The perform that tax groups serve is quickly evolving right into a extra strategic function inside trendy organizations. Nevertheless, given this tempo of change, many executives are nonetheless unaware of the untapped strategic potential inside their tax groups. That is an unlucky actuality that many tax technologists and strategists report back to us and their friends. Of their phrases, they’re all too usually seen as “compliant paper pushers,” and their departments are considered as mere value facilities or a bunch of technicians relatively than value-adding belongings.

Quite the opposite, tax groups usually play an vital strategic function. Nevertheless, this requires them to take a proactive strategy in carving out a significant place inside the firm, routinely including worth, and articulating that worth to government administration and others all through the corporate.

Tax Groups Are Stepping right into a Extra Strategic Position

If tax groups are considered as mere value facilities, it may be tough for them to safe government backing for strategic tasks. For instance, higher software program could be a keystone funding for tax groups aiming to achieve larger and obtain extra. With out that government sponsorship, a tax staff gained’t have entry to the precise instruments, which means they gained’t be capable of fulfill their strategic perform successfully. This, in flip, creates a cost-center mentality that perpetuates the picture of the tax staff as a group of paper-pushers. Sadly, the result’s that it turns into even much less probably that they’ll obtain the strategic focus and recognition essential to safe funding.

See how insightsoftware helps tax groups with our tax useful resource heart.

How can tax groups escape of this cycle?

Throughout a webinar held by insightsoftware, we heard this common sentiment reported once more. We requested attendees to inform us how they felt their tax division is considered internally by their coworkers. 45% reported being seen as merely reactive or compliant inside their organizations — a far cry from the well-valued stature that different tax groups are capable of obtain when supplied with the precise instruments.

Empowering Enterprise Tax Groups in Altering International Instances

The easiest way for tax groups to develop into extra strategic and break this cycle is by first mapping out the operational limitations that drive them to solely concentrate on compliance. After these roadblocks are recognized, it’s simpler to clarify what may be finished with higher assist and instruments. For instance, Longview Tax permits tax professionals to automate lots of the reporting processes that presently drain most of their time. With these appreciable time financial savings, they’ll dedicate extra time to mapping out completely different eventualities with precise and forecasted finance information to make their very own strategic solutions from a tax perspective.

These arguments have already been made and gained in lots of organizations. The truth is, inside the similar webinar talked about earlier, 67% of attendees reported that they confronted explicit strategic limitations inside the realm of tax and finance forecasting. When a corporation struggles with its strategic forecasts, it solely is smart for the tax staff to push for government backing for an answer that reinforces these capabilities.

What’s vital to notice is that the tax staff’s work usually hinges on the standard and timeliness of the finance information that underpins their forecasts. Higher integration with finance programs/ERPs, discovering methods to enhance the consolidation course of, or growing the granularity of the info obtainable to work with supplies each the finance and tax groups with enhanced collaborative capabilities based mostly on high-quality, correct information.

Tighter collaboration between tax and finance groups inevitably results in higher forecasts and way more alternatives to acknowledge the invaluable strategic influence that each groups can really have on their organizations.

Discover ways to take your tax division from cost-center to a strategic associate with this webinar.

BEPS Pillar 2 & a Re-Making of International Taxation

Because the strategy to world taxation has shifted, tax groups have an much more targeted function to play in setting strategic priorities for the organizations they serve. BEPS (Base Erosion and Revenue Shifting) is a algorithm and requirements established by the Group for Financial Co-operation and Growth (OECD) to overtake world taxation.

BEPS encompasses two so-called “pillars.” Pillar 1 focuses on very giant organizations, however Pillar 2 is far broader and units a minimal baseline for company taxation so multinational companies are now not incentivized to shift earnings from larger tax international locations to low-tax nations.

This has resulted in important modifications to tax reporting. The OECD described BEPS Pillar 2 as “a radical shift within the tax panorama,” and that has confirmed to be true. Corporations must be on high of recent programs and processes like BEPS Pillar 2, and our superior tax reporting options assist facilitate this agility and readiness with dynamic planning and intuitive instruments to assist groups keep forward of the curve.

See how Longview Tax helps BEPS Pillar 2 tax provisioning right here.

