The Markup Section of a Bull Market is wonderful to behold and take part in. However they do ebb and circulate. The bullish run within the main inventory indexes has been persistent in 2024. We regularly focus on the quarter-end impact for inventory index traits and the upward pattern has persevered into the top of the primary quarter with diminishing momentum. Let’s flip our consideration to some traditional and highly effective Wyckoff chart research to find out the current place and attainable future route of the indexes because the second quarter begins.

The Markup Section of a Bull Market is wonderful to behold and take part in. However they do ebb and circulate. The bullish run within the main inventory indexes has been persistent in 2024. We regularly focus on the quarter-end impact for inventory index traits and the upward pattern has persevered into the top of the primary quarter with diminishing momentum. Let’s flip our consideration to some traditional and highly effective Wyckoff chart research to find out the current place and attainable future route of the indexes because the second quarter begins.

S&P 500 Index with Wyckoff Markups. 2021-2024

S&P 500 Index with Wyckoff Markups. 2021-2024

This each day chart of the S&P 500 must be acquainted to common readers. It’s our Wyckoffian report of market construction going again to the bull market peak of 2021. It’s a real-time journal of our Wyckoff Evaluation by way of the Distribution Construction, the Markdown, the Accumulation Section of 2022-23 and now the Markup. The Markup lastly exceeded the rangebound situation of the Accumulation with the advance that started in October of ’23. We had been making the case for the unfolding Accumulation right here and within the Wyckoff Market Discussions (each Wednesday with Roman Bogomazov) all through the Accumulation interval.

Just lately the S&P 500 climbed above the properly outlined Markup channel right into a Throwover and OverBought situation. This OverBought / ThrowOver has arrived because the First Quarter was coming to a conclusion. Thus suggesting ‘Window Dressing’ shenanigans by institutional sorts. Typically robust traits within the indexes (each upwards and downwards) can comply with by way of and persist for a number of weeks into the brand new quarter. We are going to look ahead to a change of character within the habits of the indexes within the Second Quarter. An instance of this could be a reversal of the S&P 500 again into the upward striding Development Channel. A sudden and sharp break again into the channel could be labeled an Automated Response (AR) and would characterize an necessary affirmation of the upward pattern exhaustion. Till such an occasion the upward pattern have to be revered.

We anticipate the upward stride of a Markup section to be broad and robust and such is the case right here. Recall that Accumulation is a zone of deepening pessimism the place the general public and establishments turn out to be progressively extra cautious. Such warning manifests as portfolio defensiveness (larger ranges of money, decrease beta shares and extra bond sort property). In the meantime the ‘Composite Operator’ sorts are absorbing shares with good progress and worth options for the following bull market. This places shares in very robust fingers. This Provide to Demand imbalance may end up in inventory indexes launching larger following the preparation section of Accumulation. As Accumulation concludes broad pessimism is noticed within the excessive pessimism readings of assorted sentiment gauges (which have been profiled in Energy Charting and on WMD on the time).

