The Ripple Labs vs SEC authorized battle has been a spotlight level for crypto lovers. The momentary court docket ruling in favor of Ripple has stuffed crypto lovers with hope of a brighter future for cryptocurrency.

Since late 2020, the battle has been a vigorous show of authorized experience and sheer enthusiasm for cryptocurrency. SEC’s-US Securities and Change Commision accusation of Ripple executives being flawed to promote $1.3 billion value of XRP as unregistered safety choices has been quickly shattered.

Nonetheless, each the SEC and Ripple Labs have reached a win-win state of affairs because the court docket dominated the authority over institutional gross sales to the SEC; on the identical time, purchases on exchanges weren’t thought-about as an institutional securities providing.

This authorized battle might imply little to the non-crypto inhabitants. Nonetheless, such a large authorized transfer in opposition to an ICO – Preliminary Coin Providing has despatched chills down the backbone of each crypto fanatic.

It was apparent that sooner or later sooner or later, regulatory authorities would intrude with the crypto area, however the SEC vs Ripple battle was of such proportion that it needs to be mentioned the SEC made the dreaded entrance much more dramatic.

To promote an asset as an institutional securities providing, it must be registered with the SEC. This can be a expensive and time-intensive course of, which is one motive why crypto corporations usually attempt to make unregistered gross sales.

What’s vital for the crypto group is to see whether or not Ripple Labs will yield to the threats posed by the SEC and get itself registered.

