2020 was a 12 months of large progress within the cryptocurrency trade. We noticed Bitcoin attain new highs, as famend monetary establishments invested on this revolutionary asset class and enthusiasm throughout the market bounced again.

Final 12 months, bitFlyer Europe carried out the survey in European nations measuring the consciousness and religion within the way forward for crypto. Again then two thirds of Europeans admitted to having religion that cryptocurrencies will nonetheless exist in 10 years’ time, nonetheless the bulk are nonetheless unsure how they are going to be used.

In September 2020, when evaluating our knowledge from 2020 to 2018, we now have seen a rise in accounts opened by customers of their 20s within the first half of 2020 at group stage.

As a world cryptocurrency alternate that has workplaces, amongst others, in San Francisco, CA, and Tokyo, Japan, this time we determined to dive deep into the present state of investing and cryptocurrencies within the US and Japan, and discover the variations between these two large and attention-grabbing markets. Our survey focused 3000 members aged 20-59 throughout Japan and the US.

Key findings from our analysis:

- Two-thirds of individuals within the US mentioned they’re interested by investing extra in monetary belongings in 2021.

- 30% of People suppose Bitcoin/Cryptocurrencies shall be a beautiful funding this 12 months, making it two occasions extra common than Gold and the 4th most chosen asset. The most well-liked asset was shares at 54%.

- 82% of the US inhabitants has heard about cryptocurrencies.

