Foreign exchange Abstract (2021-2024):

*Efficiency:*

- – 2021 Revenue: 87.58%

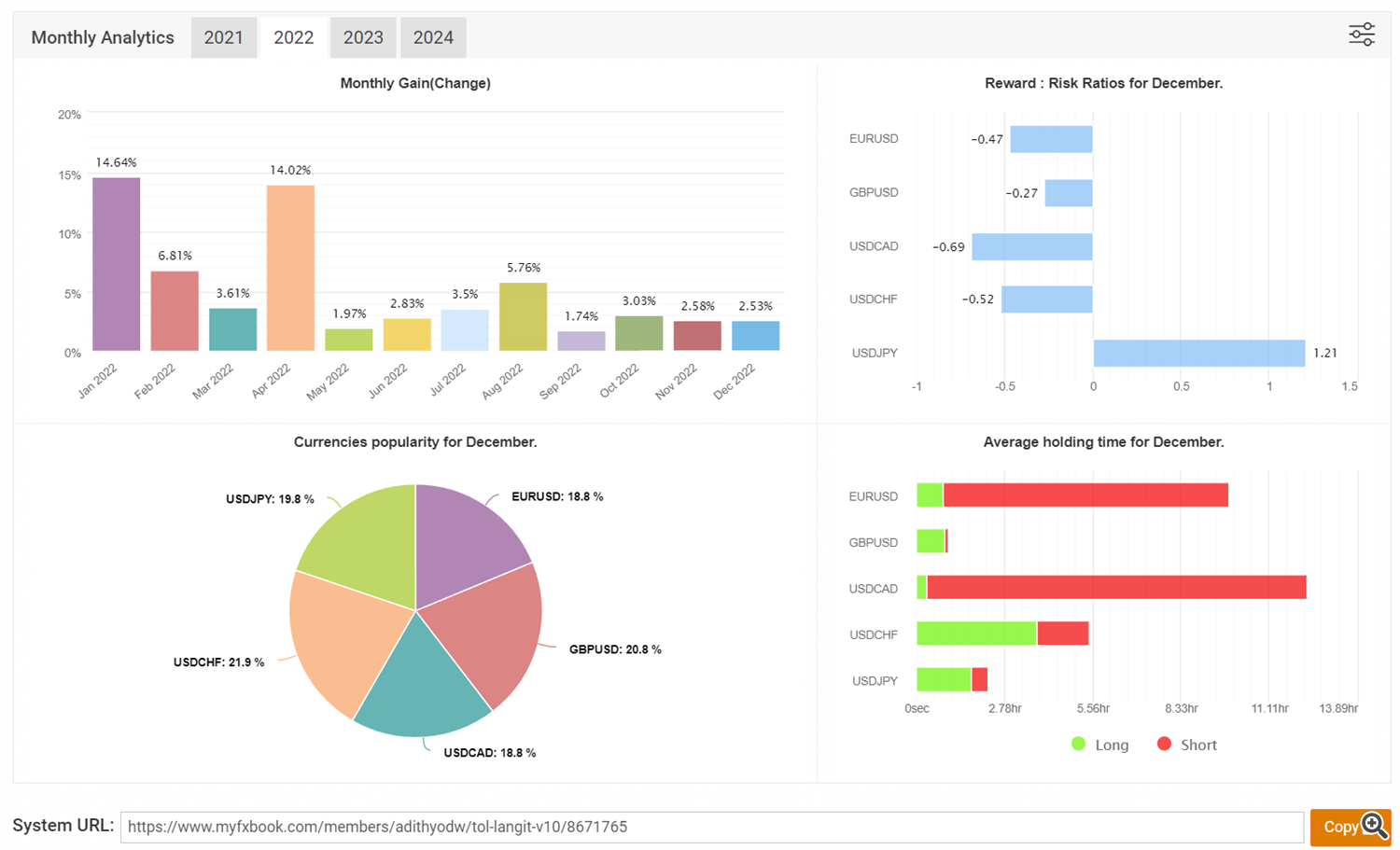

- – 2022 Revenue: 83.06%

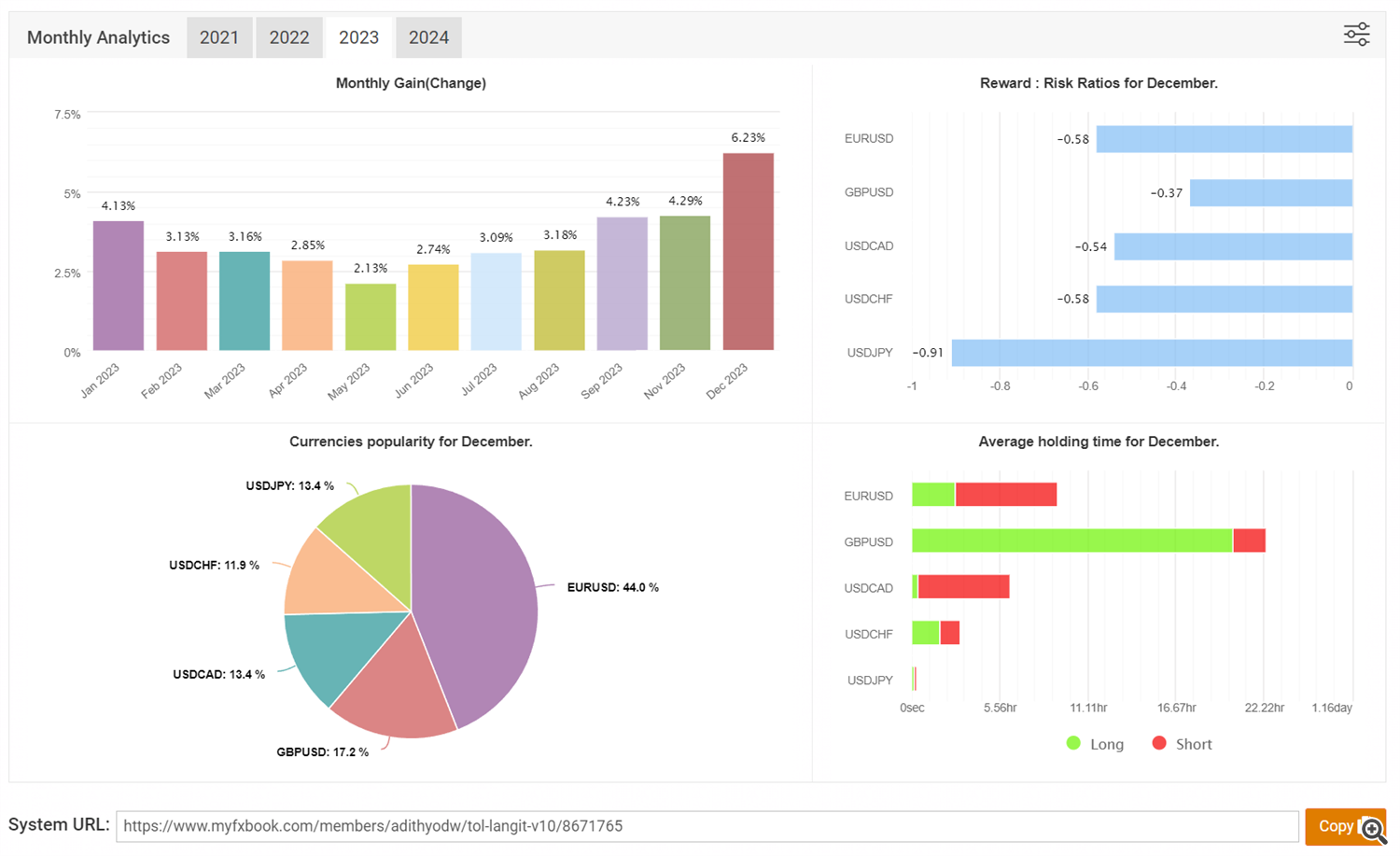

- – 2023 Revenue: 46.87%

*Technique Overview:*

Regardless of market volatility, our technique stays centered on a secure 3-5% month-to-month return with a really low-risk setup (0.01 per $1000). With a low-risk and secure system, we managed to outlive the unstable markets all through 2021-2023.

FREE LIVE SIGNAL : https://t.me/tol_langit

Main occasions affecting the foreign exchange market from 2021 to 2024:

1. COVID-19 Pandemic (2020-present):

Preliminary Panic (2020-2021): Widespread market volatility, threat aversion, and flight to protected havens just like the US greenback. Rising market currencies skilled important depreciation.

Restoration and Coverage Divergence (2021-2022): Gradual market restoration and differentiation in financial coverage throughout main economies. US Greenback initially strengthened as a consequence of quicker vaccine rollout and Fed hawkishness, however later weakened as different economies recovered.

New Variants and Uncertainties (2023-2024): Emergence of latest COVID-19 variants triggered short-term market turbulence however much less extreme than initially. Focus shifted to inflation and geopolitical tensions.

2. US Elections:

2020 US Presidential Election: Restricted instant influence on foreign exchange markets as Biden’s victory was largely anticipated. Nonetheless, longer-term coverage considerations concerning stimulus and financial spending doubtlessly influenced market sentiment.

2022 Midterm Elections: Republican beneficial properties in Congress raised potential for coverage gridlock and lowered fiscal spending, initially strengthening the US greenback however later fading as a consequence of continued financial momentum.

