On the earth of automated buying and selling, we’re at all times on the hunt for an edge. We construct advanced Skilled Advisors (EAs), backtest numerous methods, and optimize each parameter. However what if some of the highly effective instruments for enhancing profitability and managing danger is not a posh algorithm, however a easy statistical idea?

Enter pair correlation.

It is a time period you’ve got seemingly heard, however many merchants on the MQL5 platform solely scratch the floor of what it could possibly do. Understanding how completely different forex pairs and belongings transfer in relation to 1 one other is like having a secret map of the market. It may aid you dodge hidden dangers, verify your commerce alerts, and even open the door to stylish methods like pairs buying and selling.

This information will take you from the fundamentals of correlation to its sensible implementation in MQL5, providing you with the information to construct smarter, extra strong buying and selling methods.

What Precisely is Pair Correlation? 📈

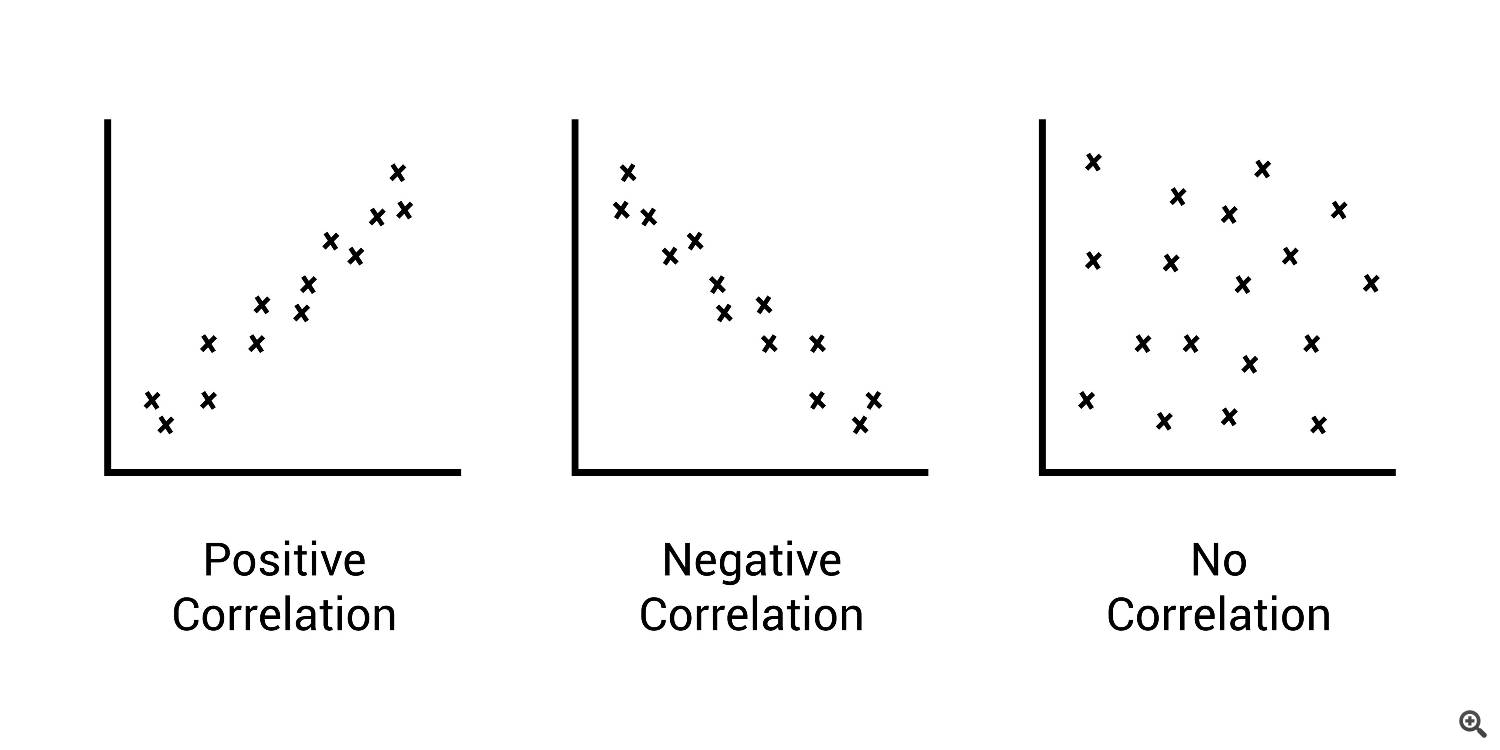

At its core, correlation is a statistical measure that expresses the extent to which two variables are linearly associated, which means they modify collectively at a relentless charge. In finance, it tells us how the costs of two belongings—like EUR/USD and GBP/USD—have a tendency to maneuver in relation to one another.