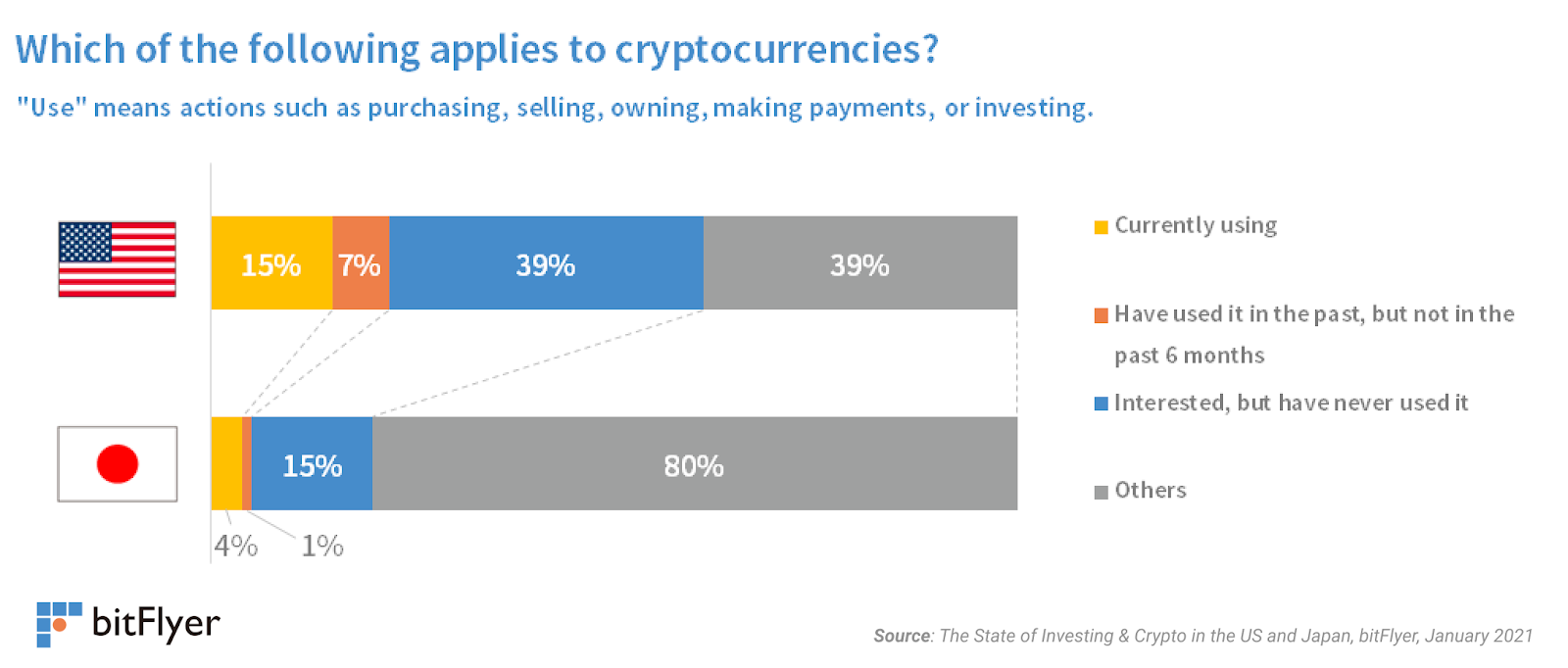

- Roughly 20% of respondents within the US are at the moment utilizing or have used cryptocurrencies prior to now.

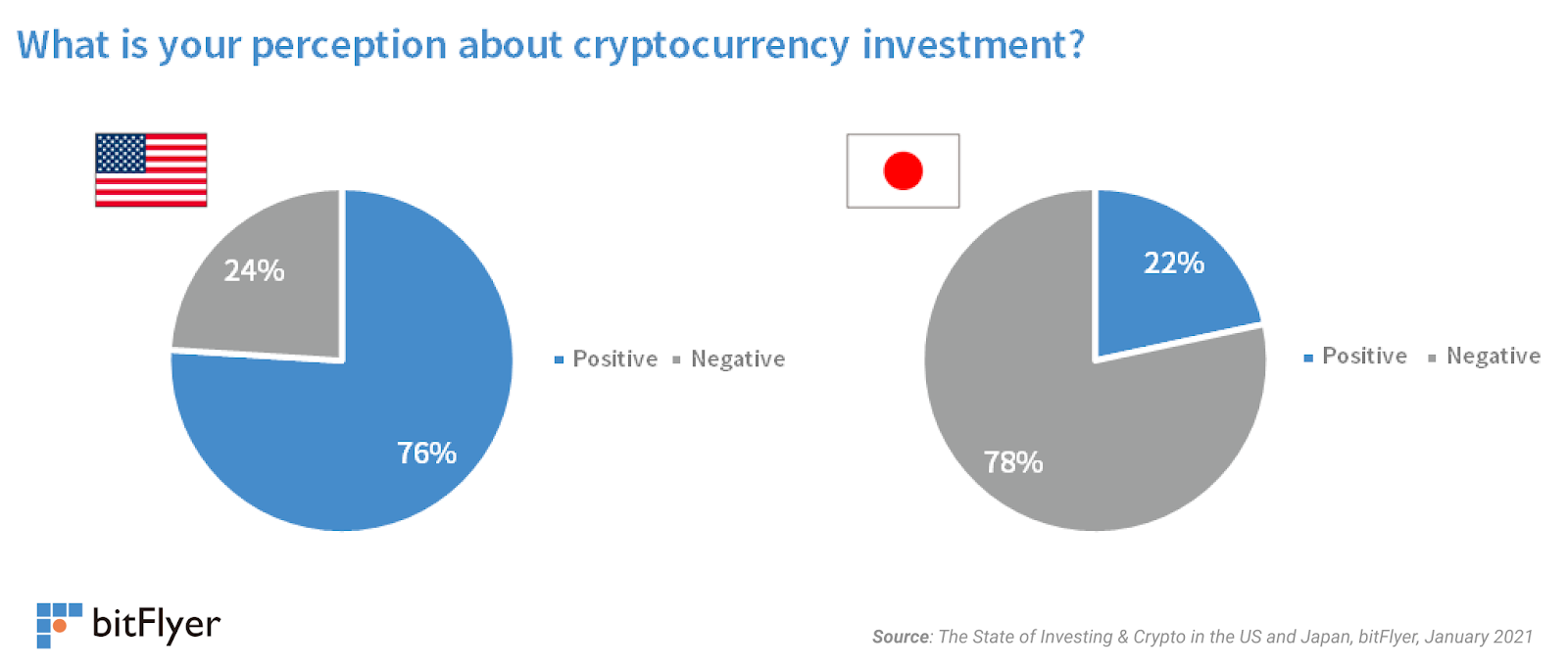

- 76% of individuals within the US which have heard about crypto have a constructive notion about cryptocurrencies as an funding. In Japan, 78% of the respondents have a unfavorable notion, exhibiting a reasonably robust distinction between the 2 areas.