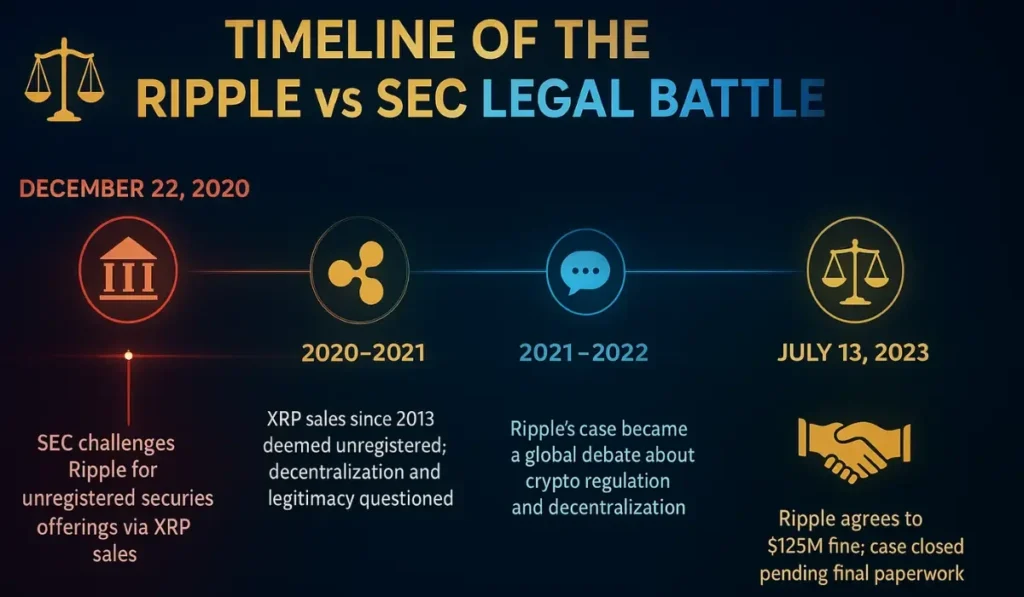

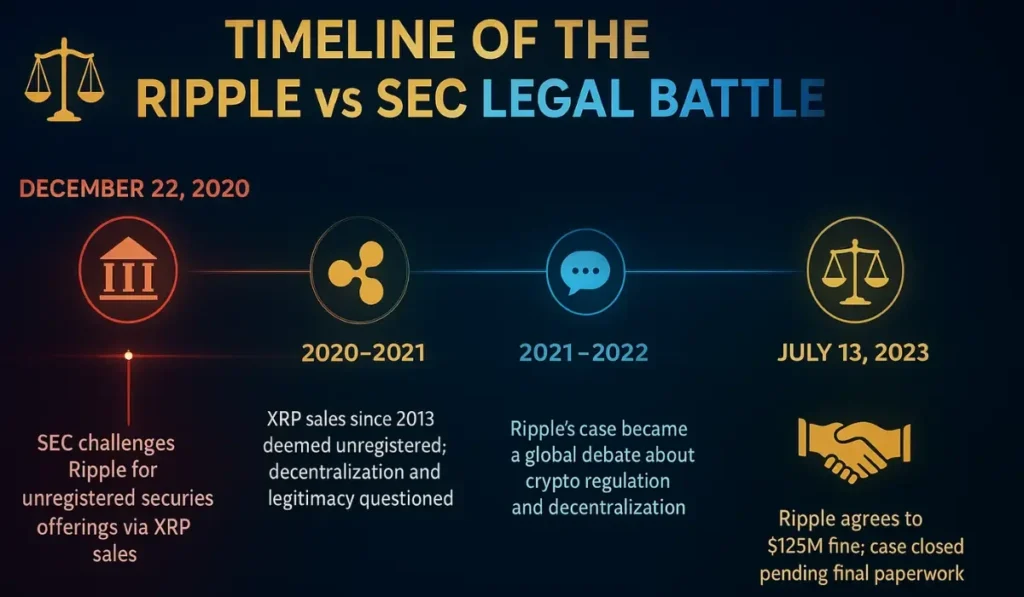

On twenty second December, 2020, the SEC proceeded to court docket difficult the legality of the unregistered securities choices and the funds raised by means of promoting XRP – the coin of the XRPL- blockchain(XRP Ledger).

Instances have been filed in opposition to the corporate and two of its executives, Brad Garlinghouse and Christian Larsen. That is reported in a December 2020 press launch by the SEC.

The allegations included gross sales of XRP for funding the enterprise from a interval of 2013 have been performed as unregistered securities gross sales, however within the type of a cryptocurrency. There are two fundamental takeaways right here: first, the SEC’s allegation implies that it doesn’t condone the decentralized nature of operations, and second, it doesn’t determine XRP as a legitimate asset.

With validity and decentralization each being questioned, this case grew to become a battle exterior the court docket between those that help Ripple and those that don’t.

On thirteenth July, 2023, a court docket ruling got here, the core concept that this ruling represented consists of the next:

- XRP or some other cryptocurrency, for that matter, doesn’t fall below the purview of securities when bought to the general public by means of devoted crypto-exchanges.

- When the identical cryptocurrency is bought to institutional buyers, it does change into prone to laws by related authorities.

With the win-win state of affairs achieved and Ripple prepared to pay a $125 million positive to the SEC, the division has dropped the case, and solely ultimate paperwork stays.

Implications of The Case

A regulatory authority in scorching pursuit was not an excellent observe file for Ripple Labs. However the court docket ruling of thirteenth July, 2023, really put them in a greater place. In doing so, by means of the court docket order, Ripple was in a position to present clear directions about all cryptocurrencies and the authorized limits of their functions.

This case has sparked widespread debate as as to if a decentralized monetary asset must be allowed such a stage of freedom. The 2 sides saved their arguments sturdy as normal, however the court docket ruling had a big affect.

First, the identification of a cryptocurrency in an alternate was accepted with out query. This can be a large win for the crypto group, as exchange-based buying and selling is one in all their main pursuits.

Second, despite the fact that the case was about XRP and Ripple Labs, it was prolonged past these two entities and addressed the entire cryptocurrency ecosystem.

The long run carries with it an uncertainty, as all the time. However the SEC-approved Ethereum and Bitcoin buying and selling property on the ETF market are proof of hope that crypto and regulatory methods can coexist with out clashing head-to-head on a regular basis.

So far as Ripple Labs is anxious, the SEC has dropped the case upon reaching a mutual settlement the place Ripple can pay a civil penalty of $125 million, and $50 million of it can go to the fee.

The SEC is a serious regulatory authority, and falling wanting their likeness just isn’t an excellent observe file to start with; nonetheless, within the case of XRP and Ripple Labs, this case has proved helpful as they may safe a win that’s important not simply to them, however to the entire group of crypto lovers.

Publish this main plot twist, we are able to hope that authorities companies will have a look at this matter with extra diligence and can make coverage adjustments to suit cryptocurrency into the area of basic buying and selling, which is neglected by them.

That is yet one more win-win state of affairs, because the structural identification of decentralization just isn’t questioned, and but, crypto turns into legally accessible to everybody.

Cryptocurrencies or their builders and beneficiaries can’t be penalized for trades performed on exchanges, however they’re regulated in the case of institutional buyers.

Most people can entry the cryptocurrency for normal buying and selling on exchanges. The legality of that motion just isn’t questioned.

The ripple consensus protocol, which is instrumental to the blockchain, can not exist with out XRP.

Ripple is used extensively for cross-border fund transfers, which have been historically achieved by SWIFT.

Ripple has many benefits on supply for cross-border fund switch when in comparison with SWIFT. Ripple has seen an increase in demand over SWIFT, but it’s unsure to state that Ripple will substitute SWIFT.