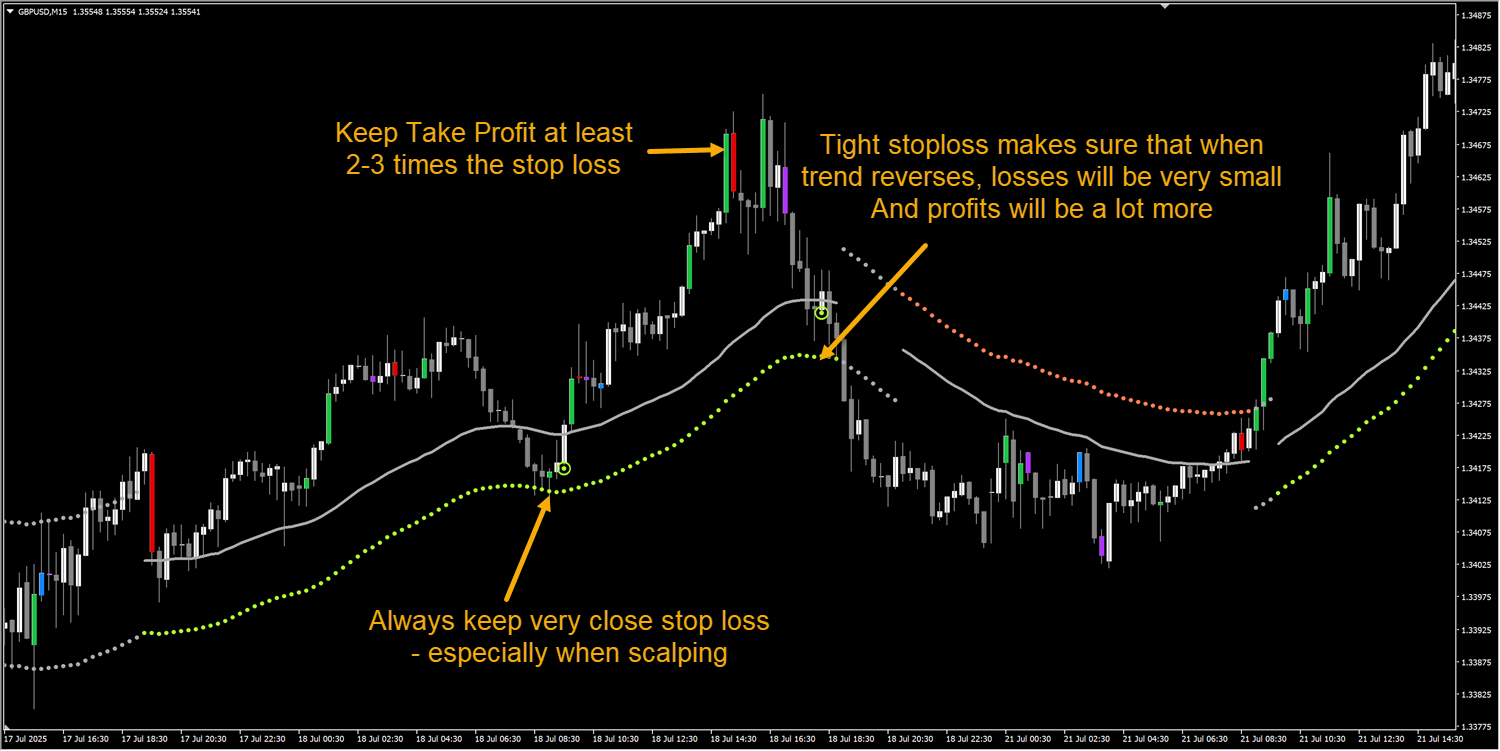

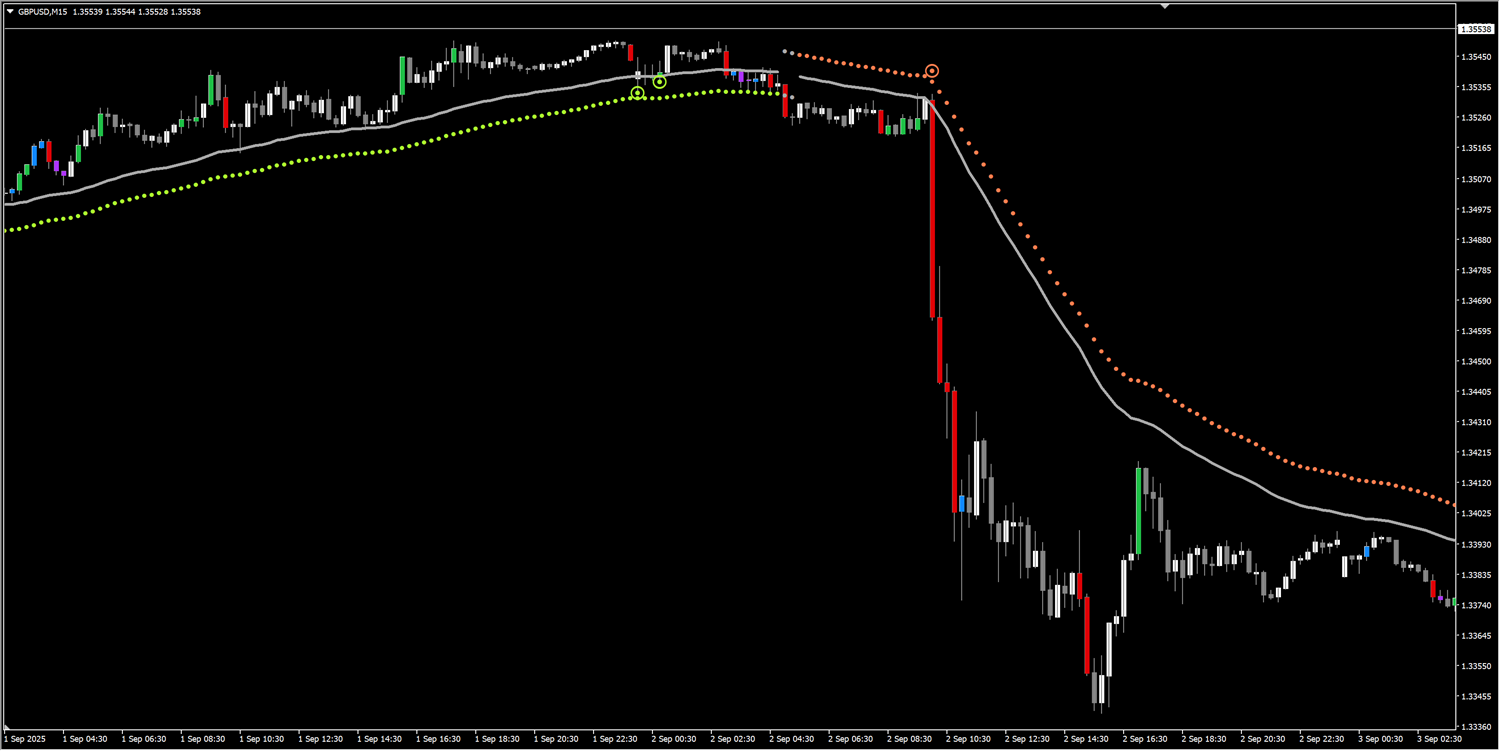

For those who get a sign when a development is ending and worth is about reverse, it is going to hit your cease loss regardless of a great development slope:

So, hold very shut cease loss, just below the inexperienced dotted line, or above the crimson dotted line. And hold Take Revenue no less than 2-3 instances the SL.

If you’re fast scalping, the ratio might be 1:1. However nonetheless increased TP is beneficial.

For those who get a sign the place worth appears to be like prefer it’s already gone too far. So won’t get the 1:2 or 1:3 (SL:TP) ratio, keep away from such alerts:

Instance:

Although, within the above instance, worth would have hit 2x TP, however nonetheless such alerts are dangerous. Particularly throughout a information occasion.

So watch out round these.