- Our analysis reveals that the present market sentiment amongst American buyers is very bullish in comparison with the Japanese, reinforcing the argument that the final run-up in value was primarily pushed by US buyers.

The State of Investing

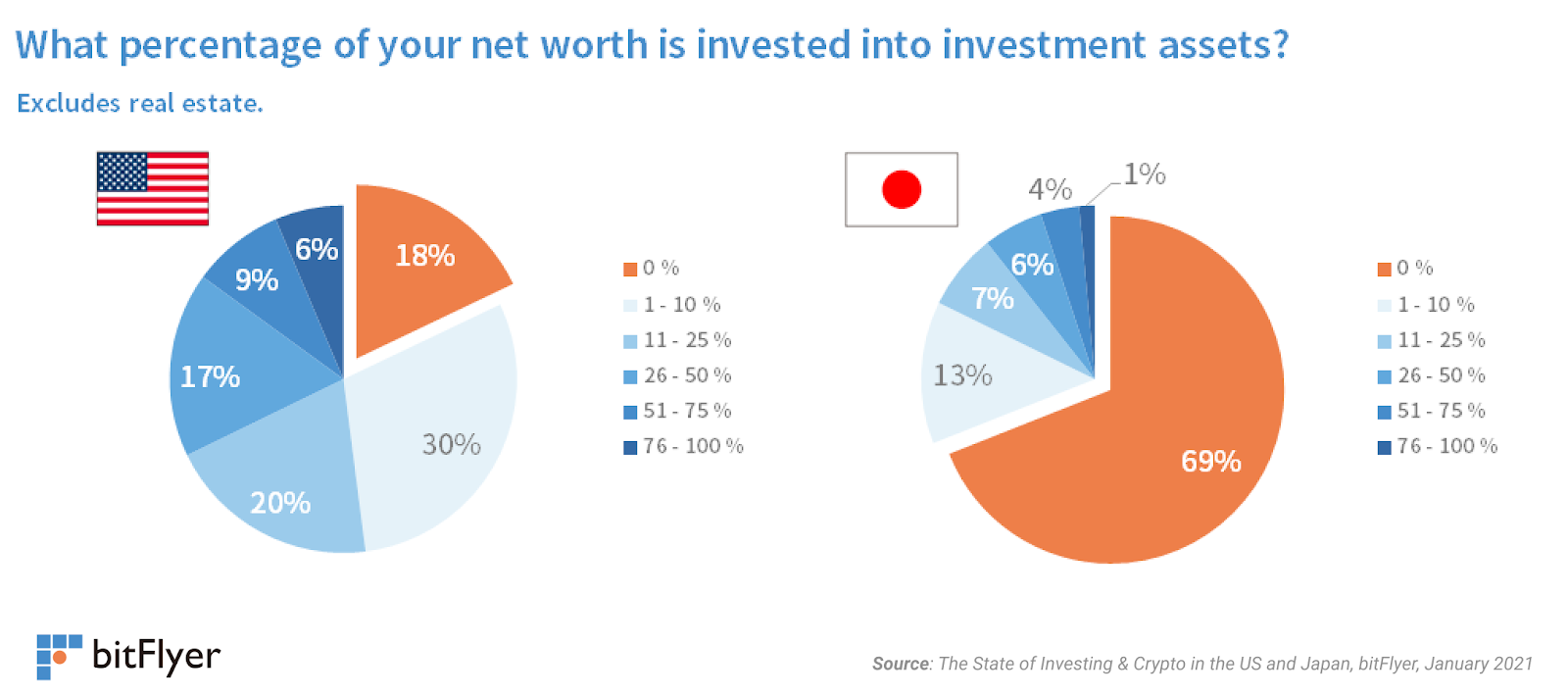

Our analysis reveals that 82% of individuals within the US put money into monetary belongings, with nearly a 3rd of the inhabitants allocating over 1 / 4 of their web price into investments. However, in Japan, 69% of individuals don’t put money into monetary belongings, exhibiting a major distinction throughout the 2 areas.