Level and Determine Worth Goals

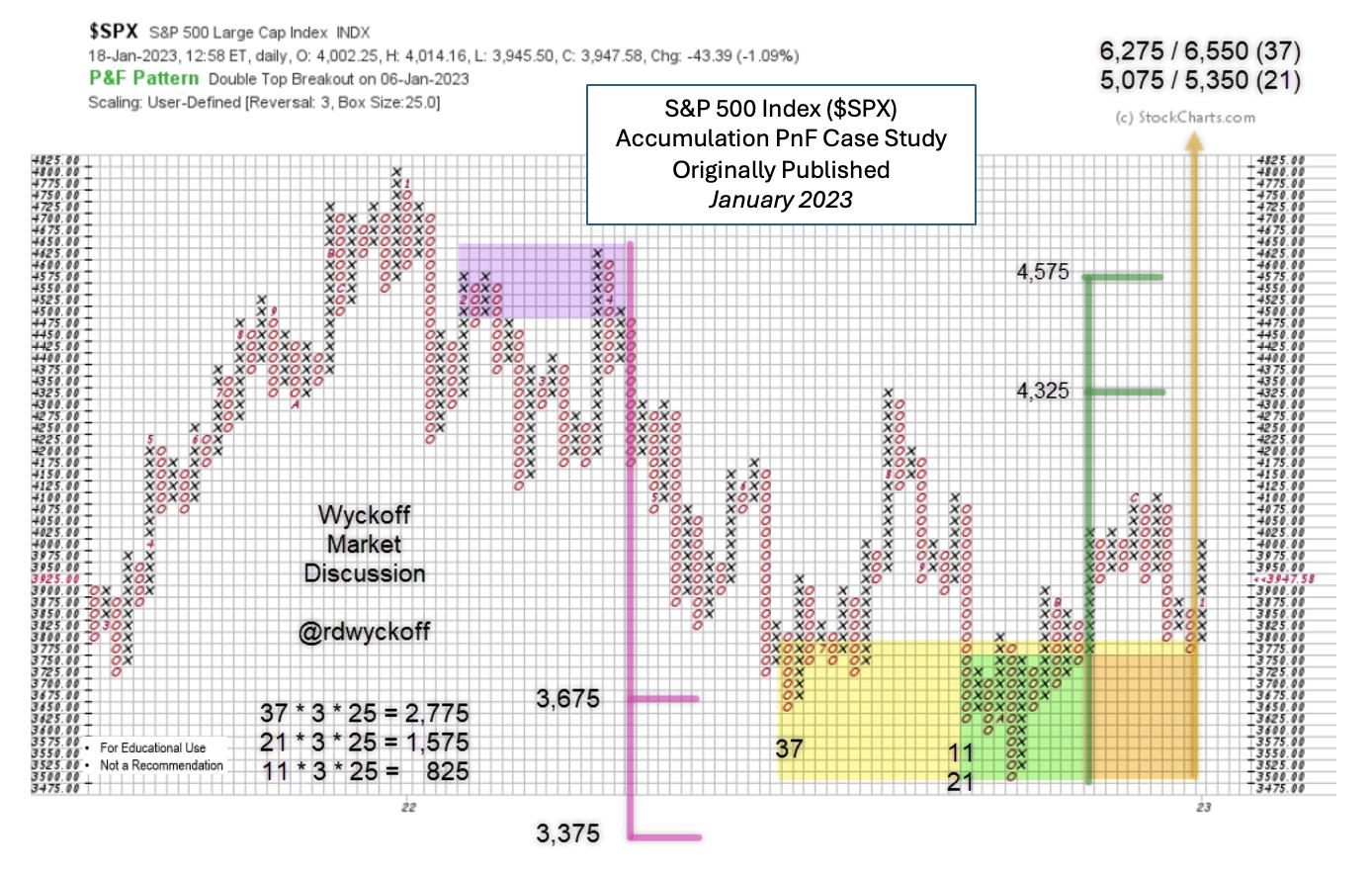

S&P 500 Level & Determine Research. January 2023

S&P 500 Level & Determine Research. January 2023

This PnF legacy chart was first profiled in January of 2023. It estimated the draw back potential of the bear market, which was fulfilled with a Promoting Climax and a Secondary Take a look at. The Climax initiated Accumulation (detailed within the vertical chart above) that continued all through the second half of 2022. In January of ’23 the upside of the almost accomplished Accumulation was estimated in three segments. The primary two segments have now been fulfilled. Word the Rely Line was 3,775 and the $SPX was at 4,000 when this projection was made and printed. Pessimism on the time was such that this research was met with a lot disbelief, an excellent signal for the upper costs but to come back because the indexes started climbing the ‘Wall of Fear’.

Under is a PnF replace with the Markup section. Second section worth targets at the moment are being fulfilled. New worth highs above the 2021 bull market peak have markedly swelled bullish sentiment. Analyst sorts at the moment are speeding to make projections for the $SPX above 6,000 and even 7,000. This bulge of optimism is a warning signal that warning is warranted.

