Non-public Credit score+ is a $45tn whole addressable market alternative, however the techniques at the moment supporting this market, retrofitted from non-public fairness or capital markets, cobbled collectively by way of M&A, or scattered throughout disconnected level options, are essentially insufficient. The present panorama isn’t simply operationally inefficient; it’s stopping corporations from scaling. Kanav Kalia, managing director at Oxane Companions, makes the case for why the trade doesn’t simply want instruments, however wants purpose-built know-how infrastructure.

Non-public credit score has expanded far past company direct lending into a wider alternative set, which we’re calling Non-public Credit score+. In our current whitepaper, we define that the overall addressable market alternative for all Non-public Credit score+ methods stands at a staggering $45tn (£33.6tn). We’ve all seen the sector quickly develop and this now covers a number of asset courses similar to asset-based finance, direct lending, industrial actual property finance, infrastructure finance, fund finance and securitised merchandise – with every day, innovation on this aggressive area is opening new alternatives for buyers. We are actually unparalleled scale and complexity points. Funding corporations should now grasp new challenges round multi-asset methods, cross-exposure, combination threat and various reporting necessities. Legacy techniques will wrestle to maintain up, that means important funding and overhauls are required so as to capitalise on this $45tn alternative.

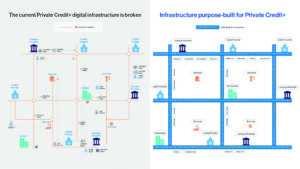

Why the present digital infrastructure is damaged

A lot of the Non-public Credit score+ world is at the moment working on legacy platforms initially constructed for personal fairness or capital market methods after which retrofitted for Non-public Credit score+ by way of add-ons and workarounds. These platforms don’t cater to asset class nuances and supply restricted flexibility and protection for the breadth of Non-public Credit score+ asset courses. They’re short-term options at finest. The M&A route hasn’t solved the issue both. With cash flowing into the area, we’ve seen suppliers purchase and mix options that look good on paper. Massive offers will all the time seem spectacular and sign ambition, however these include inherent integration challenges and infrequently don’t present full performance for the depth and breadth of wants of Non-public Credit score+ methods.

Past these, different options have emerged. Level options have stuffed some gaps, providing specialised instruments for particular workflows like valuations and monitoring, or specializing in particular person asset courses. Sadly, they’re restricted in scope and personal credit score corporations amassing these then threat having a cluttered tech stack. This may additionally find yourself creating silos and lots of overhead for managing totally different workflows. Some corporations have pursued in-house know-how options, constructing customized platforms tailor-made to their wants. This strategy requires important time, funding, and product improvement experience that almost all corporations merely don’t have.

How this infrastructure hole performs out in day by day operations

Let’s hint how capital flows by way of Non-public Credit score+. Buyers – pension funds, insurers, sovereign wealth funds, high-net-worth people, particular person buyers in some instances – commit capital to non-public credit score funds. GPs and funding corporations then successfully change into the capital suppliers and infrequently leverage this capital with financial institution financing. They lend to debtors throughout the spectrum: center market corporations, sponsors, originators and extra. So, we have now 4 key contributors within the capital layer – buyers offering fairness, GPs orchestrating deployment, banks offering leverage, debtors receiving capital. That’s the straightforward half.

Now overlay the operational layer that really makes Non-public Credit score+ operate. Each mortgage requires a number of counterparties – brokers, collateral directors, servicers, trustees – managing every thing from borrower communication, waterfall calculations, funds, borrowing bases, compliance to reporting. Every asset class provides its personal specialists: actual property wants valuers and property managers, infrastructure requires mission screens and technical advisors, asset-based finance includes specialists throughout areas from shopper loans to artwork financing. Every counterparty wants and offers particular data to operate: borrower financials, market information, valuations, authorized documentation and extra. A single mortgage would possibly contain 10 totally different events exchanging information by way of dozens of channels. Multiply that throughout lots of of loans, and you’ve got 1000’s of knowledge streams with no central infrastructure. The ensuing data chaos is staggering.

Infrastructure purpose-built for Non-public Credit score+

What Non-public Credit score+ wants is a elementary infrastructure transformation. Whereas capital needs to stream at freeway speeds, it’s constrained by guide processes, fragmented techniques, and knowledge chaos. The answer isn’t about including extra instruments, it’s about constructing a digital expressway that may deal with the velocity and scale of Non-public Credit score+.

A digital expressway would join all contributors – buyers, GPs, lenders, debtors, and operational counterparties – on unified digital rails. As a substitute of knowledge crawling by way of e-mail chains and Excel information, a digital expressway would allow seamless data stream. As a substitute of every agency struggling to construct their very own escape routes, the trade would profit from shared, scalable infrastructure. This digital expressway should deal with the sophistication of Non-public Credit score+: the nuances of every asset class, advanced deal buildings, multi-currency services, and extra. It could rework operational chaos into aggressive benefit, turning data from a burden right into a strategic asset.

At Oxane Companions, we’ve seen firsthand what it takes to assist Non-public Credit score+ at scale. Managing over $800bn of Non-public Credit score+ AUM for among the high banks and personal credit score corporations, we perceive that incremental enhancements received’t suffice. The trade wants a elementary leap ahead. It requires constructing from first ideas, which is why we created Oxane Panorama, the digital expressway that eliminates friction between events and allows subtle methods at scale. It’s not simply software program, however the infrastructure wanted to simplify, digitalise, and rework how Non-public Credit score+ is managed. We’re bringing collectively information, workflows, and all stakeholders onto a unified platform that eliminates friction, enhances transparency, and allows smarter choices.

The market is prepared. The infrastructure should comply with. And we’re constructing it, for the dimensions and complexity {that a} $45tn alternative calls for.