If you happen to’ve discovered your self with a number of 1095 kinds this tax season, you would possibly surprise what they imply in your tax return. Whether or not it’s Kind 1095-A, 1095-B, or 1095-C, these tax kinds all relate to well being insurance coverage and are essential for understanding your protection, tax credit, and potential liabilities.

The desk beneath gives a fast overview of the completely different 1095 kinds and what they’re for. Click on on any hyperlink to leap to extra detailed sections about every kind.

| Kind | What It Is | Why You May Obtain It | Acquired By |

|---|---|---|---|

| 1095-A | Well being Insurance coverage Market Assertion: For many who bought medical insurance by the net Market. | You had been enrolled in a Market well being plan throughout the tax yr. | Mid-February following the tax yr. |

| 1095-B | Well being Protection: Supplied by insurers to report that you simply had minimal important protection. | You had been lined by medical insurance exterior the Market, like by an employer or authorities program. | Mid-March following the tax yr. |

| 1095-C | Employer-Supplied Well being Insurance coverage Supply and Protection: For workers of firms with 50 or extra full-time workers. | You labored for an employer thought-about an Relevant Massive Employer (50+ workers) and had been provided medical insurance. | Late February or early March following the tax yr. |

At a look:

- You’ll obtain Kind 1095-A if you buy insurance coverage by the Well being Insurance coverage Market.

- Varieties 1095-B and 1095-C are for informational functions solely and don’t have to be reported on private revenue tax returns.

- You probably have several types of medical insurance protection, you might obtain a number of kinds (A, B, and C) in a yr.

What’s a 1095-A kind?

Kind 1095-A, Well being Insurance coverage Market Assertion, is shipped to people who purchased medical insurance by the Well being Insurance coverage Market. It performs an essential function in your tax return because it helps you full Kind 8962, Premium Tax Credit score, which determines in the event you qualify for the premium tax credit score (PTC).

How does Kind 1095-A have an effect on my taxes?

The premium tax credit score defined

The PTC is a refundable tax credit score that helps cowl medical insurance premiums bought by the Well being Insurance coverage Market. Principally, you possibly can select to take advance funds of the premium tax credit score (APTC), that means you obtain the tax credit score upfront to assist decrease your month-to-month premiums as an alternative of ready to assert the total credit score at tax time. On this situation, the Inner Income Service (IRS) sends the month-to-month advance funds on to your well being insurer.

Your family revenue determines eligibility for the APTC. The quantity you obtain relies in your anticipated revenue for the yr. The ultimate credit score quantity is decided by your precise revenue reported in your tax return for that yr. Kind 1095-A will provide help to reconcile your PTC with any tax credit score funds obtained upfront. For instance, in case your revenue is larger than estimated, you will have to pay again a few of your advance funds. But when your revenue was decrease than estimated, you might obtain further fee as a tax refund.

You’ll sometimes obtain Kind 1095-A by mid-February. If you happen to enrolled in Market protection, wait till you may have this type earlier than submitting your revenue tax return to make sure the data you present to the IRS is right.