Reshaping Future Progress: Prime Tips about Learn how to Handle Tax Forecasts

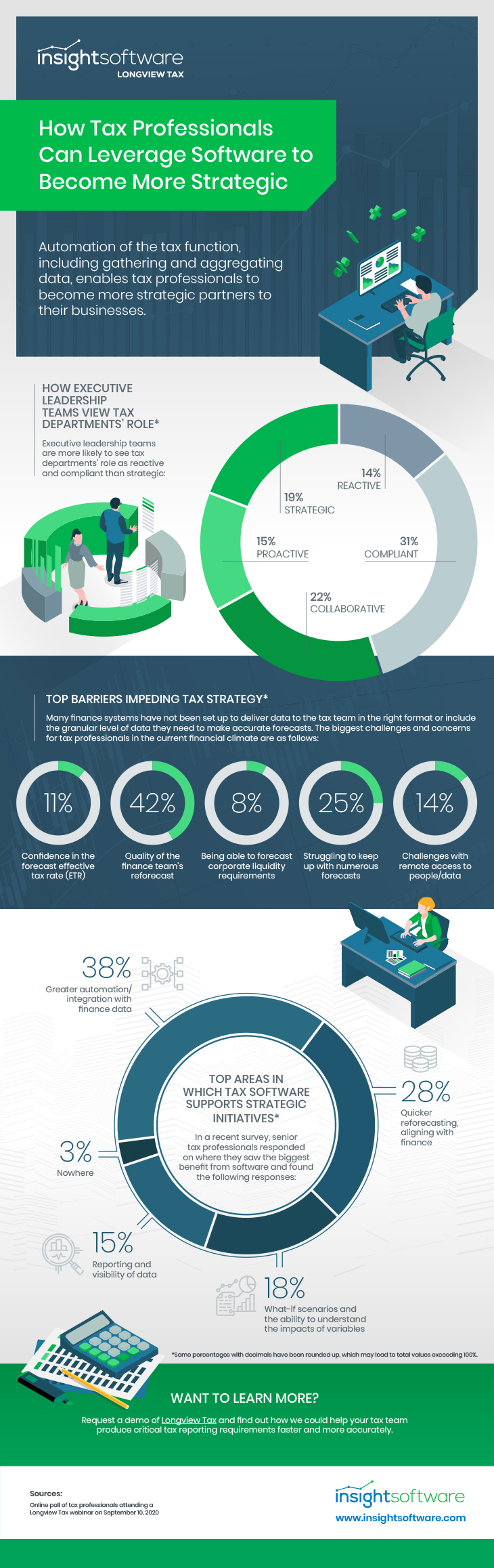

insightsoftware Infographic: How Tax Professionals Can Leverage Software program to Turn into Extra Strategic

For a visible breakdown of the learnings and information from our polls, try the infographic under or contact us to study extra.

Infographic description: 45% of government management groups view tax departments’ function as reactive (14%) or compliant (31%) in comparison with 34% that see it as strategic (19%) or proactive (15%). The most important limitations that impede tax technique are the standard of finance groups’ reforecast, struggling to maintain up with quite a few forecasts, and challenges with distant entry to individuals/information. The highest areas the place tax software program (like Longview Tax) helps strategic initiatives are higher automation/integration with finance information (38%), faster reforecasting and aligning with finance (28%), and what-if state of affairs modeling to know the influence of variables (18%). Wish to study extra? Request a demo of Longview Tax to see the way it will help your tax staff create crucial tax stories sooner and extra precisely.

Challenges Open the Door for Alternatives

Nevertheless, the important thing takeaway from these conversations and suggestions from tax groups is that these challenges additionally create alternatives. Because the world calls for higher enterprise agility and as BEPS continues to shift the tax panorama, tax departments have a robust case for change (maybe extra compelling than ever earlier than). With the precise instruments, tax groups can deal with these challenges head-on. On the similar time, they acquire the belongings they should shift their place of their respective organizations from tactical and reactive to strategic and proactive.

In lots of corporations, for instance, guide processes devour far an excessive amount of time and power. By investing in the precise tax and reporting software program, these actions may be automated. Tax groups that spend much less time on process have extra time to spend on strategic evaluation. They’ll additionally improve the cadence at which they consider the corporate’s positions, making the group extra attentive to a shifting enterprise surroundings.

How Longview Tax Empowers Tax Groups to be Extra Strategic

Our Longview Tax platform permits tax professionals to automate many of those reporting processes talked about above that devour a lot of their time. The identical instrument that gives important time financial savings additionally helps them map out completely different eventualities with precise and forecasted finance information to make their very own strategic solutions from a tax perspective.

As we mentioned, the tax staff’s work usually hinges on the standard and timeliness of the finance information underpinning their forecasts. Instruments that may combine and function extra carefully along with your current finance programs can streamline the consolidation course of and even improve the granularity of the info. Extra well timed, correct information results in higher forecasts and way more alternatives to acknowledge the invaluable strategic influence that tax groups can have on their organizations. Able to get began? Request a demo of Longview Tax utilizing the shape under.