This text explains what harmonic patterns are, how merchants use them in numerous markets (particularly Foreign exchange), and the way they join with Fibonacci ratios, all based mostly on the work of Scott M. Carney.

Who’s Scott M. Carney?

Scott M. Carney is the president and founding father of HarmonicTrader.com.

He developed a full buying and selling strategy based mostly on value sample recognition and Fibonacci measurements, generally known as Harmonic Buying and selling.

He launched and named a number of fashionable harmonic patterns similar to:

-

The Bat Sample

-

The Gartley Sample

-

The Crab Sample

Carney additionally launched key ideas just like the Potential Reversal Zone (PRZ) and essential Fibonacci ranges similar to 0.886 and 38.2% retracements.

He’s a member of the Market Technicians Affiliation (MTA) and the American Affiliation of Skilled Technical Analysts (AAPTA).

He has printed 4 books on harmonic buying and selling:

-

The Harmonic Dealer (1999)

-

Harmonic Buying and selling of the Monetary Markets, Quantity 1 (2004)

-

Harmonic Buying and selling of the Monetary Markets, Quantity 2 (2007)

-

Harmonic Buying and selling, Quantity 3: Response vs Reversal (2016)

What Are Harmonic Patterns?

Harmonic buying and selling helps merchants determine high-probability reversal factors out there.

This strategy assumes that market actions — like many pure cycles — are inclined to repeat themselves.

The aim is to determine these recurring value patterns and commerce them when the chance of a development change is excessive.

Harmonic patterns work on all timeframes — from intraday charts (1H, 4H) to day by day and weekly charts.

Swing merchants typically want day by day charts, whereas short-term merchants discover many alternatives on decrease timeframes.

The Core Concept

Crucial a part of harmonic buying and selling is recognizing particular value cycles that comply with exact Fibonacci ratios.

These ratios assist merchants determine potential reversal zones (PRZ) — areas the place the pure rhythm of the market is more likely to change route.

These reversals occur due to crowd psychology — merchants are inclined to react in comparable methods at sure Fibonacci ranges.

Nevertheless, not all PRZ zones work completely.

It’s essential to analyze value motion round these zones and search for affirmation indicators similar to candlestick patterns, quantity, or divergences.

If robust continuation candles or gaps seem, the sample may be invalid.

At all times look ahead to affirmation earlier than getting into a commerce.

Validating Harmonic Patterns

Every sample has strict guidelines based mostly on Fibonacci ratios.

Even small variations could make a sample invalid.

For instance:

The B level is vital — it helps distinguish between similar-looking patterns just like the Bat and the Gartley.

On the PRZ (Potential Reversal Zone), merchants can use quantity or divergence indicators to substantiate whether or not the worth is able to reverse.

The Core AB=CD Sample

The AB=CD sample is the inspiration of most harmonic constructions.

It represents a measured and symmetrical transfer in value that completes contained in the PRZ.

The Essential Harmonic Patterns by Scott Carney

Under are essentially the most well-known harmonic patterns, their traits, and what they inform merchants.

1. The Gartley Sample

Found by H.M. Gartley, that is the unique harmonic sample.

It indicators potential reversals utilizing Fibonacci retracements and extensions.

Key options:

-

5 factors (X, A, B, C, D)

-

AB = 61.8% retracement of XA

-

BC = 38.2% or 88.6% of AB

-

CD = 127.2% (if BC = 38.2%) or 161.8% (if BC = 88.6%) of BC

-

CD = 78.6% retracement of XA

-

D = PRZ (Potential Reversal Zone)

📈 Instance: Bullish and Bearish Gartley patterns on EUR/USD (H4)

📈 Instance: Bearish Gartley patterns on EUR/USD (H4)

2. The ABCD Sample

The only harmonic sample with 4 factors and three value swings.

As soon as legs AB and BC are outlined, the size of AB is projected from level C to seek out level D.

Key options:

-

BC = 61.8% or 78.6% of AB

-

CD = equal to AB (AB=CD)

-

Extensions will be 127.2% or 161.8%

-

D = completion level and PRZ

📈 Instance: Bullish AB=CD on EUR/JPY (H1)

📈 Instance: Bearish AB=CD on Gold Every day.

3. The Bat Sample

Found by Scott Carney in 2001, this is among the most correct harmonic setups with a excessive success charge.