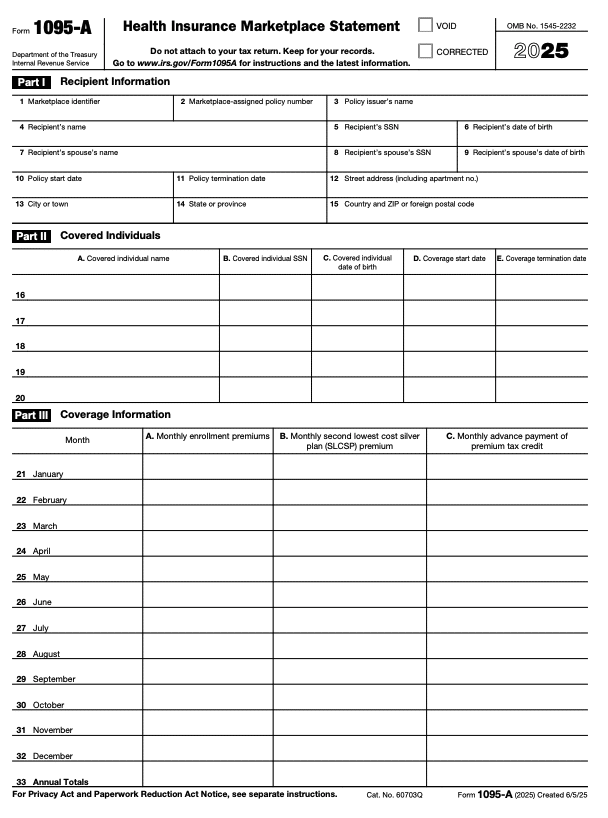

IRS Kind 1095-A instance

Right here’s an instance of what Kind 1095-A seems to be like:

This manner comprises a number of sections, and every part gives essential protection info:

- Half I: Recipient Info – Offers particulars in regards to the recipient of Market protection.

- Half II: Lined People – Lists all lined people, together with relations.

- Half III: Protection Info – Reveals the protection particulars month by month, together with premium funds and any advance funds of the premium tax credit score.

What’s a 1095-B kind?

Kind 1095-B gives proof that you simply had minimal important protection throughout the earlier yr, which is required by the Inexpensive Care Act (ACA). This manner reviews well being protection not lined by Kind 1095-A or Kind 1095-C. You would possibly obtain it straight out of your insurer, the federal government (Medicaid, Medicare Half A, CHIP, VA, and so forth.), or your employer in the event you work for a self-insured small enterprise with fewer than 50 full-time workers.

Insurance coverage suppliers use Kind 1095-B to report the kind of protection, the months of the yr the protection utilized, and the names of people lined by the plan.

Why is this type essential for taxpayers? Previously, a person mandate provision within the ACA required people to have minimal important healthcare protection or face a tax penalty. Whereas the federal particular person mandate penalty is not in impact, some states have their very own medical insurance mandates and should implement penalties for not having minimal important protection except you qualify for an exemption.

California, Massachusetts, New Jersey, Rhode Island, and the District of Columbia impose numerous penalties for not having well being protection. Exemptions differ by state and might embody an absence of affordability or hardship because of monetary . If you happen to suppose you would possibly qualify for an exemption, contact your state’s tax authority.

The 1095-B kind is informational, that means you do not want to file it together with your tax return. Nonetheless, it’s best to hold it together with your different tax data.

