For a lot of this cycle, International Liquidity has been one of the crucial correct indicators for anticipating Bitcoin’s value motion. The connection between cash provide enlargement and risk-asset development has been properly established, and Bitcoin has adopted that script remarkably intently. But lately, we’ve been paying shut consideration to a few different knowledge factors which were statistically much more correct in predicting the place Bitcoin is headed subsequent. Collectively, these metrics assist paint a clearer image of whether or not Bitcoin’s latest stagnation represents a short-term pause or the start of an extended consolidation section.

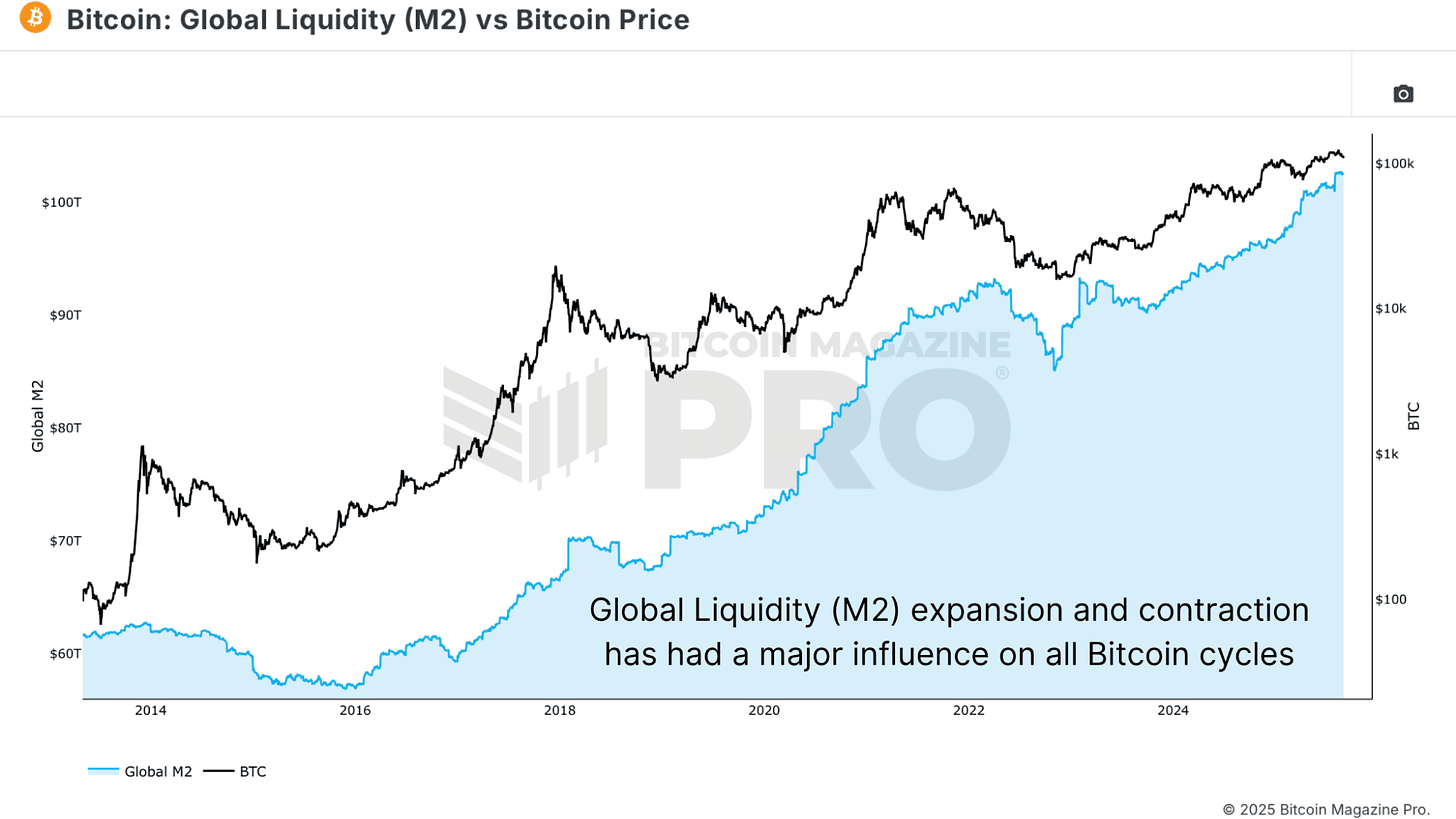

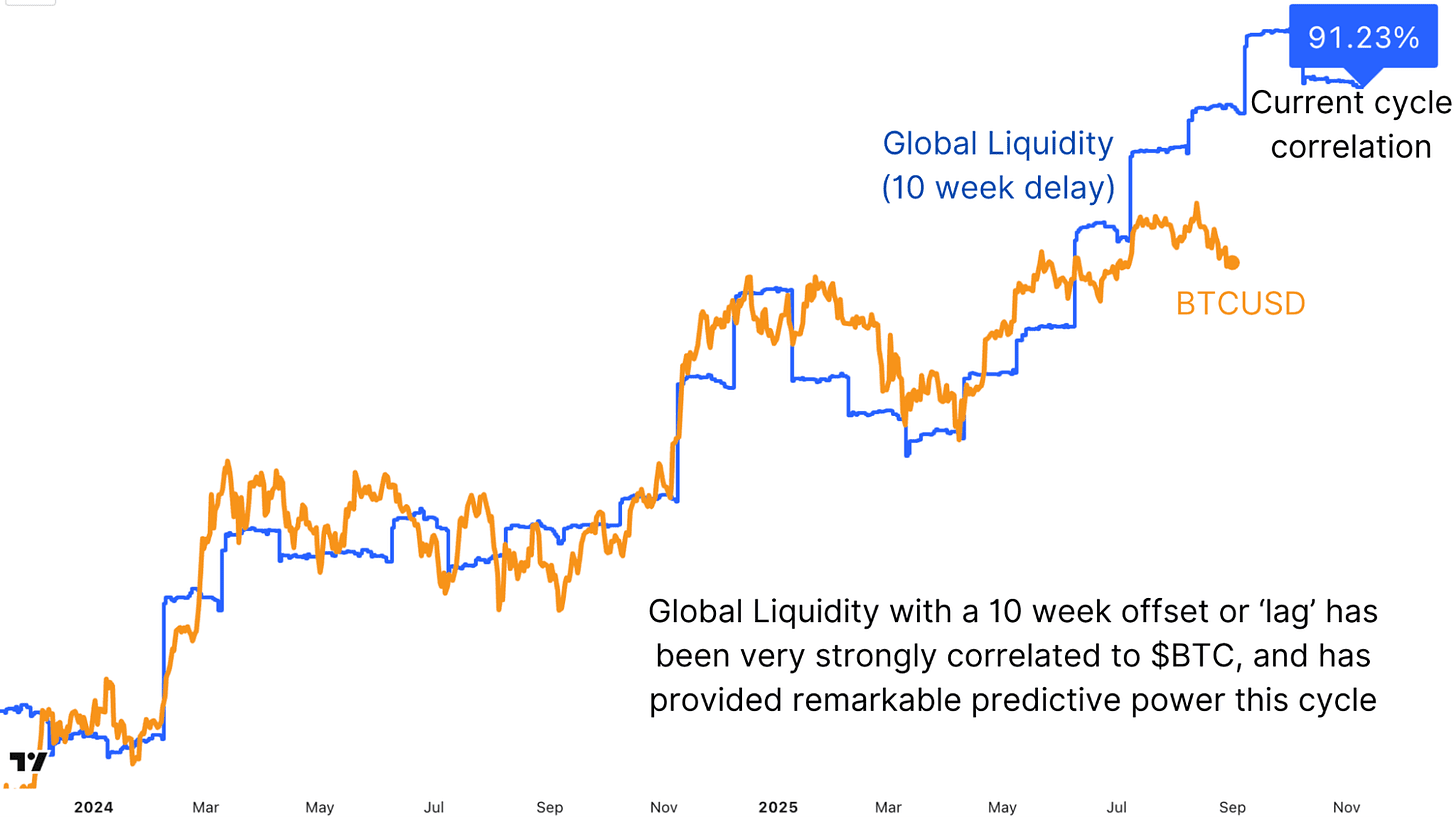

Bitcoin Value Traits Pushed by International Liquidity Shifts

The connection between International Liquidity, significantly M2 cash provide, and Bitcoin’s value is difficult to disregard. When liquidity expands, Bitcoin tends to rally; when it contracts, Bitcoin struggles.