This relationship is measured by the correlation coefficient, normally denoted by the Greek letter rho (ρ) or just as r. The worth of this coefficient ranges from -1.0 to +1.0.

-

Constructive Correlation (+1.0): This implies two belongings transfer in the identical route. If Asset A goes up, Asset B tends to go up as properly. An ideal optimistic correlation of +1.0 means they transfer in excellent lockstep. Consider two elevators beginning on the bottom ground and touring up collectively. A typical instance in Foreign exchange is AUD/USD and NZD/USD, as each economies are intently tied to commodity costs and their neighbor, Australia.

-

Unfavorable Correlation (-1.0): This implies two belongings transfer in reverse instructions. If Asset A goes up, Asset B tends to go down. An ideal adverse correlation of -1.0 means they’re excellent mirror photographs. Consider a seesaw. A basic instance is EUR/USD and USD/CHF. As a result of USD is the bottom forex in a single and the quote forex within the different, a strengthening greenback will typically push EUR/USD down and USD/CHF up.

-

Zero Correlation (0.0): This means there is no such thing as a discernible linear relationship between the actions of the 2 belongings. Their worth adjustments are basically random relative to one another.

For the mathematically inclined, the most typical method used is the Pearson correlation coefficient:

r=∑(xi−xˉ)2∑(yi−yˉ)2∑(xi−xˉ)(yi−yˉ)

The place:

Don’t fret, you will not must calculate this by hand! MetaTrader 5 can do the heavy lifting for you.

Why Pair Correlation Issues for MQL5 Merchants

Understanding this idea is greater than only a enjoyable truth; it has direct, sensible purposes in your buying and selling.

1. Superior Diversification and Danger Administration

Many merchants imagine they’re diversified as a result of they commerce a number of forex pairs. Nonetheless, if you’re lengthy on EUR/USD, GBP/USD, and AUD/USD concurrently, you’re not diversified. These pairs are all positively correlated as a result of they share the USD because the quote forex. If the US greenback strengthens throughout the board, all of your positions will seemingly transfer in opposition to you.

By analyzing correlation, you may construct a really diversified portfolio. You’ll be able to guarantee your EAs aren’t unknowingly tripling down on the identical underlying danger issue. For instance, balancing an extended EUR/USD place with an extended USD/CAD place (a much less correlated pair) gives higher diversification than merely including one other XXX/USD pair.

2. The Energy of Pairs Buying and selling (Statistical Arbitrage)

That is the place issues get thrilling. Pairs buying and selling is a market-neutral technique that thrives on correlation. The method is easy in idea:

-

Discover two extremely correlated belongings. For instance, for example a inventory like Coca-Cola (KO) and PepsiCo (PEP) traditionally have a correlation of +0.85.

-

Monitor their worth relationship. You may observe the ratio of their costs (KO/PEP). Over time, this ratio could have a median (a imply).

-

Look forward to a deviation. Typically, as a consequence of short-term market information, one inventory will outperform the opposite, and the ratio will stretch removed from its imply. As an illustration, KO may need an amazing earnings report and shoot up whereas PEP stays flat.

-

Place the commerce. Believing the historic relationship will maintain, you wager on a “reversion to the imply.” You’d quick the outperformer (KO) and concurrently go lengthy the underperformer (PEP).

-

Exit when the connection reverts. As the worth ratio between them returns to its historic common, you shut each positions for a revenue, no matter whether or not the general market went up or down.

This technique will be powerfully automated in an MQL5 EA, scanning for correlated pairs and statistically important deviations (typically measured by a Z-score) to commerce mechanically.

