Dogecoin slipped for a second straight session as heavy whale distribution and technical weak spot overshadowed optimism surrounding Bitwise’s anticipated spot DOGE ETF launch inside 20 days.

Information Background

Bitwise Asset Administration confirmed that its spot Dogecoin ETF could launch inside 20 days below the Part 8(a) automatic-approval rule, pending no SEC intervention. The transfer follows final week’s debut of SOL, LTC, and HBAR ETFs on Wall Avenue and indicators accelerating institutional product growth throughout the meme-coin phase.

Grayscale additionally amended its personal spot DOGE ETF submitting, initiating an identical countdown interval. The parallel efforts underscore how regulators’ passive stance below Part 8(a) may fast-track listings even with out express SEC endorsement.

Regardless of the broader optimism, DOGE’s value motion decoupled sharply from the ETF narrative as massive holders liquidated positions into power. On-chain information recorded over 1 billion DOGE (~$440 million) moved by whale wallets up to now 72 hours—aligning with the heaviest distribution week since early October.

Worth Motion Abstract

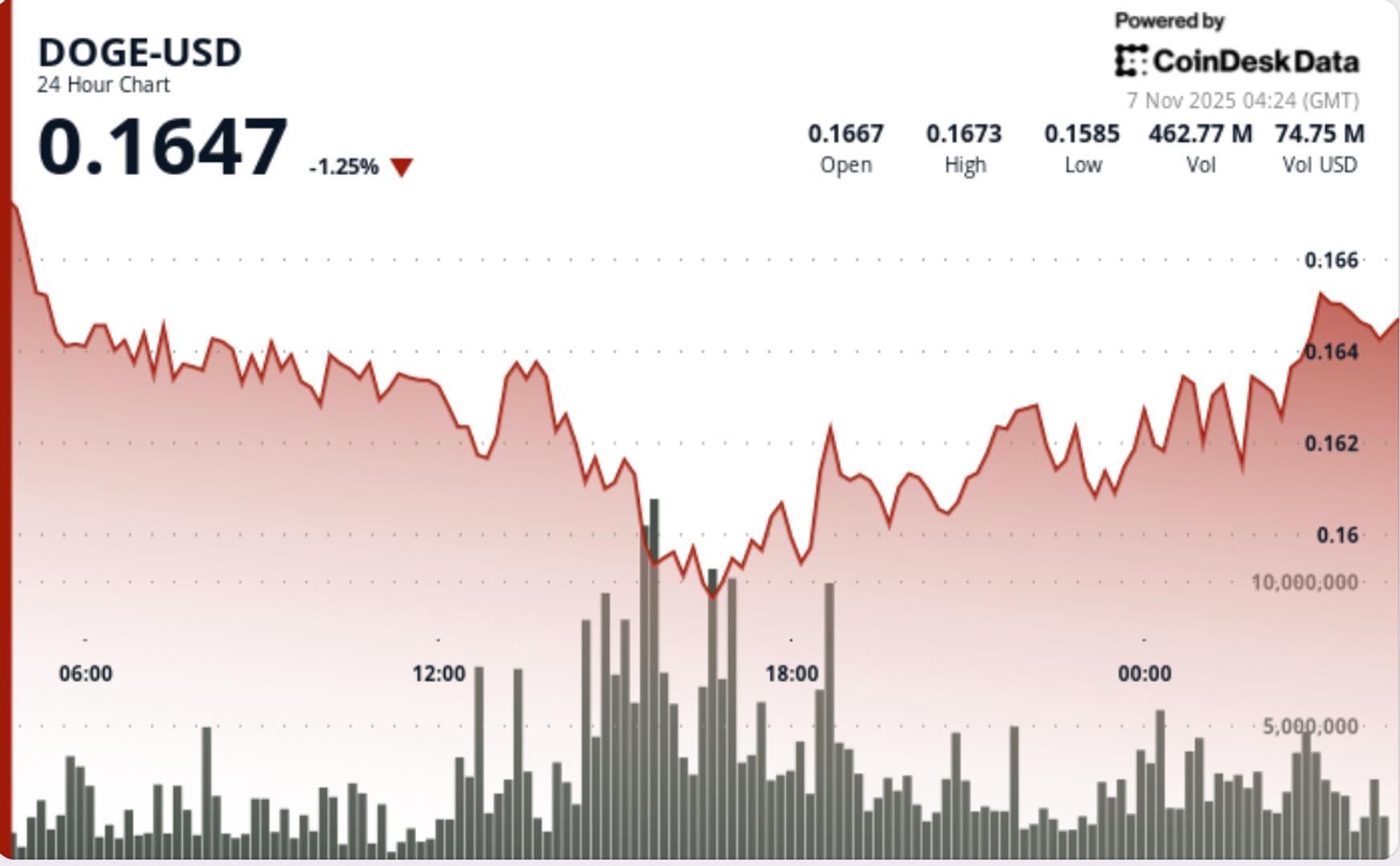

DOGE fell 2.4% to $0.1634 over the 24-hour session, breaking beneath $0.167 assist amid accelerating selloffs. The token traded by means of a 6.4% intraday vary, establishing sequential decrease highs through the first 16 hours of buying and selling.

The sharpest drop hit at 15:00 GMT, when quantity surged to 793.4 million tokens—roughly 150% above common—driving DOGE to its session low at $0.1590. A number of rebound makes an attempt failed at $0.1639 resistance, confirming persistent provide overhead.

Late buying and selling introduced stabilization as DOGE rebounded from $0.1615 to shut close to $0.1631, with final-hour exercise averaging 6.2 million tokens per minute—barely above the norm and signaling measured re-entry from institutional contributors.

Technical Evaluation

The session produced a textbook breakdown-and-retest sample, confirming short-term bearish management whereas hinting at attainable base formation. Descending highs from the open validated resistance close to $0.1674, whereas the late-session increased lows at $0.1615–$0.1625 established the early framework for a possible reversal.

Momentum indicators stay combined. RSI recovered from near-oversold territory (38–42 band), and MACD flattening suggests decelerating draw back momentum. Nevertheless, with combination futures open curiosity declining 12% and funding charges flipping unfavorable on Binance, speculative urge for food stays subdued.

The amount profile helps a transition part—heavy distribution early adopted by measured accumulation late within the session. This construction typically precedes short-term consolidation earlier than volatility compresses forward of a decisive breakout.

What Merchants Ought to Know

Merchants now deal with whether or not DOGE can defend $0.1575–$0.1615 assist whereas ETF-driven sentiment builds. The ETF countdown may act as a volatility catalyst, however technicals stay fragile till value closes above $0.1674.

If bulls reclaim that stage, short-term upside targets align with $0.172–$0.180, coinciding with pre-breakdown provide. Conversely, failure to carry $0.1575 dangers exposing the $0.15 psychological zone, the place on-chain value foundation information clusters.

The interaction between ETF headlines and whale flows will doubtless dictate near-term route: sustained outflows from massive holders may cap any ETF-driven optimism by means of mid-November.