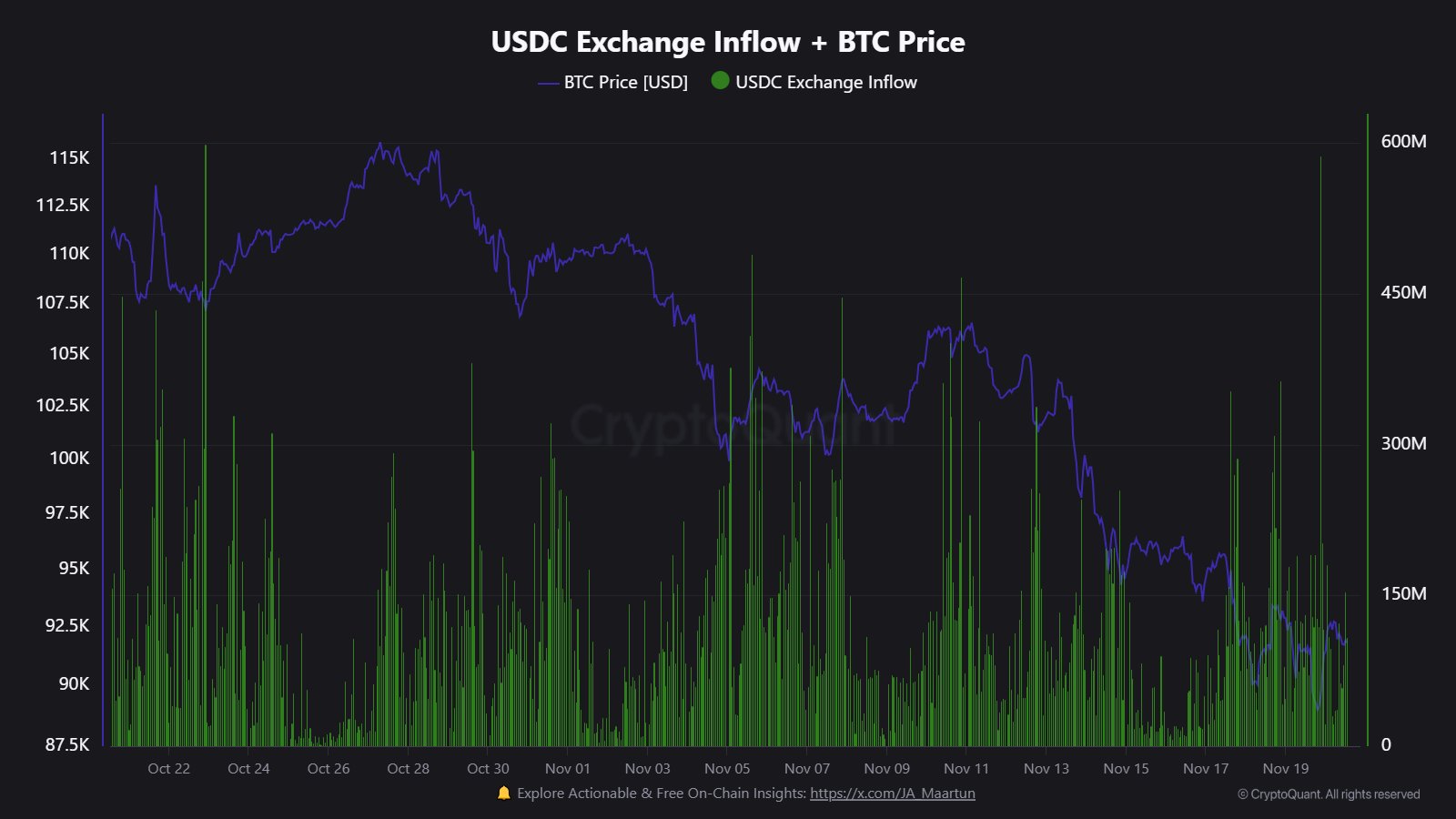

On-chain information exhibits a considerable amount of USDC inflows have simply hit exchanges, a possible signal that traders wish to purchase the Bitcoin dip.

USDC Trade Influx Has Registered A number of Spikes Just lately

As defined by CryptoQuant neighborhood analyst Maartunn in a brand new put up on X, the USDC Trade Influx has shot up lately. The “Trade Influx” right here refers to an indicator that retains monitor of the entire quantity of a given asset that’s being transferred to wallets linked with centralized exchanges.

Usually, traders deposit their cash to those platforms once they wish to commerce them away. As such, at any time when the Trade Influx spikes, it may be an indication that there’s demand for promoting the asset.

Such a development can naturally be bearish for Bitcoin and different unstable cryptocurrencies. Relating to stablecoins, nonetheless, buying and selling has no impact on their value, as they’re, by definition, steady across the fiat foreign money that they’re pegged to.

This doesn’t imply that stablecoin alternate deposits are with out penalties, although. Traders normally retailer their capital within the type of USDC or one other stablecoin once they wish to keep away from the volatility related to Bitcoin and firm. As soon as these merchants really feel the time is true to purchase again in, they ship their stables to exchanges and swap to the asset of their alternative.