3. Clever Hedging

Hedging is about defending an current place from opposed strikes. Correlation makes this extremely environment friendly. Think about your EA has a big lengthy place on GBP/JPY, however you are frightened a few sudden rise within the Yen’s worth. As a substitute of simply closing the commerce, you may place a smaller, lengthy place on a pair that’s negatively correlated with GBP/JPY, reminiscent of USD/CHF. If the Yen does strengthen (inflicting GBP/JPY to fall), the seemingly weak spot within the USD would trigger USD/CHF to additionally fall, offsetting a few of your losses.

Placing It into Apply with MQL5

Principle is nice, however how can we really use this in our code? You’ve gotten two fundamental choices: calculate it your self or use an current device.

Calculating Correlation in MQL5

You’ll be able to create a operate inside your EA or indicator to calculate the correlation coefficient between two symbols. Right here’s a fundamental construction of how you’d do it.

Step 1: Get Value Information First, you have to populate two arrays with the historic worth knowledge (e.g., closing costs) for the symbols you need to examine.

string symbol1 = "EURUSD"; string symbol2 = "GBPUSD"; int lookback_period = 50; double array1[], array2[]; CopyClose(symbol1, 0, 0, lookback_period, array1); CopyClose(symbol2, 0, 0, lookback_period, array2);

Step 2: Create a Calculation Perform Subsequent, you should use a operate to course of these arrays and return the correlation coefficient. The Pearson method will be carried out immediately in MQL5.

double CalculateCorrelation(const double &arr1[], const double &arr2[], const int rely) { if(rely <= 1) return 0.0; double sum_X = 0, sum_Y = 0, sum_XY = 0; double squareSum_X = 0, squareSum_Y = 0; for(int i = 0; i < rely; i++) { sum_X += arr1[i]; sum_Y += arr2[i]; sum_XY += arr1[i] * arr2[i]; squareSum_X += arr1[i] * arr1[i]; squareSum_Y += arr2[i] * arr2[i]; } double numerator = (double)(rely * sum_XY - sum_X * sum_Y); double denominator_part1 = (rely * squareSum_X - sum_X * sum_X); double denominator_part2 = (rely * squareSum_Y - sum_Y * sum_Y); if(denominator_part1 <= 0 || denominator_part2 <= 0) return 0.0; double corr = numerator / sqrt(denominator_part1 * denominator_part2); return corr; }

By integrating this into your EA, you can also make dynamic selections. For instance: “Solely take an extended commerce on EUR/USD if its 50-period correlation with GBP/USD is above 0.7.”

Utilizing MQL5 Market Indicators

Need to save time? The MQL5 Market is stuffed with highly effective indicators that may show the correlation between belongings immediately in your chart, typically as a easy line oscillating between -1 and +1. These instruments are improbable for visible evaluation and will be known as out of your EA utilizing the iCustom() operate.

The Huge Warning: Correlation Pitfalls ⚠️

Earlier than you construct your total technique round this idea, it’s essential to perceive its limitations.

-

Correlation is NOT Causation. Simply because two belongings transfer collectively does not imply one is inflicting the opposite to maneuver. A 3rd, unseen issue (just like the power of the US greenback) may very well be influencing each. By no means assume causality.

-

Correlations are Dynamic. The connection between pairs can and can change. A +0.80 correlation can break all the way down to +0.20 in a matter of days throughout main information occasions (like Brexit) or shifts in central financial institution coverage. That is known as correlation breakdown, and it could possibly destroy methods that assume a static relationship. All the time use a rolling correlation calculation slightly than a single, long-term worth.

-

Lookback Interval Issues. A correlation calculated over 20 durations will likely be very delicate and “noisy.” A calculation over 200 durations will likely be smoother however slower to react to adjustments. Discovering the correct lookback interval is essential and depends upon your buying and selling type.

Last Ideas

Pair correlation is not a holy grail. It isn’t a standalone technique that ensures income. As a substitute, consider it as a robust lens by way of which you’ll view the market.

By mastering correlation, you may transfer past single-asset evaluation and begin understanding the intricate net of relationships that drives the monetary world. You’ll be able to construct extra resilient EAs, handle danger extra intelligently, and unlock refined methods which can be out of attain for many retail merchants.

So, dive in. Take a look at a correlation indicator from the MQL5 Market. Add a correlation filter to your current EA. Begin exploring the highly effective world of pairs buying and selling. You may simply uncover the sting you’ve got been in search of.