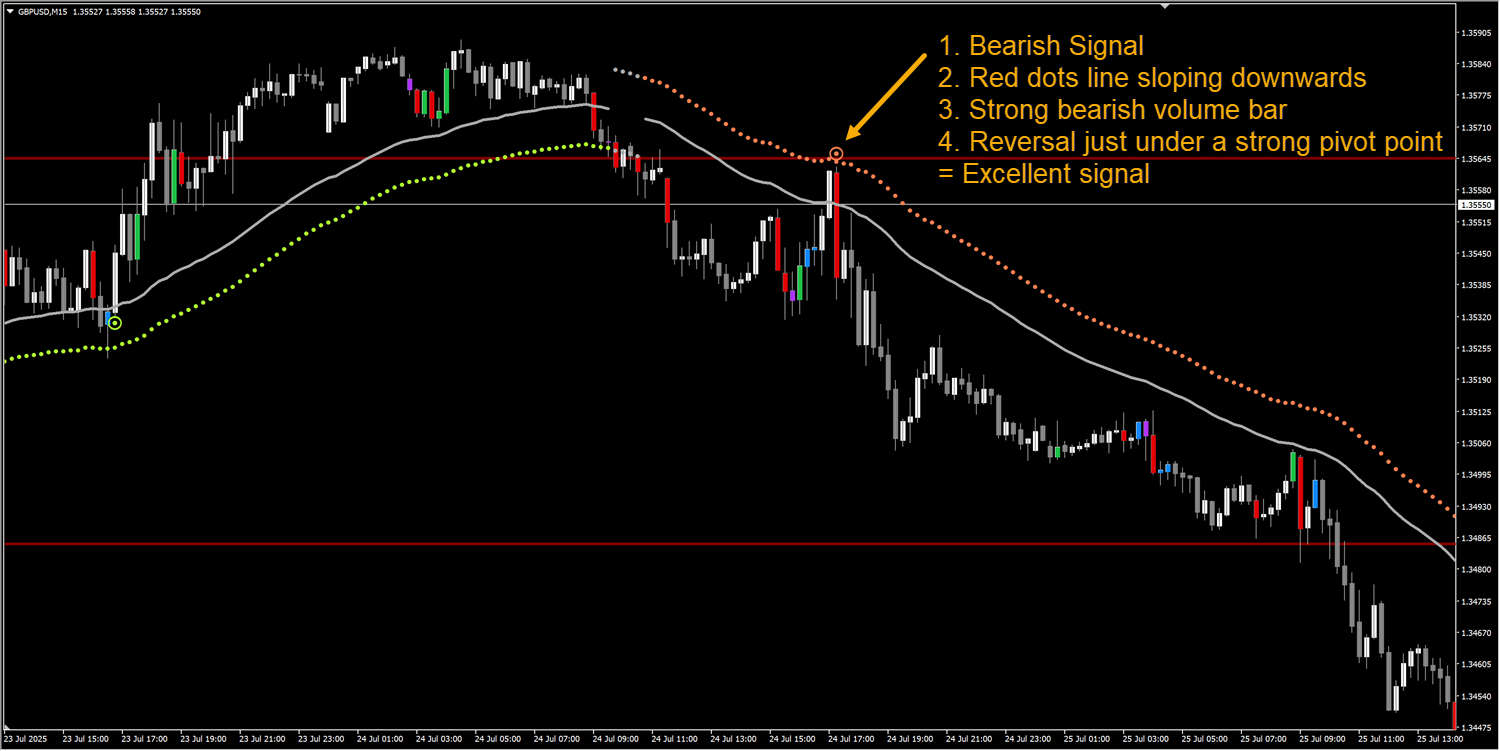

Brief Evaluation Ideas (provides power)

- Quantity affirmation: excessive quantity + inexperienced dot → stronger purchase.

- Help/Resistance: purchase alerts close to sturdy assist or pivot factors are stronger.

