The significance of finance is extra thought of (sadly) in instances of crises than in instances of “peace”.

The significance of finance lies in the truth that it’s wanted principally for every part.

From managing private funds to managing enterprise funds and studying information, monetary literacy is one thing to take into excessive consideration to keep away from pointless dangers and to raised perceive the world that surrounds us.

Lately, the pandemic, the elevated exercise of regulators, and the banking disaster posed some questions, and there’s primarily one query we’d prefer to reply: when a inhabitants is financially educated, is it capable of navigate on a regular basis life even when financial and monetary circumstances are opposed?

The significance of finance: use monetary literacy to navigate the world

On the finish of the day, all of it comes down to 2 rules: saving and investing.

- Pay your self, first: you may need heard this elementary rule many instances. “Pay your self first” merely implies that you prioritize your well-being – to be extra particular, we’re speaking about your monetary well-being on this case: regardless of the objective it’s a must to enhance your monetary future, prioritize it. For example, if it’s essential improve your expertise – so, it’s essential put money into your schooling – do it earlier than fascinated about some other expense.

- Spend money on your self: investing in your self is a direct consequence of the rule “pay your self first” – and, on the similar time, it is step one in the direction of monetary freedom. Often, paying your self first, or investing in your self, begins the identical means: how a lot can you save to create a fund that may assist you attain your targets?

- Keep away from unhealthy debt: the potential of saving is strictly associated to how savvy you’re in the case of investing. A nasty debt has not less than two circumstances: you’re not capable of repay it, and also you created it to put money into one thing that doesn’t give any return. That’s why making a debt to purchase the trendiest pair of footwear just isn’t the identical as making a debt to purchase an costly course that may lead you to a well-paid job. The significance of finance – and the best way you handle your private funds – can assist you make the precise decisions and, as talked about, keep away from ineffective dangers.

- Having an emergency fund. Additionally on this case, the precise decisions can lead you to raised handle your funds and canopy any surprising bills should you create for your self an emergency fund.

Finally, finance is necessary to reside peacefully.

If we contemplate all of the earlier factors and put them into the present international monetary context, we will begin answering our query.

- As a rule of thumb, it’s thought of that every particular person ought to have sufficient financial savings to cowl the bills for 3 to six months. That is an attention-grabbing period of time should you contemplate that, on common, it takes the identical variety of months to get a brand new job. If we contemplate that we don’t at all times reside in instances when international monetary and financial circumstances are “regular”, you must know {that a} recession lasts – on common – 11 months. So, the extra you save the higher.

- An necessary a part of any disaster is panic. People who find themselves sufficiently financially savvy to handle their funds will likely be much less vulnerable to any exterior change within the international financial and monetary frameworks. Panic normally spreads due to information, and this leads us to a different level: the significance of finance for companies and establishments has direct penalties on folks, but when folks know learn the information, they’ll be much less topic to any piece of content material and can make choices primarily based on goal parameters, with out struggling panic. 2008 is a superb instance to have in mind. On the finish of the day, the disaster began in the true property sector: folks profited from dangerous property simply because they have been straightforward to get. However understanding floating curiosity, emergency funds, and realizing handle threat, would have saved lots of them.

Why monetary literacy is necessary to learn information

A complete lack of economic literacy could make it arduous additionally to hold out easy duties like studying on a regular basis information – for the straightforward motive that it turns into more durable to grasp it.

To offer you a sensible instance, let’s analyze what occurred with the Silicon Valley Financial institution and why information contributed to altering folks’s perceptions.

With the start of the pandemic, fintech (monetary know-how) – and the tech business normally – witnessed spectacular development, since this was principally the business that might assist companies discover new options and use totally different cost strategies and monetary merchandise, and on the similar time, it was the business that might permit folks to proceed managing their funds and get services with out leaving their properties.

Silicon Valley Financial institution, being one of the crucial necessary reference factors for fintech firms and startups, obtained giant deposits and, like some other financial institution, invested them.

The financial institution invested these funds within the property which are thought of among the many most secure – US Treasury Bonds.

So, from this perspective, the financial institution didn’t do something bizarre or purposefully dangerous. However… it invested them in long-term bonds.

And right here’s the purpose – if you wish to know why long-term bonds are thought of riskier and the way dramatic it may be after they fall beneath short-term bonds, you will discover an entire, easy-to-read rationalization in our Diary Of A Recession.

The “period threat” didn’t reward SVB.

The period threat is outlined as the danger attributable to doable modifications within the worth of an asset due to rates of interest. On this case, long-term bonds are extra vulnerable to this threat, as a result of there are extra prospects for rate of interest fluctuations in 10 years than in 3 months.

