Final week, the Congressional Finances Workplace (CBO) launched an up to date Finances and Financial Outlook. The report (launched yearly) presents the company’s present projections of main fiscal and financial tendencies for the approaching decade and past. Whereas elements of the nation’s fiscal image look higher in comparison with earlier iterations, the general outlook remains to be regarding. The CBO tasks deficits will likely be greater than historic ranges, largely as a result of progress in necessary spending applications like Social Safety and Medicare. And whereas some latest laws has diminished the deficit, the Inflation Discount Act is proving to be dearer than initially promised.

Massive Image Seems Grim

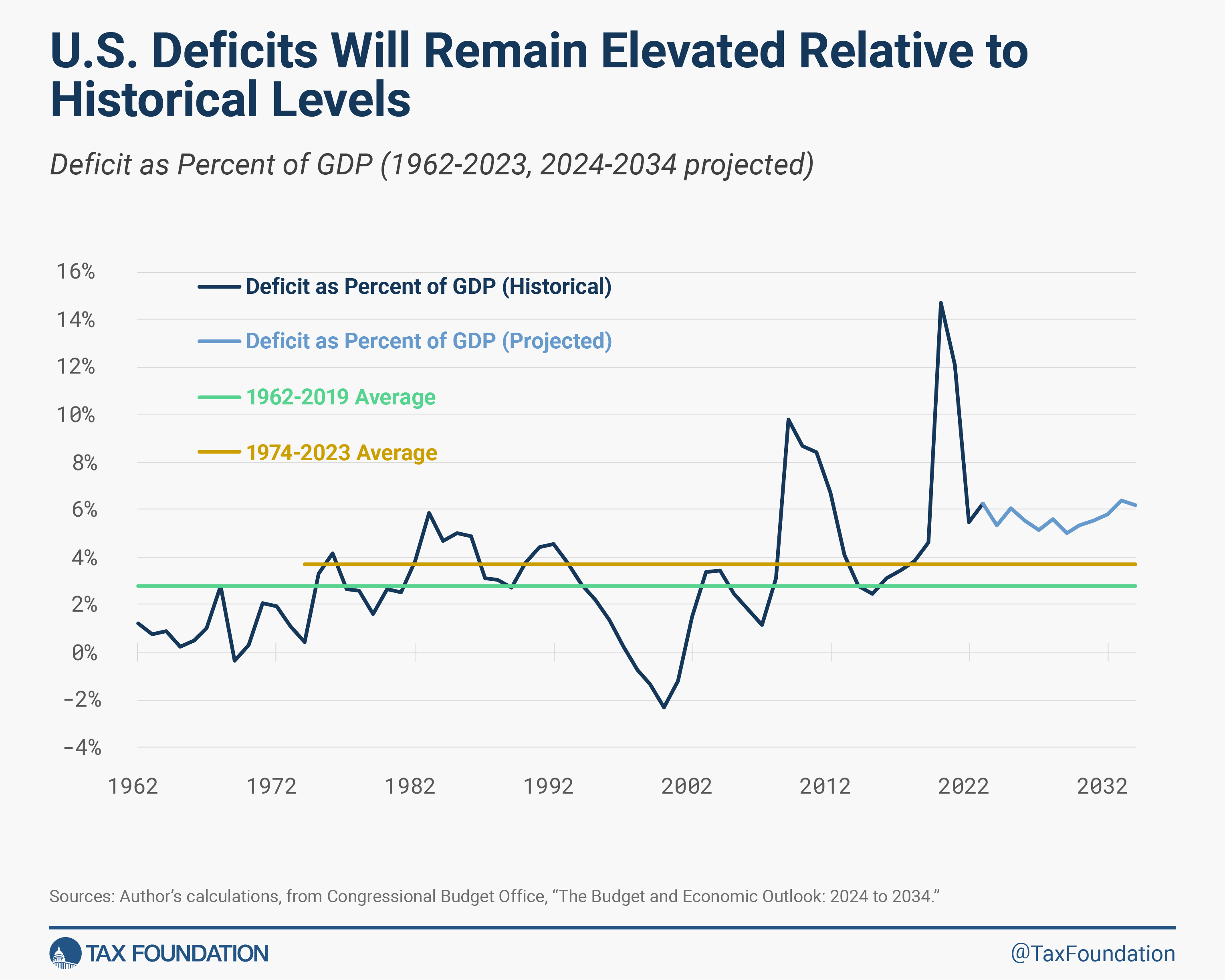

Each spending and income are projected to be elevated above historic ranges. Over the earlier 50 years (from 1974 to 2023), whole outlays averaged 21.0 % of GDP, whereas whole income averaged 17.3 % of GDP. Nevertheless, over the subsequent 11 years (from 2024 to 2034), each numbers will likely be elevated above their averages. From 2024 to 2034, whole outlays are projected to common 23.4 % of GDP, whereas whole revenues are projected to common solely 17.7 % of GDP. The bigger improve in outlays exhibits how spending is the first driver of additional rising deficits.