Key options:

-

B level retracement: 38.2%–50% of XA (under 0.618)

-

BC retracement: 38.2%–88.6% of AB

-

CD retracement: as much as 88.6% of XA

-

CD extension: 161.8%–261.8% of AB

-

D = PRZ for potential reversal

📈 Instance: Bullish Bat on SP500 (Every day)

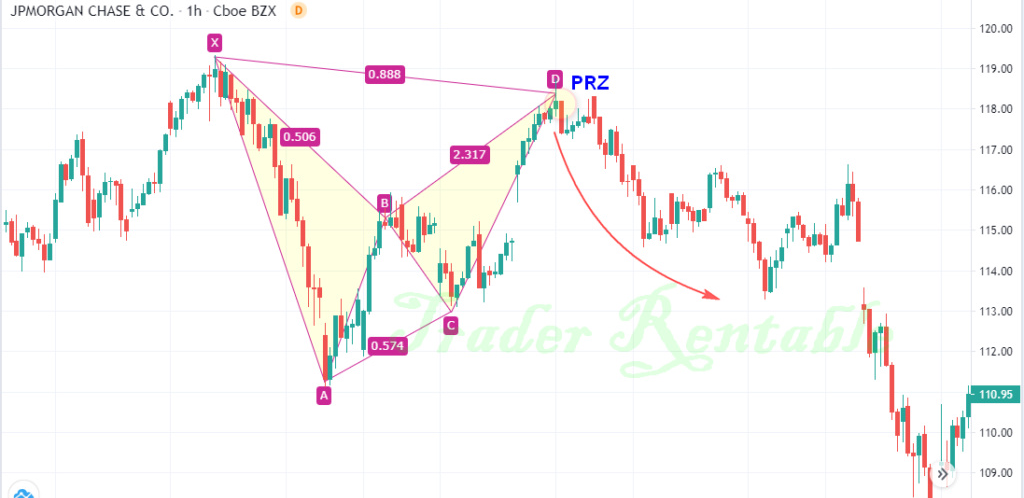

📈 Instance: The Bearish Bat on JP MOrgan Chase (H1)

4. The Crab Sample

One other exact sample from Scott Carney (2000).

It typically exhibits very sharp reversals close to the PRZ.

Key options:

-

AB = ≤ 61.8% of XA

-

BC = 38.2% or 88.6% of AB

-

CD = 161.8% extension of XA

-

CD extension: 224%–361.8% of BC

-

D = PRZ (Potential Reversal Zone)

📈 Instance: Bullish Crab on Fb (15min)

📈 Instance: Double Bearish Crab Dow jones (M15).

5. The Butterfly Sample

Found by Bryce Gilmore and refined by Scott Carney.

It appears to be like just like the Gartley sample however has totally different Fibonacci ratios.

Key options:

📈 Instance: Bullish Butterfly on GBP/USD (H1)

📈 Instance: Bearish Butterfly on NETFLIX (M30)

6. The 5-0 Sample

Launched in Harmonic Buying and selling Quantity 2 by Carney.

It’s a retracement-based sample that focuses on the 50% stage of the BC leg.

Key options:

-

AB = 113%–161.8% extension of XA

-

BC = 161.8%–224% extension of AB

-

CD ends close to 50% retracement of BC

-

D = PRZ (entry level)

📈 Instance: Bullish 5-0 on EUR/USD (15min)

📈 Instance: Bearish 5-0 sample on AUD/USD (H1) .

7. The Shark Sample

Found by Scott Carney in 2011, the Shark sample is just like the Crab however contains an prolonged C leg.

Key options:

📈 Instance: Bullish Shark on Nikkei 225 (5min)

📈 Instance: Bearish Shark, Bitcoin (M30).

Conclusion

Harmonic buying and selling is a sophisticated technical evaluation methodology that mixes chart patterns with Fibonacci ratios to determine potential turning factors out there.

It may be utilized to Foreign exchange, shares, crypto, and commodities — on any timeframe.

Nevertheless, it requires endurance, apply, and strict cash administration.

Invalid ratios imply invalid patterns — and that’s the place many new merchants make errors.

At all times verify with candlestick indicators, quantity, or momentum indicators like MACD earlier than getting into a commerce.

Combining harmonic patterns with affirmation instruments helps you’re taking high-probability trades with minimal threat and robust revenue potential.

Our Weblog posts

Excel ProTrading Analytics Template