As such, stablecoin inflows can truly be a bullish signal for the market. From the chart shared by Maartunn, it’s seen that the USDC Trade Influx has surged lately, a possible signal that recent capital is trying to accumulate the unstable cash.

The newest wave of USDC alternate deposits have arrived as Bitcoin and different digital belongings have gone by means of a crash. Given this timing, it’s potential that merchants are shopping for the dip.

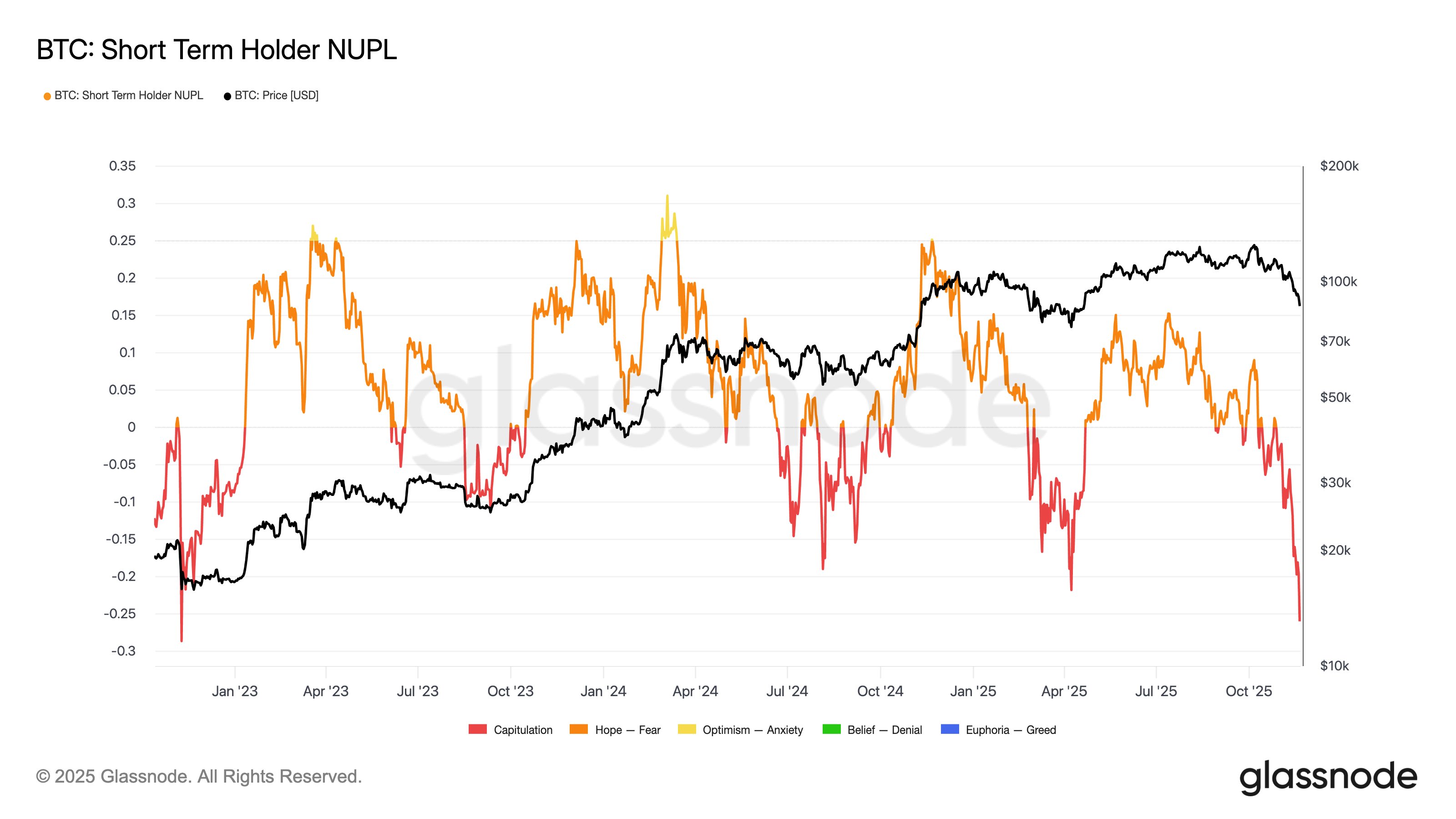

In another information, the current bearish value motion has been particularly arduous on the short-term holders (STHs), as Glassnode analyst Chris Beamish has identified in an X put up.

As displayed within the above graph, the Bitcoin STHs have witnessed a plunge of their Internet Unrealized Revenue/Loss (NUPL) alongside the market downturn. STHs are the traders who bought their cash inside the previous 155 days, and the asset is at present buying and selling at ranges notably under any seen throughout this window, so the complete cohort has dropped right into a state of loss.

For the reason that current downtrend has been fairly steep, the diploma of unrealized loss confronted by the cohort has additionally been not like something witnessed since November 2022, when the final bear market reached its backside. “STH are significantly feeling the ache,” famous Beamish.

BTC Value

Bitcoin briefly slipped under $81,000 earlier within the day, but it surely has since seen a small soar again to $83,900.