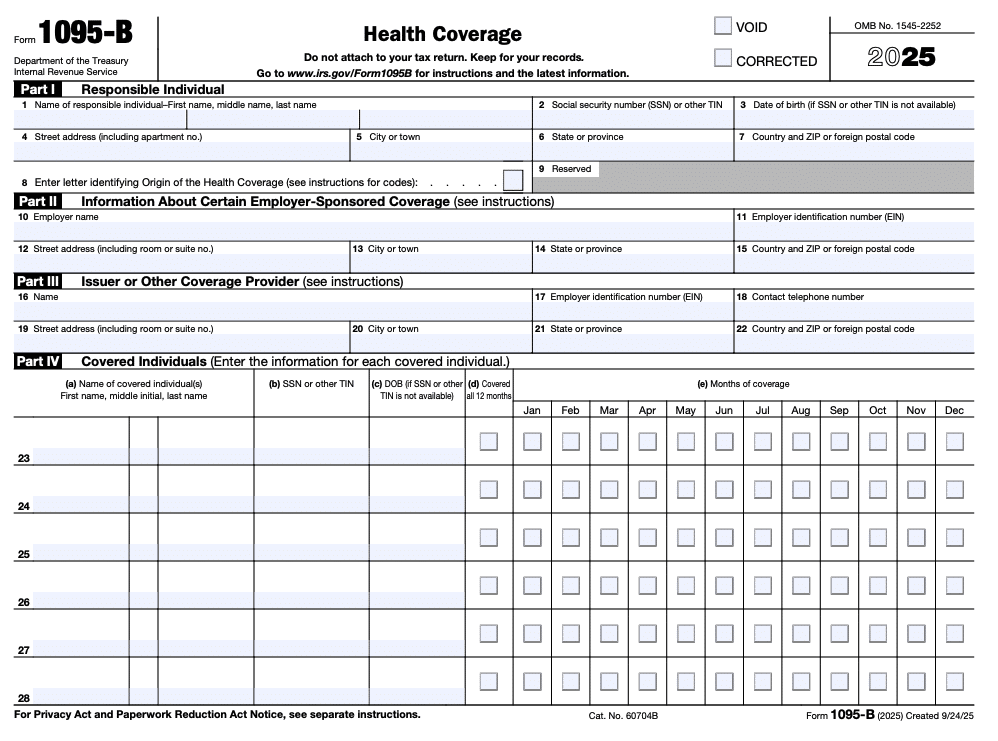

IRS Kind 1095-B instance

Right here’s an instance of what Kind 1095-B seems to be like:

Like 1095-A, this type contains details about your insurance coverage protection:

- Half I: Accountable Particular person – Details about the accountable particular person, normally the first policyholder.

- Half II: Info About Sure Employer-Sponsored Protection – Lists your employer’s title and whether or not your employer sponsors your protection.

- Half III: Issuer or Different Protection Supplier – Offers particulars on the corporate offering the protection.

- Half IV: Lined People – Lists all people lined beneath the plan, akin to dependents. The checked bins point out whether or not every particular person was lined for your complete yr and, if not, which months that they had protection.

What’s a 1095-C kind?

Employers with 50 or extra full-time workers or full-time equal workers, additionally referred to as an relevant massive employer (ALE), problem Kind 1095-C. This manner particulars the employer’s medical insurance protection and whether or not you (the worker) enrolled in protection. It’s used to confirm if the employer met the necessities of the ACA.

If you happen to labored for an ALE, you’ll obtain Kind 1095-C by early March. This manner helps decide eligibility for the premium tax credit score, however identical to Kind 1095-B, it doesn’t have to be filed together with your federal tax return.

IRS Kind 1095-C instance

Kind 1095-C seems to be like this:

The shape is split into three sections:

- Half I: Worker – Normal details about you (title, Social Safety quantity, deal with) and your employer.

- Half II: Worker Supply of Protection – Particulars in regards to the well being care protection plans provided, your age, the months whenever you had been eligible to take part, and when the plan yr started. The IRS has an entire record of codes for line 14 within the directions for Kind 1095-C to point the form of plan provided.

- Half III: Lined People (not pictured) – Info on all relations who additionally enrolled in protection, plus their dates of start and tax identification numbers.

FAQs about Varieties 1095-A, 1095-B, and 1095-C

The place to get a 1095 kind?

Your 1095 kind might be despatched to you by your medical insurance , employer, or the Well being Insurance coverage Market. Typically, it’s best to obtain your 1095 kind(s) within the mail by the next dates:

- Kind 1095-A: mid-February

- Kind 1095-B: mid-March

- Kind 1095-C: early March

If you happen to nonetheless haven’t obtained your 1095 kind by the above deadlines, contact your insurance coverage supplier or employer. Additionally, keep in mind to examine your on-line accounts in case the shape was despatched electronically as an alternative!

How do I get my 1095-A, B, or C kinds on-line?

You might be able to entry your 1095 kinds on-line by your medical insurance supplier, employer, or the Market web site. Log in to your account to view or obtain the shape. You probably have any questions on how one can log in, contact your supplier or employer for help.

Why do I want Kind 1095-B or Kind 1095-C?

Varieties 1095-B and 1095-C are info returns, that means they’re used primarily for informational functions. They show that you simply had medical insurance protection all through the tax yr and ought to be stored in your data, however you don’t usually want these kinds to file your revenue tax return.