In each the US and Japan, males have a tendency to speculate greater than ladies, whereas additionally allocating a better share of their web price into their investments.

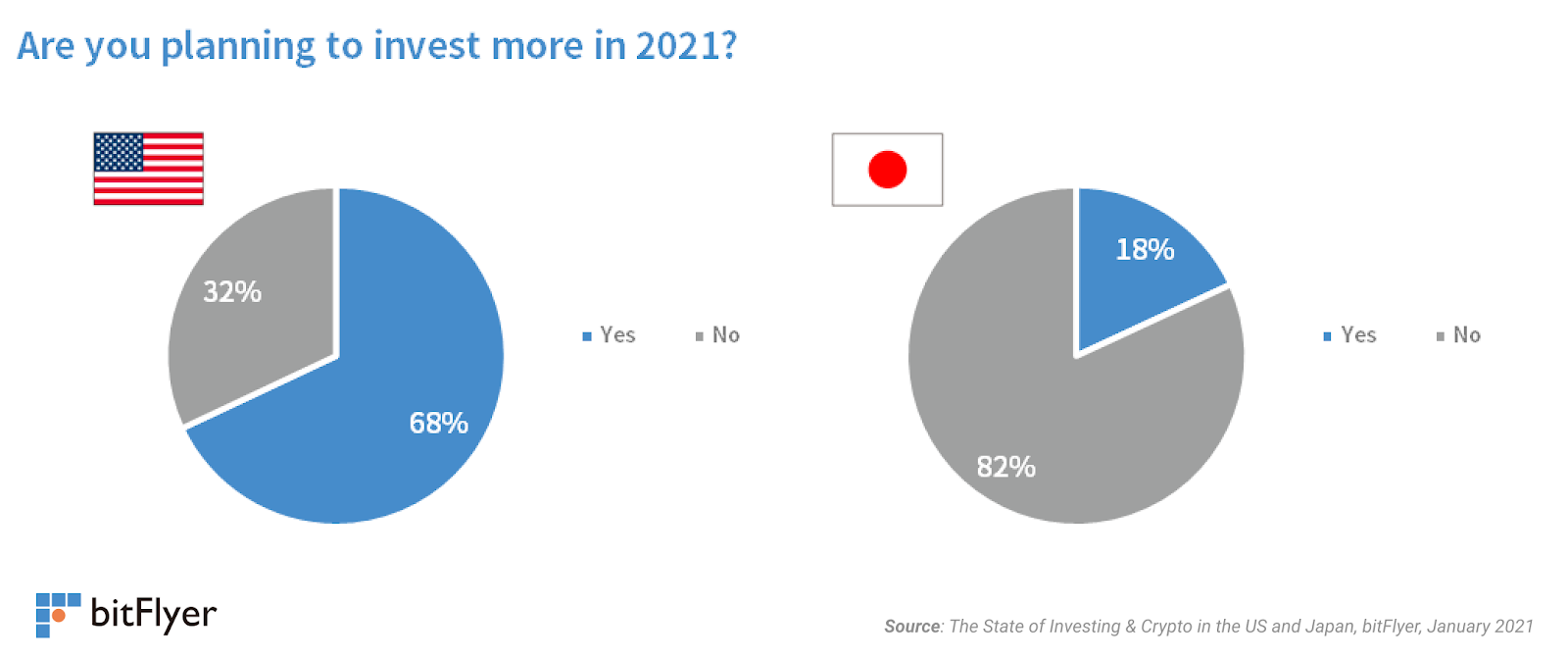

There’s additionally a major distinction within the outlook for investing this 12 months. 68% of respondents within the US are planning to speculate or proceed investing, whereas that determine is solely 18% in Japan.

Why are folks investing in 2021?

Throughout the globe, some of the common causes folks need to make investments this 12 months is to put together for the long run and improve their long-term web price. A big share of respondents need to diversify their earnings via investments and consider that investing is the strongest and quickest method to develop their capital.