Measured throughout this present cycle, the correlation stands at a powerful 88.44%. Including a 70-day offset pushes that correlation even larger to 91.23%, that means liquidity adjustments usually precede Bitcoin’s strikes by simply over two months. This framework has confirmed remarkably correct in capturing the broad development, with cycle dips aligning with International Liquidity tightening, and the next recoveries mirroring renewed enlargement.

Nonetheless, there was a notable divergence lately. Liquidity continues to rise, signaling help for larger Bitcoin costs, but Bitcoin itself has stalled after making new all-time highs. This divergence is value monitoring, however it doesn’t invalidate the broader relationship. The truth is, it might recommend that Bitcoin is solely lagging behind liquidity situations, because it has performed at different factors within the cycle.

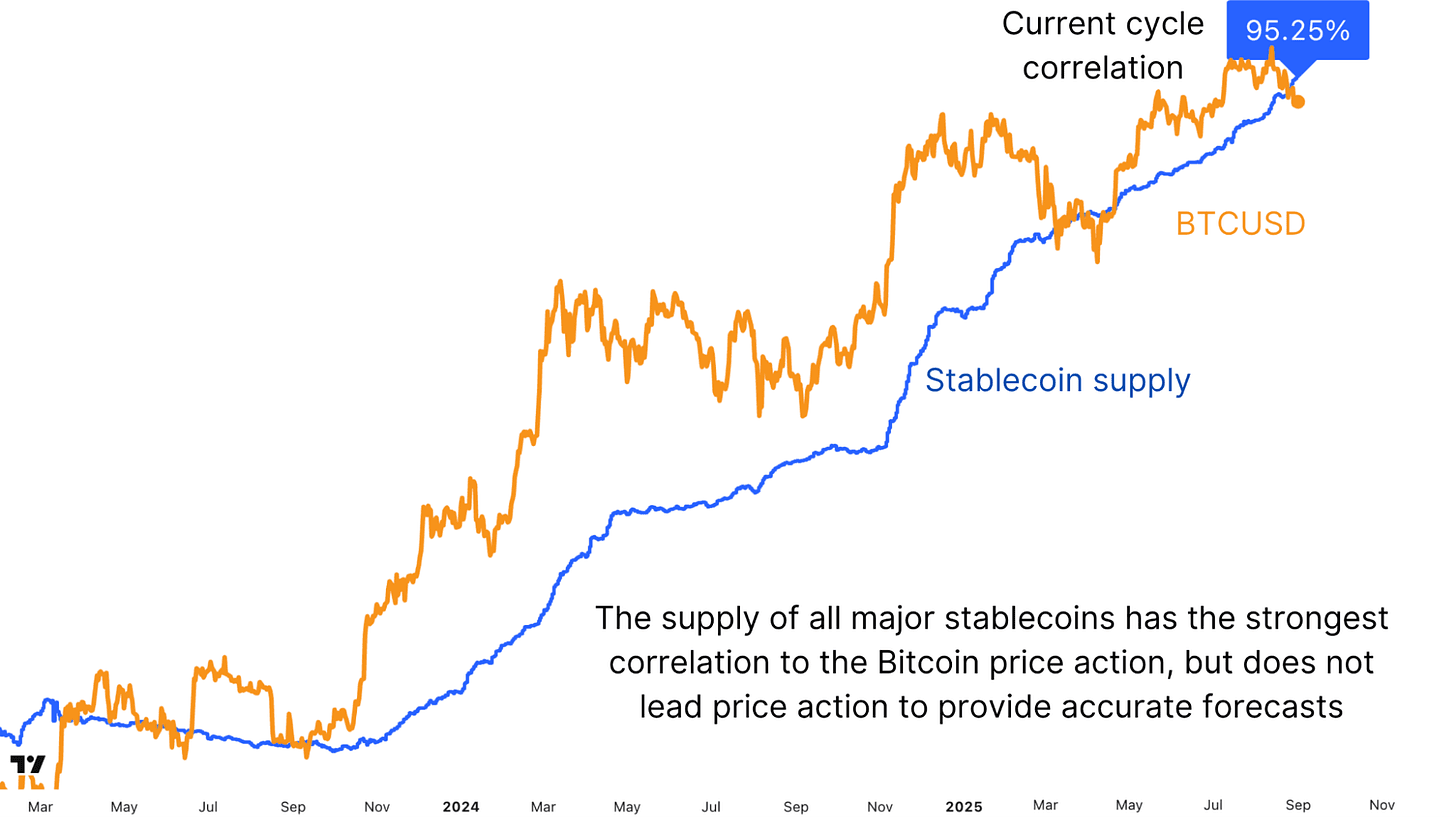

Stablecoin Provide Signaling Bitcoin Market Surges

Whereas International Liquidity displays the broader macro surroundings, stablecoin provide supplies a extra direct view of capital able to enter digital belongings. When USDT, USDC, and different stablecoins are minted in giant quantities, this represents “dry powder” ready to rotate into Bitcoin, and ultimately extra speculative altcoins. Surprisingly, the correlation right here is even stronger than M2 at 95.24% with none offset. Each main influx of stablecoin liquidity has preceded or accompanied a surge in Bitcoin’s value.

What makes this metric highly effective is its specificity. In contrast to International Liquidity, which covers the whole monetary system, stablecoin development is crypto-native. It represents direct potential demand inside this market. But right here, too, we’re seeing a divergence. Stablecoin provide has been increasing aggressively, making new highs, whereas Bitcoin has consolidated. Traditionally, such divergences don’t final lengthy, as this capital ultimately seeks returns and flows into threat belongings. Whether or not this means imminent upside or a slower rotation stays to be seen, however the power of the correlation makes it one of the crucial necessary metrics to trace within the quick to medium time period.