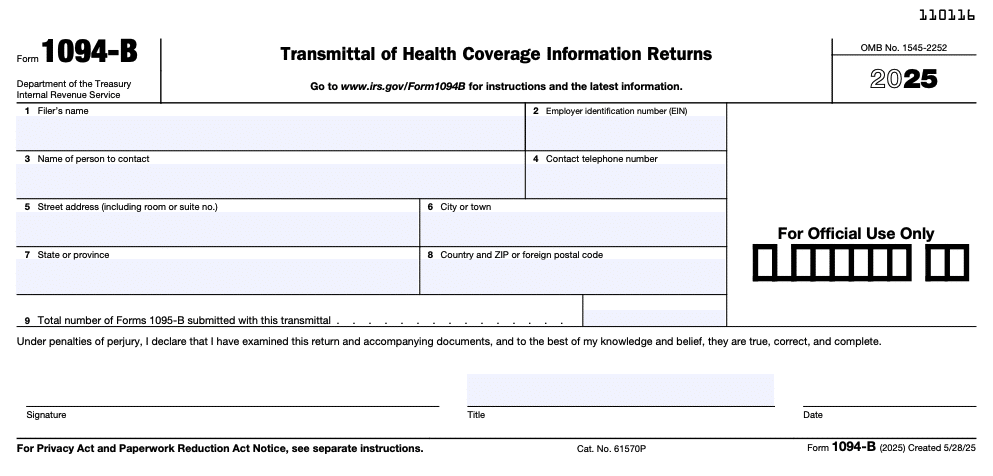

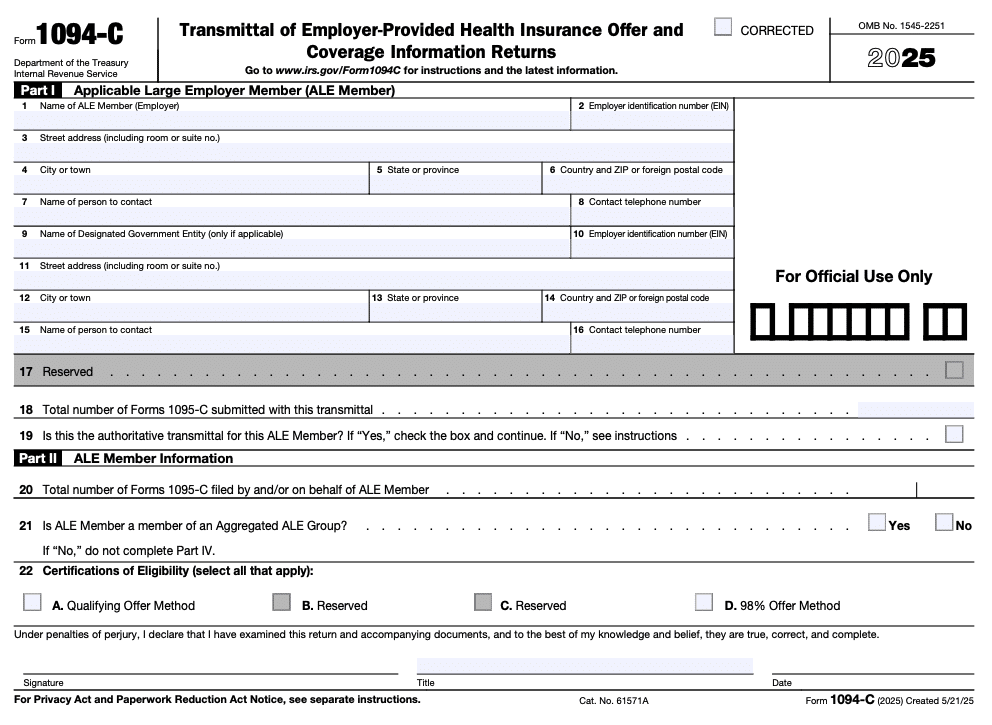

What are Kind 1094-B and Kind 1094-C?

Varieties 1094-B and 1094-C are transmittal kinds that accompany Varieties 1095-B and 1095-C, respectively. These kinds are solely despatched to the IRS, so that you gained’t obtain them as a taxpayer. Briefly, 1095 kinds are for people, whereas 1094 kinds are for the IRS.