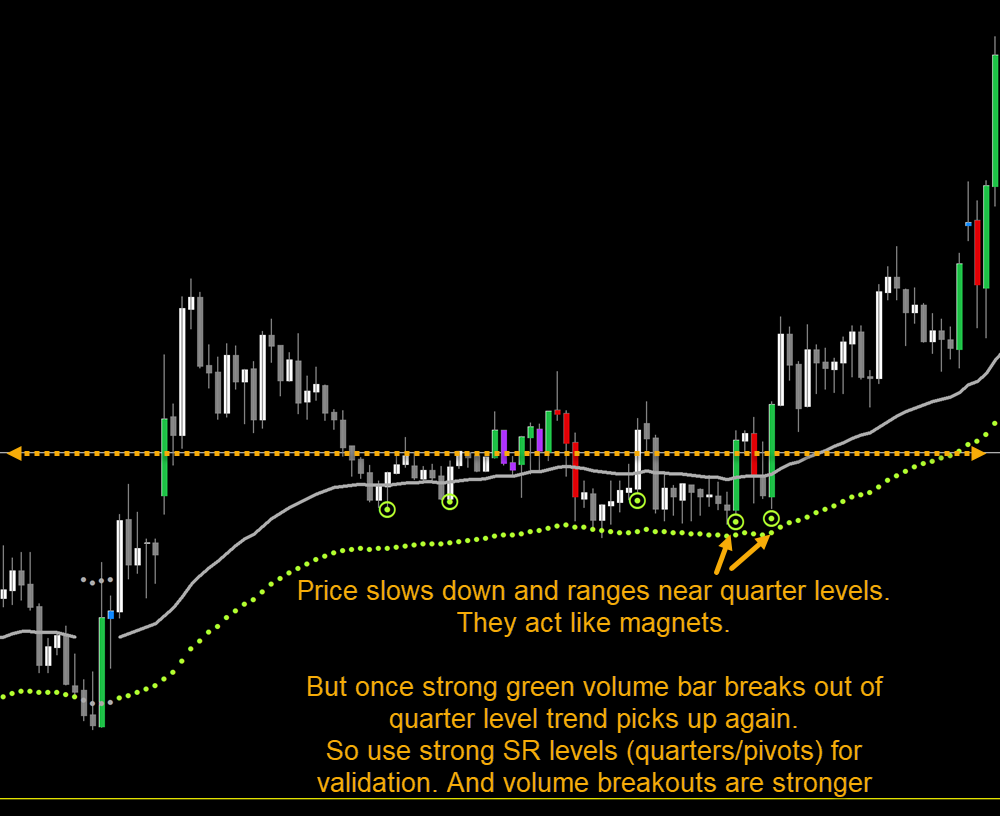

- Pivots/quarter strains: alerts close to 25%/50%/75% ranges add confidence.

- A number of timeframe match: similar development on increased TF = increased likelihood. Like evaluating H4 development, earlier than buying and selling on M15 gives you extra profitable alerts.

Instance with Quantity and Pivot validation:

Calculations (easy)

- Kalman Filter: smooths worth utilizing previous worth and a responsiveness weight (alpha/beta).

- Supertrend: makes use of ATR round Kalman worth to make higher/decrease bands and determine course.

- Vary Filter: volatility WMA creates higher/decrease vary bands. If worth stays between them, indicator reveals “ranging” (grey). Breakouts set off development alerts.

All Settings Defined

Kalman settings

- Kalman Alpha: responsiveness. Decrease = smoother. Increased = extra reactive.

- Kalman Beta: adapts to volatility. Improve in uneven markets.

- Kalman Interval: lookback for filter. Longer = smoother.

Supertrend settings

- Supertrend Issue: controls band width. Larger = fewer alerts.

- ATR Interval: sensitivity of ATR. Decrease = faster adjustments.

Vary settings

- Deviation: multiplier for vary band width. Increased = wider vary.

- Volatility Interval: size for volatility WMA.

Visible & alerts

- Impartial/Bull/Bear colours: change for visibility.

- Present Arrows: toggle purchase/promote arrows.

- Alerts: allow development or arrow alerts.

Debug

- Present Debug Values: prints inner values in Specialists tab for troubleshooting.

- Refresh After Ticks: enhance to scale back CPU utilization. When you have too many charts open, perhaps hold this worth to 50 or so.

Debugging (fast)

- If dots don’t match expectations: reload the indicator.

- Activate debug and watch Specialists tab for development, ktrend, vary values.

- Guarantee sufficient historical past is loaded.

- If efficiency drops: elevate Refresh After Ticks or simplify settings.

Trades to Keep away from

- Tight sideways ranges with many grey dots.

- Flat slope despite the fact that crimson/inexperienced dots are there

- Buying and selling proper after main information spikes.

- Low-volume instances (weekends, off-session).

- Going in opposition to the development on increased timeframes (watch out)

Conclusion

Use the indicator to identify development vs vary and to time entries with confluence (quantity, SR, pivots). Begin with defaults. Take a look at on demo. Modify Kalman and Supertrend to match your timeframe and pair. Mix alerts with quantity and assist/resistance for higher outcomes.

Cheat sheet:

Settings will actually rely in your type of buying and selling and the image/timeframe you’re buying and selling with.

However here’s a fast cheat sheet of instance settings which will probably be helpful to you:

-

Scalping (quick)

- Timeframe: M1–M15

- Kalman Alpha: 0.01

- Kalman Beta: 0.08

- Kalman Interval: 50

- Supertrend Issue: 0.6

- ATR Interval: 5

- Deviation: 1.0

- Volatility Interval: 100

- Use: fast entries, tight stops

-

Day Buying and selling (balanced)

- Timeframe: M15–H1

- Kalman Alpha: 0.02 (default 0.01 okay)

- Kalman Beta: 0.10

- Kalman Interval: 77

- Supertrend Issue: 0.7

- ATR Interval: 7

- Deviation: 1.2

- Volatility Interval: 200

- Use: important preset for many pairs

-

Swing Buying and selling (clean)

- Timeframe: H4–D1

- Kalman Alpha: 0.05

- Kalman Beta: 0.12

- Kalman Interval: 100

- Supertrend Issue: 0.9

- ATR Interval: 10

- Deviation: 1.5

- Volatility Interval: 300

- Use: concentrate on development power, wider stops

Please share your finest settings with pair/timeframe in feedback beneath. And let me know what you suppose!