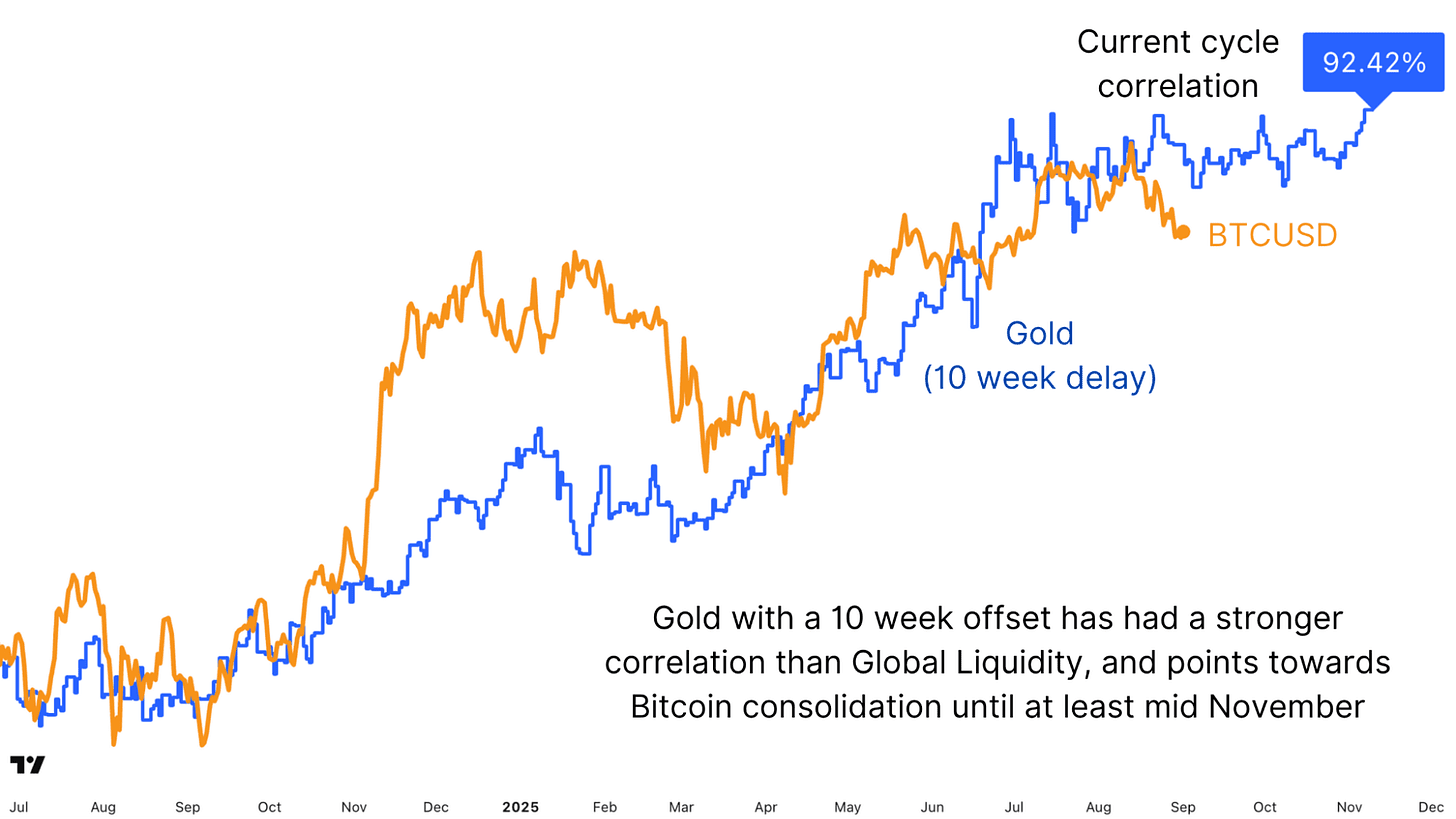

Bitcoin Predictive Energy of Gold’s Excessive-Correlation Lag

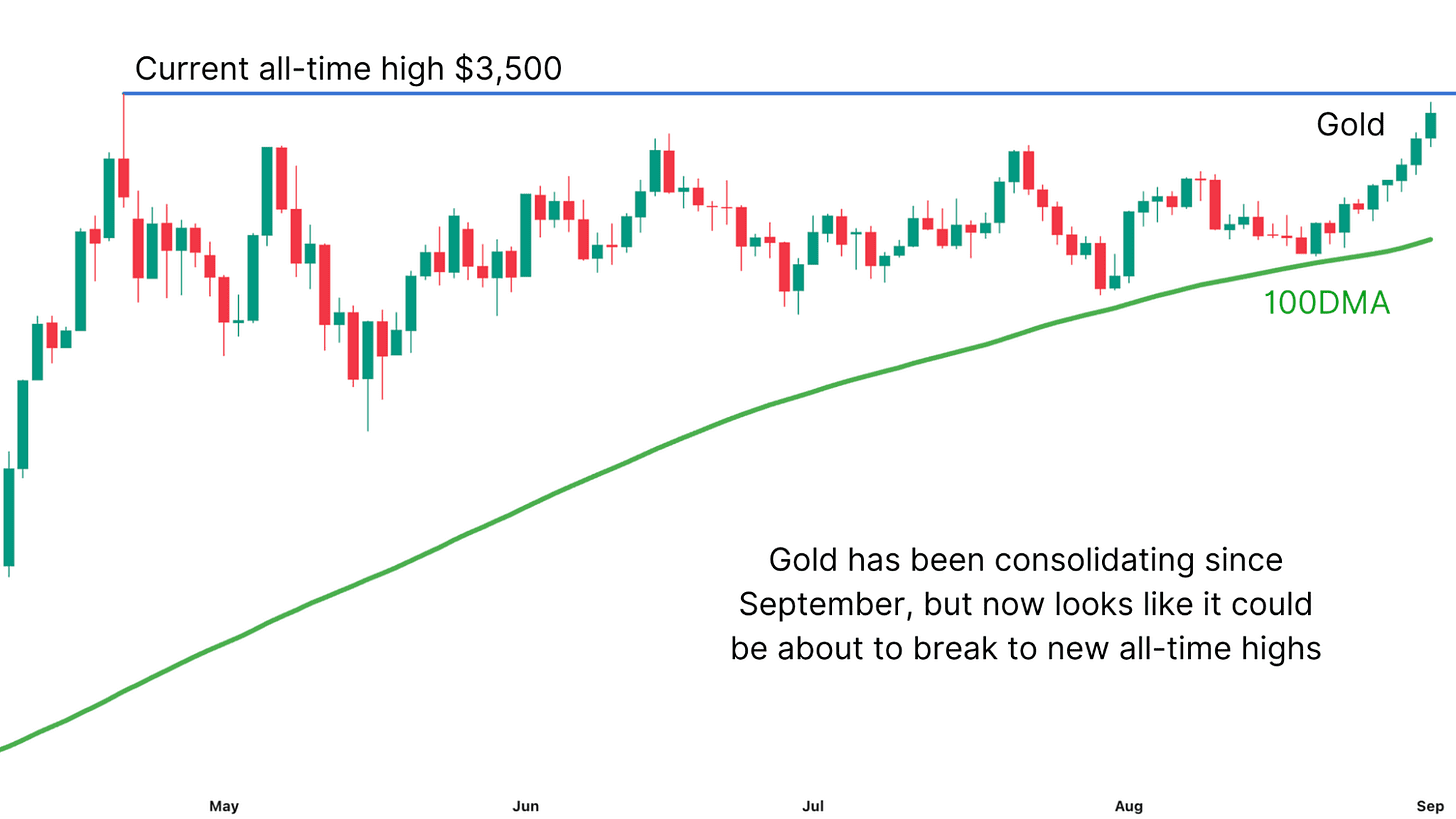

At first look, Bitcoin and Gold don’t share a constantly sturdy correlation. Their relationship is uneven, typically shifting collectively, different instances diverging. Nevertheless, when making use of the identical 10-week delay we utilized to the International Liquidity knowledge, a clearer image emerges. Throughout this cycle, Gold with a 70-day offset reveals a 92.42% correlation with Bitcoin, larger than International M2 itself.

The alignment has been putting. Each belongings bottomed at almost the identical time, and since then, their main rallies and consolidations have adopted related trajectories. Extra lately, Gold has been locked in a chronic consolidation section, and Bitcoin seems to be mirroring this with its personal uneven sideways motion. If this correlation holds, Bitcoin might stay