Protection suppliers use Kind 1094-B to report a abstract of minimal important protection to the IRS. It seems to be like this:

In the meantime, Kind 1094-C is utilized by employers to report details about employer-provided medical insurance. It seems to be like this:

Can I obtain IRS Kind 1095-A, 1095-B, and 1095-C multi function yr?

Sure, you might obtain a number of kinds in case your healthcare protection modified all year long. For instance, in the event you had been enrolled in a Market well being plan for a part of the yr and later obtained employer-provided protection, you would possibly get each Kind 1095-A and Kind 1095-C.

As one other instance, in the event you work for an organization with 50 or extra workers and the protection offered by that employer is bought by an insurance coverage firm, you’ll obtain 1095-B from the insurance coverage firm and 1095-C out of your employer.

The place do I enter tax info from IRS Kind 1095-A, 1095-B, or 1095-C on my tax return?

If it’s essential file Kind 1095-A with TaxAct®, you are able to do so utilizing our tax preparation software program. We ask you easy Q&A interview questions and information you thru the steps to file. We are able to additionally provide help to add a brand new Kind 1095-A or edit an present one if crucial.

Varieties 1095-B and 1095-C are usually not required to be filed together with your tax return — simply hold them together with your data.

What if I’ve grownup youngsters on my medical insurance plan, however they file their very own tax returns?

Just one Kind 1095 is shipped to the first policyholder. In case your grownup youngsters are lined beneath your well being plan however file their very own tax returns, you’ll want to offer them with copies of the shape.

Do I qualify for the premium tax credit score?

To qualify for the PTC, you could meet the next standards:

- You had been enrolled in medical insurance protection by the Market for a minimum of one month of the calendar yr.

- You didn’t qualify for an employer-sponsored plan that was thought-about inexpensive in your revenue stage.

- You weren’t eligible to enroll in a authorities program akin to Medicare, Medicaid, or CHIP.

- You fall inside sure family revenue limits (extra on that later).

- Nobody else can declare you as a dependent on their tax return.

- Your submitting standing just isn’t married submitting individually. Nonetheless, there are exceptions for some victims of home abuse and spousal abandonment — the IRS addresses these situations on its PTC FAQ web page.

How a lot can I make earlier than I not qualify for a premium tax credit score?

The PTC begins phasing out for these incomes 100% to 400% of the federal poverty line. Nonetheless, the revenue limits are larger in the event you reside in Hawaii or Alaska.

You’ll be able to reference the 2025 poverty pointers web page to search out the revenue limits that apply to residents of the 48 contiguous states for tax yr 2025, primarily based on household measurement. Revenue limits are tied to inflation every year. Sometimes, the decrease your revenue, the extra provide help to obtain by a premium tax credit score. You don’t qualify for the premium tax credit score in case your revenue is above the higher restrict.The poverty pointers web page additionally contains completely different figures for Hawaii and Alaska residents.

How do I calculate my family revenue for the premium tax credit score?

To find out your family revenue for the PTC, begin together with your adjusted gross revenue (AGI). Your adjusted gross revenue contains all of your taxable revenue, diminished by “changes,” together with deductions and retirement plan contributions.

Add again the next gadgets to calculate your family revenue:

- Non-taxable Social Safety advantages

- Tax-exempt curiosity revenue

- Excluded overseas revenue

TaxAct may also help right here — our software program calculates your family revenue and allowable credit score for you making it simple to find out your revenue.

If my revenue disqualifies me from advance credit score funds I’ve already obtained, how a lot might I’ve to pay again?

Let’s say your revenue was greater than you anticipated throughout a yr whenever you obtained advance credit score funds, and your revenue is above 400% of the federal poverty stage. In that case, your advance credit score funds have to be paid again. Nonetheless, in the event you made greater than you anticipated however your revenue remains to be beneath 400% of the federal poverty stage, there’s a compensation limitation on the quantity you could repay.

For instance:

- In case your revenue is lower than 200% of the federal poverty stage ($31,300 for a person in 2025), you’ll not must pay again greater than $350 of advance credit score funds as a single filer (and not more than $700 for different submitting statuses).