To get again to our instance, with rising inflation, digital property beneath the highlight of regulators, and crypto companies’ failures due to the (pure) market downturn, the Fed determined to boost rates of interest. And the worth of long-term bonds fell.

At this level, SVB determined to launch a brand new share sale – price $2.25 billion ( $1.25 billion in widespread shares, $500 million in depository shares, and the $500 million widespread shares bought to Basic Atlantic) – to strengthen its capital. It was March 8, 2023.

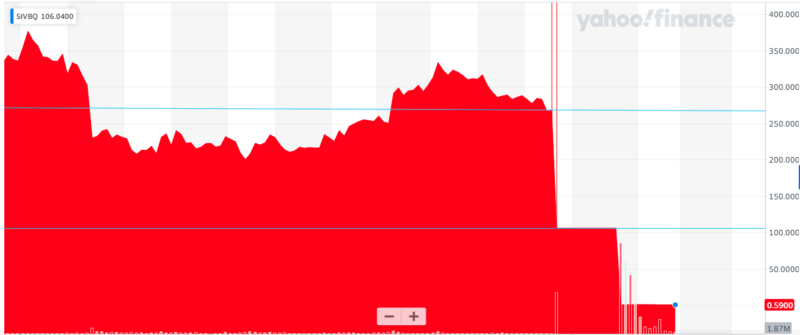

As quickly because the information turned public, traders began panicking: the worth of the SVB Monetary Group (SIVBQ) inventory went down by 60.41% – from $267.83 to $106.04. It was March 9, 2023:

Supply: Yahoo! Finance

That very day, Greg Becker – CEO of Silicon Valley Financial institution – held a convention and he requested shoppers to remain calm – that’s, don’t panic.

However within the meantime, information about any doable points associated to the solvency of the financial institution was already making traders counsel to one another to maneuver their funds.

It’s like if somebody all of a sudden asks you for $3,000, and also you solely have $100 money in your pockets: even you probably have the opposite $2,900 in a financial savings account, and also you simply want extra time to get them, it doesn’t matter. You weren’t capable of meet such a sudden request.

At a bigger scale, it’s what occurred to Silicon Valley Financial institution: it needed to face withdrawal requests for $42 billion in in the future, whereas the collateral it may use to borrow cash and canopy sudden withdrawals was dropping worth – due to greater rates of interest, and the very firm was dropping worth – due to the sell-off.

All this might solely have one ending: failure.

We’re not saying that SVB doesn’t must take its share of the blame:

- Investing in long-term bonds can nonetheless be dangerous,

- Not all funds have been insured.

At this level, the US authorities took management of SVB: it was shut down and the Federal Deposit Insurance coverage Corp. (FDIC) created a bridge financial institution. It was March 10, 2023.

Within the area of three days, a financial institution collapsed. And it wasn’t simply any financial institution, it was the sixteenth financial institution within the US and one of the crucial necessary banks within the fintech area. What if traders averted the financial institution run?

What occurs on this instances was extensively defined by Ben S. Bernanke, Douglas W. Diamond and Philip H. Dybvig, who gained a Nobel Prize in 2022.

Mainly, what they are saying is that one of the best ways to make use of financial savings is investing, however in the case of banks, a battle arises, as a result of – on the similar time – folks need to have instant entry to their cash.

If rumors about any doable problem begin spreading – we may substitute the phrase “rumors” with “information” – folks’s panic causes financial institution runs, and it is a nice instance of what’s referred to as a “self-fulfilling prophecy”: principally, it’s exactly the financial institution run that causes the disaster.

Ultimate ideas

What we analyzed in our instance is what occurs in instances of giant monetary catastrophes, however it doesn’t imply that this doesn’t occur, on a minor scale, in on a regular basis life.

What should you don’t have sufficient funds to cowl surprising bills? What should you don’t have sufficient info and information to keep away from panic? What if any piece of reports can change the way you understand your monetary administration?

On the finish of the day, it’s at all times about folks – even CEOs and high managers of high funds are folks, and there may be an especially great amount of books associated to the psychology of finance.

The purpose is that it is very important perceive finance, and its significance will assist each folks and companies to securely navigate the world.

In the intervening time, if you wish to take a look at your monetary literacy, right here’s a sampling of the questions requested within the Private Finance Index carried out by the GFLEC and TIAA. Have enjoyable – and don’t panic.

If you wish to know extra about fintech and finance, and uncover fintech information, occasions, developments, and insights, subscribe to FinTech Weekly Publication!