“With a purpose to construct your wealth, you’ll want to make investments your cash. Investing lets you put your cash in automobiles which have the potential to earn robust charges of return. When you do not make investments, you’re lacking out on alternatives to extend your monetary price.” — (male in his 30s, US)

After final 12 months’s occasions, extra persons are being attentive to the market in hopes of capitalizing on a potential financial rebound this 12 months.

“This can be a nice time to speculate, hopefully issues can solely get higher and go up.” — (feminine in her 30s, US)

Low rates of interest are additionally fueling folks’s motivation to allocate their wealth into funding belongings. We are able to see an analogous pattern in Japan.

“Curiosity is just too low for deposits and financial savings. I feel it’s higher to handle your capital with some danger” — (male in his 40s, Japan).

Why are folks not seeking to put money into monetary belongings?

There’s an attention-grabbing distinction in why persons are not seeking to make investments throughout the 2 areas. One of the crucial common the explanation why folks within the US aren’t planning to speculate this 12 months is due to monetary challenges created by the COVID-19 disaster.

“I’ve no job at the moment, so no earnings. Cannot make investments what you do not have” — (male in his 30s, US)

“Cash could be very tight because of the pandemic” — (feminine in her 30s, US)

Our knowledge reveals that, logically, folks with decrease incomes are 40% much less more likely to make investments. This, amidst the latest surge in COVID-19 circumstances and adjustments in energy within the US, has elevated folks’s uncertainty and worry of what’s going to occur subsequent on the macroeconomic stage.

What’s most attention-grabbing, nonetheless, is that the major motive why People don’t make investments isn’t due to the dangers of shedding cash. They primarily don’t do it as a result of they don’t have the required assets. In Japan, it’s a special story.

Whereas the financial impression from the COVID-19 disaster additionally impacted many individuals’s capacity to put money into Japan, nearly all of those that mentioned that they aren’t seeking to make investments highlighted the potential dangers related to investing, moderately than a scarcity of assets to take action.

“I do not wish to lose even 0.0001% of my cash. I do not wish to put money into something that has the danger of shedding even a small amount of cash. Nevertheless, if there’s a no-risk, high-return funding, I’ll positively do it” — (male in his 40s in Japan)

“I feel funding is similar as playing. I do not wish to do harmful issues like shedding cash.” — (Male in his 30s in Japan)

“I do not know learn how to do it, and it appears that there’s a excessive danger of loss.” — (feminine in her 30s in Japan)

There’s a transparent distinction within the sentiment in the direction of investing between the 2 areas. We see folks within the US being much more open to investing and having an even bigger want to diversify their earnings via investing. In Japan folks are likely to have a way more cautious stance.

The State of Crypto

Cryptocurrency adoption is increased within the US than it’s in Japan. Within the US, 22% of respondents have invested in crypto in some unspecified time in the future – over 4 occasions increased than Japan.

Equally with investing, the sentiment in the direction of cryptocurrencies is quite a bit stronger within the US than it’s in Japan. 76% of the respondents within the US who’ve heard about cryptocurrencies have a constructive notion about cryptocurrencies as an funding, whereas in Japan it was the exact opposite.

What’s driving folks’s constructive notion about cryptocurrencies?

Individuals like cryptocurrencies within the US and Japan for very comparable causes. One of the crucial common ones is the rising recognition of cryptocurrencies and its exceptional rise in value, which makes it a really engaging funding.

“Cryptos are rising at a quick charge and I really feel they are going to continue to grow and be very worthwhile” — (male in his 20s, US)

“I noticed within the information that the worth has elevated lately” — (male in his 20s in Japan)

However it’s not solely its run-up in value that’s getting folks’s consideration. Many respondents highlighted crypto’s worth propositions and consider in its long-term worth.

“I really feel [cryptocurrencies] put you in management versus large Wall avenue companies. You should purchase/promote 24/7. Some have fastened amount versus shares that may all the time subject new shares and so on” — (male in his 50s, US)

“Cryptocurrency appears to be gaining momentum with the fallout of world and nationwide foreign money programs.” — (feminine in her 20s, US)

Furthermore, in 2020 we noticed a wave of establishments coming into the cryptocurrency area, and folks within the US observed. Institutional participation solidified folks’s long-term outlook for crypto, and even their notion of it.