- In case your revenue is lower than 300% of the federal poverty stage, the utmost quantity you’ll pay again as a person is $900.

- In case your revenue is lower than 400% of the federal poverty stage, you gained’t must pay again greater than $1,500 as a person.

How you can report 1095 kinds with TaxAct

To enter or overview Kind 1095-A within the TaxAct program:

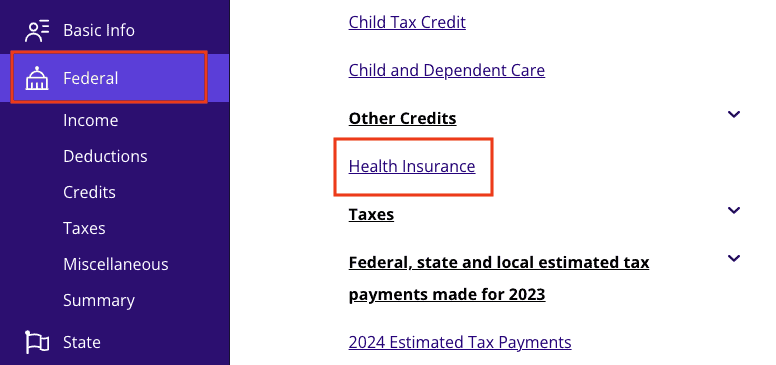

- From inside your TaxAct return (On-line or Desktop), click on Federal. (On smaller gadgets, click on within the high left nook of your display, then click on Federal).

- Click on Well being Insurance coverage as proven beneath.

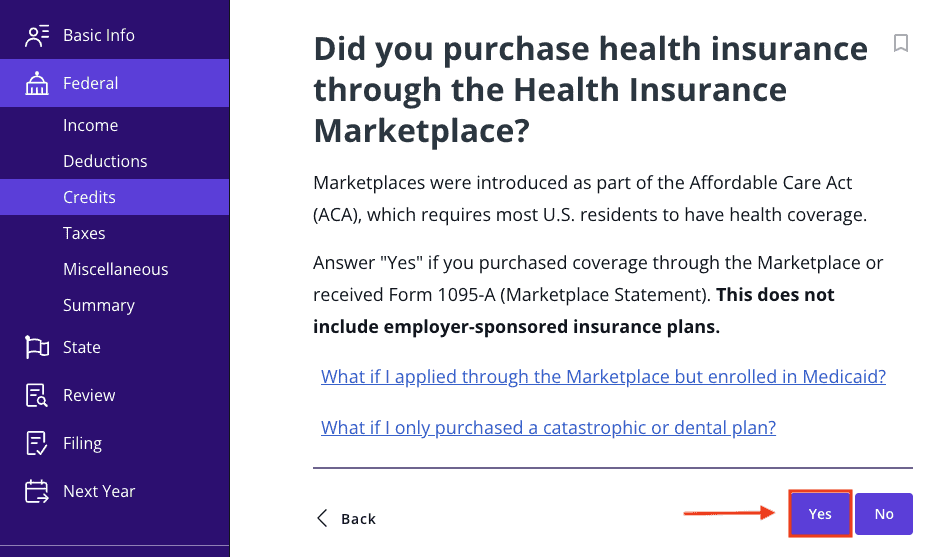

3. Click on Sure, as proven beneath, after which click on Proceed.

4. Proceed with the interview course of to enter your info.

Keep in mind, Varieties 1095-B and 1095-C don’t have to be filed together with your tax return, however it’s best to hold them together with your different tax paperwork.

The underside line

Whereas Kind 1095-A is essential for individuals who bought insurance coverage by the Market, Varieties 1095-B and 1095-C are primarily informational. Hold these tax kinds useful in your data and use TaxAct’s useful tax preparation software program to information you thru the submitting course of. We’re right here to assist make your tax submitting expertise as clean as attainable!

This text is for informational functions solely and never authorized or monetary recommendation.

All TaxAct gives, services are topic to relevant phrases and circumstances.