3. Ukraine-Russia Conflict (2022-present):

Instant Shock (2022): Important volatility and threat aversion, with protected haven currencies like USD, CHF, and JPY appreciating in opposition to riskier belongings. Russian Ruble plummeted as a consequence of sanctions and financial disruption.

Protracted Battle and Vitality Disaster (2023-2024): Conflict’s continuation fueled international inflation and exacerbated power disaster, impacting currencies of energy-dependent economies. Euro initially weakened as a consequence of proximity to the battle however later stabilised.

4. Different Key Occasions:

Central Financial institution Coverage Divergence: Financial coverage choices by main central banks, notably the US Federal Reserve’s rate of interest hikes and quantitative tightening, considerably impacted forex valuations.

World Provide Chain Disruptions: Ongoing provide chain bottlenecks and rising commodity costs contributed to inflationary pressures and influenced forex efficiency.

Cryptocurrency Volatility: Booms and busts within the cryptocurrency market sometimes spilled over into conventional foreign exchange markets, impacting threat urge for food and buying and selling sentiment.

Risky Markets:

Rising Market Currencies: Typically extra delicate to international financial shocks and coverage modifications, experiencing greater volatility in comparison with main currencies.

Commodity-Linked Currencies: These tied to particular commodities (e.g., oil, metals) have been closely influenced by fluctuations in these commodity costs.

Currencies with Geopolitical Dangers: Currencies of nations experiencing political instability or conflicts have been vulnerable to greater volatility.