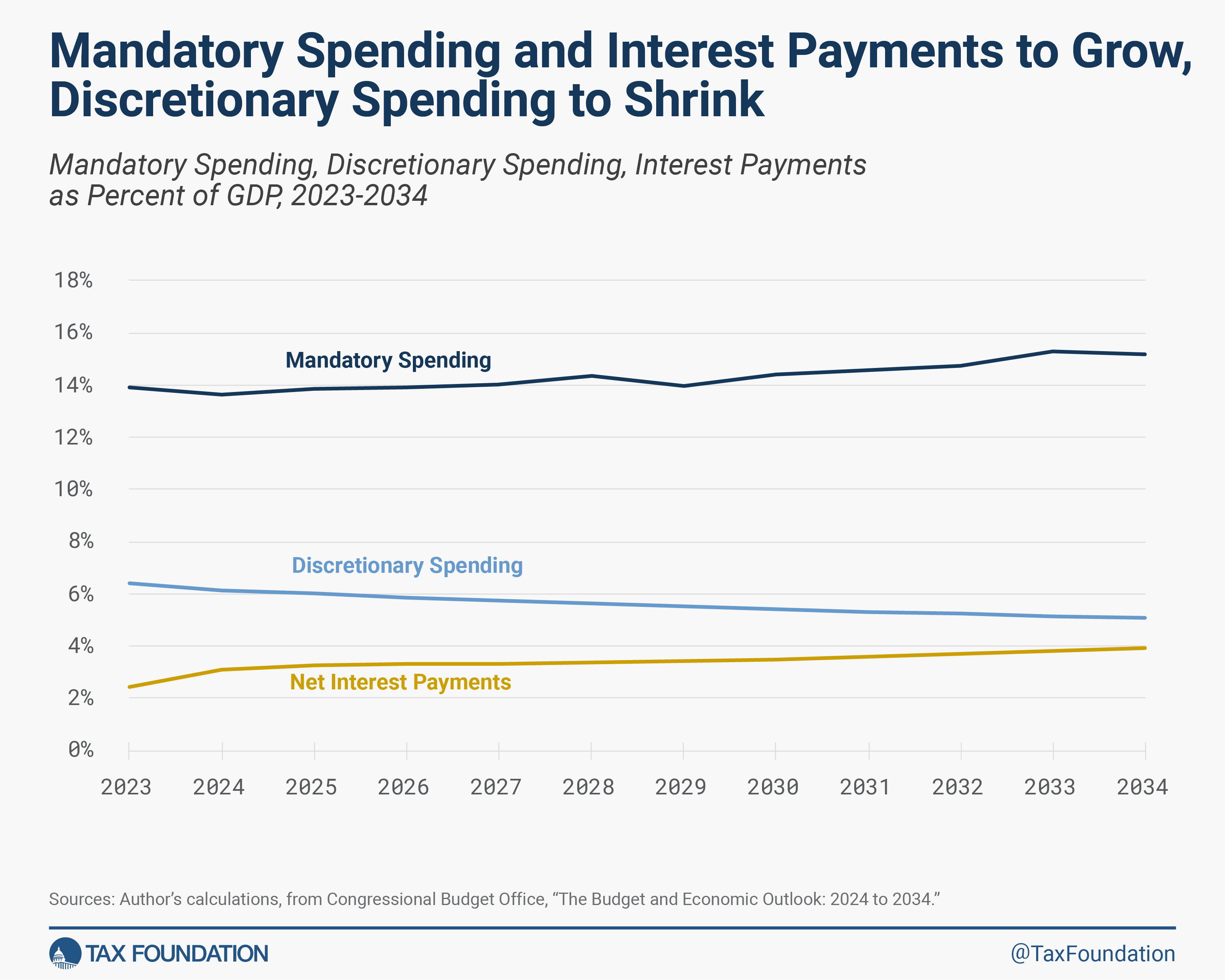

Elevated outlays are primarily in charge for greater deficits going ahead, significantly the expansion in necessary spending applications, together with Social Safety and Medicare, and rising curiosity on the debt. From 2024 to 2034, necessary spending will develop from 13.6 % of GDP to fifteen.2 % of GDP, whereas discretionary spending will decline from 6.2 % of GDP to only 5.1 % of GDP. The remaining improve in outlays is because of a historic improve in curiosity funds, which go from 3.1 % of GDP in 2024 (exceeding the protection funds for the primary time in data going again to 1940) to a brand new file excessive of three.2 % in 2025, earlier than rising greater to three.9 % in 2034.