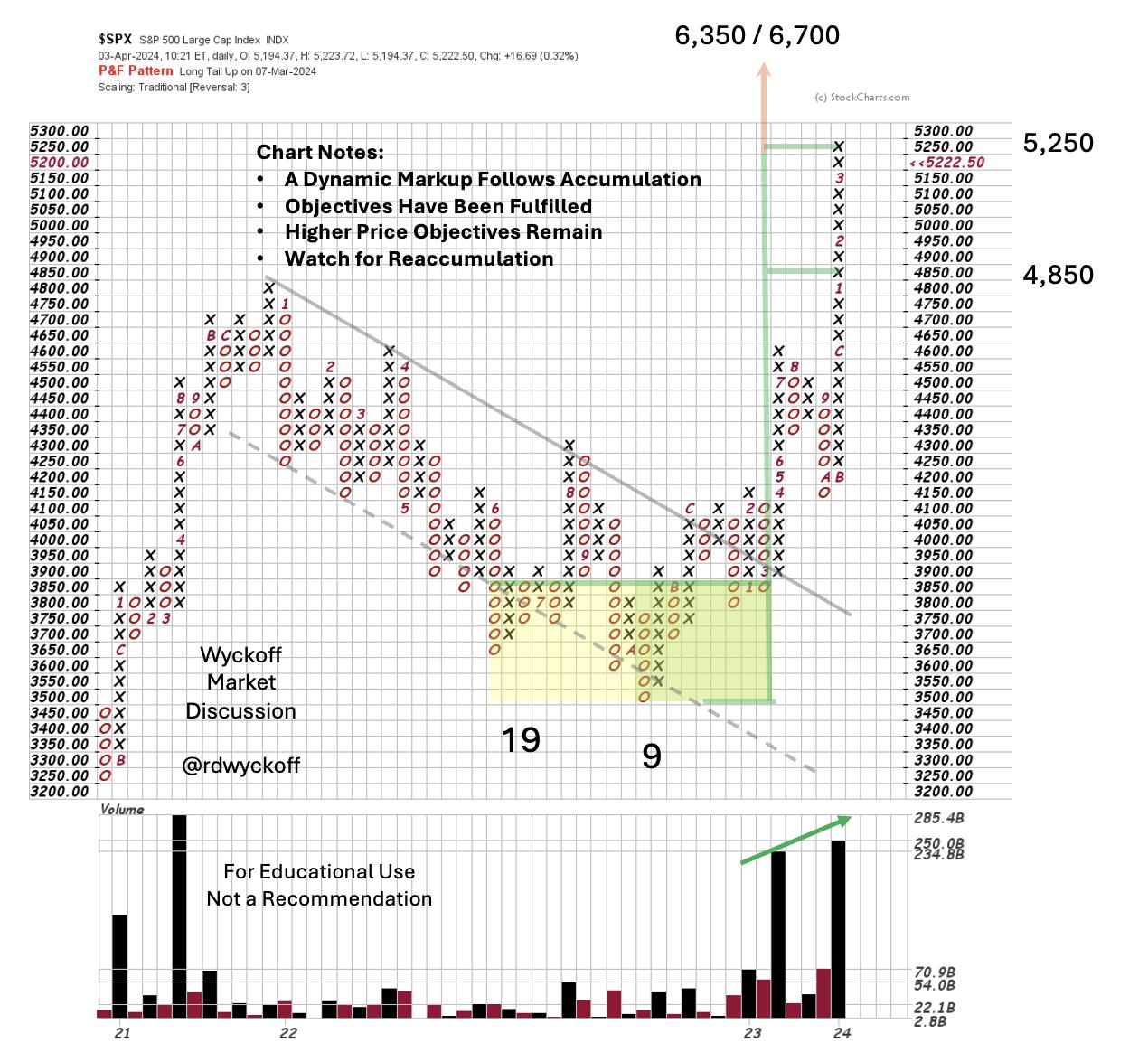

S&P 500 Level & Determine Research, 50 Level Scale. April 2024

S&P 500 Level & Determine Research, 50 Level Scale. April 2024

The present interpretation of the 2022-23 Accumulation exhibits the strong Markup following the Accumulation (50 level scaling barely adjustments the worth targets). As soon as the downward pattern channel was damaged and examined from above the upward stride was dramatic. Index costs have now Upthrusted the bull peak of 2021 the place a Backup to previous resistance is probably going.

Trifecta of Bother (a abstract)

1) The S&P 500 is now above the upward stride of its pattern channel. This OverBought situation might result in a correction and could be confirmed by return into the channel. Previous resistance from the 2021 bull peak could be a worth degree to anticipate help to develop.

2) Level & Determine Worth Goals generated in early 2023 at the moment are being fulfilled. Watch for traditional indicators of stopping motion akin to an Automated Response and range-bound sideways buying and selling. This might generate PnF rely potential for both ReAccumulation or Distribution. Larger worth targets stay and there’s good seasonality within the second half of this election yr. We are going to watch the tape for additional indications.

3) Sentiment has flipped from bearish to bullish. Excessive readings from the NAAIM, AAII, CNN Worry & Greed and different necessary gauges are frothy. That is regular and typical in a Bull Market because the upward stride of the pattern ebbs & flows. Corrections of the uptrend convey again warning and even pessimism which builds money for larger costs sooner or later.

A dynamic Markup may be very thrilling, necessary, and to not be missed. Corrections alongside the way in which are inevitable. They typically characterize rotation of management because the financial system matures and adjustments character and that seems to be the case right here (topic for future WPC weblog posts).

All of the Finest,

Bruce

@rdwyckoff

Disclaimer: This weblog is for instructional functions solely and shouldn’t be construed as monetary recommendation. The concepts and techniques ought to by no means be used with out first assessing your individual private and monetary state of affairs, or with out consulting a monetary skilled.

Announcement

Wyckoff Market Dialogue – Free Open Door Session. Wednesday April 10, 2023, 3pm PT

Be part of Roman Bogomazov and me for a FREE session of the Wyckoff Market Dialogue. From a Wyckoffian perspective we focus on the present state of key monetary markets.

Register to attend this free session (CLICK HERE)

To Study extra concerning the WMD collection (click on right here)

Bruce Fraser, an industry-leading “Wyckoffian,” started instructing graduate-level programs at Golden Gate College (GGU) in 1987. Working intently with the late Dr. Henry (“Hank”) Pruden, he developed curriculum for and taught many programs in GGU’s Technical Market Evaluation Graduate Certificates Program, together with Technical Evaluation of Securities, Technique and Implementation, Enterprise Cycle Evaluation and the Wyckoff Methodology. For almost three many years, he co-taught Wyckoff Methodology programs with Dr.

Study Extra