range-bound till at the very least mid-November, echoing Gold’s stagnant conduct. But with Gold now wanting technically sturdy and primed for brand new all-time highs, Bitcoin might quickly observe if the “Digital Gold” narrative reasserts itself.

Bitcoin’s Subsequent Transfer Forecasted by Key Market Metrics

Taken collectively, these three metrics, International Liquidity, stablecoin provide, and Gold, present a robust framework for forecasting Bitcoin’s subsequent strikes. International M2 has remained a dependable macro anchor, particularly with a 10-week lag. Stablecoin development presents the clearest and most direct sign of incoming crypto demand, and its accelerating enlargement suggests mounting stress for larger costs. In the meantime, Gold’s delayed correlation supplies a shocking however precious predictive lens, pointing towards a interval of consolidation earlier than a possible breakout later within the coming weeks.

Within the quick time period, this confluence of indicators means that Bitcoin might proceed to cut sideways, mirroring Gold’s stagnation at the same time as liquidity expands within the background. But when Gold breaks to new highs and stablecoin issuance continues at its present tempo, Bitcoin might be organising for a robust end-of-year rally. For now, persistence is vital, however the knowledge means that the underlying situations stay favorable for Bitcoin’s long-term trajectory.

Cherished this deep dive into bitcoin value dynamics? Subscribe to Bitcoin Journal Professional on YouTube for extra skilled market insights and evaluation!

For extra deep-dive analysis, technical indicators, real-time market alerts, and entry to skilled evaluation, go to BitcoinMagazinePro.com.

Disclaimer: This text is for informational functions solely and shouldn’t be thought of monetary recommendation. All the time do your personal analysis earlier than making any funding choices.