In impact, rising curiosity prices and necessary spending on main entitlement applications are crowding out spending on core authorities features within the discretionary funds, together with protection, regulation enforcement, and infrastructure.

Progress Made on Some Factors, Not Sufficient on Others

The CBO diminished its projections of the cumulative deficit from 2024-2033 relative to the identical interval in its final estimate as of Might 2023, from $20.3 trillion to $18.9 trillion—a web discount of $1.4 trillion. Legislative adjustments collectively diminished the projected cumulative deficit by $2.6 trillion over that interval, with the Fiscal Duty Act of 2023 (FRA) accountable for a big share of that distinction. The overwhelming majority of that impact comes from decreasing discretionary spending, which was already on a downward trajectory as a share of the financial system previous to the FRA, whereas progress in necessary spending was primarily untouched.

Affect of Latest Laws and Coming Modifications

The brand new outlook additionally shed some gentle on the InflationInflation is when the final worth of products and providers will increase throughout the financial system, decreasing the buying energy of a foreign money and the worth of sure property. The identical paycheck covers much less items, providers, and payments. It’s generally known as a “hidden tax,” because it leaves taxpayers much less well-off as a result of greater prices and “bracket creep,” whereas rising the federal government’s spending energy.

Discount Act of 2022. The report estimates energy-related taxA tax is a compulsory cost or cost collected by native, state, and nationwide governments from people or companies to cowl the prices of normal authorities providers, items, and actions.

provisions will improve deficits by $427.7 billion greater than beforehand projected between 2024 and 2033, offsetting a number of the financial savings from the FRA. Whereas a number of components contribute to this variation, an Environmental Safety Company (EPA) rule change has the most important impact. In April 2023, the EPA proposed stricter car emissions requirements beginning in 2027. This rule change reduces revenues by way of two channels: it will increase the adoption of electrical automobiles (and thus utilization of the clear car tax credit), and it decreases fuel taxA fuel tax is usually used to explain the number of taxes levied on gasoline at each the federal and state ranges, to supply funds for freeway restore and upkeep, in addition to for different authorities infrastructure tasks. These taxes are levied in a couple of methods, together with per-gallon excise taxes, excise taxes imposed on wholesalers, and normal gross sales taxes that apply to the acquisition of gasoline.

income (as it’ll cut back the utilization of gas-powered automobiles).

Initially, the CBO scored the Inflation Discount Act (IRA) as a deficit-reducing coverage, on web decreasing the deficit by $90 billion between 2022 and 2031 plus about $200 billion in elevated revenues from elevated IRS enforcement. However these new value estimates make it clear that the IRA will find yourself rising the deficit. Now, based mostly on CBO’s newest estimates, the IRA credit seem to value roughly $786 billion over the brand new funds window (2024-2033), indicating the IRA laws in whole will increase deficits by about $300 billion from 2024 to 2033, or $562 billion excluding the results of IRS enforcement. Be aware this can be a tough estimate, because it mixes two CBO baselines, nevertheless it exhibits the necessity for the CBO and the Joint Committee on Taxation to supply transparency and a brand new estimate of the IRA’s budgetary affect.

Contrarily, the upcoming expiration of a lot of the Tax Cuts and Jobs Act (TCJA) is behind the projected improve in tax income as a share of GDP later within the coming decade. Most of the Tax Cuts and Jobs Act’s expiring provisions should be made everlasting. On the identical time, although, they should be accompanied by both tax income offsets or spending reductions to stop permanence from elevating the already-rising debt. It seems from the CBO’s newest evaluation that capping or repealing lots of the IRA credit would offset a considerable portion of the price of extending key elements of the TCJA.

Conclusion

Whereas the latest report isn’t all doom and gloom, it does present a still-concerning long-term fiscal image. There are three essential components that go into the deficit: spending, income, and financial progress. As policymakers (hopefully) transfer to cut back the deficit going ahead, they need to cope with the first driver of the deficit: necessary spending on Social Safety and Medicare. Growing income could also be a part of the answer as properly, nevertheless it needs to be achieved in a fashion that maintains or enhances financial progress. In spite of everything, federal tax income collections and the spending that it helps are a by-product of the well being and dimension of the U.S. financial system.

Keep knowledgeable on the tax insurance policies impacting you.

Subscribe to get insights from our trusted consultants delivered straight to your inbox.

Share