“Giant establishments have been beginning to purchase crypto, which may drive up shortage and subsequently the worth. That, and after a decade it doesn’t seem to be it’s going anyplace anytime quickly.” — (male in his 20s, US)

“I selected constructive as a result of I positively suppose it has leveled out now. At first it was positively unfavorable (from what I heard). I feel it’s a brand new method of investing.” — (Feminine in her 20s, US)

Why do folks have unfavorable perceptions about cryptocurrencies?

Whereas the value of Bitcoin has elevated over 250% within the final 12 months, many individuals are nonetheless afraid of its excessive value volatility.

Moreover, after seeing many incidents corresponding to hacks and experiences from mass media, many are involved in regards to the crypto’s safety dangers and utilization in the present day. In Japan, the place the overwhelming majority of individuals have unfavorable perceptions about crypto, these safety considerations have been paramount and deep-rooted into folks’s perceptions.

“There was a digital foreign money incident within the information some time in the past.” — (male in his 40s, Japan)

“There’s a chance of somebody stealing it” — (male in his 30s, Japan)

Lastly, as with every new expertise, there’s a large studying curve.

“I don’t know sufficient about it to have a constructive opinion” — (feminine in her 30s, US)

Many individuals don’t perceive cryptocurrencies effectively sufficient in an effort to make a correct judgment about them, which finally impacts their notion. As folks be taught extra about cryptocurrencies, we will anticipate this to alter sooner or later.

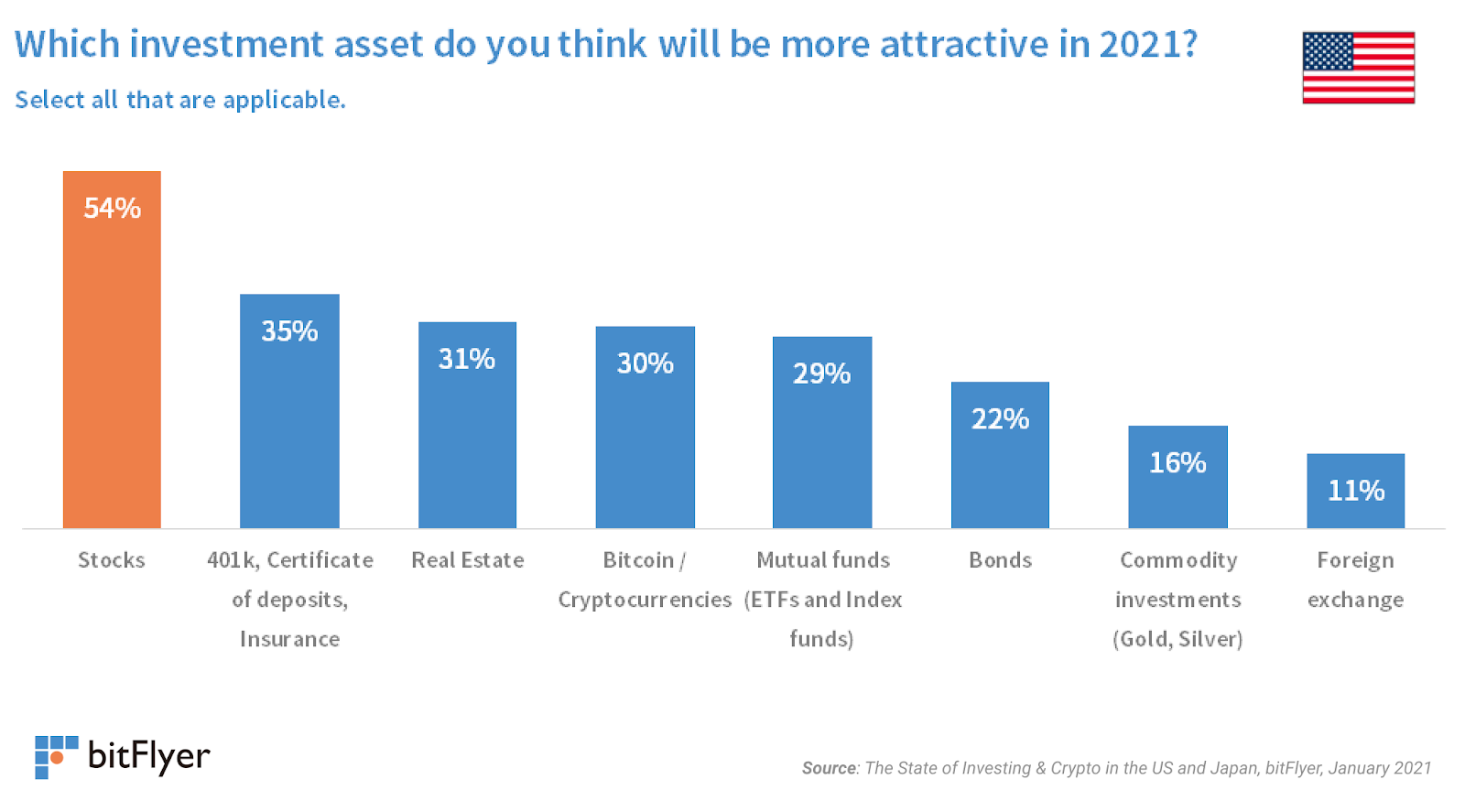

Which funding belongings do folks suppose shall be most engaging in 2021?

54% of respondents suppose shares shall be a beautiful funding in 2021, making it the hottest asset within the US.

Crypto was two occasions extra common than Gold and in addition the 4th hottest asset, as 30% of People consider it will likely be an engaging funding alternative. In Japan, crypto was the fifth hottest asset, as folks favored different funding automobiles corresponding to Mutual Funds and FX.

Diving deeper into the completely different segments, we noticed that for buyers within the US with the highest stage of expertise crypto was the third hottest asset. This group highlighted the excessive progress that cryptocurrencies have skilled currently and consider it will likely be some of the worthwhile investments.

“ETFs are simple and low value foundation, actual property will all the time produce earnings and bitcoin is gaining steam and can proceed to in 2021” — (male in his 40s with greater than 10 years of funding expertise, US)

However, crypto was the second hottest asset amongst the least skilled buyers. Crypto’s run-up in value and rising adoption spiked the curiosity of this group, which need to capitalize on the newest tendencies out there.

Wrapping up

A major share of People need to make investments this 12 months, as they view it as one of many only methods to extend their wealth. The alternative was true in Japan, the place buyers have a extra conservative stance.

Furthermore, the adoption of cryptocurrencies within the US has grown considerably during the last 12 months, as we’ve seen an rising variety of American firms allocating capital into this new asset class and increasing their companies to cowl this revolutionary expertise. The market sentiment is at the moment very constructive, particularly when in comparison with the Japanese market.

The outlook for cryptocurrencies this 12 months seems very promising within the US because it continues rising in recognition, particularly with the brand new era of buyers which favored the asset greater than anybody else. This may be signal for Europe as schooling about cryptocurrency and the desire to diversify funding portfolios is all the time rising.

Regardless of the bearish sentiment in Japan, it stays as some of the vital markets on the planet and with some of the structured regulatory frameworks globally.

Since 2014, our mission as a world firm has been to supply the best and most safe strategy to entry cryptocurrencies all over the world. We plan to proceed specializing in providing the very best stage of safety to our prospects and new merchandise to offer extra worth.

Survey methodology

- Survey interval: January 5, 2021-January 11, 2021

- Goal group: A complete of three,000 customers (20-59 years outdated) dwelling within the US and Japanese markets. Japan n = 2,000, USA n = 1,000

- The information of every market adjusts the composition of gender and age primarily based on the census outcomes in order that the tendencies of customers within the surveyed nations are accurately mirrored.

- Survey methodology: WEB questionnaire survey

* When utilizing the survey outcomes of this launch, please specify [Survey by bitFlyer USA.].